Apollo Global Management, Inc. (ticker: APO) (“Apollo”) closed 2025 in a way that few firms can claim: record earnings, record origination, record inflows, and a stock price that surged around 5.5% the morning its full-year results dropped.

The numbers are striking. But the real story is what those numbers say about where private credit and alternative asset management are heading. And whether Apollo’s extraordinary run can last.

Marc Rowan’s ‘Exceptional Execution’: Apollo Prints $5.2B Net Income as FRE Hits Record Highs in 2025

On February 9, Apollo reported full-year 2025 adjusted net income of $5.2 billion, up 14% compared to 2024. That translates to $8.38 per share. Combined fee-related earnings (FRE) and spread-related earnings (SRE) hit $5.9 billion. Fee-related earnings alone reached $2.5 billion, up 23% year-on-year (YoY). Spread-related earnings, the income Apollo earns through its insurance arm Athene, came in at $3.4 billion, up 9% on a normalised basis.

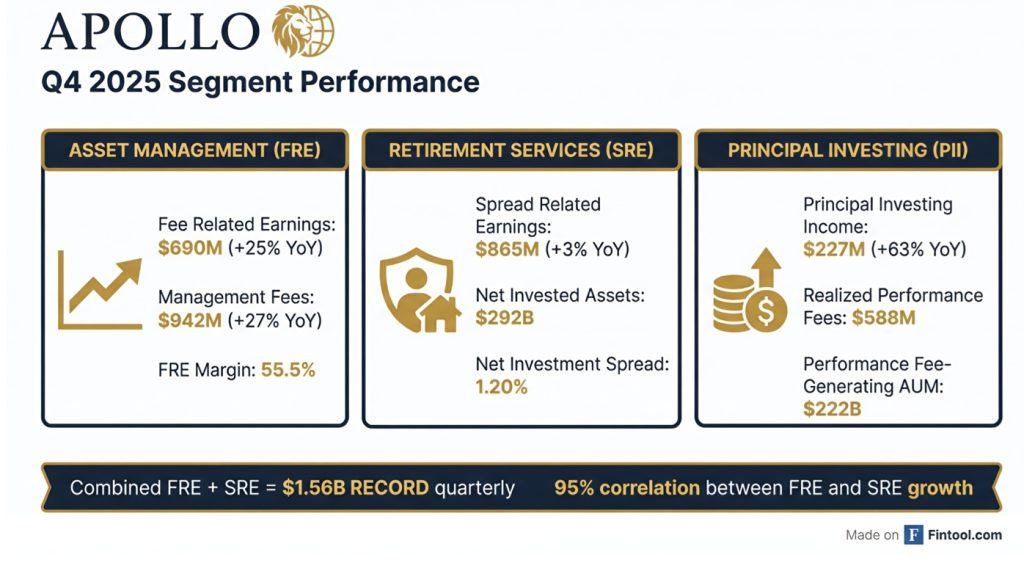

For Q4 specifically, Apollo posted adjusted net income of $1.54 billion, or $2.47 per share, a significant beat on analyst estimates. Fee-related earnings for the quarter reached a record $690 million. Athene’s spread-related earnings came in at $865 million for the period, driven by high-interest-rate tailwinds allowing for wider spreads on the firm’s investment-grade credit book.

CEO Marc Rowan called it “a year of exceptional execution.” That description is hard to dispute on the surface. But there are important details worth unpacking.

$309 Billion Originated in 2025, At a 350bps Spread Over Treasuries

Apollo originated a record $309 billion in assets across 2025, delivering spreads of approximately 350 basis points above Treasuries. The firm also pulled in a record $228 billion in total inflows, of which $182 billion was organic (primarily third-party capital raised through fundraising and business growth, with the balance including inorganic sources such as acquisitions adding AUM). This drove fee-generating assets under management (AUM) to $709 billion and total AUM to $938 billion, a blistering 25% increase YoY (from $751B at end-2024) and a firm now knocking on the door of $1 trillion.

