For the uninitiated, crypto airdrops refer to the process where creators of a cryptocurrency distribute their tokens. These rewards are given to existing holders of a particular blockchain currency, such as Bitcoin or Ethereum. This is usually done for free and serves as a marketing strategy. The intent is to spread awareness about a new cryptocurrency. The process starts after an ICO or Initial Coin Offering, and is meant to reward loyal customers.

However, multiple reports indicate a proliferation of scam/fake airdrops. This is because anyone can create a token and start an airdrop project for unknown or mischievous reason(s).

Fake airdrops fall into the category of investment fraud. According to the FBI’s Annual Internet Crime Report, cryptocurrency-related investment fraud rose nearly 200% from USD $907 million in 2021 to USD $2.57 billion in 2022.

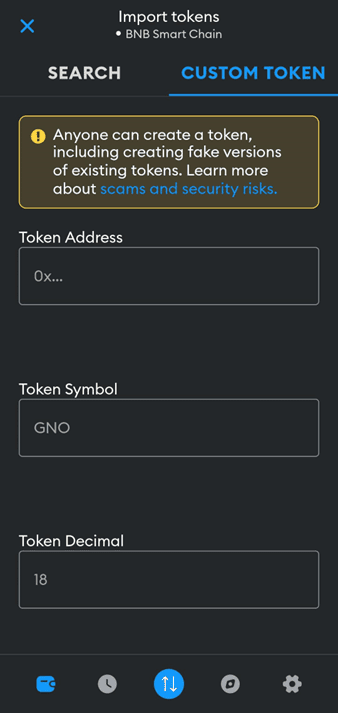

Metamask, a foremost crypto wallet, is always updating secrurity. It’s worth checking the warnings when venturing into an airdrop project or any crypto venture.

If its any consolation, there are still a handful of legit and profitably rewarding airdrops out there in Web3.

Now, let’s delve into how users get airdropped.

How Airdrops Work

The process of an Airdrop involves the distribution of tokens to the digital wallets of users. These tokens are classified into different types. And are usually based on the criteria, purpose, or mechanism the project owner decides to use to distribute the tokens. Some of the common types of Airdrops are, but not limited to:

● Holder Airdrops

These are Airdrops that are given to users who hold a specific token in their wallet at a certain date or time. A classic example is the Flare Airdrop. This airdrop was based on the snapshot of the XRP ledger from December 12, 2020.

December 12th 2020 is when @FlareNetworks will take a snapshot of the $XRP ledger which will determine your $spark airdrop

— Bitrue (@BitrueOfficial) September 1, 2020

If your XRP is on Bitrue then we will handle EVERYTHING for you. Not all exchanges will support this, so make sure you check to avoid missing out! https://t.co/gErMToyZIT pic.twitter.com/83lqrxvhRO

To participate, users had to hold XRP in a supported wallet or exchange. They then had to claim their FLR tokens using a tool or a process provided by the project or the platform.

● User Airdrops

These types of Airdrops are given to users who perform a specific action or meet certain requirements.

An example is the Uniswap Airdrop, which was based on the interaction with the Uniswap platform before September 1, 2020. Participants would have used Uniswap to swap, provide liquidity, vote on proposals, and claim their UNI tokens using the Uniswap app.

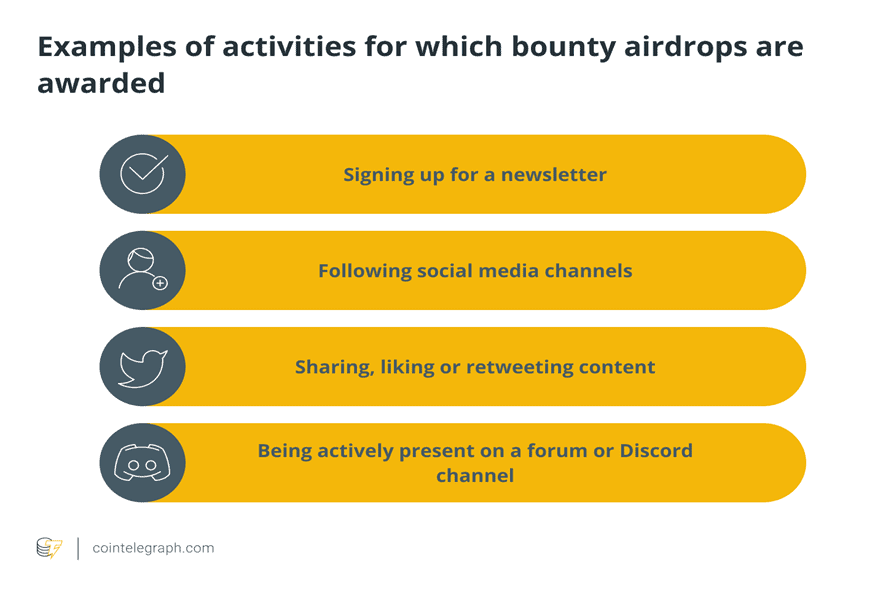

● Bounty Airdrops

Bounty airdrops are one of the most common of all three types of Airdrops. They are given to users who complete a specific task or challenge. These activities will only cost the participants effort and time, a fair price for free (tokens) money.

Now that you finally own an Airdropped token, what do you do with it next?

Who Benefits from Airdrops?

With the growing buzz around airdrops, crypto enthusiasts are constantly puzzled with questions like “Do Airdrops hold any real value? Of what use are they, and what profit do they promise, if any?” And many more.

Jun Hasegawa, CEO of Omise, the company that allegedly pioneered the first successful airdrop concept, OmiseGO (OMG), on Ethereum in August 2017, answered some of these questions.

Hasegawa, speaking to the broader benefits of the distribution model of the “OMG” airdrop, in an email to CoinDesk via a spokesperson, said:

“The real value of Ethereum projects doing Airdrops to all ETH holders is that it’s a crypto-economic mechanism designed to incentivize Ethereum project communities to maintain alignment with the entire Ethereum community.”

Hasegawa’s statement underpins that airdrops benefit both crypto projects and users. For projects, they serve as a proven strategy to grow their community and drive financial viability. For users, airdrops provide an opportunity to earn free tokens. Something that could potentially increase in value over time.

Author: Ayanfe Fakunle

#Airdrops #Ethereum #Crypto #Bitcoin #DigitalAssets

See Also:

Guardians of the Wormhole: The Superheroes Protecting Blockchain Bridges | Disruption Banking

The Crypto Diary of a Hodler | Disruption Banking

The Rise of the Retail Investor with Mosaic Alpha | Disruption Banking