Today at the World Economic Forum in Davos, the President of the United States gave a Special Address. His wide-ranging speech sought to exhibit the economic success of America and the continuing embracing of innovation under his administration.

Deregulation and the Return to Growth

The Trump Treasury Department has made regulatory burdens on fintechs lighter, with the opening of sandboxes, allowing fintechs the free flow of money transfers across state lines and generally supporting a PSD2-like (Open Banking) support of customer data exchanges as seen in Europe. The same department has also gone on to support the use of alternative data, such as utility payments and consuming habits, to form credit checks.

Read: Jim Wadsworth, Senior Vice President, Open Banking, Mastercard, discussing the trends and concerns surrounding open banking, and shares what the company is doing to ensure that the concept remains on an upward curve;

Read: An opinion on the possible dystopian nature of Alternative Data for Finance transactions and Credit scores and the future impact on society.

On the subject of relaxing rules Trump claimed that “for every new regulation we are adopting we are removing 8 old regulations. As a result of our efforts, investment is pouring into our country. In the first half of 2019, the United States attracted nearly one quarter of all foreign direct investment in the world. 25%”

A major aspect of this deregulation has been the partial repealing of the Dodd-Frank Act – the 2010 law that sought to constrain the financial services industry in the by placing strict regulations on lenders and banks in an effort to protect consumers and prevent another all-out economic recession.

The Trump administration have also made other amendments to important financial services guidelines, including relaxing the Volcker Rule for community banks and dismantling the so-called “fiduciary rule”.

The Volcker Rule seeks to limit the trades and investments done by a bank on its own account and limits their dealings with hedge and private equity funds. It aims to protect the customers of the bank from highly speculative behavior by the bank itself – especially in relation to mortgage-backed securities (that many attribute to the 2008 financial crisis). A sort of ‘forced behavior change’ from wild and excessive trading floors back to a trusted custodian of savings and customer assets.

Deregulating this will certainly accelerate sector growth in consumer finance. This could lead to a boom in lending fintechs, those for instance that are pushing P2P loans, and will encourage large financial institutions to buy, partner or invest in the startups that are providing such innovations.

The ‘fiduciary rule’ meanwhile, also known officially as the “Conflict of Interest” rule, states advisers have to give conflict-free advice on retirement accounts, putting their clients’ needs ahead of their own potential compensation.

Throwing out the fiduciary rule “will shrink the market for robo-investing” according to one industry executive, which explains why fintech startup Betterment went so far as to take out ads in the New York Times and Wall Street Journal with open letters urging Trump not to undo the rule.

The Stock Market and Wealth

On stock market growth he mentioned that the “years of economic stagnation have given way to a roaring geyser of opportunity. US stock markets have soared by more than 50% under my administration, adding more than $19 trillion to household wealth and boosting 401Ks, pensions and college savings accounts- for millions of hardworking families. And these great numbers are many things. And its despite the fact that the Fed has raised rates too fast and lowered them too slowly.”

The record low, and in some cases negative, interest rates from the BoJ, BoE, Fed and other central banks have contributed to a period of spectacular stock market gains which have seen the NASDAQ and Dow Jones possibly enter into a parabolic rise- but at the cost of vast amounts of debt and continuous Repo interventions. According to the World Economic Forum Global Risk Report, by 2025, the G20 will have an average debt ratio of 95% of GDP.

