Sentiment and narrative analytics in this report are powered by Permutable AI.

For most of the past two decades, the yen carry trade has functioned as an invisible engine within global finance. It has drifted quietly in the background, an unassuming mechanism built on the Bank of Japan’s (BoJ) long experiment with ultra-low rates, drip-feeding liquidity into the world like a slow but constant tide. Investors borrowed yen, converted it into higher-yielding currencies and enjoyed predictable returns from the interest-rate differential. The BoJ set the tone, the spread did the work, and markets harvested carry with little regard for what lay between those points.

Over the past year, however, the character of that trade has changed. Japan’s gradual policy normalisation, the steepening of the Japanese Government Bond (JGB) curve, rising fiscal sensitivity under Sanaenomics, and a more reactive BoJ have pushed the yen into a new regime.

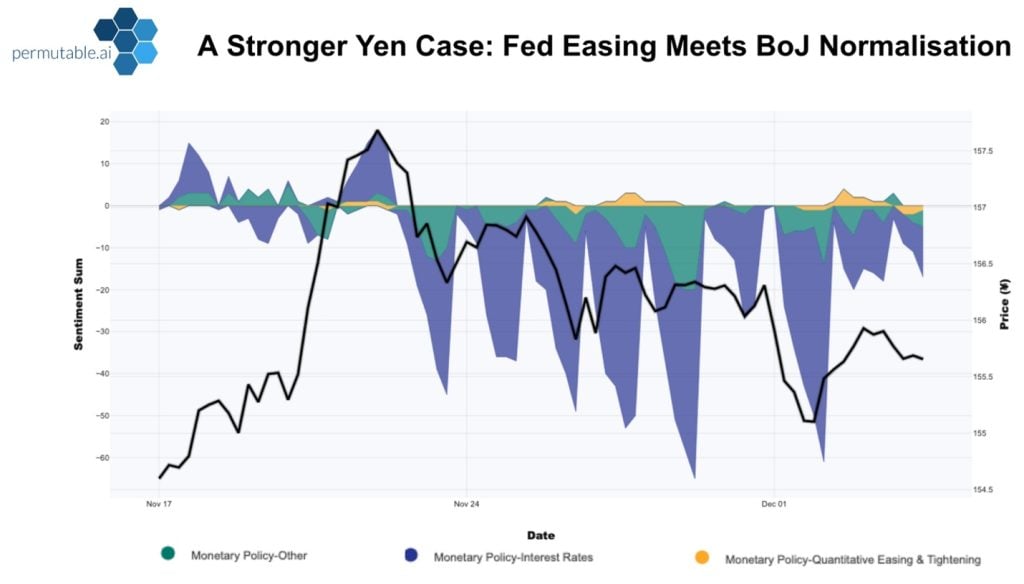

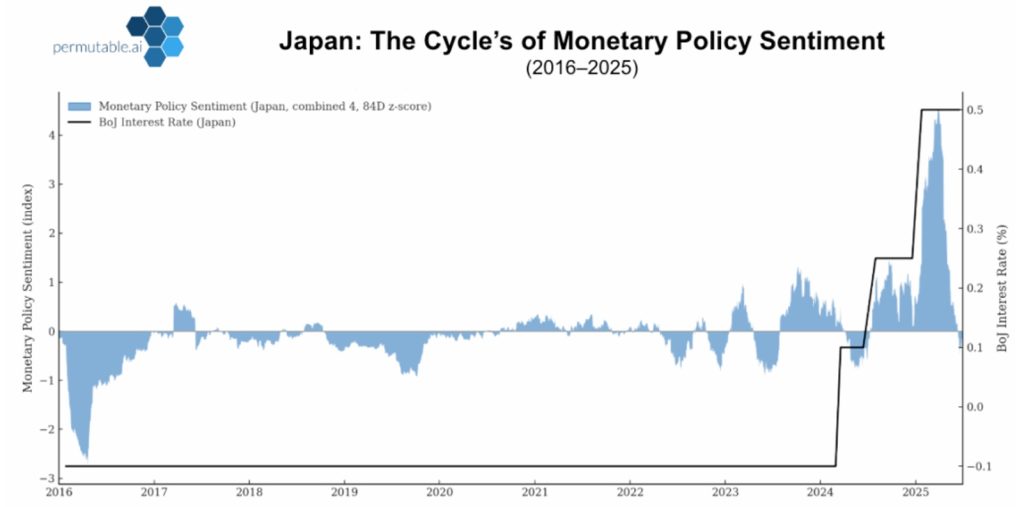

Rates and normalisation sentiment from 2022 through 2025 show a steady build in focus around policy exit and tightening dynamics. What began as a marginal theme has increasingly moved to the centre of macro discourse, with interest-rate and normalisation language becoming more persistent even during periods of relative market calm.

