Washington, DC – December 12, 2025: An International Monetary Fund (IMF) mission, led by Mr. Jorge Salas, visited Nassau during December 2-12 for the 2025 Article IV consultation. At the end of the discussions, the mission issued the following statement:

Macroeconomic Outlook

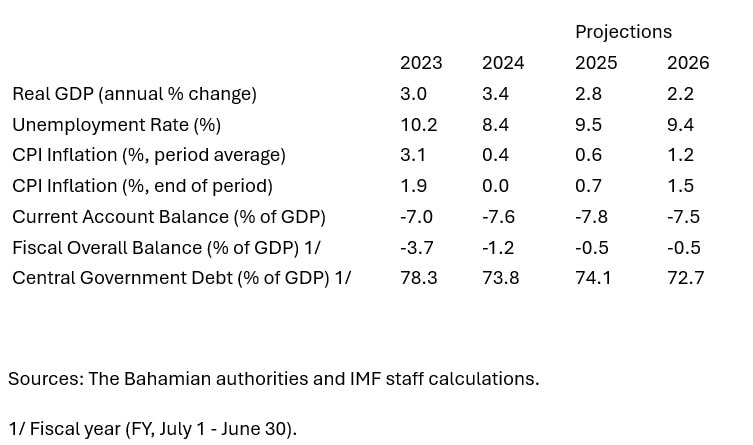

The economy remains resilient, and growth is expected to decelerate slightly in 2025. Real GDP was robust in the first semester and is projected to grow by 2.8 percent in 2025, mainly driven by construction and buoyant cruise tourism. Growth is projected to continue moderating in 2026, partly due to relatively stagnant stayover tourism. Over the medium term, growth is expected to slow toward the assessed potential growth rate of the economy (1½ percent). The unemployment rate declined to 9.3 percent in the second quarter of 2025, with an improvement in the labor force participation rate. Against the background of subdued global energy prices, inflation remains low and is projected to be below 1 percent in 2025.

Risks are broadly balanced. Downside risks stem from a potential global slowdown (which would have adverse impact on Bahamian tourism), tighter global financial conditions, or natural disasters. Upside risks include the possibility of results from efforts to diversify tourist source-countries and greater-than-expected effects of public and private infrastructure projects linked to tourism and the energy sector reform. Risks to inflation are broadly balanced.

Fiscal Policy

Public finances have continued to strengthen. In recent years, the economy has benefited from tourism-related revenue flows, and steps have been taken to reduce deficits and public debt. A primary surplus was achieved in FY2024/25 for the third consecutive fiscal year. In June 2025, a US$1.1 billion Eurobond issuance allowed for a buyback of nearly US$0.8 billion in more expensive external obligations. While declining, central government debt remains elevated at 74 percent of GDP, and further fiscal consolidation is required. The FY2025/26 budget targets an overall fiscal surplus, supported by the introduction of the Domestic Minimum Top-Up Tax on large multinational corporations.

Achieving the authorities’ 50 percent of GDP target for central government debt in FY2030/31 is estimated to require additional measures. In addition to sustained actions to improve tax administration and compliance, quickly reducing central government debt to 50 percent of GDP should be prioritized by adopting new revenue-enhancing and expenditure-optimizing measures. These policies include:

- Replacing the business license fee with a new corporate income tax.

- Introducing a progressive personal income tax.

- Reducing tax expenditures (notably exemptions to the VAT and customs duties).

- Eliminating the ceiling on the property tax.

- Raising the standard VAT rate to around 15 percent (which is the midpoint of that charged by regional peers).

- Improving the operations of state-owned enterprises (SOEs) and reducing fiscal transfers to them (especially the health and water enterprises).

These measures would allow for a reduction in the fiscal deficit but would also give some space to invest more in education, social protection, and hardening infrastructure for natural disasters.

Upgrading fiscal institutions is critical to mitigate fiscal risks. Efforts to reduce debt rollover risks, including by mobilizing domestic financing at longer maturities, should continue. It will be key to accurately assess and mitigate fiscal risks arising from SOEs through enhanced monitoring and regular publication of SOEs’ audited financial statements. The planned reform to civil service pensions should be supplemented with more holistic changes that can lessen the actuarial imbalance of the civil service pension system. Advancing plans to adopt an accrual-based accounting system for the budget would be important to improve fiscal transparency and decision-making.

The increased use of public-private partnerships (PPPs) to develop infrastructure should go hand in hand with stronger PPP governance. PPPs can be useful for meeting the country’s investment needs, including in energy, roads, and climate-resilient infrastructure. Ensuring that PPPs deliver public value without creating hidden fiscal liabilities requires clear legal frameworks; transparent procurement; proactive fiscal risk management; and proper budgeting, accounting, and reporting standards. An immediate priority should be to improve fiscal reporting and enhance the overall institutional framework for PPPs.

Financial Sector Policies

As credit to the private sector increases, it is important to safeguard banks’ resilience. Systemic financial stability risks are moderate, and domestic banks remain in good health. Bank credit to the private sector is growing at a steady pace, with corporate loans increasing quickly (though from a relatively low base). Supervisors assess lending standards as generally prudent and risks to asset quality are low, but it will be important to upgrade stress test tools and continue monitoring risks stemming from banks’ exposure to the sovereign.

