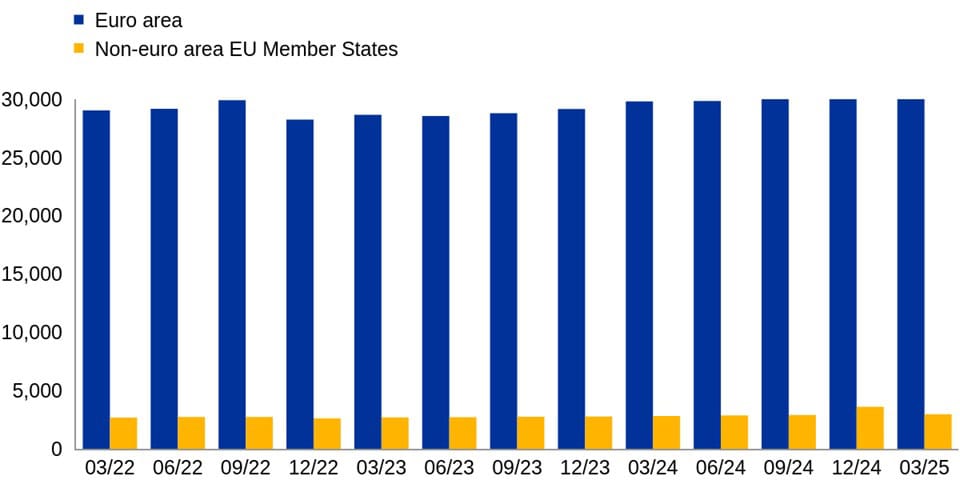

- The aggregate of total assets of EU-headquartered credit institutions increased by 1.54%, from €32.62 trillion in March 2024 to €33.13 trillion in March 2025

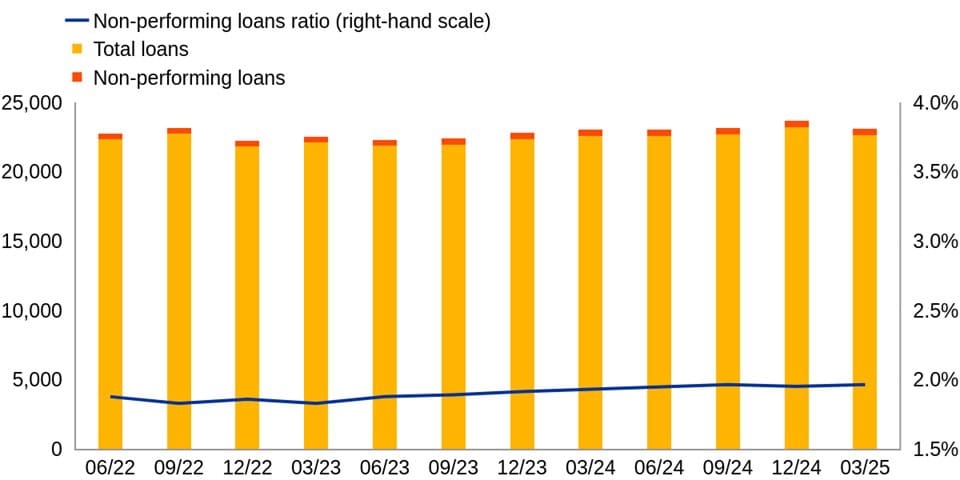

- During the same period, EU credit institutions’ aggregate non-performing loans ratio[1] increased by 0.03 percentage points year on year to stand at 1.96% in March 2025

