It is hard to read the daily news or follow the financial markets and not see a headline on growing demand for both AI and the power that will be necessary to drive that development. One segment of the market that has become a focus for investors has been the Bitcoin mining operators. Traditionally, the large, public Bitcoin miners have been in the enviable position of owning large power portfolios.

One of the leading public Bitcoin miners, Riot Platforms, has over the past year begun a transformation of their business with the development of a data center strategy which at its core will leverage the enormous power portfolio that Riot currently owns and operates.

The Rising Demand for AI Data Centers

In January Goldman Sachs submitted a report focusing on whether nuclear energy is the answer to AI data centers’ power consumption. The report highlighted how electricity usage by data centers is expected to more than double by 2030.

Additionally, Goldman Sachs Research projects that power demand from data centers is on track to grow more than 160 percent by 2030, compared to 2023 levels.

What is becoming clear to both regulators and market participants is that demand for power is far outpacing additional supply coming on to the grid. The report explains how nuclear is becoming a real alternative for hyperscalers looking to power data centers and we are seeing multiple projects being discussed with nuclear as part of the power solution. But obviously building new nuclear or restarting older projects is a long-term solution which will not likely make an impact for many years to come.

The demand for power in the near term is becoming a more and more significant issue for the hyperscalers, like AWS or Google, which is why Bitcoin miners like Riot potentially offer a big part of the solution. With its large load of readily available power today, Riot presents a very real solution for hyperscalers looking for large power sites over the next several years and beyond.This structural shift in demand for power along with the growth of AI has factored directly into Riot’s strategy and development of the data center business.

The Path to Riot Platform’s Power First Strategy

To help understand how Riot Platforms has evolved its strategy we sat down with Chief Executive Officer Jason Les and Executive Chairman Benjamin Yi, as the two went into detail about the hard work they have undertaken over the years to transform the company.

Seven years ago, when Benjamin and Jason first joined the board , Riot Platforms was a sub $50 million company which was very much finding its feet. The company may have started out in 2000 with its listing coming later in 2007; but it really started to scale in early 2021 with the acquisition of the Rockdale site in Austin and the 700 MW available at that site.

The focus at that time was to build a leading Bitcoin mining company. Benjamin and Jason indentified key elements of that strategy which have driven the success of the company from the early days. As a cyclical business, Riot’s philosophy has been that a successful miner needs to be a low-cost producer, maintain a strong balance sheet, and be able to operate at scale. These core elements have helped drive the success of the business and are now critical elements enabling the company to transform into a leading data center operator.

Benjamin and Jason’s leadership have been crucial in developing the company into the leading Bitcoin mining operation it is today. And, whilst Bitcoin mining is what has defined Riot Platforms in the past, it’s the company’s evolution into a data center operator that is what we wanted to talk about. Driven by those core principles, Riot now runs two of the largest Bitcoin mining facilities in the world and has a power portfolio of approximately of 1.7 GW of readily available power today. This is comprised of two major sites in Texas.

Investing in Texas

Riot Platforms owns 858 acres in Corsicana, less than an hour drive south of Dallas. It also owns about 100 acres in Rockdale, a little over an hour drive west of Austin. The company also owns a facility in Kentucky. However, it’s the size of the operations in Texas that makes Riot Platforms one of the most significant companies in the sector in the world.

Jason explained how Texas was incredibly attractive due to the availability of power and the business friendly, low regulation approach in the state. The local Electric Reliability Council of Texas, or ERCOT, is a strong partner. Benjamin and Jason believed that Riot Platforms could have a positive impact on the grid.

Maximizing Megawatts with a Power First Strategy

With 1.7 gigawatts of readily available power between its two sites in Texas, Riot is in a unique position. With the size and scale of power readily available today, Riot is now able to offer hyperscalers and other enterprises very large-scale sites in very attractive locations for AI and high-performance computing (HPC) use. The size and proximity to Dallas and Austin make these sites uniquely attractive.

Bitcoin mining remains an important part of the business at Riot. It is what has allowed the company to develop two attractive sites in Texas. It has also helped the company maintain a strong balance sheet with almost 20,000 Bitcoins held in addition to fiat reserves.

However, going forward the role of Bitcoin has changed. While it continues to be an important revenue driver and near-term use of power, Riot’s strategy is to maximize the value of all of its megawatts. The company believes that by transitioning the vast majority of its power portfolio into HPC, Riot will realize a far greater value for the power portfolio and ultimately for the company and its shareholders. Over time, Riot plans to allocate a significant portion of its portfolio to AI and HPC.

This will take time, and it is not a process that can occur over night. The company has invested significant amounts into its two sites in Texas. But whilst some companies have pivoted their Bitcoin mining infrastructure to offer bespoke cloud solutions to customers, Riot is different.

Riot is building HPC AI data centers. The company wants to own and operate and build to suit AI HPC tier three data centers. This, in turn, will allow the company to share some of the most significant assets in Texas from a power and land standpoint.