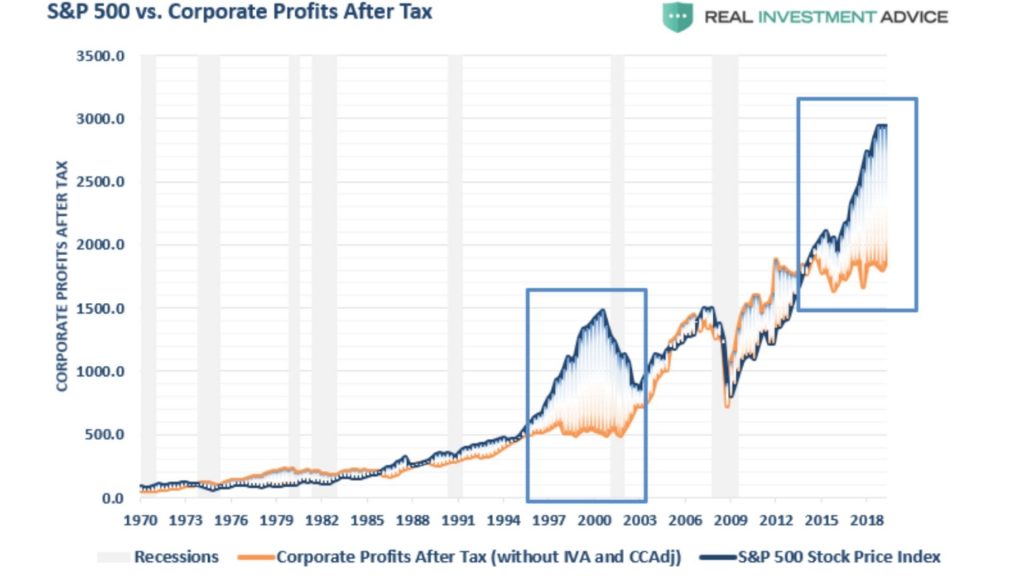

This excess of cheap capital has now led to a divergence in corporate profits and market valuation, reminding traders of the dot.com boom, bubble and burst.

Trump alluded to this aspect of backwards economics in his speech – “And we compete with nations that are getting negative rates. Meaning they get paid to borrow money – something I could get used to very quickly. Love that. Can I pay back my loan? No. How much am I getting?” There was a palpable scoff from the audience at Davos.

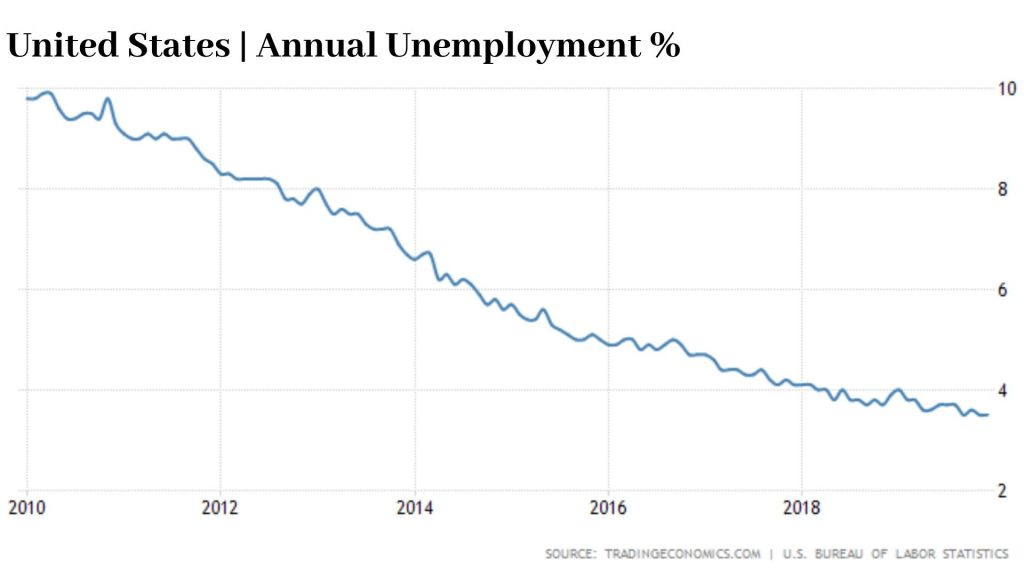

His policies have continued a trend of record low unemployment, the statistics of which he rattled off for a good five minutes. What was interesting was how his administration did this – “We created nearly 9,000 opportunity zones in distressed communities where capital gains on long-term investments are now taxed at zero. The 35 million Americans who live in these areas have already seen their home values rise by more than $22 billion.”

“I knew that if we unleashed the potential of our people, cut taxes and slashed regulations, and we did that at a level that had never been done before in the history of our country in a short period of time. Fixed broken trade deals and fully tapped American energy – that prosperity would come thundering back at a record speed. And that is exacly what we did and exactly what happened.”

