When two big companies merge, it can create a lot of buzz and excitement. But these huge deals are not easy to pull off. Big ticket mergers and acquisitions involve many challenges, risks, and uncertainties that can adversely affect the value of the new company and the portfolios of its shareholders. This is what long-term investors of Bayer AG, a German pharma and biotech giant, are learning the hard way. The company’s stock price has been plummeting since it bought Monsanto, a controversial agrochemical firm, for more than $60 billion in 2018 in its largest deal ever.

Bayer’s stock price has been on a downtrend since the deal: [Source:Trading View]

According to TradingView, Bayer traded at around 93 Euros/share on Friday 8th June 2018, the date the acquisition was completed. The shares are currently trading at around 32 Euros, representing a 65% drawdown for investors who failed to cut their exposure to the stock after the transaction closed. Amidst this nerve-wracking volatility, the entire value of Monsanto has been wiped out of the share price, leaving the management in a tough spot with irate shareholders.

A Leaky Boat

A good deal is like a good joke, it leaves everyone laughing all the way to the bank; but a bad deal is like a leaky boat, you’re sinking even before you start sailing. This is how Bayer’s shareholders and management must have felt in the last six years, as they faced one disappointment after another.

Right from the start, Bayer’s takeover of Monsanto was beset by challenges and risks. Monsanto had a controversial reputation due to its involvement with genetically modified crops and harmful chemicals. One of its best-selling products, a weed killer called Roundup, was linked to cancer cases and resulted in massive lawsuits against the company in the 2010s.

Bayer inherited these legal troubles when it acquired Monsanto in 2018, though at the time of the deal the courts still hadn’t ruled on the lawsuits. However, shortly after finalizing the acquisition, the first Roundup lawsuit was decided and the verdict went against it. The market reacted negatively to the prospect of similar rulings in future and the resulting huge settlements, and Bayer’s stock price tanked. In 2020, Bayer agreed to pay over $10 billion to end the litigation over Roundup. By then, Monsanto had already been absorbed into Bayer’s crop science division, leaving behind a legacy of damage and disappointment.

"A proposed tie-up between Bayer and Monsanto may still face numerous hurdles but it has already inflamed opinion in Germany where most people oppose genetically modified foods."https://t.co/Ql8FwatVtV

— #DisruptionBanking (@DisruptionBank) January 23, 2024

Training Its Sights On Africa

Investors have been calling for the separation of Bayer’s consumer-health business from its crop science operations for more than seven years, according to a report on Bloomberg. Markus Manns, portfolio manager at Union Investment, a shareholder, notes that: “Simplifying the group structure would be an important step in making the company more attractive on the capital market. Spinning off consumer health would be the easiest way to generate value.”

Despite the pressure from some investors to separate its pharmaceutical and crop science divisions, Bayer has resisted this idea under the leadership of its former CEO Werner Baumann, who left the company in June 2023. His successor, Bill Anderson, seems to share the same vision. According to a Bloomberg report, the company has no intention of breaking up its business in the near future. Instead, it is concentrating on increasing its efficiency, and Reuters reported that the company is planning to cut many management jobs.

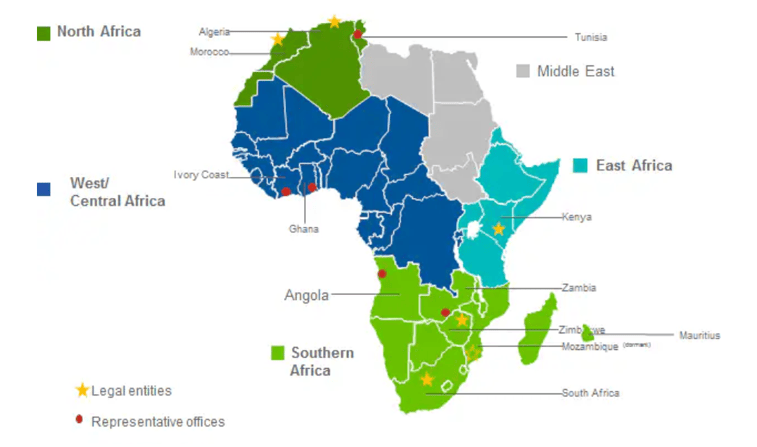

Bayer is also making an interesting bet on a small but promising market – Africa. Although the majority of Bayer’s total sales on the continent are generated in South Africa, it has been expanding its presence across the continent in recent years, with legal entities in Zimbabwe, Kenya, Algeria, and Morocco and representative offices in Ghana, Ivory Coast, Angola, Zambia, and Tunisia.