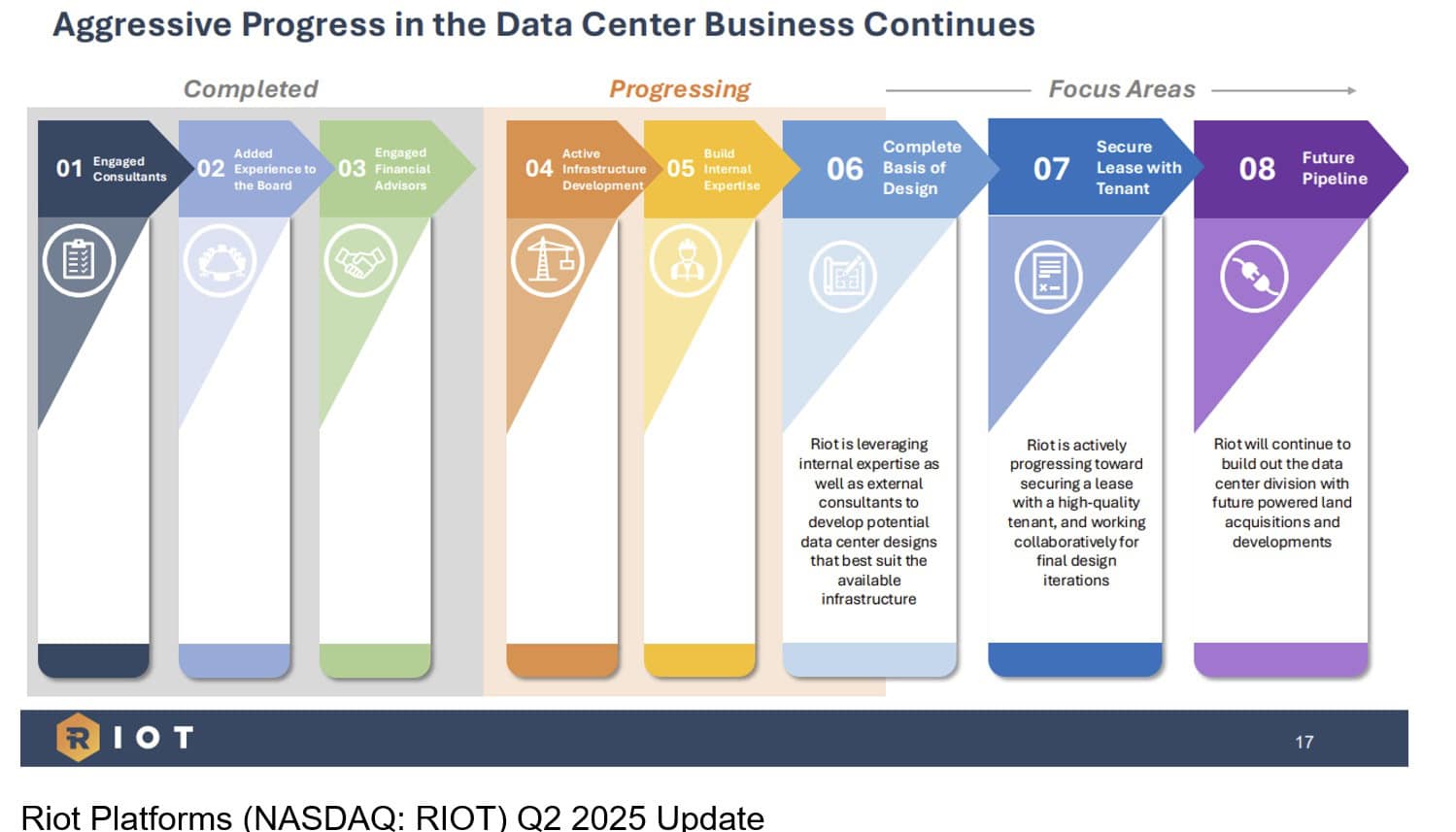

Turning Strategy Into Action

In order to successfully execute on its strategy, Riot has brought in an in-house team with the experience and capability to deliver on these goals. In June this year Riot Platforms announced the hiring of Jonathan Gibbs as Chief Data Center Officer to lead it’s data center platform strategy.

Jonathan brings over 15 years of experience designing and building large-scale, state-of-the-art data centers, delivering high-quality infrastructure for hyperscale and enterprise tenants.

With the company’s land and power assets, balance sheet, and team, management is committed to building a world-class data center platform.

“Bitcoin mining is a tool to bring power capacity forward — and now we’re using it to unlock infrastructure for AI and HPC. We started with Bitcoin. Now we’re scaling that foundation into a new era of compute,” CEO, Jason Les, shared.

“We are committed to an incredible set of assets in power and land we have in Corsicana and Rockdale which is currently utilized primarily for Bitcoin mining. But over time we believe that the maximum value that we can extract from those sties will be through converting them to HPC data centers.”

Strong Leadership Brings Opportunity

This next step in the evolution of Riot is only possible because of the strong balance sheet, assets and team that management have put in place. Under the leadership of Benjamin and Jason, they have provided the vision behind the success that saw Riot post excellent results for the second quarter of 2025. It’s not just revenue that has improved dramatically. The company’s costs have also been reduced, assuring the future profitability of the company.

To make the case even more compelling, in quarter 2 2024 the company operated at a 61% operational uptime when mining Bitcoin. This improved dramatically through 2025 and is now at 87%, highlighting the efficiency gains the company has managed to achieve in the last 12 months.

New directors have been recruited over the last nine months, and the focus for the company has shifted towards AI HPC data centers. New investors joined at the right time, helping the company to further align its interests. A culture of excellence is visible at the company. From individual operators facilitating Bitcoin mining to the senior management, everybody is heavily invested in the success of Riot today.

Riot is prepared for the next iteration of the market and market demand. With a robust balance sheet, strategic Texas locations, and a forward-thinking leadership team, Riot Platforms is well-positioned to lead in both Bitcoin mining and the burgeoning AI data center market.

You can meet the team from Riot Platforms at the upcoming North American Blockchain Summit taking place in Dallas on 9 – 10 October. Find more information here.

Author: Andy Samu

See Also:

Why is the Biden Administration targeting Bitcoin Miners? — Texas Blockchain Council

Riot Announces Q2 2025 Earnings Conference Call | Disruption Banking