The Weapon: A Stablecoin That Pays You 5% While You Hold It

Tokenized money market funds (TMMFs) are emerging as a regulated, yield-bearing asset ideal for blockchain interoperability. Like stablecoins, these funds aim to maintain a $1 price, move wallet-to-wallet, and serve as on-chain cash surrogates. But unlike unregulated stablecoins, tokenized MMFs are actual securities managed by banks or asset managers, investing in short-term government bonds or cash equivalents. They offer 24/7 settlement and transparent holdings while paying real interest to holders, as Franklin Templeton explains. In effect, TMMFs promise “yield, transparency, and real-time mobility” within a familiar, regulated fund structure.

As of 2025, assets in tokenized funds remain tiny (less than $10 billion globally) compared to roughly $7 trillion in traditional MMFs, a scale the CFA Institute highlights. However, growing pilots by major firms suggest they could become a “new operational standard” for cash management.

Inside the Hit List: Every Major Bank Now Shipping Yield-Bearing Tokens

Leading banks and asset managers are already issuing or testing TMMFs. In Singapore, DBS Bank and Franklin Templeton teamed with Ripple to tokenize the government‐backed sg-BENJI money market fund on the XRP Ledger. Goldman Sachs and BNY Mellon’s LiquidityDirect platform are enabling private-ledger tokenized fund shares for corporate clients.

In the U.S., JPMorgan’s blockchain arm (Onyx/Kinexys) rolled out “JPM Coin” (now JPMD), a tokenized USD deposit, on the Base and Polygon public blockchains in late 2025, a launch Bloomberg covered. This deposit token, which represents bank deposits, can carry interest and settle 24/7, directly competing with stablecoins. Its launch follows similar moves by HSBC, Citigroup, and others, as HSBC has committed to offer tokenized 24/7 deposit transfers to clients by the first half of 2026.

BNY’s LiquidityDirect and @GoldmanSachs’ Digital Asset Platform have collaborated to launch tokenized money market funds (MMFs). 🤝

— BNY (@BNYglobal) July 23, 2025

This significant initiative sets our clients on a path to access a new capability to increase the utility and potential transferability of MMFs in… pic.twitter.com/WJ1lv7m6T4

Traditional asset managers are joining too. Franklin Templeton’s “Benji” platform powers several TMMFs: it launched the world’s first US mutual fund on blockchain in 2021 and a fully tokenized Luxembourg UCITS in 2024. By 2025, FT had regulatory approval for a retail tokenized fund in Singapore, approval it publicly announced.

BlackRock tokenized at least $2.5 billion of its U.S. Treasury money-market fund (ticker BUIDL) through Securitize, making it the largest on-chain MMF to date. This month, Binance began accepting BlackRock’s BUIDL tokens as collateral for institutional trading and Securitize released a BNB-Chain share class so it can be used in DeFi. Even Circle, known for its USDC stablecoin, now offers USYC or USDC Reserve, a tokenized US money fund, on BNB Chain for eligible DeFi users.

Collectively, these pilots span the U.S., Europe, and Asia, reflecting a global push to bring cash‐fund yields onchain while staying within regulated frameworks.

Why Zero-Yield Stablecoins Just Got Executed (and No One Heard the Shot)

Tokenized MMFs pack the best of both worlds: blockchain speed with bank-level safety. In practice, they let users park dollars on a blockchain and earn the fund’s yield directly. For example, BlackRock’s BUIDL pays token holders the interest on its Treasury holdings. JPMorgan executives similarly note that deposit tokens can pay holders interest on bank deposits, unlike stablecoins whose issuers keep reserve earnings to themselves, a contrast Bloomberg reported. This makes TMMFs attractive for entities that need stablecoins as collateral; now they can earn yield on that collateral.

