With more than a hundred years of history, The Walt Disney Company is one of the most iconic and influential media brands ever. Its success started with the creation of Mickey Mouse and Donald Duck in 1928, two characters that became symbols of animation and entertainment. Since then, Disney has expanded its reach and scope to become a media giant with over $80 billion in annual revenue and a market cap of $163 billion.

The NYSE-listed company operates in various sectors, such as media networks, direct-to-consumer services, studio entertainment, theme parks, and resorts. It also owns many well-known studios, TV channels, and franchises, such as Marvel Entertainment, Lucasfilm, ABC, Pixar Animation Studios, and ESPN.

A Rough Patch For Shareholders

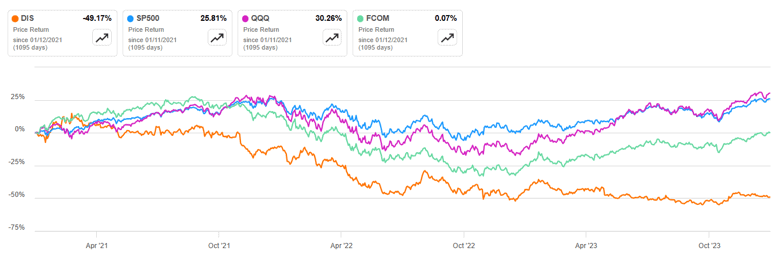

Despite Disney’s storied history, its billion-dollar brands, and enviable media empire, the stock has not been able to reward its investors in recent years. The company’s stock price has plummeted by almost half in the last three years, while the broader market and the communications sector have soared.

According to Seeking Alpha, a platform for financial analysis, Disney has underperformed the S&P 500 by 75% and the Nasdaq 100 by 80% in the same period. Disney has also fallen behind its peers in the Fidelity MSCI Communications Services Index ETF, which includes companies like Meta, Alphabet, Comcast, Netflix, and Disney. The ETF has gained 32% in the last year, while Disney has lost 10%.

Source: Seeking Alpha

Disney’s stock price has plummeted from its peak of $190 per share in 2021 to around $90 per share today. Some investors might see this as a bargain opportunity to buy the shares of a well-known entertainment giant. However, this could be a mistake, as the company faces several challenges that could drag its performance down even more. The company’s weakening competitive position, weak growth prospects, and unjustifiably high valuation are all factors that could limit its upside potential.

Company-Specific Issues

Longtime Wall Street Journal columnist Jason Zweig, in an introduction to his 2003 revised edition of Benjamin Graham’s “The Intelligent Investor,” summarizes Graham’s core principles; one of which is: “A stock is not just a ticker symbol or an electronic blip; it is an ownership interest in an actual business, with an underlying value that does not depend on its share price.”

Disney’s business performance has been disappointing, despite its impressive revenue growth. The company’s costs have been rising faster than its income, squeezing its profit margins. The company reported a record annual revenue of $88.89 billion for the fiscal year ending September 30, 2023, up 7% from 2022. However, its diluted earnings per share (EPS) from continuing operations dropped to $1.29 from $1.75 in the previous year, as per the company’s earnings release.

The company’s streaming and theme park investments have put a dent in Disney’s profitability. Disney faces stiff competition from established players like Netflix in the streaming market, and has ramped up its content spending in recent years.

“Disney’s spending has been significantly higher historically, often double or nearly triple that of Netflix,” notes global research firm Statista, adding that: “Disney’s content spending in 2022 was estimated to be 33 billion U.S. dollars, an eight billion dollar increase, while that of Netflix was projected to be 17 billion, the same as its content spending in the previous year.”

In addition to spending heavily on content, Disney has dedicated a great deal of resources towards its theme parks. The company in September disclosed that it plans to nearly double investments in its parks and resorts segment to $60 billion over the next ten years, according to Bloomberg.

