Salesforce (ticker: CRM) joined the Dow Jones Industrial Average on August 31, 2020, alongside Amgen AMGN and Honeywell HON). CRM took the place of ExxonMobil in a reshuffle triggered by Apple’s stock split, a move that highlighted the index’s shift toward tech. Amgen and Honeywell replaced other companies in the Dow. At the time, Salesforce was a $200-billion cloud software giant, and its addition marked the Dow’s turn from oil to cloud, bringing one of the world’s leading customer relationship management (CRM) platforms into the blue-chip mix.

In this piece, Disruption Banking examines Salesforce’s journey before and after its Dow debut, its recent financial and dividend milestones, and what makes it a dynamic component powering the DJIA.

A Decade of Cloud Growth Before the Dow Jones

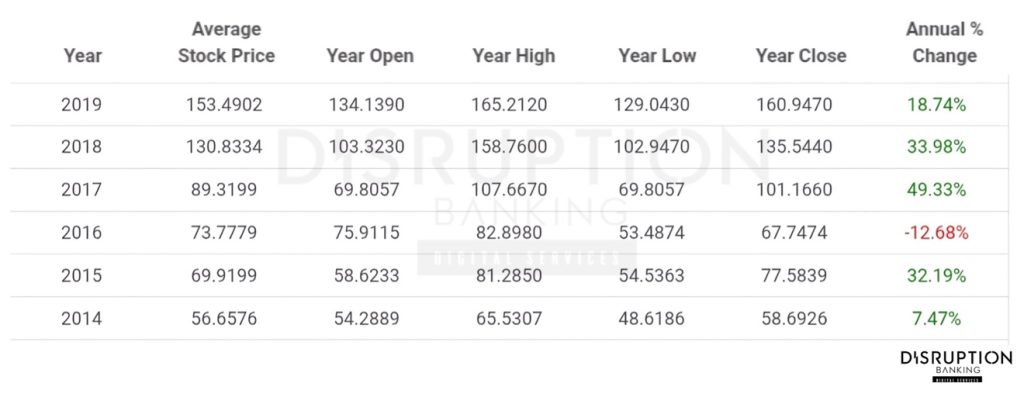

Salesforce’s 2010s run was defined by rapid growth and stock gains that paved its way into the Dow Jones. Between 2014 and 2019, Macrotrends data shows that CRM shares returned an average of roughly 22% annually, with standout years like 2017 (+49%) and 2018 (+34%), driven by booming demand for its Sales Cloud, Service Cloud, and marketing tools. Even dips like 2016’s –13% barely slowed momentum.

By the time Salesforce joined the Dow, a $1,000 investment in 2014 had more than tripled, mirroring other tech high-flyers. Revenue climbed from $4+ billion in 2014 to $17+ billion by 2020, underlining the cloud boom that made it worthy of Dow Jones inclusion.

Cloud Boom, Then Reset

Salesforce joined the Dow during the pandemic’s cloud boom, with its stock soaring 37% in 2020 and another 14% in 2021 as digital transformation surged. The momentum broke in 2022, when shares bottomed –48% amid rising interest rates and a tech selloff, per Macrotrends.

To boost profits, Salesforce cut costs, laid off about 10% of its staff, and doubled down on efficiency. The reset paid off. By 2023, the stock had surged 98%, lifted by stronger earnings and renewed excitement around its new AI features. The rally continued into 2024, with shares up ~28%, before pulling back ~27% as global tensions and Trump’s tariff battle with China shook the markets.

Volatility aside, Salesforce trades around $243 per share (TradingView) at the time of writing, roughly flat versus its August 2020 level, giving it a market cap of over $230 billion.

Record Q2, Raised Guidance

Salesforce’s latest results highlight its resilience and steady growth. In Q2 FY2025 (for FY2026), the company reported record revenue of $10.2 billion, up 10% year-over-year, with subscription and support sales rising 11%. Operating margins jumped to 22.8% GAAP and 34.3% adjusted.

“We delivered an outstanding quarter… and remain on track for fiscal 2026 to be a record year,” said CEO Marc Benioff, citing strong revenue, margins, and cash flow. President and chief operating and financial officer Robin Washington added that Salesforce “exceeded all our financial targets” and achieved a tenth straight quarter of margin expansion.

With momentum high, Salesforce raised its full-year guidance to $41.1–$41.3 billion in revenue (about 8.5–9% growth) and expects continued margin gains, perhaps to prove it can still expand profitably at scale, even in a softer economy.

Salesforce shares jumped after the company forecast faster revenue growth in the coming years, easing concerns that AI tools were eroding demand for its software https://t.co/oyrijY39QI pic.twitter.com/CG7thgHcE0

— Reuters (@Reuters) October 16, 2025

First Dividend, $50B Buybacks

Unlike many fast-growing tech companies, Salesforce is now giving more back to its shareholders, which could be seen as a sign that it’s entering a new, more mature phase. In early 2024, it announced its first-ever quarterly dividend of $0.40 per share. That payout was raised by 4% this year to $0.416, or $1.66 annually. It’s a small but steady way of showing confidence in its strong cash flow and long-term outlook. While the yield is modest at around 0.7%, the move marks a new phase for Salesforce as a cash-generating enterprise.

