Is Shenzhen the best example of a City of the Future?

Many of us woke up this morning to see another flurry of Tweets from Donald Trump, this time warning the federal pension fund to divest its portfolio from Chinese companies. Before you agree or disagree with what POTUS is saying, maybe you should consider the story behind investment in China…

President Trump has requested that the federal pension fund divests its portfolio from Chinese companies. This request highlights his growing displeasure with China's lies about the spread of the Covid-19 pandemic.https://t.co/p9y1PY3XyP

— Newt Gingrich (@newtgingrich) May 13, 2020

The 20th Century was a pivotal Century where global empires like the British, French, Ottoman, Austro-Hungarian, German and finally Soviet – Russian Empires all collapsed. Empires that had been performing outstandingly during the 19th Century. The adage that you can only count on 1 thing in life, and that is change, applies to both currencies, empires and not just technology.

While Europe was busy working out whether it could ever lead again after the Second World War, Deng Xiaoping was creating and implementing the Chinese economic reform which was the start of the process that led to the China that we are seeing and hearing so much about today. As opposed to Central Europe and Russia’s economic demise in the late 80s, the Chinese were strengthening their economy with a rich helping of capitalism which seems to have been a huge success. Leading on to China taking back the two Western colonies of Macau and Hong Kong, Deng Xiaoping is said to be the Author of many of China’s modern-day strategies.

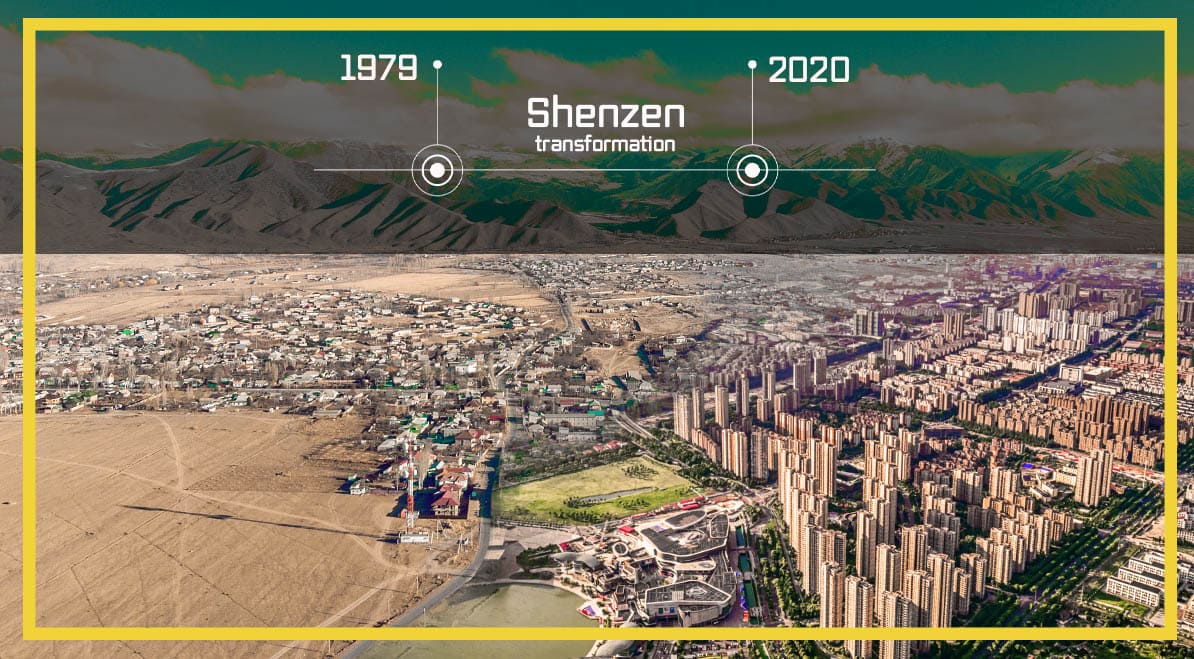

One of the lasting memories and showpieces of this reform is the modern-day City of Shenzhen. Many of our readers will be familiar with the stories of how Shenzhen started as an agglomeration of fishing villages, and swiftly became an example of China’s economic miracle. A list of technological landmarks such as the Huaqiengbei electronics wholesale market – thought to be the largest single electronics market in the world – have taken prominence in Shenzhen since the early 90s:

Shenzhen electronics market, here you find every possible electronic components.if you are into IoT you might be interested in visiting this place. pic.twitter.com/CRgo9WCLPC

— Lwazi (@LwaziMBK) February 10, 2019

Even the World Economic Forum was praising initiatives from Shenzhen a few weeks ago:

Shenzhen is first city in the world with an all electric bus fleet (16,000 buses). Soon all 20,000 taxis will also be electric.

— Mike Hudema (@MikeHudema) April 26, 2020

We have solutions to the #climate crisis. Let's speed up and implement them. #GreenNewDeal

#ActOnClimate #energy #tech #PanelsNotPipelines #go100re pic.twitter.com/8msqPK2Svq

Couple this with a record amount of skyscrapers being built and a state of the art stadium for the local population, it appears that Shenzhen continues to deliver where other Tech Cities still look for inspiration. The terminology “StartUp” is also a slightly different concept for the locals of Shenzhen, who prefer to be referred to as “Makers” and have embraced initiatives such as the Makers Faire where Electronic Tech is showcased in much the same way as StartUp Festivals are undertaken in the USA or Europe:

"With the end of a journey marks the beginning of another."