Crucially, it is sentiment, not just policy, that now drives much of the movement. Narrative momentum has become a macro force of its own, bending price action, shaping expectations and influencing cross-asset positioning in ways that spreads alone cannot explain.

Why Sentiment Is Driving the Japan Yen Carry Trade More Than Policy

Narratives often begin quietly, gathering force in fragments before coalescing into something with momentum. For the yen, the early tremors came in 2022 and 2023 when long-dated JGB yields began climbing as markets sensed the BoJ was stepping away from extreme yield suppression. It wasn’t a crisis. It was simply the first hint that something structural was shifting.

As yields climbed, analysts began linking the move to an evolving BoJ policy stance, Japan’s inflation dynamics and its dependence on energy imports. What was once the realm of FX strategists widened into a broader macro story about whether Japan could sustain its role as the world’s cheapest funding source. The rapid clustering of narrative keywords such as “tightening path,” “funding stress,” “FX fragility,” and “synthetic-carry risk” creates a pattern that historically precedes a narrative consolidation. Once this happens, markets begin to trade the story as a whole rather than the individual data points inside it.

This dynamic is what marks the yen carry trade’s entry into what we describe as a narrative supercycle. Story flow, reflexivity, and emotion begin to shape the path of price. Uncertainty becomes magnified not because fundamentals deteriorate, but because the narrative simplifies, accelerates, and spreads.

🚨 BREAKING:

— SilverTrade (@silvertrade) December 12, 2025

🇯🇵 BANK OF JAPAN TO HIKE RATES BY 25 BPS ON DECEMBER 19. 🚨

Buckle Up- The Yen Carry Trade Unwind is Set to ACCELERATE!!

Japan is also the largest holder of US debt.

They won't be for much longer.

We suspect The Fed will soon need all of that $40 Billion…

Catalyst Stacking: How Sentiment Outpaces Policy in the Yen Carry Trade Unwind

In previous cycles, yen volatility emerged largely in response to concrete policy changes: an unexpected rate hike, a shift in yield-curve control, or a rare intervention. This time, sentiment is outrunning action. A succession of macro catalysts has given the narrative a cumulative momentum.

The sharp contraction in Japan’s Q3 GDP (-2.3% annualised), the persistent erosion in real wages, and the ongoing supply-driven steepening in the JGB curve all contributed to a sense of a country in the midst of a delicate economic pivot. Add stronger wage negotiations and an inflation backdrop that remains quietly but stubbornly above the BoJ’s target, and the market began to perceive Japan as a live story rather than a stable backdrop.

Layered on top of this was a steeper JGB curve driven not only by policy expectations but also by growing fiscal pressure. Japan’s latest stimulus package added to issuance needs at the long end, and markets began to worry that increased supply would force higher term premiums, regardless of BoJ policy. That concern has macro and psychological consequences: if higher yields reflect fiscal anxiety rather than policy confidence, they can weaken the currency rather than strengthen it.

Japan’s long-term borrowing costs have surged to their highest in decades, in an intensifying 'Takaichi trade' that the new administration will unveil a much larger fiscal spending package than originally expected. https://t.co/eBgYWtgUg1 pic.twitter.com/gwKSHlpEQU

— Financial Times (@FT) November 19, 2025

What the Data Says About Japan Yen Carry Trade Risks

At this stage, sentiment reacts earlier, faster and more forcefully than the underlying macro data. Permutable AI’s tone-analysis metrics show a shift toward urgency and caution in research commentary, with analysts writing in a noticeably more interpretive, less mechanical voice.

A concrete example comes from Hiroyuki Seki, head of Global Markets at MUFG, who warned that “markets are growing concerned about Japan falling into a ‘negative spiral,’ where insufficient monetary tightening amid persistent inflation and a weak yen could accelerate import costs and inflation.”

