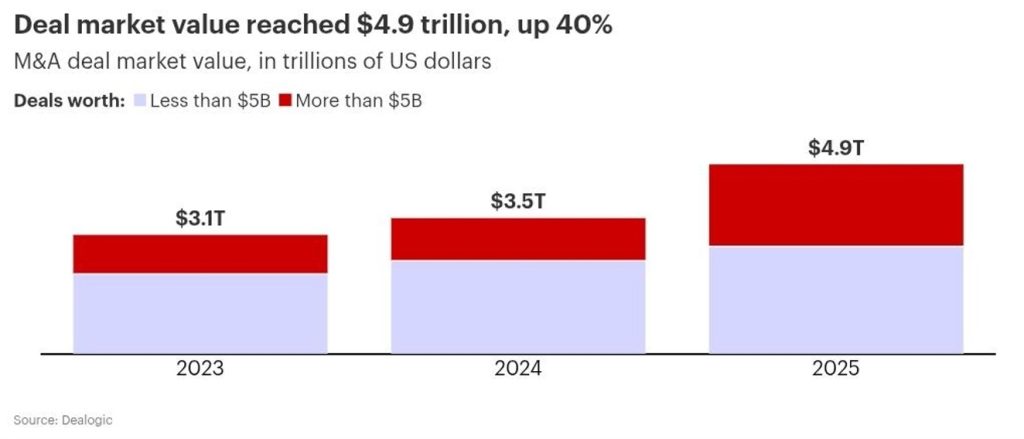

Global mergers and acquisitions (M&A) hit $4.9 trillion in 2025, a 40% jump and the second-highest deal value on record. Now 80% of dealmakers expect to sustain or increase that pace in 2026, according to Bain & Company‘s Global M&A Report 2026, released this week.

The numbers tell one story. The urgency tells another.

“Companies urgently need to reinvent themselves to get out ahead of the big forces of technology disruption, a post-globalization economy, and shifting profit pools,” said Suzanne Kumar, EVP of Bain’s M&A practice. “M&A will play a pivotal role in this reinvention in 2026.”

Bain & Company’s View on the M&A Landscape

Bain & Company, a global management consulting firm advising corporations, investors, and institutions across more than 40 countries, publishes an annual assessment of global dealmaking trends. Its Global M&A Report 2026 draws on market data and a survey of 300 senior M&A executives to assess where capital, strategy, and confidence are heading.

Bain’s research shows the foundation for continued dealmaking is firmly in place. The economy is improving, but the real driver is lasting change: many companies have outgrown their old growth engines, while private equity and venture capital firms are bringing a growing backlog of assets to market.

Against this backdrop, 80% of surveyed executives expect M&A activity in 2026 to either match or exceed last year’s pace.

Three Forces Driving 2026 Deals

- Technology disruption leads the pack. Nearly half of all tech deals already involve AI components, double 2024’s rate. Non-tech firms are scrambling to build out technology solutions through acquisitions. Companies aren’t just buying assets anymore. They’re buying AI talent, robotics capabilities, and quantum computing expertise.

- Geopolitics and post-globalization are reshaping deal logic. Tariff shocks in 2025 forced executives to understand how fragmentation affects goods, capital, IP, and labor flows. Expect bolder moves: companies doubling down on favorable markets while exiting less favorable ones through M&A and divestitures.

- Portfolio pressure completes the trifecta. Over half of surveyed companies are prepping assets for sale within a few years. The goal? Gain focus, free up cash, and capitalize on today’s higher valuations. Industry evolution isn’t giving firms a choice.

AI Adoption Doubles in M&A

45% of executives used AI tools in M&A during 2025, more than double the prior year. One-third of dealmakers are systematically deploying AI or redesigning processes around it. Over half expect AI to significantly transform how deals get done.

“AI is quickly becoming indispensable to M&A,” Kumar noted. “Early adopters are gaining a concrete advantage when it comes to dealmaking.”

Leading companies use AI for:

- Dynamic pipeline management

- Enhanced intelligence accuracy

- Faster synergy realization

- Minimized integration prep

- Deeper stakeholder insights

The competitive gap between AI adopters and laggards is widening.