“In just three years in my administration 3.5 million people have joined the workforce. 10 million people have been lifted off welfare in just the last three years. Celebrating the dignity of work is a fundamental pillar of our agenda. This is a blue-collar boom. Since my election the net worth of the bottom half of wage earners has increased by +43% – three times faster than the increase for the top 1%.”

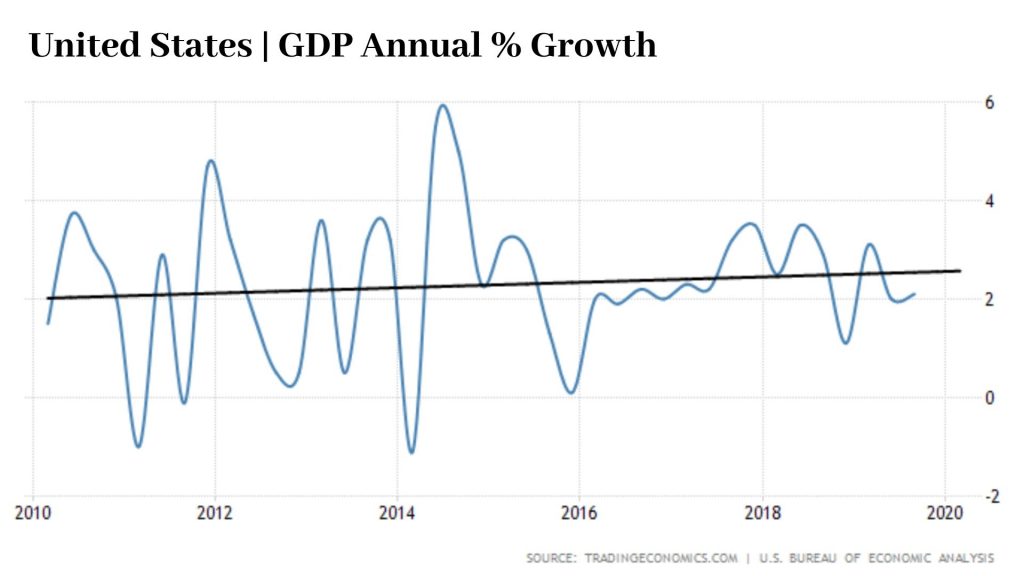

The statement that “the States is in the midst of a great economic boom the likes of which the world has never seen before” is however something that may have to be refuted as Gross Domestic Product growth has slowed in the past year, dogged by the US-China trade spat.

Disruptive Changes to Come

To seemingly again assure the crowd that he is not a luddite Trump zeroed in on ‘progress’- “But the wonders of the last century will pale in comparison to what today’s young innovators will achieve because they are doing things nobody thought even feasible to begin. We continue to embrace technology – not to shun it.”

“For three years now America has shown the world that the path to a prosperous future begins with putting workers first, choosing growth and freeing entreprenours to bring their dreams to life.”

One the subject of the China Phase 1 trade deal, Trump claimed to have addressed concerns of predatory behavior by the world’s second largest economy with “measures to protect intellectual property, stop forced technology transfers, remove trade barriers and agricultural goods. Open its financial sector and maintain a stable currency – all backed by very strong enforcement.”

In answer to the growing fears of robotics and AI, Trump spoke of how “as a central part of our commitment to building an inclusive society, we established the National Council for the American Worker. We have every citizen, regardless of age or background to have the cutting-edge skills to compete and succeed in tomorrow’s workplace. This includes critical industries like artificial intelligence, quantum computing and 5G.”

Read: An overview of the technology that is Quantum Computing, where it is being used and how all current encryption methods could become obsolete.

On February 11, 2019, President Trump signed Executive Order 13859 announcing the American AI Initiative — the United States’ national strategy on artificial intelligence. This strategy is a concerted effort to promote and protect American AI technology and innovation.

It seems the United States government may not have turned its back on the climate after all as Trump is to follow Davos with their new green scheme. “Today I’m pleased to announce the United States will join the One Trillion Trees initiative being launched here at the World Economic Forum” he vowed to widespread applause. This might help in mitigating the potential $100 trillion loss from climate inaction.

[do_widget id=custom_html-2]

Views expressed above are those of the author and do not necessarily reflect the stance of DisruptionBanking or its partners.

By Ignatius Bowskill-Dutkiewicz

One Response