This framing reflects how sentiment has moved into the driver’s seat, with investors reacting not just to data, but to evolving interpretations of policy and economic risk. This is the hallmark of narrative-driven markets: when analysts start sounding like storytellers, investors begin trading like them. Institutional caution is now rapidly translated into social amplification, distilled into sharper, more emotive language that travels faster than research notes ever could.

When commentary like this circulates widely, it becomes part of the feedback loop that drives investor behaviour. Traders position defensively because they believe others will do the same, and in that reflexivity, the narrative begins to materialise.

The influencer amplifiers translate institutional themes into language that ricochets across the broader investor ecosystem. And the yen, curiously, lends itself to dramatic interpretation. Whether or not these takes are technically precise is beside the point. Influencer commentary lies in its emotional reach.

Cross-Asset Fragility: Is Yen Carry Trade Stability Masking a Market Crash?

Perhaps the most unusual feature of the current phase is the way cross-asset markets are interpreting stability as a sign of fragility. In normal conditions, strong performance in gold or US equities would ease concerns about global financial instability. Today, those same conditions are being reframed as the calm before a potential carry-trade unwind.

This is where narrative psychology becomes self-reinforcing. If gold holds steady while the yen remains weak, investors increasingly treat the stability as a sign of something hidden. A kind of active quiet before volatility erupts. Market participants are not reacting to realised stress; they are reacting to the idea of latent stress. And the yen, once the least emotional currency in the G10, has become the narrative prism through which this latent fragility is being perceived. Conversations about “quiet fragility” and “surface calm masking stress” have multiplied across research notes and macro podcasts. As these interpretations spread, they influence positioning even when nothing fundamental has changed.

Permutable AI’s monetary policy sentiment data shows a sharp rise in investor attention following recent Bank of Japan interest rate hikes, alongside a more clearly bearish tone. At the same time, broader market commentary has increasingly framed market stability as something to be questioned rather than welcomed. Taken together, these shifts point to a narrative inversion in which calm conditions are viewed as potential warning signs rather than signals of equilibrium. This pattern is typical of narrative supercycles, where markets are interpreted through a dominant storyline rather than traditional valuation frameworks.

Intervention Myths: Containing the Yen Carry Trade Story, But Not Ending It

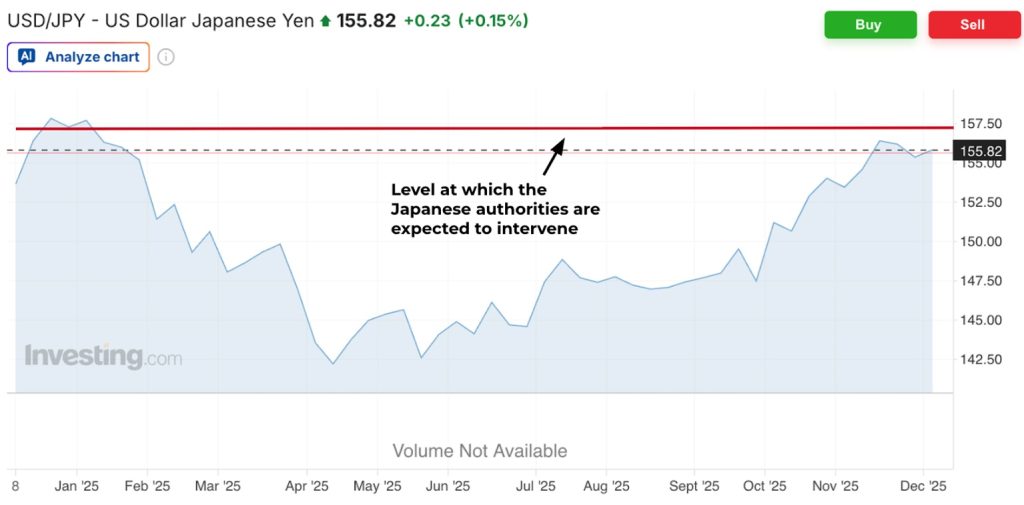

Foreign-exchange intervention has historically acted as a stabilising force: an anchor that kept the yen from drifting too far from policymakers’ comfort zone. Today, intervention expectations are functioning differently. Rather than reversing yen weakness, they are simply defining the upper boundary of the narrative.