The Capital Constraint Problem

Despite 2025’s robust activity, M&A’s share of capital allocation hit a 30-year low. Companies increased capex and R&D spending instead. With competing demands raising the bar for deals, disciplined value creation isn’t optional anymore.

Industry Snapshots

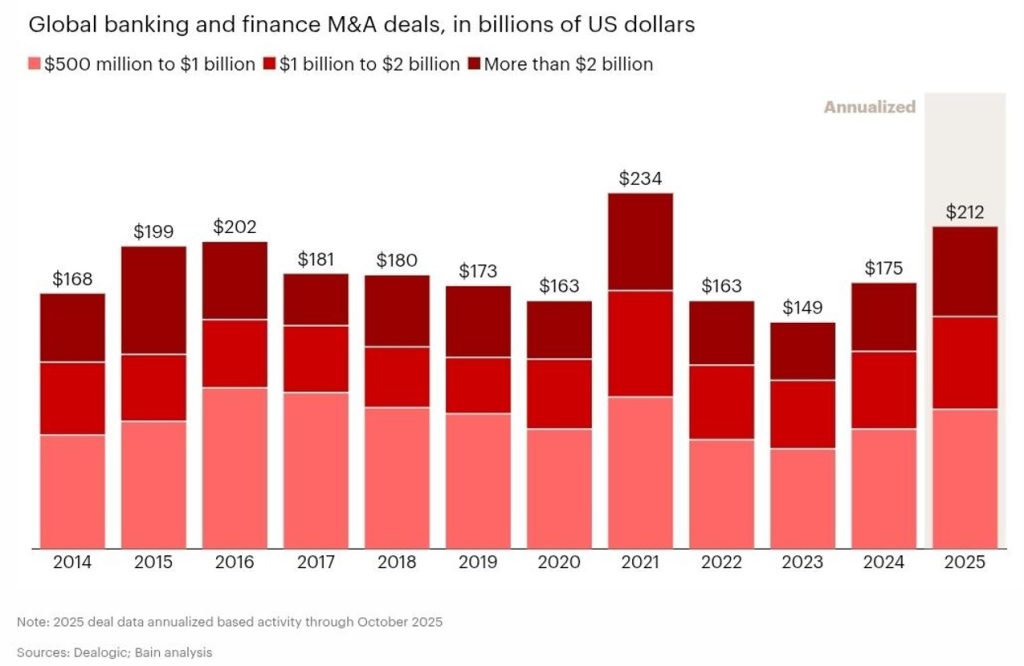

- Banking:

Banking M&A surged to $212 billion, driven by friendlier regulators and modernization urgency. Deals combining scale and scope saw 30% better valuation gains than single-focus acquisitions.

- Oil and Gas:

Oil and gas companies consolidated at record levels, chasing scale and cost cuts. The top 20 acquirers captured 53% of deal value over the past decade. Concentration is intensifying.

- Software:

Software firms acquired record numbers of AI assets, with AI-related deal value shooting up. Companies need talent pools and product capabilities fast, M&A delivers both.

Five Strategies for 2026

Bain outlines the M&A playbook for 2026:

- Ground deals in a new strategic context. Test whether M&A helps you compete better, build capabilities faster, or exit when you’re not the best owner.

- Make megadeals pay off. 2025’s wave of large transactions needs proper integration theses. Decide what to stabilize, integrate, and transform, then tackle priorities first.

- Take full potential view in due diligence. With capital constrained, diligence must confirm M&A is the best capital use. Thesis-led approaches help infrequent acquirers compete with seasoned buyers.

- Build end-to-end M&A capability. Invest now to compete for assets, build conviction, and deliver synergies faster.

- Refresh capital allocation. Maintain multiyear capital planning clarity on capex, M&A, and R&D timing and size. Articulate M&A’s strategic role to investors regularly.

The macro conditions favor deals: improving economics, growing PE and VC exit backlogs, and urgent reinvention needs. Traditional business models hit their growth limits. M&A offers the fastest path forward, if executed right.

Author: Richardson Chinonyerem

See Also:

Bain and Company Identifies ‘Pioneer Strategy’ | Disruption Banking