In August 2020, S&P Dow Jones announced that Amgen (AMGN) would join the 30-stock Dow Jones Industrial Average (DJIA), replacing Pfizer. This move — prompted by Apple’s 4:1 stock split and a desire to diversify the index — added the first pure-play biotech and the sixth Nasdaq-listed firm to the Dow.

Amgen’s inclusion was widely seen as reflecting biotech’s rising importance. CNBC’s Jim Cramer praised the change for bringing the Dow “closer to the reality of the new economy.” The reshuffle helped eliminate overlap among old constituents and “better reflect the American economy,” as S&P Dow Jones Indices explained.

As DisruptionBanking dives deeper into the DJIA’s 30 giants, Amgen stands out. A biotech heavyweight — a quiet mover with big ambitions, and maybe the most underrated bet in the index — trying to play by blue-chip rules. Let’s see if the gamble is paying off.

Stock Performance Since Dow Inclusion

Amgen’s stock has more than held its own since joining the Dow Jones. AMGN traded around the $200 mark just before joining the index. By 2025, as at time of writing it was near $300 a share per MacroTrends data, not far below its all-time peak of $329 in September 2024.

In other words, AMGN has seen significant growth over the past five years, with the stock price increasing by almost 50 percent thanks to product launches and acquisitions.

New Drugs and the Horizon Deal

Amgen’s growth engine continued to fire on all cylinders in the second quarter (Q2) of 2025, building on the robust performance delivered in quarter one. Total revenues surged to $9.2 billion in Q2 from $8.1 billion in Q1, reflecting a 13.6 percent quarter-over-quarter increase.

The company showcased its strength with fifteen products posting double-digit sales gains in Q2 — up from fourteen in Q1 — driven by standout performers like Repatha®, Evenity®, and Imdelltra®.

In Q1 this year, Amgen’s biosimilars business generated about $735 million in sales — roughly 9 percent of total revenues — a 35 percent jump from a year earlier. Amgen’s recent copycat launches include versions of Avastin, Eylea, and Stelara, and chairman and CEO Bob Bradway says the biosimilar arm “continues to contribute meaningfully” to growth.

Even within the Dow Jones, few peers match this generics push.

Amgen’s First Quarter 2025 Financial Results. Source: Amgen

Amgen’s Second Quarter 2025 Financial Results. Source: Amgen

Horizon’s $27.8 billion acquisition in 2023 added two rare-disease powerhouses, Tepezza (thyroid eye disease) and Krystexxa (gout), with Tepezza alone tipped to hit nearly $3.9 billion in peak annual sales, according to analyst Gregory Renza of RBC Capital Markets’ forecast.

FTC vs Amgen

Regulators pushed back. The FTC sued in 2023, fearing Amgen might bundle Horizon’s monopoly drugs. By the end of the year, Amgen had won approval — on the condition it wouldn’t tie those drugs to its own or make similar deals without sign-off. The settlement cleared the path for integration while curbing anti-competitive tactics.

It was a rare high-profile pharma merger challenge — the first litigated drug deal in years; one that analysts believe set Amgen’s fortune in the Dow Jones in stone.

Dividends Keep Flowing

Amgen didn’t just grow — it paid its investors along the way. Since 2011, the company has sent out dividends every quarter, and for 12 years in a row, those payments have gotten bigger.

Amgen offers $2.38 per share every three months, adding up to $9.52 a year. Based on its stock price of $285 as at the time of writing that’s a 3.34 percent return just from dividends.

For those who value steady income, Amgen has become a trusted name, backed by strong cash flow from its worldwide business.

Dividend Announcement$AMGN#dividend #investing pic.twitter.com/IgubHfnXBt

— Dividend Blasters on YouTube (@DividendBlast99) August 5, 2025

When Patents and Prices Collide

As a Dow Jones component, Amgen faces headwinds on patents and pricing that ripple through the Dow itself. Its legacy blockbusters like Enbrel and Otezla are losing steam. Management warns of “sales erosion” this year as generics hit the market.

Prolia, Amgen’s top osteoporosis drug, saw volumes rise in Q1 2025 but net price fall 5 percent, with heavier biosimilar pressure expected later this year. Amgen also took an $800 million hit on Otezla’s value, signaling an expected crash in future sales as the patent expires.

