Alibaba Cloud Intelligence, China’s largest cloud computing service provider owned and operated by Alibaba Group, recently announced significant fee cuts for using its generative artificial intelligence (AI) models. These models, known as large language models (LLMs), are the backbone of services like OpenAI’s ChatGPT and other generative AI applications.

Alibaba’s price reductions apply to nine of its LLMs built on its proprietary Tongyi Qianwen AI platform. The goal of the repricing decision is to lower the threshold for enterprises and industries to leverage LLMs effectively. Expectedly, the company’s drastic price reductions – up to 97% for some services – have ignited a fierce price war in China’s nascent AI market, with competitors Baidu and ByteDance swiftly responding with aggressive pricing strategies.

Hours after Alibaba Cloud’s announcement, Baidu, the web search giant, declared that its Ernie Speed and Ernie Lite LLMs would be available free of charge. Baidu’s founder and chairman, Robin Li Yanhong, emphasized the company’s commitment to making AI services more affordable and accessible. This came after Baidu had previously charged for its top-end Ernie Bot 4.0.

ByteDance, the parent company of TikTok, also entered the fray, pricing its top-of-the-line Doubao LLM model at an astonishingly low rate of 0.0008 yuan (US$0.0001) per 1,000-token prompt. In comparison, Alibaba Cloud’s Qwen-max, a commercial model equivalent to OpenAI’s GPT-4 Turbo, now costs 0.04 yuan per 1,000 input tokens after a 67% discount.

“Alibaba’s decision to cut pricing on its Large Language Models (LLM) by up to 97% will likely further disrupt China’s AI market, pushing the sector into a price war. The move is probably in response to ByteDance’s recently launched Doubao LLMs, which were priced at a deep discount to the market,” said Bloomberg Intelligence analyst Robert Lea.

Alibaba Group slashes prices for a clutch of AI services by as much as 97%, spurring an immediate response from Baidu in potentially the start of a price war in China’s nascent AI market https://t.co/SgtyxOlA4i

— Bloomberg Technology (@technology) May 21, 2024

Startups Shine Amid Rising Competition

Prominent Chinese technology companies like Alibaba and Tencent are following the lead of their Silicon Valley counterparts, such as Microsoft, by making substantial investments in generative AI. In addition to developing proprietary foundational models, these companies are allocating significant capital to emerging startups like Baichuan and Zhipu AI. Notably, more than 200 LLMs have already been introduced in China, reflecting the increased pace of investment and intense competition in this space.

