Since the start of the year we have seen a number of high-profile mergers and acquisitions in the fintech space. American Express, eToro and Mastercard have all bought out innovative start-ups in the last twelve months; with many other fintechs collaborating with each other in the hope of providing a better service to their clients – and, of course, achieving better profits.

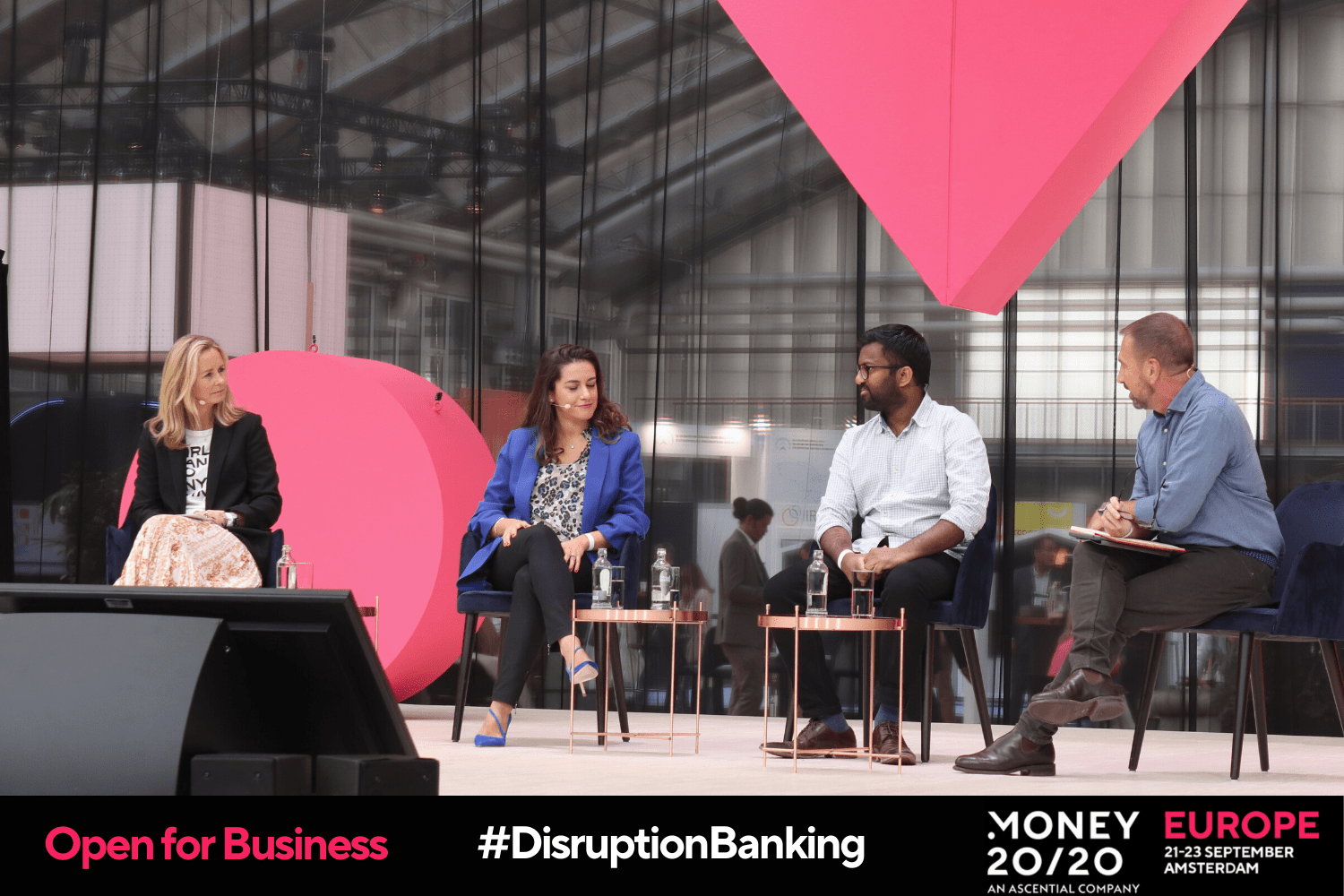

Yesterday afternoon at Money 20/20, Arun Tharmarajah (Head of Europe at Wise), Sendi Young (Managing Director, Europe at Ripple) and Siri Borsum (VP Finance Vertical Global Partnerships and Eco-Development at Huawei) took to the stage, alongside chair Colin Payne (VP Global Lead and NextGen FS at Capgemini Invent), to discuss how to create the most successful and beneficial partnerships possible between fintech companies.