The company has also been aggressive when it comes to buybacks, repurchasing $2.2 billion in the latest quarter and authorizing up to $50 billion of buybacks overall. In Q2 2025, it returned a combined $2.6 billion through dividends and buybacks.

Together with continued research and development (R&D) and acquisitions, these steps show Salesforce’s balanced strategy, rewarding investors while fueling innovation, including its new AI “Agentforce” initiative.

3.2% of the Dow — Mid-Tier Mover

Salesforce holds a mid-tier position in the price-weighted Dow Jones index. With its current share price, CRM accounts for roughly 3.2% of the Dow’s value (Slickcharts), meaning a one-point move in Salesforce moves the Dow by about 3.2 points.

That’s far less influence than high-priced stocks like Goldman Sachs GS (nearly 10% weight) or Caterpillar CAT (~7%), but comparable to Apple AAPL, which trades in a similar range and makes up about 3.3% of the index. It still carries far more weight than traditional staples like Coca-Cola KO or Verizon (both under 1%).

In short, Salesforce sits comfortably in the Dow’s middle tier — not a heavy mover like Microsoft MSFT or UnitedHealth, but strong enough that its price swings noticeably influence the index’s daily performance.

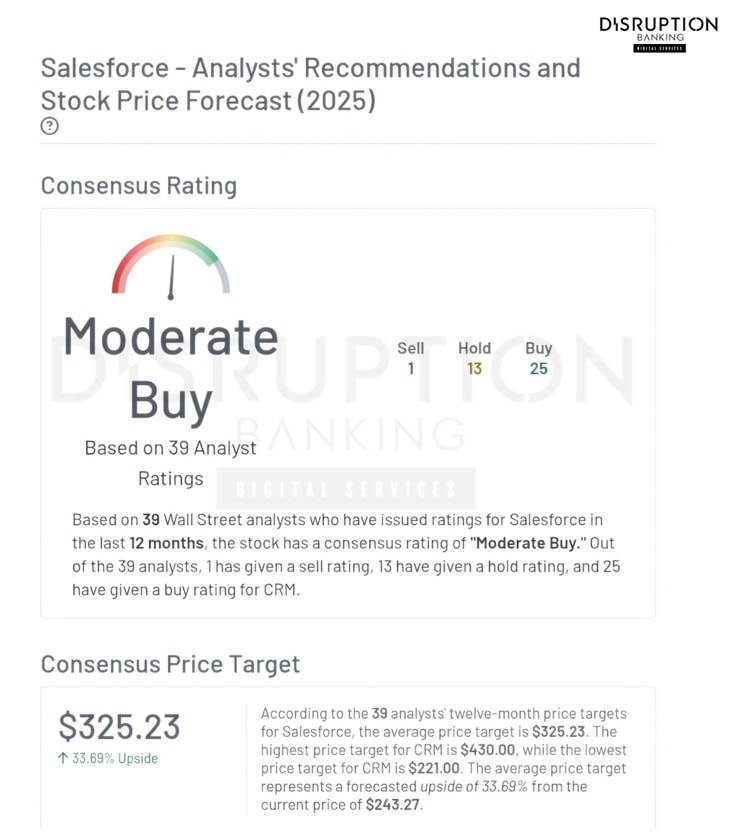

Analysts: “Moderate Buy” at $325

Wall Street analysts generally remain optimistic. According to a compilation by MarketBeat, CRM stock carries a “Moderate Buy” consensus rating, with an average 12-month price target of about $325. That’s roughly 34% above the current price. This implies expectations of steady upside rather than the kind of explosive rally seen in 2023.

Cloud & AI: The Dow’s New Core

When Salesforce joined the Dow Jones in 2020, it marked how deeply digital transformation had taken root in business. Five years on, the company has managed, very well, the pandemic and the usual investor scrutiny, coming out leaner but still growing. Its new dividend and stock buybacks show a company that’s confident about the road ahead; and willing to share that confidence with shareholders.

Growth has stayed steady. Margins are improving. And Salesforce’s push into cloud and AI shows it’s evolving with the times. As the Dow Jones shifts to reflect the modern economy, Salesforce stands as proof that software and data now sit at the heart of long-term value creation.

#CapitalMarkets #Salesforce #DowJones #DJIA #cloudsoftware #customerrelationshipmanagementplatform #CRM #Dividends

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Procter & Gamble: A Century of Steady Gains in the Dow Jones | Disruption Banking

Apple’s Decade in the Dow: Powering Tech’s Market Influence Since 2015 | Disruption Banking