On December 15, TeraWulf’s stock (WULF) slumped over 12% on fears that the company won’t be able to ride surging Bitcoin prices to complete its shift to hyperscalar compute. The selloff didn’t happen in a vacuum: markets were already jumpy about whether the current AI capex arms race is building real, durable cash flows or just levering balance sheets into the next unwind.

A key reference point for that anxiety about the scale of investments in AI and the possibility of an AI bubble has been Oracle, which has $108 billion in debt due to investments in AI. Oracle’s shares dropped 13%, spurring a tech selloff, according to Reuters.

From Bitcoin Miner to AI Landlord: The $9.5 Billion Pivot

TeraWulf’s pivot to AI from pure-play Bitcoin mining is ongoing, driven by fast-growing AI and data center demand. In late October, TeraWulf announced a $9.5 billion deal with Fluidstack, the AI compute firm that builds HPC clusters for tech giants.

The deal is backstopped by Google for $1.3 billion and involves a data center campus with 250 megawatts of capacity at Lake Mariner in New York state. The agreement specifies 168 MW of critical IT load, while TeraWulf cites 200 MW and 250 MW of gross capacity, which is perhaps not contracted yet but will be up for sale at some point in the future.

The Google Backstop: Confidence, Credit Support, or Both?

Google started with $1.3 billion for installation in NY. Then, it upped the investment to $3.2 billion, becoming TeraWulf’s largest shareholder, which amounts to a 14% stake in the company.

On CNBC, Paul Prager, CEO of TeraWulf, said, “[Google] understands better than anyone that the next era of AI requires large, durable, power-centric infrastructure. That’s what TeraWulf has, and that’s what we deliver. It’s a great partnership.”

Google’s investment is a powerful vote of confidence, but it doesn’t eliminate execution risk.

Prager went on, “What we’re doing in our partnership with Google is enabling the infrastructure to be ready to go on the timeline they need, with the performance capabilities they’ve specified, so they can compete in what is now a highly competitive market. The key questions are: can you find the sites, do they have the electrons, and can you complete the build on schedule?”

CFO Patrick Fleury said in the earnings release, “Over the past several months, we have completed more than $5 billion in capital formation, underscoring investor confidence in our business model and growth trajectory.”

This sounds strong, but the financials are anything but. TeraWulf’s recent financial statements show how expensive that race can be before the AI revenue base is fully delivering.

Power Is the Moat, But Only If You Can Monetize It

TeraWulf has a cool-sounding name and prestigious industry linkages. There’s plenty to be optimistic about. One of TeraWulf’s strongest structural advantages is its exclusive renewable energy contracts, which allow it to access energy at below-market prices and reduce its exposure to grid volatility.

TeraWulf’s vertical integration and its leases on sites in New York and Texas give it a competitive edge against rivals like Marathon Digital, Riot Platforms, and CoreWeave.

Until last year, TeraWulf marketed itself as a ‘zero-carbon baseload miner’ powered by nuclear, solar, and hydro. Then, it sold it’s stake in the nuclear-powered bitcoin mining in Pennsylvania to finance its pivot to AI / HPC.

A Costly Quarter for a Capital-Hungry Strategy

However, TeraWulf’s 3rd quarter results underline the gap between narrative and execution. Last month, the company missed third-quarter expectations and reported growing net losses. After the earnings report, TeraWulf initially shed 5%.

