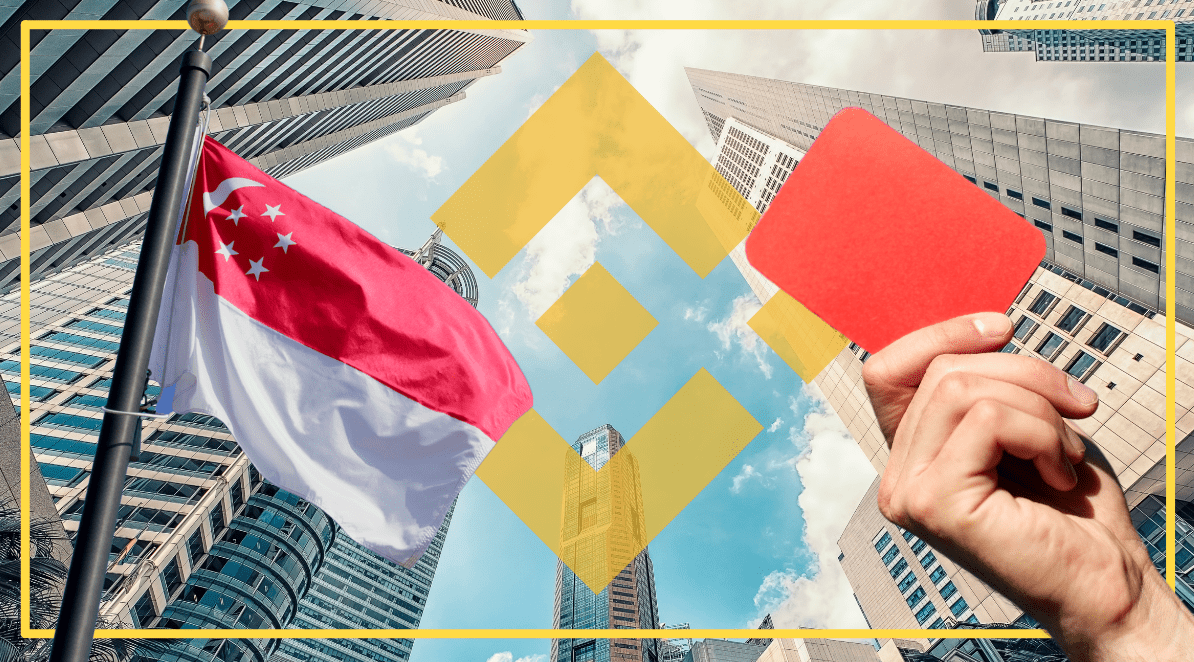

Earlier in December we heard the news that Binance had withdrawn its application to obtain a cryptoexchange licence in Singapore. This followed frequent clashes with the regulator in Singapore, which in September prompted Binance to ban its users in the country from trading on its global platform.

Markets by Trading view