When Walt Disney Co. (DIS) joined the Dow Jones Industrial Average, it marked a historic shift. Burbank-based Disney officially entered the 30-stock Dow on May 6, 1991, becoming “the first pure entertainment stock in the Dow.” That inclusion was designed to give the index more exposure to the services/media economy, replacing U.S. Steel’s USX Corp. as the Dow’s first entertainment industry representative. Today – a full generation later – Disney still sits among America’s blue chips. However, from 2014 through mid-2025 its story has been anything but easy.

Today’s piece examines Disney’s Dow-era performance, its trials (streaming wars, leadership upheavals, ESPN decline, and a pandemic), and strategic turns, to assess its long-term outlook and weight in the index.

Disney’s Dow Debut: A New Era for the Index

Disney’s Dow inclusion reflected the index’s evolution. In the early 1990s, the U.S. economy was shifting away from heavy industry toward services and media. As the LA Times reported in 1991, adding Disney “tilts” the Dow “further toward the services economy” and away from manufacturing. Along with Disney, Dow Jones also added Caterpillar and J.P. Morgan in that 1991 reshuffle. By joining, Disney (ticker DIS) brought amusement parks, films, and consumer products into the venerable “Industrial” Average – a sign Dow guardians recognized entertainment as part of America’s economic leadership.

Because the DJIA is price-weighted, Disney’s influence depends on its share price, not market cap. In practice that means higher-priced stocks move the index more. As of mid-2025 DIS trades around $118 per share (TradingView), giving it roughly 1.7% of the Dow (Slickcharts). That weight is modest – far below giants like Boeing or Apple, whose share prices exceed $190 and thus carry much more index sway. Nonetheless, Disney’s presence adds media and consumer exposure that the index otherwise lacks.

Stock Stumbles: From Market Star to Dow Laggard

Disney’s stock outgrew its Dow label but lagged the broader market over the past decade. Adjusted for dividends, DIS rose from about $87 at end-2014 to roughly $118 by mid-2025 — a gain of approximately 35% over a little more than 10 years. (DIS all-time closing high was $199.45 on March 8, 2021)

By contrast, the S&P 500 roughly doubled during that time. Indeed, analysts note Disney’s cumulative return since late 2014 was only about +12%, far below the S&P’s roughly over 130%. To put it another way, Disney has been among the weakest Dow names. As recently as August 2023, DIS traded at a nine-year low, falling behind almost all peers.

Disney $DIS is currently on pace to close trading today at its lowest level in almost 9 years

— Evan (@StockMKTNewz) August 24, 2023

Disney shares haven’t closed lower than $84 since Oct. 17, 2014 pic.twitter.com/u5ckm2s4Ds

Post-Pandemic Plunge: Disney’s Lost Magic

Optimism around Disney+ drove shares to highs of $143 at the end of 2019 — 33% above 2018. Early 2020 saw a peak of over $170 before the pandemic crashed DIS into the $80s by March. A swift rebound pushed it to $199.45 in March 2021, buoyed by reopening hopes and streaming growth. Yet streaming losses, leadership turmoil, and investor jitters triggered a 14% drop in 2021 and a brutal 44% plunge in 2022.

By year-end 2022, DIS sat near $86 — flat from 2019 — while the Dow and S&P surged ahead. Commentators note Disney “crushed” every index historically, but since March 2021 it has underperformed the S&P 500, transforming it from a Dow standout into one of its weakest links.

$DIS, Disney, is the worst performing stock in the Dow Jones this year, and it's trading even lower than when Disney parks and movie theaters were closed in 2020.

— unusual_whales (@unusual_whales) July 18, 2022

Battling Headwinds: Streaming, Sports, and Shocks

Over 2014–2025 Disney has faced multiple headwinds that dented its valuation and Dow role. Four stand out: fierce streaming competition, leadership turmoil (Bob Iger’s exit and return), ESPN’s decline, and COVID-19’s blow to parks.