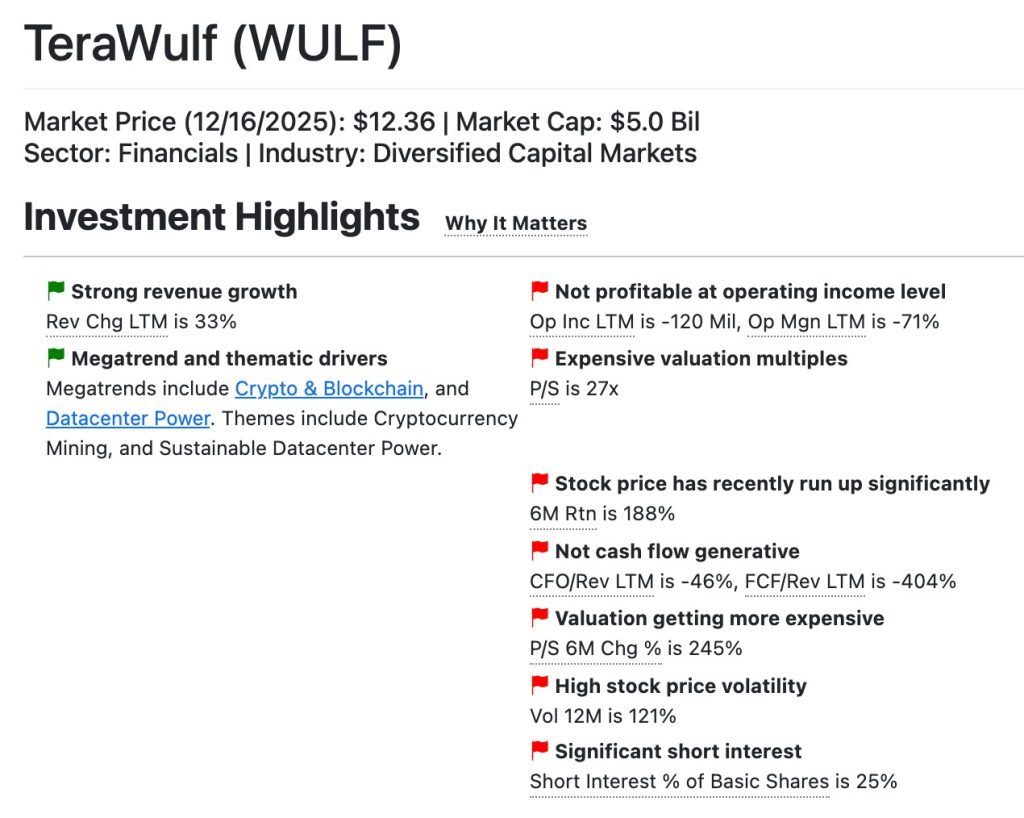

The market narrative suggests the stock is a new buy zone, but Trefis, the financial analytics platform, flags the investment for its expensive valuation multiples, at 37x price-to-sales. Even high-growth tech firms rarely go above 10-15x, and it’s usually only after they reach profitability, whereas TeraWulf is not cash flow generative.

In addition, the company’s yield minus risk-free rate is negative, meaning it’s riskier and less profitable than holding a T-bill. On top of that, there’s significant short interest, meaning a higher probability of a short squeeze.

TeraWulf’s pretax profit margin is -228.4% and the debt to equity ratio is 4.56. On top of that, the company revealed a net loss of ~$455 million.

Dilution, Leverage, and the Hidden Volatility of ‘Simplification’

The company recently converted preferred shares into common shares, causing dilution. CFO Fleury said, “[This] announcement represents a key milestone on our journey to simplify TeraWulf’s capital structure going forward, supporting future growth while providing transparency to investors.”

The company characterized this as simplification and transparency, but for common shareholders, it also means the market must digest dilution while still underwriting a capital-intensive buildout.

The capital structure and financing instruments required to fund the pivot can introduce massive P&L volatility.

The stock is being priced as an AI infrastructure platform now, while the company is still proving it can convert power, land, interconnects, and financing into durable, contracted compute revenue.

TeraWulf may genuinely have what AI customers want: a scalable site with power and an infrastructure-first posture. However, the stock’s December 15 drop is a reminder that the market is now less interested in visionary language and more interested in whether the company can translate megawatts and partnerships into cash flows without continually leaning on complex financing and shareholder dilution.

The company still has to prove the AI buildout becomes repeatable, financeable, and cash-flow generative at scale.

Author: Tim Tolka, Senior Reporter

#Crypto #Blockchain #DigitalAssets #DeFi

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Why Riot Platforms is Focusing on Data Centers, and not just Bitcoin | Disruption Banking

From Bitcoin to Big Data: Inside Cipher’s Hyperscale Power Play | Disruption Banking