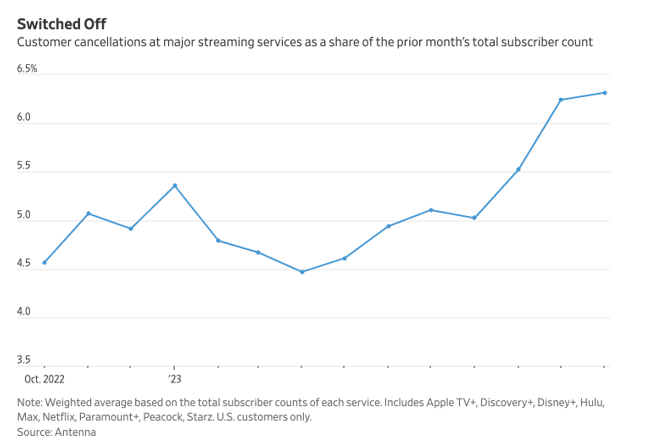

Disney’s bets on streaming and theme parks have not paid off yet. The streaming business, which saw a surge in subscribers during the pandemic, is now facing a slowdown in growth. In the US, Disney’s main streaming market, more customers are dropping their subscriptions. According to a Wall Street Journal report, streaming rivals like Netflix and others are offering bundles, discounts, and ad-supported plans to retain customers.

Source: Wall Street Journal

Outlook Increasingly Uncertain

As costs increase, Disney’s profits are shrinking. The company’s leaders have tried to calm the market by saying they are taking steps to reduce expenses and maintain profits. “We have a solid foundation of creative excellence and innovation built over the past century, which has only been reinforced by the important restructuring and cost efficiency work we’ve done this year, and we’re on track to achieve roughly $7.5 billion in cost reductions,” noted Robert Iger, Disney CEO in the 2023 earnings release published in November.

Disney’s cost-cutting measures have failed to impress investors, who are worried about the company’s ability to boost its revenues in a highly competitive market. The entertainment giant is facing challenges not only in its streaming division, but also in its film production arm. In 2023, Universal surpassed Disney as the highest-grossing movie studio in the world, with a global box office of $4.91 billion, while Disney earned $4.83 billion. The outlook for 2024 is bleak, as the Hollywood strikes are expected to reduce the domestic box office from $9 billion in 2023 to $8 billion in 2024.

Overvalued Stock, Politically Exposed Brand

Disney’s forward P/E ratio of 24.5x is much higher than the median P/E ratio of about 16x for the communications services sector, based on data from Seeking Alpha. This means that the stock is overvalued compared to its peers, even though it has lagged behind the market and the sector in performance. This suggests that the stock could face downward pressure as the market adjusts to the risks.

Disney also has a politically exposed brand. It has repeatedly rubbed off fans the wrong way by advocating for sensitive political positions that have resulted in multiple accusations of “wokeism.” This term is often used to describe a perceived trend of corporations adopting progressive stances on various social and political issues. The company has also been accused on kowtowing to political authorities. In China, for example, Disney has complied with the Communist Party’s directives in the past, including failing to offer The Simpsons episode that mocks China’s terrible suppression of the Tiananmen Square protests. The leadership of Disney has apologised to the Chinese authorities for making films about Tibet in the past.

Disney’s leadership turmoil may have spooked some investors. The company has seen dramatic changes in its top management in the past few years. Bob Chapek, who was the CEO of Disney until November 20, 2022, was ousted from his position for various reasons, such as PR blunders, employee discontent, weak financial results, and accusations of financial wrongdoing. His departure was unexpected, as it happened only five months after the board had extended his contract. The board then brought back Bob Iger, the former CEO of Disney, to resume the role. Iger is a veteran of Disney, having joined the company in his early career as an executive of ABC before it was acquired by Disney in 1996.

For many investors, the mix of declining profits, increasing costs, executive instability, and a politically sensitive brand poses a high risk when evaluating Disney as an investment option. This could explain why the stock has lost its appeal and is currently trading at multi-year lows.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.