The Inflation Reduction Act has initiated Medicare drug price negotiations, with the first round of ten drugs already selected and prices set to take effect in 2026. Notably, Amgen’s top seller Enbrel was included in the first round, while Otezla, another top seller, is part of the second round, which is currently under way.

While Capitol Hill has set its eye on all biotech firms in the DJIA and other indices, Congress has questioned Amgen’s price hikes. A consent decree from its Horizon acquisition limits drug bundling through 2032. Still, Amgen’s deep pipeline and strong cash flow cushion these blows.

For many Dow investors, that mix of defense (diversified innovation) and offense (generics growth) is exactly why Amgen earned its spot on the Dow Jones.

🚨 @RepJamesComer is opening an investigation into the Federal Trade Commission’s failures to safeguard confidential corporate information and improper litigation practices in the premerger process between Amgen Inc. and Horizon Therapeutics. https://t.co/DRanwgR6OU

— Oversight Committee (@GOPoversight) November 20, 2023

Amgen’s Dose in the Dow Jones

Because the Dow is price-weighted, Amgen today carries just over a 4 percent index weight per Slickcharts at the time of writing. That makes it the heaviest healthcare/biotech stock in the index, with a weight higher than long-time Dow Jones members like UnitedHealth and significantly outperforming giants like Johnson & Johnson.

This run has made Amgen — currently with a market cap of over $155 billion — one of the larger DJIA components.

Amgen’s Biggest Test

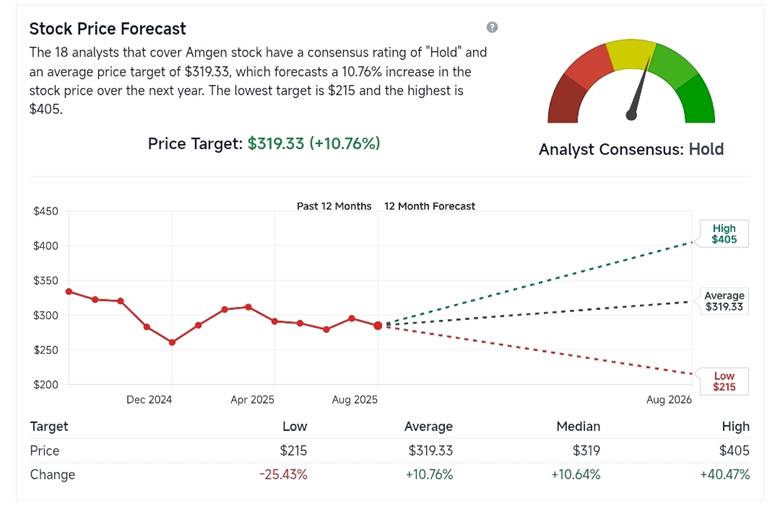

Amgen’s future holds promise — but comes with big questions. Analysts are cautiously bullish. As at the time of writing, AMGN’s average 12-month price target is $319.33, with a forecast increase over the next year of 10.76 percent, per StockAnalysis. Most experts have a “moderate hold” rating, betting that new drugs and the Horizon acquisition will help offset fading blockbusters.

Amgen AMGN price forecast. Source: StockAnalysis

Firms like Morgan Stanley and UBS expect a 15-25 percent upside if Tepezza and biosimilars perform well. But much rides on execution. Will new launches make up for legacy losses? Can biosimilars keep gaining ground?

With a roughly 3 percent dividend yield and a deep pipeline, Amgen appeals to long-term Dow Jones investors. But any big R&D setbacks — for example, Amgen’s obesity drug AMG 513 was placed on hold during its trial phase earlier this year by the Food and Drug Administration — would temper expectations.

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

#Amgen #DowJones #Industrial #Innovation #Dividends

See Also:

McDonald’s in the Dow Jones: Golden Arches on Wall Street | Disruption Banking

3M in the Dow Jones: from Innovation to Tribulation | Disruption Banking

Johnson & Johnson: A Steady Dose of Dividends in the Dow Jones | Disruption Banking