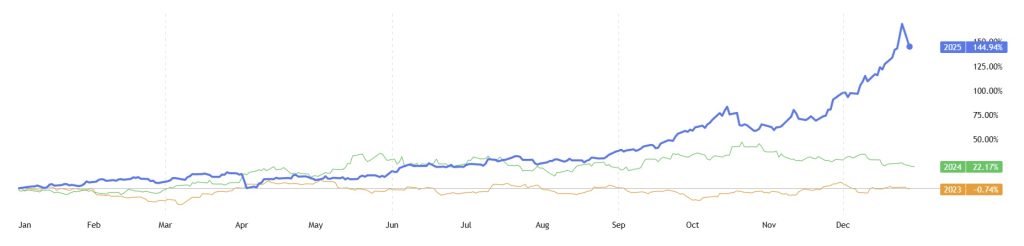

Silver has been one of 2025’s standout performers, surging almost 145% year-to-date from around $29-30/oz at the start of the year to highs briefly exceeding $83/oz before a sharp pullback to ~$73-75/oz as of December 29. This rally, driven by robust industrial demand (solar, EVs, AI hardware), persistent supply deficits, ETF inflows, and geopolitical tensions, has fueled speculation about stress on banks with historical short positions in silver futures.

Social media buzz over the weekend claimed eight major banks (including JP Morgan Chase, HSBC, Scotiabank, BNP Paribas, UBS, Deutsche Bank, Citigroup, and Goldman Sachs; some added State Street) were under severe pressure from shorting the metal. One viral narrative alleged a “systemically important” bullion bank failed a massive margin call, leading to forced liquidation of shorts and even collapse, with emergency Fed liquidity injections of $17B (Friday) plus $34B (overnight) totaling over $50B.

It is the first time in many years that investors have had this problem. In 2023, for comparison, the price of silver went down during the year. In 2025 so far it is up almost 145%. Could there be fire where there was some smoke?

Why are Banks Struggling?

This morning Silvertrade posted a story about a major bullion bank which may collapse after silver shorts were liquidated. The story infers that one particular bank had a margin call on Friday afternoon last week. It alleges that on Friday morning banks affected by the sudden rise in the price of silver tapped the Fed’s Repo Facility. The banks needed $17.251 billion in emergency liquidity. Some have reported online that this number is nearer to $34 billion though.

A post on X from @silvertrade amplified this, linking to reports of a bank collapse after shorts were liquidated.

🚨REPORT: Major Bullion Bank COLLAPSES After Silver Shorts LIQUIDATED!! 🚨

— SilverTrade (@silvertrade) December 29, 2025

🔥Friday, we asked whether a large bullion bank massively short silver was about to be LIQUIDATED after being unable to make a margin call Friday afternoon. https://t.co/In3xNc2imt

🚨Fast forward to… pic.twitter.com/d8p4DEAmbO

The problem with the story is that the Fed is not obliged to report which banks use its Repo Facility. However, online commentators rather than any news from the Fed have suggested that JP Morgan Chase may be the bank involved.

Why the Rumors Spread

The story traces back primarily to Hal Turner, operator of the Hal Turner Radio Show, a site and broadcast known for promoting conspiracy theories, far-right views, and unverified claims (e.g., past hoaxes on bioweapons, election fraud).

Turner’s December 28 posts described a bank liquidated at 2:47 AM after missing a margin call, with concealed identity and Fed intervention. These gained traction on X, Reddit (e.g., r/WallStreetSilver), and precious metals forums, amassing tens of thousands of views.

Additional fuel: Weekend repo facility usage hit ~$26B (per Fed data released Monday morning), interpreted by some as “emergency bailout.” A separate unverified claim of a $429M bet on silver miners ETF (likely SIL or SILJ, market cap ~$1-2B range) was touted as a desperate hedge.

Speculation often points to JP Morgan Chase as the bank affected the most, citing its historical dominance in silver futures (once the largest short, now reportedly flipped to massive physical long ~750M oz).

The Reality Check: Mostly Smoke

Despite the hype, no credible evidence supports a major bank collapse or extraordinary margin crisis:

- No Confirmed Failure: FDIC, Fed, CME, or major news outlets (Bloomberg, Reuters, WSJ) report no systemically important bank seizures, liquidations, or distress in December 2025.

- Repo Usage: Elevated (~$26B weekend) but not unprecedented, routine for year-end liquidity management, volatility, or regulatory flows. Not proof of a specific silver-related bailout.

- Margin Hikes Real, But Standard: CME raised silver futures margins amid volatility (real rally to $79-83 highs), a normal risk control, not evidence of one bank blowing up.

- ETF Ticker Error: References to “$SILF” appear mistaken; major silver miners ETFs are SIL (Global X) or SILJ (Amplify Junior).

- JP Morgan Chase Shift: Earlier 2025 reports confirm JPM reduced/closed legacy shorts and accumulated physical silver, but no verified $4.9B loss filing (claimed fake 8-K from Dec 27).

Mainstream sources attribute silver’s rally to fundamentals: Record industrial offtake, Chinese demand premiums ($7-8/oz in Shanghai), and export curbs looming Jan 1, 2026. No reports tie this directly to bank insolvencies.

Could There Be Partial Truth?

Historical shorts (e.g., JPM’s past positions) have faced scrutiny, and rapid price spikes can trigger margin stress. Volatility was extreme. Silver went up 6% overnight, then down 17% from highs. But extraordinary claims require extraordinary evidence, which is absent here.

Not All News Is Real News

This episode underscores how sentiment drives markets more than facts in thin holiday trading. A rumor from fringe sources snowballed into viral panic, influencing prices temporarily. Hal Turner’s claims alone reached high visibility yet remain unsubstantiated.

As always: ‘Look first, then leap.’ Verify sources, cross-check regulators/exchanges, and focus on fundamentals over hype.

Author: Andy Samu

See Also:

Permutable AI: Turning Global Perception into Real-Time Edge | Disruption Banking

Why ‘look first, then leap’ is the best advice for traders in 2020

3 Responses

I heard on UTube that HSBC had stolen all the silver in its vaults and was running the price up trying to buy silver to cover up that empty shelves. $67mn stolen by HSBC. Anyone else hear that? Now, that video is GONE.

Here is the DC Report of David Kay Johnson and researcher James Henry: https://www.dcreport.org/2025/12/29/ny-fed-unlimited-cash-infusions-bank-crisis/

Their chart, if accurate, shows no REPO lending until the silver crisis late this year: after Halloween. The question I have is whether they, or you, are overlapping normal amounts of overnight REPO lending with this sudden burst, if that is what happens. REPO’s are loans, overnight usually, collateral needed from accepted instruments, although that can be loosened and was in 2008 crisis.

So you are saying nothing abnormal going on, including the amounts. They say, and their chart says: sudden abnormal amounts and a rule change to balloon the individual and collective bank REPO loans to extraordinary amounts. Comment?

I heard this exact same story about hsbc. They had margin calls on the excessive ( tens of billions of dollars) shorts they had plus they were being sued by investors saying hsbc couldn’t provide their registered metal upon request because they leased it out for profit illegally. They supposedly have until January 31st to exit the silver market completely however im sure they will be saved again (too big to fail b.s.)