It made you look twice, didn’t it? The thought of alien spacecraft affecting central bank policy and leading to a stock market crash. But it isn’t such an ‘alien’ thought, some people in banking do have to prepare scenarios where something that unusual could happen.

It’s Unidentified Anomalous Phenomena or UAPs and not aliens or UFOs, which is an important distinction. The U.S. Department of Defense recently adopted the acronym, which describes any object detected in the air, sea and space that defies easy explanation.

In November 2025 a new documentary was released. Called the ‘Age of Disclosure’, the trailer starts with Marco Rubio, Secretary of State and National Security Adviser setting the scene for the rest of the story. The documentary is about the cover up of non-human intelligent life and a secret war among major nations to reverse-engineer advanced technology of non-human origin. It’s put the topic of UAPs right back on the map.

So much so that at least one expert has considered how UAPs openly engaging with the rest of us could affect monetary policy.

In a story in the Times last week, it was reported that Helen McCaw has written to Andrew Bailey, the governor of the Bank of England. The letter urged him to organize contingencies for the possibility that the White House may one day confirm we are not alone in the universe.

The story has raised debate on social media. Some commentators think the story is fake, others have made jokes about “buying the alien dip” or “aliens travelled billions of light-years to short stocks”.

BREAKING: Bank of England told to prepare for a market crash if the United States announces Alien Life.

— Douglas Macgregor (@DougAMacgregor) January 18, 2026

Helen McCaw who served as a senior analyst in financial security at the UK’s central bank sounded the alarm.

She has now written to Andrew Bailey, the Bank’s governor, urging…

Who is Helen McCaw?

According to her LinkedIn profile, Helen has studied Economics at Cambridge and worked at the Bank of England for more than ten years. During her time at the central bank, she was an economist, a policy analyst, a credit risk analyst, and a senior analyst, financial stability.

More important is what Helen wrote on LinkedIn earlier today referring to the story in the Times.

Helen highlighted how in 2024 she had written a “white paper with the Sol Foundation, a policy group focused on a Post-UAP World, setting out the policy implications of UAPs for the UK government.

The policy implications of UAP relate to:

- Government and National Security;

- International Relations;

- Scientific Progress and UK Competitiveness;

- Financial Stability; and

- Sociological Aspects.

She goes on to thank the Times and the journalist who interviewed her for treating the UAP topic with the seriousness it deserves.

“After five successive years of US government legislation on UAP, three Congressional UAP hearings, and a new UAP documentary, The Age of Disclosure, featuring 34 senior members of the US government, military and intelligence community – including Secretary of State and acting National Security Adviser Marco Rubio and Senator Kirsten Gillibrand – the United States government appears to be partway through a multi-year process to declassify and disclose information on the existence of a technologically advanced non-human intelligence responsible for UAP.

“Indeed, during her confirmation hearing in January 2025, U.S. Director of National Intelligence Tulsi Gabbard cited UAP as one of several “recent intelligence failures” that she intended to address during her tenure as DNI.

“The time for cognitive dissonance is over,” Helen states. She then adds how the governments of Canada and Japan have already engaged with the United States on UAP. Now her hope is that the UK government does so too.

What is the Purpose of Writing to the Bank of England?

In the Times story McCaw is quoted as saying “there might be extreme price volatility in financial markets due to catastrophizing or euphoria, and a collapse in confidence if market participants feel uncertain on how to price assets using any of the familiar methods.”

She adds how precious metals may be an answer for investors looking to a safe haven in the event of UAP disclosure. However, with access to new sources of precious metals, i.e. in space, the price may not be as certain.

She raises many other economic, political and financial questions in the story too.

“Even if you feel it’s very unlikely, it’s madness not to consider it and plan accordingly,” Helen summarizes.

The Bank of England has declined to comment on Helen’s letter, leaving the proposal in the realm of private advocacy for now.

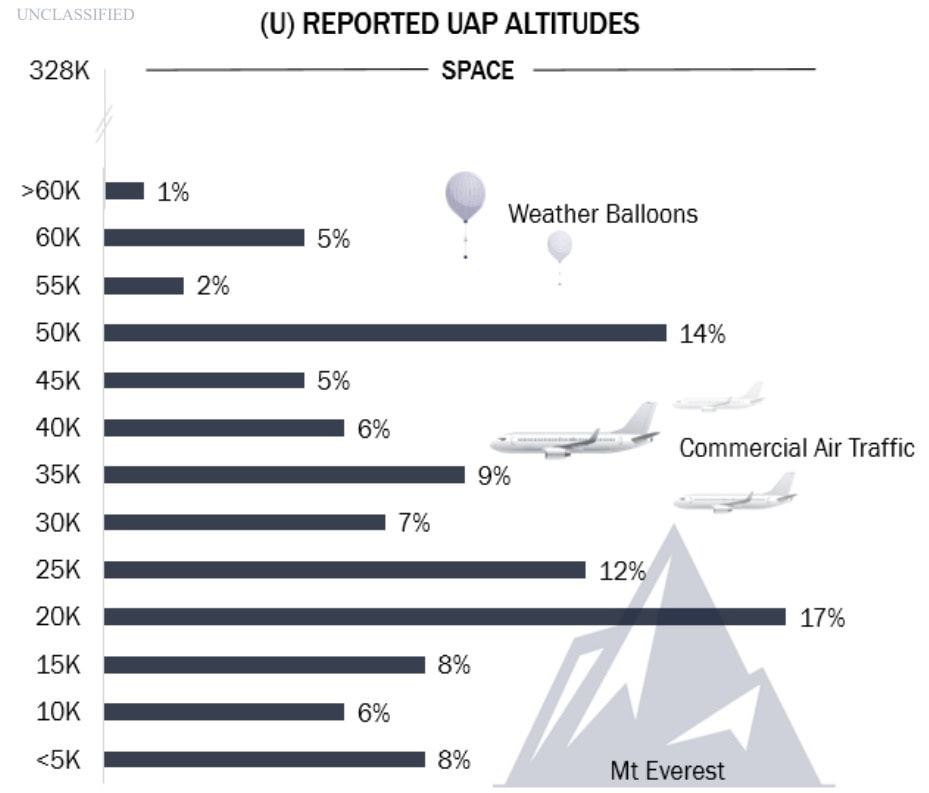

Perhaps she is right. There have been talks about UAPs for decades. In November 2024 The U.S. Department of Defense All-Domain Anomaly Resolution Office released an annual report on UAP.

The report included information about 708 UAP incidents which occurred in the air domain, and 49 that occurred in the space domain. There is even a map to show where the different sightings occur most frequently:

What would happen to capital markets if we were told that alien life exists tomorrow? What if they were hostile? Maybe the chances of this happening have increased. It’s worth reading the article in the Times if you want to know more.

Author: Andy Samu

See Also:

Forget assets on Earth, Space Assets are coming | Disruption Banking