What if one of the world’s biggest Bitcoin miners decided its future wasn’t really about Bitcoin at all? That’s exactly the bet Iris Energy (re-branded as IREN Ltd.) (NASDAQ: IREN) is making. The Sydney-based company, founded in 2018, built its brand on green Bitcoin mining, but now it’s leaning hard into something bigger: data centers for artificial intelligence and high-performance computing (HPC).

It’s a bold move in an industry that is very new, and Wall Street is paying close attention. With analysts setting targets as high as $82 and the stock already up more than 500 percent this year, the question isn’t whether IREN is changing — it’s whether this pivot could redefine what a “crypto miner” even means, and what Wall Street thinks about this huge leap.

From Bitcoin Mining to AI Cloud: Why IREN Is Pivoting to Data Centers

The foundation of IREN’s new strategy lies in its vertically integrated model. The company owns its sites, controls its renewable power contracts, and builds its own data centers. That model delivered FY25 revenue of $501 million — up 168 percent year-on-year — and net income of $86.9 million. IREN reports its results in Australia where the financial year ends on June 30.

Instead of simply expanding Bitcoin capacity, management doubled down on GPUs, announcing in September that its AI cloud fleet has grown to 23,000 Nvidia chips with annualized revenue run-rate targets of $500 million by late this year.

A new 75MW liquid-cooled facility in Sweetwater, Texas, designed for hyperscale AI workloads, underlines the seriousness of the shift.

This strategy tackles Bitcoin’s “halving problem,” where rewards drop every four years, by tapping into AI’s global boom. Analysts expect 1,000 gigawatt (GW) of new data center capacity by 2030. Hosting AI workloads can generate 2–3 times the revenue per megawatt versus mining alone.

Furthermore, IREN’s renewable energy focus makes it attractive for clients under pressure from ESG regulations like the EU’s Corporate Sustainability Reporting Directive.

“We’re focused on AI Cloud – moving up the value chain, capturing more of the economics by providing that compute, and building relationships directly with end customers”

— IREN (@IREN_Ltd) September 26, 2025

Catch the replay of $IREN Co-Founder & Co-CEO @danroberts0101 on @CNBCOvertime discussing the latest trends… pic.twitter.com/Nifn1pZzAe

How Wall Street Sees It: Divided but Engaged

So far, Wall Street likes what it sees though analyst reactions to this pivot are anything but uniform.

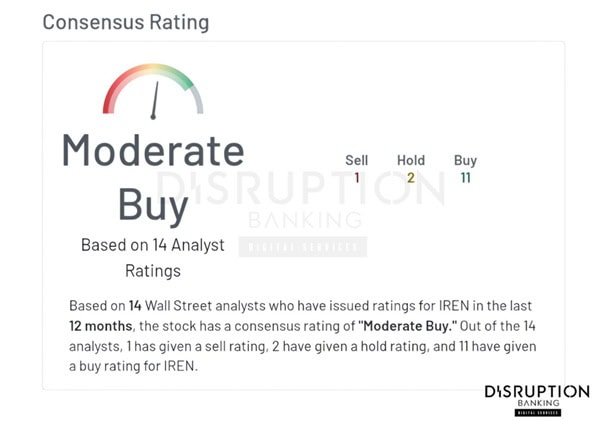

On the bullish end, Bernstein’s Gautam Chhugani recently raised his price target to $75, while Roth Capital/MKM’s Darren Aftahi went further, hiking their forecast to $82 on the view that IREN’s GPU buildout could deliver $2.7 billion in revenue and $1.2 billion in EBITDA by FY28. Arete Research has set a similarly aggressive $78 target, and Compass Point recently raised its target to a moderate $50 while emphasizing the revenue intensity of over $10 million per megawatt for AI compared with $2 million for colocation.

Fifteen firms now cover IREN, most with “Buy” ratings. The consensus, according to MarketBeat, shows a moderate buy rating with an average 12‑month target of $47.73. Five new “Buy” calls in recent months highlight confidence in its AI-driven pivot.

Not all are convinced. J.P. Morgan’s Reggie Smith downgraded IREN to underweight with a $24 target, warning that the stock already prices in “a >1 GW colocation deal” — a CapEx bill that could exceed $10 billion. Critics also note that IREN’s AI cloud revenue was only $2.7 million in Q2 FY25, a modest contribution compared with mining; scaling to $500 million will require flawless execution.

This divergence highlights a deeper truth: IREN is no longer valued purely on Bitcoin mining economics, but on the pace and profitability of an AI infrastructure rollout. For investors, that means higher potential returns — but also higher volatility, all things considered.

IREN is attending the North American Blockchain Summit (NABS), from 9–10 October 2025 at the George W. Bush Presidential Center in Dallas, Texas. IREN, alongside Riot, are both sponsors. And with regulators scrutinising energy usage and AI privacy, participation at NABS allows Iren and others to lobby for favourable policies and showcase its renewable credentials.

Risks and Outlook

Risks remain. GPU shortages, stricter energy regulations, and competition from giants like Equinix could slow growth. The 2022 crypto winter showed how fragile this sector can be.

But IREN’s low-cost structure, renewable power pipeline, and clear AI pivot provide a cushion. It’s aiming for $500 million in annualized EBITDA by 2026. With AI demand booming, mining revenues now serve as a springboard into higher-margin hosting.

Bottom Line

Wall Street mostly approves. With shares soaring, bold analyst targets, and a sustainability edge, IREN’s pivot looks promising.

Execution will be the test — but if the company delivers, even $82 price targets may not be out of reach. For context, the stock sits at almost $50 today and was a mere $17 in July.

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.