Peter Orszag, the CEO of Lazard who took the reins in October last year, finds himself on the horns of a dilemma. He has promised to double the firm’s revenue by 2030, an ambitious feat that will require a compounded annual growth rate of 10% over the next six years and, importantly, the unwavering commitment of his top bankers amid growing competition from rival firms. Yet, less than a year into his tenure, discontent simmers within the ranks, threatening the execution of his growth strategy. Formerly the director of the office of management and budget under President Barack Obama, Orszag’s leadership style has raised eyebrows and sparked internal debate.

Last December at the firm’s first global gathering of managing directors, he invited an unusual guest to give his bankers a pep talk: Ralph Schlosstein, the retired head of Evercore, who like Orszag, served as a cabinet member in the Obama administration.

Orszag’s intention was to leverage his personal connections to inspire his lieutenants, but reports have emerged that not everyone was impressed by the decision to bring a man closely affiliated with an arch-rival firm to an internal strategy session. “It was a little awkward,” the Financial Times reported one Lazard banker as saying. “What is Ralph going to tell us that helps us?” the unnamed banker posed.

Peter Orszag wants to reimagine Lazard. Will his bankers let him? https://t.co/rVAGonlTdv

— Finance News (@ftfinancenews) June 4, 2024

Dissenting Voices Grow

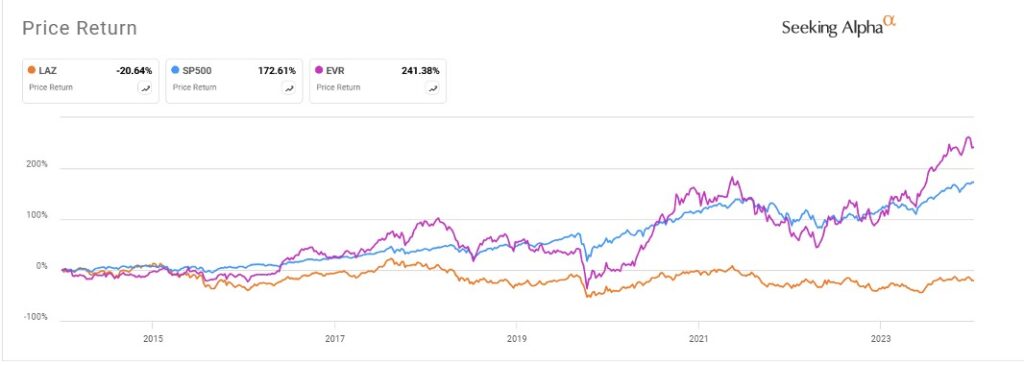

Evercore, despite being around for less than 30 years, has trounced the 176 year-old Lazard in terms of both revenue and valuation. The share price of Evercore has surged 241% in the past decade while Lazard’s has lost some 20%, reflecting its shifting fortunes. Even worse, Lazard has in the last decade trailed the S&P 500, which has gained some 172.61%.

Lazard’s stock has underperformed in the past decade; source: Seeking Alpha

To be sure, Orszag has only been with Lazard since 2016, when he joined the firm to head up the investment banking arm of the business. Yet as the CEO, the responsibility to turn things around rests on his shoulders. Revelations that some are doubting his methods and style of leadership will test his resolve as he endeavors to restore the glory of one of the most storied firms in finance.

Moreover Orszag joined Lazard with just five years of banking experience. While he projects confidence, some view him as a “high-finance newbie” who underestimates the complexities of the industry. Longtime Lazard insiders contend that Orszag – an economist and former political operator within democratic party circles – excels when discussing topics like China or geopolitical matters like the chip war. However, they posit that he lacks the finesse of a seasoned dealmaker during client interactions. “Peter looks the part…But he’s not a deal guy when he’s talking” another unnamed managing director told Financial Times.

Well Motivated To Succeed

Despite the dissenting voices, Orszag is well motivated to succeed. Under a board-devised pay plan, stock worth at least $86mn will vest on top of his annual package and bonus if Lazard’s share price climbs from the low $30s at his appointment to $69 by 2030. However, not all shareholders are on board. A third of them voted against the proposal, labeling it overly generous. Their concern stems from the firm’s recent stagnation—a backdrop that intensifies the spotlight on Orszag’s compensation and leadership style

Lazard’s asset management arm had about $245 billion in assets under management as of May 31 this year, some 25% higher than the $200 billion when Orszag’s appointment was announced last year. Evidently, he is making headway in this side of the business.

He has now trained his sights on the advisory arm of the business, hiring high flying bankers to join its investment banking business in the US, UK and other global markets. In January, Lazard made strategic additions to its investment banking team. Jason New, co-founder of crypto firm NovaWulf Digital Management and former CEO of Onex Credit, was brought in to serve as vice chairman of investment banking. Kevin Glodowski, previously a managing director at Rothschild & Co., joined Lazard as well. Both executives are now based in New York.

Lazard hires two managing directors for its restructuring practice as part of a plan to diversify offerings and boost the investment bank’s revenue https://t.co/OEOqgOhfVK

— Bloomberg Markets (@markets) January 2, 2024

These appointments align with Lazard CEO Peter Orszag’s goal of bringing in 10 managing directors for financial advisory services this year. Additionally, they aim to enhance Lazard’s restructuring and liability-management business.

Recently in May Lazard appointed seasoned healthcare dealmaker Michele Colocci as vice chairman and managing director, aiming to boost the growth of its healthcare advisory, according to a company announcement.

Formerly the Chairman of Mergers and Acquisitions at Morgan Stanley, Colocci brings a wealth of experience. His tenure included roles as Global Co-Head of Healthcare Investment Banking and Deputy Head of Investment Banking for Europe.

Colocci is based in London, assuming a newly created global position. As part of Lazard’s healthcare franchise, he will work closely with David Gluckman and contribute to the team overseen by Jean-Louis Girodolle and Cyrus Kapadia. “Michele’s experience as a trusted advisor to clients will be tremendously valuable as we continue to invest in our significant European business,” said Orszag on the appointment.

AI To Free Up Budget

In December, Orszag said the company plans to expand its number of managing directors by ten per year and boost productivity among those ranks amid a goal to double revenue by 2030. He noted the investment bank is targeting revenue per managing director of $8.5 million by 2025, and then $10 million in 2028.

“On the advisory side of the business, achieving the 2030 goals is a combination of higher productivity and more MDs” said Orszag, who emphasized that the form would be promoted within its ranks in addition to tapping external talent.

According to the CEO, the emergence of technology like generative artificial intelligence will help improve productivity by ending “mundane” analyst tasks, in turn freeing up the firm’s compensation budget to hire more managing directors.

As Orszag endeavors to supercharge Lazard’s growth, he must be prepared to deal with backlash and resistance from veterans who feel he is changing the culture too fast. Can he steer Lazard toward unprecedented growth without alienating its core talent? This is the central question. The delicate balance between expansion and preserving the firm’s storied culture will likely be the biggest test of his leadership as he strives to double the firm’s revenue in six years.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.