Investors widely assume that once USD/JPY approaches the 157–160 zone, authorities will step in. This belief does not discourage bearish yen positioning; it merely caps it. The result is a narrative that remains suspended between fear of a carry unwind and confidence that intervention will prevent panic. The story continues, contained but unresolved.

This transforms intervention from a policy tool into a narrative constraint.

It defines the outer edges of market imagination while leaving the core story (the fragility of the carry structure) intact. That inversion is telling. It shows just how deeply narrative has embedded itself into the pricing mechanism. When traders assume that intervention is merely a brake rather than a reversal, sentiment gains room to expand within a confined corridor.

Japan Yen Carry Trade at a Crossroads: Thinner Margins and Rising Volatility

All of this places the yen carry trade in a curious position: it is still working, yet it feels increasingly uneasy. It continues to deliver positive returns, but the reliability that once defined it has cracked. The carry is more path-dependent, more twitchy, more exposed to the shape (not just the level) of future policy.

Three shifts are particularly important:

First, the U.S.–Japan spread, while still positive, is narrowing. As the Fed transitions into an easing cycle, the raw arithmetic of the Yen carry trade becomes less compelling. A carry trade can survive many things, but a shrinking differential forces investors to justify the risk with higher margins.

Second, volatility now ripples through the trade much more easily. The cost of synthetic yen funding via FX swaps can widen abruptly when stress hits, meaning that timing errors or short-term volatility spikes can destroy months of careful carry accumulation.

Third, institutional investors are beginning to diversify the funding mix. The Swiss franc, with its lower inflation and clearer policy direction, has attracted incremental attention. CHF is not replacing JPY as a wholesale funding currency (its higher nominal rates prevent that), but its credibility is seen as a hedge against yen-specific risk. The allocation shift is subtle but meaningful: not enough to rewrite the system, yet enough to signal that the system itself is being questioned.

Together, these shifts create a landscape where the Yen carry trade is not collapsing, but its equilibrium is thinner, its pathways narrower, and its transmission mechanism more delicate.

Outlook: BoJ Hike Looming: Will It Force a Yen Carry Trade Squeeze or Market Crash?

We are now far enough into this cycle to judge impact. The yen remains weak; USD/JPY has been suspended in the mid-150s even as spreads compress. Intervention talk defines the emotional perimeter of the trade. And most importantly: market participants trade the yen with a heightened sensitivity that was absent for most of the last 20 years.

- The carry trade remains profitable, but it feels conditional.

- The market remains calm, but it feels temporary.

- The data remain stable, but the story feels like it is coiling.

As the narrative supercycle unfolds, the yen carry trade remains alive, but no longer invisible. In a market where story flow shapes price, success will depend on understanding not just the data but the storyline that markets are desperate to trade.

The BoJ’s December meeting, where another rate hike appears widely expected according to recent economist surveys, sits at the centre of market attention. If the BoJ hikes again, the narrative of structural normalisation solidifies. If it pauses, the fragility story gains fresh oxygen. Either way, story flow accelerates. Markets are no longer waiting for the BoJ to move; they are moving on what they believe the BoJ might be compelled to do.

“In the December 2-9 poll, 90% of economists, or 63 of 70, expected the Japanese central bank to raise short-term interest rates to 0.75% from 0.50% at next week’s meeting.” – Reuters

Based on Permutable AI’s forecast data, short-term yen strength is one plausible outcome. Not because fundamentals demand it, but because sentiment can trigger sharp moves when positioning becomes crowded. In this scenario, the irony of narrative-driven cycles comes into focus: reversals tend to occur not when dominant stories weaken, but when they become too strong.

We have entered a narrower corridor intellectually, sentimentally, and structurally. The old certainty around the yen carry trade is gone, replaced with an elegant fragility where small changes can generate outsized narrative impact.

Author: Caroline Adams

#Yen #Japan #CarryTrade

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

How Dangerous Is the Yen Carry Trade? | Disruption Banking

How Strong Will the Japanese Yen (JPY) Be In 2026? | Disruption Banking

Japanese Yen (JPY) Hits Lowest Level Since 1986 | Disruption Banking

Permutable AI: Turning Global Perception into Real-Time Edge | Disruption Banking