Looking forward to speaking at #M2020EU tomorrow — in-person! I'll be joining Huawei, Wise and Capgemini to discuss "How can we discover unexpected partnerships?" pic.twitter.com/13YKuDzifT

— Sendi Young (@sendiyoung) September 20, 2021

Siri began by making the point that collaborations should be focused on achieving better outcomes for clients. There is the danger, she suggested, that fintech entrepreneurs are motivated largely by getting rich: inspired by the glamour of large-ticket M&A deals and neglecting what should be the most important consideration for any business – the product. In her words:

“I think you see it quite often that folk come in and get involved with technology to become rich. […] Sometimes the wrong reason drives people – it’s “let’s get rich, I want to make $100 billion!” But [focusing on] the consumer is how you succeed; you need to have a great product and then the customers will follow.”

How are #Fintechs partnering in innovative and unexpected ways? Siri Borsum from @Huawei explores the potential for collaboration in this space at #Money2020EU pic.twitter.com/zWxauCEkCf

— #DisruptionBanking (@DisruptionBank) September 21, 2021

Many are arguably deterred from collaborations because of regulatory and compliance fears. Particularly in terms of how consumer data is shared between companies, M&As or other forms of partnerships can cause notable legal complexities. Whilst proper oversight is of course necessary, it is also important that compliance considerations are not a drag on growth. Arun was keen to emphasise that – even in the payments space which is notorious for compliance problems – these hurdles can almost always be overcome:

“I think we’ve seen two main challenges that we [at Wise] have got really good at overcoming. One is the compliance and regulatory problems. Especially in a market involved in payments, it is complicated – particularly when you look at cross-border multiple jurisdictions. Compliance can be a blocker but our compliance teams are awesome; we say “go and speak to the partners and figure it out, because we need to built this partnership as it’s good for our customers.” Good things happen, crazy things happen and unexpected things happen.”

Sunak says investors have nothing to fear over tougher tech M&A regulation https://t.co/IRvxcYP220 pic.twitter.com/kikg9pQzj0

— City A.M. (@CityAM) September 15, 2021

A prominent feature of this year’s Money 20/20 has been the social good fintech companies can do; for consumers and for citizens. All the panelists touched on how the technologies their companies are involved in are ultimately about making people’s lives easier. Ripple, for example, is “focused on the blockchain solving the problem for cross-border payments;” using innovative new technology to improve speed and transparency in international payments. Sendi and the other panelists all suggested that fintech should be all about helping consumers understand their finances and, in turn, driving up living standards. Siri argued that this should be the starting point for any fintech partnership: working together to create the technology that will achieve this aim. Many fintechs are arguably somewhat short-sighted on this point, as such technology is often not a huge revenue driver in the short-term. But if it has the effect of facilitating understanding, it will be a highly effective way to build trust. Looking longer-term, building this trust is crucial for displacing people’s loyalties to traditional financial providers.

Technology can make people’s lives easier. Helping people understand their finances may not drive revenue to begin with, but it will help build trust. #Money2020EU pic.twitter.com/4SZ9K8JOaH

— #DisruptionBanking (@DisruptionBank) September 21, 2021

The panelists concluded by noting that any partnership must be based on shared values and shared aims – those of improving the service available to clients. In Arun’s words, “the culture fit is important.” Encouraging collaboration in this space, creating the conditions where partnerships can develop, is clearly crucial for promoting growth. Done properly, it can also spark the innovation that in turn will transform financial services and the lives of those who use them.

Author: Harry Clynch

#Money2020 #Money2020EU #M&A #UnexpectedPartnerships #Collaboration #Innovation #Growth