According to Bloomberg’s report, these origination figures set a record and mark Apollo’s clearest push yet to rival traditional Wall Street lenders. The firm is no longer content being an alternative, it wants to be the standard. That ambition is rational given the retreat of regulated banks from mid-market and large-cap lending. Apollo has stepped into that vacuum aggressively and profitably too.

Fund X, Hybrid Value at 16%, Direct Origination at 12%: What Investors Actually Earned

Not all of Apollo’s 2025 performance was equally impressive across its strategies. Its flagship private equity fund (Fund X) returned approximately 7% over the last twelve months (LTM), solid, but not spectacular.

Apollo’s Hybrid Value strategy delivered a 16% gross return LTM, which stands out and reflects the firm’s ability to find mispriced credit across the capital structure. Direct Origination and Asset-Backed Finance (ABF) each returned 12% LTM, benefiting from floating-rate structures and Apollo’s proprietary sourcing through AI data centre financing, infrastructure deals, and European energy projects.

These are gross returns, not net. Investors in private funds typically pay management and performance fees that reduce these figures materially. The Securities and Exchange Commission (SEC) has been pressing for more disclosure on exactly this point. Still, mid-double-digit gross returns in credit strategies during a volatile macro year are a result most large allocators will take.

APO Stock Down ~13% in 2025 Despite Record Earnings: Here’s Why That Matters

There is a disconnect worth examining. Even as Apollo’s underlying business posted record results, APO shares fell roughly 12.9% over the 2025 calendar year. Broader macro jitters, particularly around interest rate volatility and growing regulatory scrutiny of private credit, weighed on the stock. The day the Q4 2025 results were released, shares jumped roughly 5.5%. That reaction tells you sentiment had run too cold relative to the fundamentals.

Zoom out and the picture is far more compelling. APO has returned roughly 750% over ten years, and approximately 172% over five years.

The 2022 merger with Athene, which gave Apollo a permanent, self-reinforcing capital base, has fundamentally changed the firm’s earnings quality. Permanent capital means Apollo does not have to keep fundraising to deploy. Athene simply needs assets to match its long-dated insurance liabilities, and Apollo supplies them at scale.

Teachers’ Unions Ask SEC to Probe Apollo Over Jeffrey Epstein Ties: What It Means for Investors

As Disruption Bankingreported here, Apollo has a track record of shrugging off the kind of legal and reputational headwinds that would unsettle smaller firms. At the time, the firm faced a lawsuit alleging it held nearly $20 billion in stranger-originated life insurance policies through a network of alleged sham trusts. Apollo flatly denied the claims. The market moved on, and Apollo kept growing.

That pattern is now being tested again.

Two major U.S. teachers’ unions, the American Federation of Teachers (AFT) and the American Association of University Professors (AAUP), have urged the SEC to investigate whether Apollo’s disclosures around historical links of its execs mostly, Apollo CEO Marc Rowan, his co-founders and former CEO Leon Black, and Joshua Harris,to Jeffrey Epstein gave investors a sufficiently complete picture, according to the Financial Times.

The unions, which say members have at least $27.5 billion invested with Apollo, stressed they are “troubled” by the revelations but did not allege current wrongdoing. Apollo has previously defended its conduct.

For now, investor behaviour looks consistent with past episodes: attention spikes, but capital tends to stay put unless earnings momentum breaks. Investors have seen this movie before, and they’ve stayed the course.

Investors Keep the Faith, Capital Keeps Coming

The 2025 results confirm that thesis. Total inflows of $228 billion represent a decisive vote of confidence from pension funds, sovereign wealth funds, insurance companies, and increasingly, retail investors. The latter being an area where Apollo is pushing hard through semi-liquid vehicles.

The lesson is that Apollo’s investor base is institutional, long-term oriented, and largely unfazed by controversy as long as the returns hold up.