More work is needed to improve oversight of the nonbanks and address data gaps. Ongoing actions to strengthen credit union governance are welcome. Closing data gaps remains a priority to upgrade the oversight of nonbanks; for example, to comprehensively assess climate risks, including in the insurance sector. Supervisors should adopt a time-bound plan for operationalizing loan-level data (from bank and nonbank lenders) and real estate price indices, particularly as construction activity continues to grow (mainly in the commercial real estate segment). The recently established Financial Stability Council can help strengthen systemic oversight, but addressing the priorities identified by the council will require to enhance technical capacity across financial regulators and supervisors.

Progress is being made to implement the 2019 FSAP recommendations. The authorities are preparing legal improvements to strengthen the resolution frameworks and provide backstop funding mechanisms to the deposit insurance corporation. Enacting these legal changes should help tackle shortcomings in crisis preparedness and safety nets. It is essential to maintain efforts to implement the 2024 DARE Act, which upgraded the regulatory framework for digital assets. Work is still needed to lower the ceiling on central bank advances to the government.

Efforts to expand financial inclusion through agency banking, the Sand Dollar, and digital payments are advancing. The Central Bank has completed a consultation on agency banking to allow licensed non-bank providers to deliver services on behalf of banks and credit unions. These licensed entities would have to ensure full operability of the Sand Dollar, which is helping improve access to financial services for underserved communities. Initiatives to implement fast payment systems are also underway. To match these efforts, it is necessary to continue investing in financial literacy and, especially, to enhance telecom and electricity infrastructure.

Actions are being taken to address money laundering threats and vulnerabilities identified in the 2024 National Risk Assessment. This includes improving investigative capabilities and allocating adequate resources to risk-based AML/CFT supervision. The authorities are working to prepare for the review of the country’s AML/CFT framework by the Caribbean Financial Action Task Force, planned for late 2026.

Supply-Side Reforms

Policies should aim to increase labor productivity and foster investment in human and physical capital. To identify productivity challenges and recommend actionable reforms, the authorities have established the National Productivity Task Force, a multi-sector initiative with public and private participation. The authorities’ work to upgrade airport infrastructure, along with several private sector projects to enhance hotel infrastructure and develop new cruise destinations, should help alleviate capacity constraints in the tourism sector.

Addressing challenges in the labor market is essential. Strong reliance on the service sector, often characterized by high labor intensity, seasonality, and the need for work beyond standard hours, can create conditions for relatively unstable jobs. Meanwhile, self-employed workers (including in the construction sector) face heightened vulnerability and exposure to informality. These labor market patterns can undermine productivity growth. Moreover, firm surveys identify skill shortages as a main obstacle for business and innovation. Policy priorities include streamlining business registration requirements, creating a supportive environment for startups, strengthening the education system, expanding vocational training, and improving job-matching services and upskilling opportunities (including through lifetime learning).

To strengthen economic resilience, efforts are being made to diversify trade. Expanding import source countries has the potential to reduce import costs and increase resilience. To achieve these potential gains, it will be critical to improve the private sector infrastructure for shipping and logistics and work on the harmonization of product regulations. To pass on imports’ savings to local consumers, the authorities should promote competition in local goods markets. On the export side, tourist inflows remain highly concentrated (around 80 percent from the U.S.), and further actions should be taken to continue improving airlift connectivity with more source countries.

The energy sector reform is underway. Energy projects are aiming to generate 30 percent of electricity with renewables by 2030 and upgrade the grid to modernize transmission and distribution. These projects largely rely on power purchase agreements with private sector partners. The impact of the energy reform is expected to materialize starting next year and, if successful, it should significantly improve the cost and reliability of electricity as well as strengthen the financial health of the Bahamas Power and Light Corporation (an SOE).

There is scope to continue enhancing disaster risk management. To improve the implementation capacity of the Disaster Risk Management Authority, the IDB recently approved a US$160 million loan. The Comprehensive Financial Strategy for Disaster Risk Management, adopted in July 2025, established a multi-layered financial protection system which envisages the use of risk retention and risk transfer instruments in response to disasters for an amount equivalent to nearly 2 percent of GDP. Building on these important steps, more work is needed to strengthen the resilience of public assets and address gaps in property insurance.

Housing affordability is a social and economic challenge. Access to mortgage loans is relatively limited and new housing construction has been weak in recent years. Stronger supervisory efforts are needed to accelerate the reduction in legacy mortgage nonperforming loans, and to identify other unwarranted constraints for residential mortgage supply, particularly for low- and middle-income households. The authorities could create fiscal space to invest more in affordable social housing. Better regulations to govern rental contracts and landlord-tenant relationships may help incentivize increased supply of rental properties. However, elevated construction costs and modest rates of wage growth could deepen affordability pressures in the near term.

The IMF staff team would like to thank the Bahamian authorities and other counterparts for their hospitality and the open and constructive discussions.

The Bahamas: Selected Economic Indicators

See Also:

Who are the original pioneers of the stablecoin? | Disruption Banking