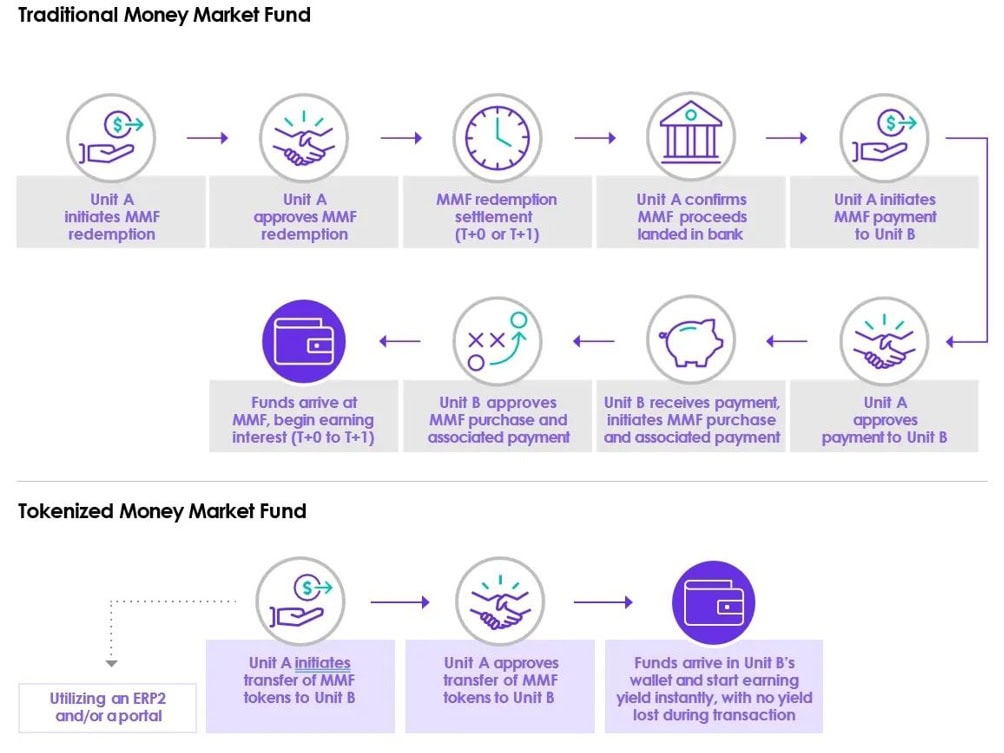

Settlement is faster too. Tokenized funds move instantly on-chain, cutting traditional T+1/T+2 waits. A CFA Institute analysis notes that token shares can pass between custodians in “near real time,” enabling instant margin calls or redemptions without bank wires. The on-chain record creates an immutable audit trail, reducing manual reconciliation. Importantly, these funds remain regulated securities.

As Franklin Templeton points out, a tokenized MMF is “like a stablecoin” in operation but is actually a registered fund with daily holdings and third-party custody. Only KYC’d investors can hold it, and the fund’s prospectus limits where its cash is invested. These rules add investor protection and avoid the over-collateralization typically required for crypto stablecoins.

In contrast, most crypto stablecoins simply promise $1 backed by reserves; they rarely distribute interest to token holders. Circle’s USDC and Tether’s USDT grew into ~$100 billion markets, but each dollar of supply may only yield for the issuer, not the holder.

As the year winds up, regulators worldwide have moved to clarify stablecoin rules (for instance, the U.S. “Genius Act” or pending bipartisan bills). Yet tokenized MMFs appeal as an even more regulated alternative: in many ways, a tokenized fund can be posted as collateral like a stablecoin, but with “better protection,” and no need for excess backing.

Washington Looked Away for 30 Seconds – That’s All the Banks Needed

In the U.S., legal clarity is arriving for these digital instruments. In 2025, Congress considered bills like the Digital Asset Market Structure and Clarity Act (“Clarity Act”), which would explicitly define tokenized securities and stable-value assets.

CFA Institute notes Coinbase CEO Brian Armstrong calls such clarity “foundational” for institutional adoption of onchain funds. Meanwhile, a new stablecoin regulatory framework (“Genius Act” in media) was enacted, which officials said creates rules for dollar-backed crypto. This dual move — regulating stablecoins and defining digital securities — reduces legal risk for tokenized funds as well.

Banks also face separate initiatives. For example, the NY state regulator approved banking charters for tokenization; some banks plan on-balance issuance. JPMorgan’s Kinexys deposit token is fully on-balance-sheet, unlike many off-chain stablecoins. HSBC announced it will let clients move deposits via token 24/7 starting in 2026. These efforts show regulators are generally supportive as long as tokens map onto known banking products.

For treasury departments and fintechs, that means they can experiment with TMMFs without the legal uncertainty that has held back wider crypto adoption.

The Perfect Crime: DeFi Speed + Wall Street Backing + Zero Trace of Risk

Tokenized money funds represent a pragmatic compromise between decentralization and traditional finance. They run on open ledgers and can plug into DeFi protocols, yet they operate under securities law and bank custody. As BlackRock’s digital head notes, allowing its fund to be collateral in crypto markets “brings foundational elements of traditional finance into the on-chain arena.” In other words, TMMFs leverage blockchain programmability and speed while remaining anchored in the trusted banking system.

This hybrid approach seems to attract both worlds. Crypto traders gain a new yield-bearing, liquid asset that behaves like on-chain cash. Meanwhile, treasury chiefs and retail investors gain faster access to cash-like returns without the unregulated risks of stablecoins. If implemented responsibly, tokenized funds could indeed become the “plumbing of digital finance,” offering investor yield and transparency in real time, all within a familiar fund structure.

With pilots advancing in 2025, TMMFs may soon define a new standard for digital cash in both Wall Street treasuries and everyday investment portfolios.

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

#TMMF #FranklinTempleton #Stablecoin #Regulated #TradFi #HSBC #DeFi #MoneyMarketFunds #Treasuries #BlackRock #JPMorgan

See Also:

Why are abrdn’s money market fund investments being tokenized using Hedera? | Disruption Banking

FRANKLIN TEMPLETON LAUNCHES FRANKLIN ONCHAIN U.S. GOVERNMENT MONEY FUND | Disruption Banking