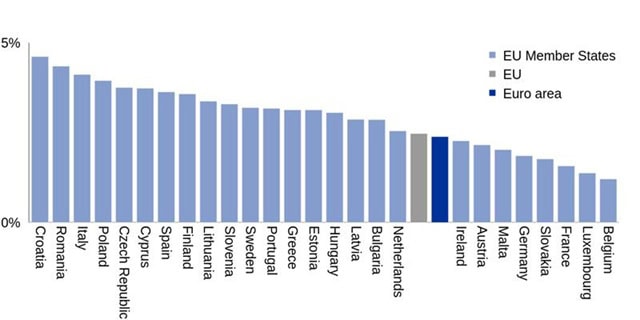

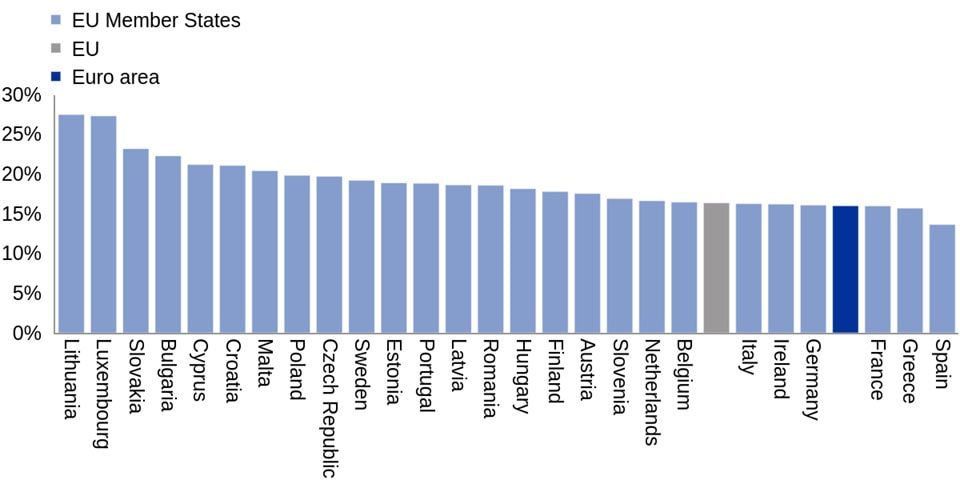

- EU credit institutions’ aggregate return on equity[2] was 2.47% in March 2025 and their Common Equity Tier 1 ratio[3] was 16.34%

24 September 2025

Chart 1

Total assets of credit institutions headquartered in the EU (EUR billions)

Note: Data for all reference periods relate to the EU27.

Data on the aggregate of total assets of credit institutions headquartered in the EU

Chart 2

Non-performing loans ratio of credit institutions headquartered in the EU (EUR billions; percentages)

Note: Data for all reference periods relate to the EU27.

Data on the aggregate non-performing loans ratio of credit institutions headquartered in the EU

Chart 3

Return on equity of credit institutions headquartered in the EU in March 2025 (percentages)

Note: Data for all reference periods relate to the EU27. Data for Denmark are not displayed individually as they were still subject to rigorous quality checking at the time of publication, while they are included in the EU aggregate.

Data on the aggregate return on equity of credit institutions headquartered in the EU

Chart 4

Common Equity Tier 1 ratio of credit institutions headquartered in the EU in March 2025 (percentages)

Note: Data for all reference periods relate to the EU27. Data for Denmark are not displayed individually as they were still subject to rigorous quality checking at the time of publication, while they are included in the EU aggregate.

Data on the aggregate Common Equity Tier 1 ratio of credit institutions headquartered in the EU

The European Central Bank (ECB) has published consolidated banking data as at end-March 2025, a dataset for the EU banking system compiled on a group consolidated basis.

The quarterly data provide information required to analyse the EU banking sector and comprise a subset of the information that is available in the year-end dataset. The data cover 338 banking groups and 2317 stand-alone credit institutions and non-EU controlled subsidiaries and branches operating in the EU, accounting for nearly 100% of the EU banking sector’s balance sheet. They include an extensive range of indicators on profitability and efficiency, balance sheet composition, liquidity and funding, asset quality, asset encumbrance, capital adequacy and solvency. Aggregates and indicators are published for the reporting population.

Reporters generally apply International Financial Reporting Standards and the European Banking Authority’s Implementing Technical Standards on Supervisory Reporting. However, some small and medium-sized reporters may apply national accounting standards. Accordingly, aggregates and indicators may include some data that are based on national accounting standards, depending on the availability of the underlying items.

In addition to data as at end-March 2025, the published figures also include a few revisions to past data.

Important Considerations

- The data for Denmark were still subject to rigorous quality checking at the time of publication, therefore Danish values for Q1 2025 are not disseminated individually, while they are still included in the EU aggregates.

- These consolidated banking data are available in the ECB Data Portal.

- More information about the methodology used to compile the data is available on the ECB’s website.

- Hyperlinks in the main body of the press release lead to data that may change with subsequent releases as a result of revisions.

- [1] Defined as the ratio of non-performing loans to total loans. Cash balances at central banks and other demand deposits are included.

- [2] Defined as the ratio of total profit (loss) for the first three months of 2025 (non-annualised) to total equity. Profitability indicators are not annualised.

- [3] Defined as the ratio of Common Equity Tier 1 capital to the total risk exposure amount.