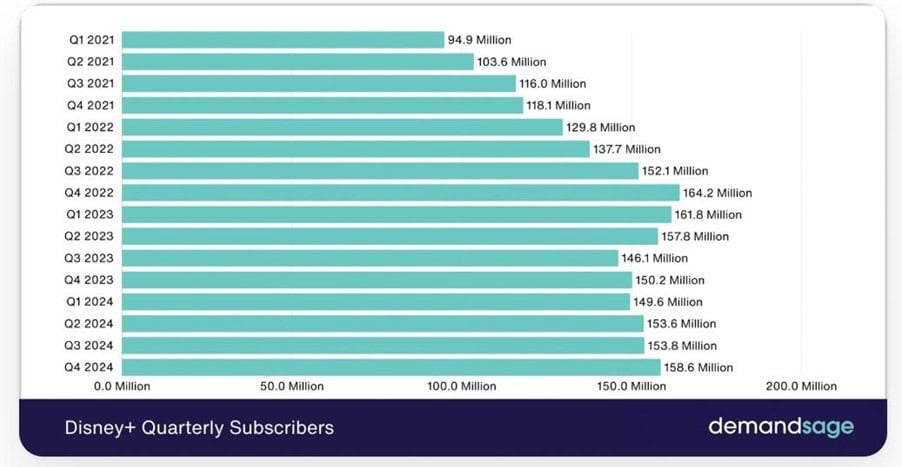

After spending $71.3 billion to acquire 21st Century Fox’s film and TV assets in March 2019 — bringing franchises like X-Men, Avatar and The Simpsons under its roof, to fuel Disney+ and capture Netflix’s audience — the service hit 116 million subscribers (Q3 2021) but lost about $1.5 billion per quarter by late 2022. When Bob Iger returned as CEO, he cut budgets and raised prices across Disney+ and Hulu, delivering a modest $253 million profit in Q4 2024.

Leadership turmoil compounded the pain: Previous CEO Bob Chapek’s pandemic-era missteps led to his replacement by Iger in November 2022, sparking a 9% stock rally after a brutal 41% drop that year.

Meanwhile, ESPN’s once-robust margins eroded as cord-cutting and soaring rights fees drove TV network revenue down 7% (to $6.7 billion) and operating profit down 23% in Q3 2023. CEO Iger has declared Disney will “stay in the sports business” but looks for partners or a joint-venture for ESPN rather than spinning it off. He noted ESPN is “caught between declining cable subscribers and increasing fees paid to sports leagues.” However, recent data shows recovery signs, with domestic ESPN advertising revenue up 15% in Q1 2025.

Disney’s theme parks division (Disneyland, etc), shut in 2020 losing $1.9 billion, but broke even by late 2021 and rebounded through 2024 — Q3 2023 parks revenue hit $8.3 billion (+13% Y/Y) with operating income $2.4 billion (+11%) (helped by full-year reopening of a theme park in Shanghai). However, lingering cost pressures and unpredictable attendance trends revealed how vulnerable even the strongest cash engine can be.

Strategic Pivots: Rebuilding the Kingdom

Disney’s decades-long franchise-building — Marvel, Pixar, Lucasfilm, and Fox — remains at its core. During the pandemic, day-and-date streaming releases kept audiences engaged. But integration costs from the Fox acquisition saddled Disney with debt and amortization expenses. Chapek-era overspending in parks and content amplified losses, prompting Iger’s 2023–24 cost-cutting program targeting $5.5 billion in savings. This was later increased to $7.5 billion, achieved by fiscal 2024, as confirmed by Q4 2024 earnings reports.

Investor sentiment, as per Motley Fool, has oscillated as activist pressure from Trian Partners called for sharper asset rationalization, while analysts now view Disney as undervalued if its streaming turnaround holds. The company’s valuation metrics (P/E multiples under 20 in 2022) reflect skepticism, even as parks and studios stabilize.

One of the major reasons we invested in Disney $DIS back in AUG 2024 (~$90/share) was b/c I thought the market wasn't fully respecting Disney figuring out the streaming business.

— The Wealth Dad (@thewealthdad) June 17, 2025

Streaming for $DIS (Disney+ & HULU) is now a legit money-making business ($336M PROFIT in Q2 FY25). https://t.co/9ZStf4ogY6

Can Disney Reclaim Its Crown?

Disney’s decade in the Dow has been a study in disruption. Its revered franchises and global parks remain powerful assets, but the advent of streaming and unpredictable crises have tested Disney’s adaptability. The forecasts for Disney’s stock price by the end of 2025 range from $111 to $221.35, reflecting varied perspectives on its growth potential. Positive drivers include streaming profitability, evidenced by a 20% adjusted EPS increase in Q2 2025, and a $30 billion theme park expansion plan through 2033.

Will Disney reclaim its role as a top Dow performer? Its brand enchantment and diversified portfolio argue “yes,” but execution will be critical. As the Dow moves deeper into the digital era, Disney’s stock performance will reveal whether this iconic storyteller can once again delight investors and propel the index into its next chapter.

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

#Disney #DowJones #Entertainment #Streaming

See Also:

Amazon’s Dow Jones Rise: Innovating Markets, Facing Scrutiny | Disruption Banking

Disney: Why the Stock Price Could Fall Further in 2024 | Disruption Banking

Has Disney capitulated to the Chinese Communist Party? | Disruption Banking