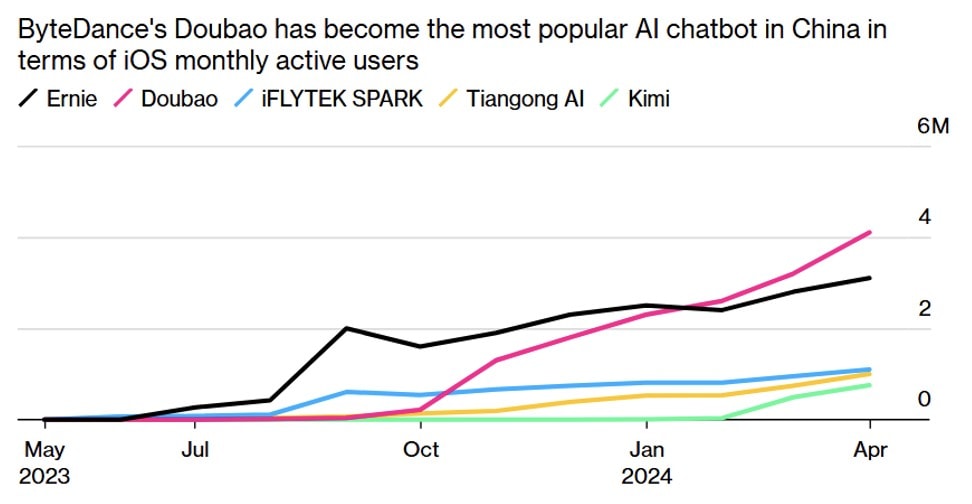

ByteDance’s Doubao surpassed Baidu’s Ernie in downloads last year and now has more regular monthly users on iOS in China, according to Sensor Tower data. ByteDance in May revealed that Doubao currently has some 26 million monthly active users across mobile and PC, making it the most popular chatbot in the Asian nation. The figure of 26 million, however, indicates that the market is still relatively young – the market leader has still not crossed 100 million users in a country where approximately 1.09 billion people were subscribed to mobile internet services as of 2023, per Statista.

Source: Bloomberg

Amid this rising competition, some AI startups have emerged as significant players in terms of market share. Moonshot AI, a Beijing-based start-up, has been making waves in China’s AI space with its innovative chatbot, Kimi. Launched in October, it has risen to become among the top five AI chatbots in the country in terms of iOS monthly active users, according to Sensor Tower data. “The AI services race in China includes young startups like Beijing-based Moonshot AI with its Kimi bot, underscoring the sector’s low barrier to entry,” notes Bloomberg’s Lea.

Some researchers believe Kimi has already surpassed Baidu’s Ernie in the race to become China’s most popular AI chatbot. Kimi was ranked the second most popular Chinese AI chatbot in April, with more than 20 million visits to its website and apps, according to AIcpb.com, which tracks the popularity of AI products worldwide. That placed it one spot above Ernie, which attracted 16.91 million visits in April.

Moonshot AI is backed by local venture capital funds and large tech companies like Alibaba, which in February led a $1 billion round. Reports in local media note that the company is pursuing another fundraising round that could potentially value it at $3 billion. Tencent is reportedly in talks to invest in this imminent round, joining rival Alibaba, which led the previous round.

Monetization Efforts At Risk

Although price cuts in AI services and the entry of ambitious startups will help accelerate the adoption of this transformative new technology in China, investors who overlook the risks that come with backing companies that offer free products may end up bearing steep losses.

“Rampant competition in China’s AI sector — which remains dominated by free-to-use services — combined with US trade restrictions on advanced AI accelerator chips will likely continue to hamper monetization efforts for all,” Lea notes.

Monetizing AI can indeed be challenging when many AI services are offered for free. Developing and deploying AI solutions require substantial computational resources. Additionally, AI models, especially deep learning ones, demand significant processing power and storage. If customers and end users do not pay for these services, then companies must frequently turn to the capital markets and other sources of financing to stay afloat. This means that investors looking to capitalize on the AI boom in China need to be comfortable with the risk of being diluted as equity investors or backing a company with too much debt. Either way, investors must weigh this against potential long-term returns.

It’s also worth mentioning that AI systems may not always deliver the desired results. They can be unpredictable, leading to challenges in creating reliable revenue streams. Moreover, with numerous players offering similar services, standing out and convincing users to pay for AI products can be tough.

Investors need to beware of the soaring valuations of companies that are betting on #AI as the next frontier of #growth. AI has indeed shown great promise and potential, but it also faces many challenges and uncertainties.https://t.co/Y8F3PlTre0

— #DisruptionBanking (@DisruptionBank) December 19, 2023

As the AI industry in China grows, legitimate concerns about data governance, censorship and privacy will also need to be addressed. The “Great Firewall of China” restricts access to foreign websites and platforms. While this protects national security, it limits users’ access to global information. Crucially, it could limit Chinese AI models from utilizing data from the rest of the world, hampering the growth of the sector which is attracting billions of dollars in new investments, despite the challenges of monetization, price wars and competition.

The price war in China’s AI market has broader implications beyond the nation’s borders. Analysts speculate that it could trigger a global price war, even as big-ticket investments pour into LLMs following the success of OpenAI’s ChatGPT. While lower prices and increased competition may boost innovation and enhance accessibility for users, its impact on profit margins and return on investment could be decidedly negative.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.