Bayer Africa Presence [Source: Bayer]

Bayer has three business segments in Africa: consumer, pharmaceutical, and crop-health. The crop-health segment is especially relevant for the continent’s enormous agricultural potential. Africa’s appeal for Bayer’s crop-health products stems from its vast areas of unexploited farmland and low adoption rates of fertilizer, herbicides, and genetically modified crops. This untapped market offers a chance for growth. However, Bayer faces increasing criticism for selling some of the disputed legacy Monsanto products to African farmers.

GMO Debate Heats Up

A group of farmworkers from Paarl, South Africa, staged a street demonstration in September 2023 to voice their opposition to the use of banned agrochemicals by European firms. The demonstrators, who were part of the Women on Farms Project, targeted the Bayer office and urged the company to stop marketing pesticides, herbicides, and fungicides that contain ingredients prohibited by the European Union (EU).

Organisers aimed to expose the double standards of European agrochemical firms that dump their hazardous products in developing countries, while respecting stricter regulations in their home markets. The protests came shortly after the visit of Marcos Orellana, PhD, the UN Special Rapporteur on Toxics and Human Rights, to South Africa earlier in August. He voiced concerns in his official report over what he described as “environmental racism” in reference to some of the controversial pesticides imported to the country.

Welcoming the outcome of Dr Orellana’s visit, Minister Creecy urged the @UN to support South Africa’s journey from #environmental racism to #sustainable development and realization of the human rights contained in Section 24 of the Constitution. pic.twitter.com/tAkFBzg0Ed

— Environmentza (@environmentza) August 11, 2023

The South Africa protest was the latest instance of tension between Bayer and farmers in Africa over the environmental and health impacts of its products. Activism across Africa could lead to lawsuits and punitive verdicts against Bayer. The company has already faced lawsuits in the US over its herbicide Roundup, which scores of plaintiffs linked to their cancer. Now, it may face more legal troubles in Africa if governments decide to follow the farmers’ demands and hold Bayer accountable.

Another challenge for Bayer in Africa is the controversy over genetically modified organisms (GMOs), which are a core part of its business. While some African countries have banned GMOs outright, such as Algeria and Madagascar, others have imposed strict regulations or faced public opposition.

While scientific research is taking root in Africa, the debate over GMOs on the continent is strongly influenced by political, social, and cultural factors that shape people’s perceptions and attitudes. Bayer may find it difficult to expand its market share in Africa if it does not address these concerns and engage with the stakeholders.

With climate change exacerbating food insecurity in Africa, some experts and policymakers believe that GMOs, which can be engineered for faster maturity or higher tolerance to pests or drought, could be part of the solution.

The prioritisation of food security by leaders in Africa could also boost Bayer’s prospects with GMOs on the continent. According to the chief of Bayer’s Crop Science division, Rodrigo Santos, the conflict between Ukraine and Russia has been a “wake up call” for food-importing nations in Asia and Africa to seek more self-reliance. He told Bloomberg in a June 2023 interview in New York that this could create more demand for genetically modified crops, which Bayer produces and sells.

Bayer may see a potential market for its GM crops in Africa, but that alone may not be enough to improve its financial outlook and win over investors. The company still faces many challenges before it can make GMOs in Africa a major source of income. Many African countries still have strict regulations and ongoing debates about the safety and ethics of GMOs. Each country has its own approach to dealing with GMOs, and Bayer has to navigate the complex and diverse landscape of African biotechnology.

The war in Ukraine, which has caused disruptions in grain supplies, has some countries turning to genetically modified crops https://t.co/oxPpze7T1l

— Bloomberg (@business) June 21, 2023

ESG Ratings At Risk?

Bayer faces multiple challenges in Africa, where it is pursuing its interests in GM crops and importing pesticides that are controversial. GM crops are a contentious issue not only in Africa, but also globally, as there are many unresolved questions about their safety, testing, health effects, and biodiversity impacts. There are also social and economic concerns about the domination of seed resources by a few large corporations, and the possible consequences for small farmers.

Bayer’s expansion in Africa could also affect its Environmental, Sustainability, and Governance (ESG) ratings, which could have a negative impact on its stock performance. Bayer’s ESG ratings are currently above average for its industry and sector, according to Moody’s. However, this could change if Bayer faces more resistance and criticism for its activities in Africa.

Bayer’s outlook for 2024 is not very promising, as the management expects “a soft growth outlook and continued challenges” to profitability, as per the latest published guidance. Bayer is also under pressure from investors to separate its businesses, which it has resisted so far. With these factors in mind, Bayer’s stock could continue to lag behind this year.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.