— 柴火创客/Chaihuo Makerspace (@chaihuomaker) December 17, 2019

This concludes our #TimeDefinitionProject, by team Chaihuo. We hope that you guys liked this project of ours, do check out the full project showcase in the post below!#maker #diy #art #timehttps://t.co/skSSXPAKIy pic.twitter.com/PD2yq71HXM

And this, I am sure you will agree is a great story in itself, but what about the economics? Many people are aware that the Chinese Government itself has been the main sponsor of economic change, and has put huge efforts into stimulating entrepreneurship, especially in cities like Shenzhen. Back in 1991 when the Shenzhen Stock Exchange (SZSE) was officially opened, Hong Kong was still a foreign country, albeit only a few miles over the water.

The SZSE had a historical peak in February 2020 just as the Virus was strengthening its’ grip on the rest of the world. At least, it was a historic peak for 2020. Back in 2016, the Shenzhen Stock Exchange index was hovering over 3000, today it is barely able to touch 2000. What caused this? Back then this was related to the fear that the Chinese economy was contracting, however the recovery of Shenzhen’s exchange has not been as strong as many would have predicted comparing it to the FTSE100 or the DJIA as in the Charts below:

You might be thinking that this is the kind of evidence that shows that Shenzhen is worth investing in. Some have gone further and seen the opportunities behind initiatives such as the Shenzhen-Hong Kong Stock Connect founded back in December 2016 – many billions are being traded on this platform today already. And last year saw a flurry of activity in global research firms adding the Shenzhen and Shanghai Stock Exchanges to their portfolios:

Our Chief Asia and EM Equity Strategist Jonathan Garner discusses his positive view on China stocks compared to other emerging markets, and our favored sectors within the APAC region on @CNBCi. #MSIdeas https://t.co/xh6ulVoaqF pic.twitter.com/3povxM2rwT

— Morgan Stanley (@MorganStanley) May 12, 2020

MSCi are starting to get a good foothold in the Chinese Stock market, a world where Credit Cards and Cash have been largely replaced by WeChat and AliPay, and a market that has certainly not conformed to the prerequisites of US institutions such as the SEC. And apart from a few bumps on the road, the Emerging Markets portfolios of many firms will now include a few Chinese investments that would have been unheard of a few years ago.

HSBC are also strengthening their reach into Asia, publishing multiple reports about the attractiveness of the Chinese investment landscape as well as building relationships with stakeholders from the Chinese government sector:

Either way, I strongly believe that we should be following the Stock Exchanges and the performance of the Chinese currency more than ever before. There are some great Twitter profiles that share information regularly about the performance of various equities in China, one of our favourites is:

#Chinese mainland #shares opened higher on Friday as the benchmark #Shanghai Composite Index edged up 0.39%. The #ChiNext was up 0.52% and the #Shenzhen index rose 0.56%. #5G-related stocks rallied. pic.twitter.com/X9xwGGBqXH

— Global Times (@globaltimesnews) May 8, 2020

A larger global challenge may be on the horizon though. Ray Dalio has recently discussed the growth of China’s participation in Global GDP, with Europe dropping off the radar as a competitor to either the USA or China. Depending on how the USA looks in the next few months, 2021 may just usher in the first discussions about what the global reserve currency should be if it is no longer the USD:

Another prevalent economist who covers the Asian markets is Jim Rickards who was in a compliance role during the Asian Financial Crisis of 1998. Jim is quoted to say that 2008 was a bit like Groundhog Day for him, which makes me wonder what 2020 must look like for him. Jim published a book in 2011 called Currency Wars which hints at the problems around the situation with the global reserve currency being the USD. Highly recommended for anyone who has not seen this book:

Predicting the Currency War and the Case For Gold (w/ Jim Rickards & Grant Williams) by Real Vision Finance https://t.co/cHfPIrdDan

— KryptoKids (@KryptoKids_) September 13, 2019

An Article about China without eluding to the BRICS nations would not cover the full story. And since the term was coined by the then head of Global Asset Management at Goldman Sachs – Jim O’Neill back in 2010. The story of this economic pact is yet to truly unfold but can only help China strengthen its’ influence further.

On a completely different note. China’s tourist scene also seems to be on the up, with Hainan registering 83 million visitors in 2019… And if you want to know what all the fuss is about, then please have look at the below link:

More than 83 million tourists from home and abroad visited S China's tropical island Hainan in 2019, up 9% from last year. Hainan's tourism revenue went up 11% over last year to 105 billion yuan (about 15 billion USD), official data shows. pic.twitter.com/fidrB5tFL6

— People's Daily, China (@PDChina) January 11, 2020

Should we share more content about Shenzhen and the wider markets situation in China again in the future? It seems like the World needs to be more aware of the biggest competitor that Silicon Valley has ever faced…

Author: Andy Samu

2 Responses