2026 Outlook: 20%+ FRE Growth Expected, $2.25 Dividend, and a Push Toward $1 Trillion AUM

Apollo’s guidance for 2026 is ambitious. Management expects fee-related earnings to grow more than 20%. Spread-related earnings are projected to grow roughly 10%, targeting around $3.85 billion, assuming an 11% alternatives return. Net spreads are expected to stay in the 120–125 basis point range. The firm has also raised its annual dividend per share by 10% to $2.25, starting Q1 2026.

Apollo returned approximately $1.5 billion to shareholders in 2025 through dividends and share repurchases. The 10% dividend raise signals confidence, not just in current performance but in the durability of its earnings stream going forward.

The path to $1 trillion AUM is now in clear sight. Apollo hit $938 billion at year-end 2025, up from roughly $651 billion two years ago. If inflow momentum holds, crossing that threshold in 2026 is a realistic expectation, not a stretch target.

Wall Street Stays Bullish on Apollo, but Not Blindly

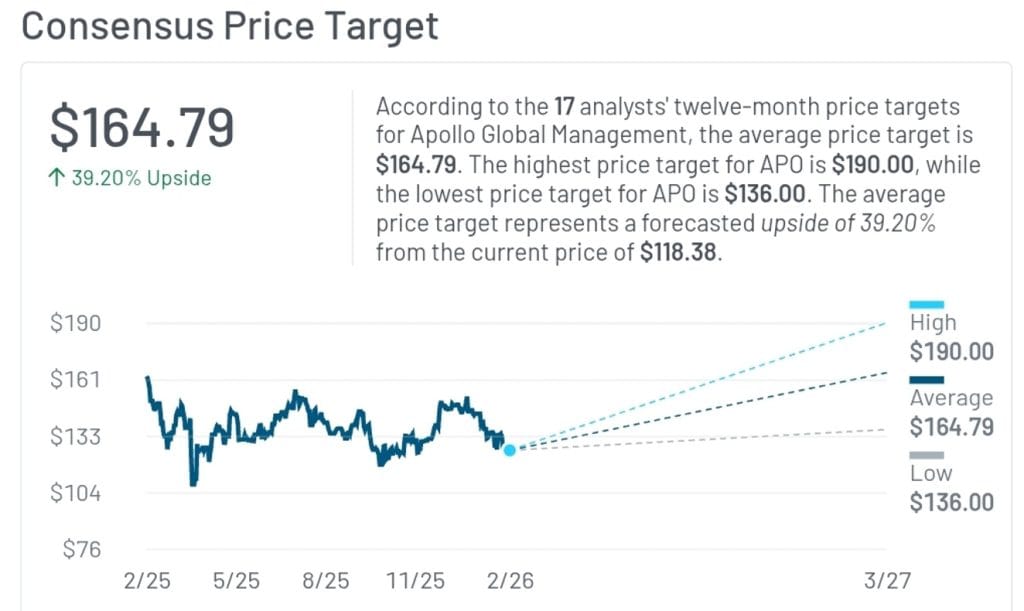

Wall Street remains broadly supportive of Apollo Global Management, even as valuation questions begin to creep in.

Evercore recently lifted its price target to $155 and maintained an outperform stance, while Deutsche Bank reiterated its buy rating. Morgan Stanley nudged its target higher to $181 with an overweight call, and Piper Sandler also reaffirmed an overweight with a $165 objective.

Weiss Ratings was the notable outlier, sticking with a hold.

In aggregate, the signal is still firmly positive: one Strong Buy, fourteen Buys, and two Holds, leaving Apollo with a MarketBeat consensus of Moderate Buy and an average price target of $164.79.

The takeaway is familiar: analysts still like the earnings machine, but the dispersion in targets suggests the easy upside may already be in the price.

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Apollo Global Management: Why Investors Are Not Worried About Latest Lawsuit | Disruption Banking