Ukraine has quickly become one of the world’s most crypto-active nations. 2025 Chainalysis data ranks Ukraine 8th globally in crypto adoption and first in Eastern Europe on a per-capita basis. Analysts attribute this to economic uncertainty, distrust of banks, and high technical literacy in a country under war and inflation pressures.

According to local reports, Ukrainians moved roughly $106 billion worth of cryptocurrency into the country between mid-2023 and mid-2024, and spent nearly $882 million on Bitcoin purchases in that period.

Today, roughly 6.5 million Ukrainians, about 15–16% of the population, are estimated to own crypto. These figures place Ukraine among the top crypto markets in the world alongside India, Nigeria, Indonesia, the United States, and Vietnam.

A Young, Tech-Native User Base Drives Growth

Crypto adoption in Ukraine is led by younger, tech-native citizens. A 2022 Gradus Research survey found that over half of Ukrainians knew about crypto, and 20.7% of 18–24-year-olds had used it, compared to just 5% of the general population. Like in other leading crypto countries, most crypto owners are aged 24–35.

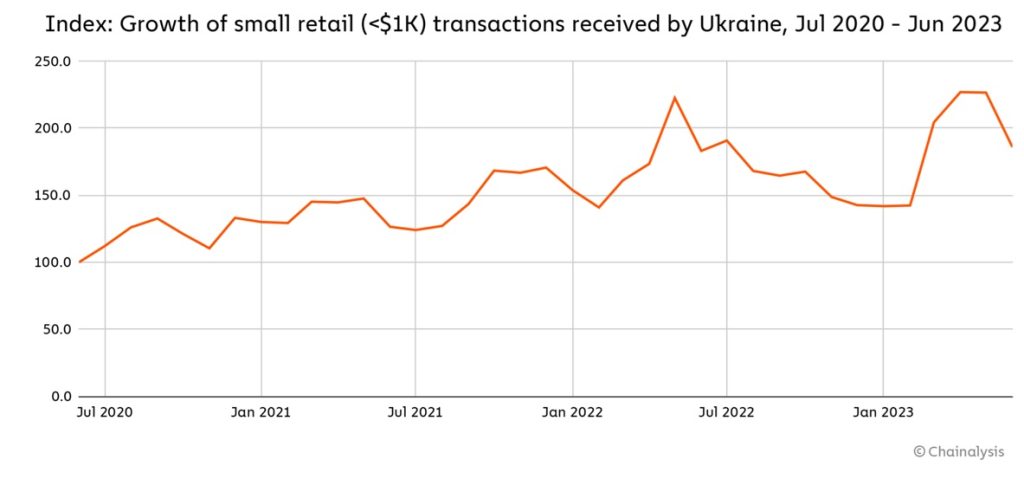

Still, most remain cautious. A more recent 2023 survey showed that adoption has risen even higher. Roughly 25% of financially active Ukrainians already held crypto according to the survey, and another roughly 23% plan to invest soon. Chainalysis 2023 data show small crypto transfers under $1,000 have risen steadily, reflecting consistent use.

Many young Ukrainians turn to Bitcoin or stablecoins as protection against currency devaluation and wartime instability. With the volatility of the hryvnia and banking limits in place, crypto has become a practical store of value.

Displaced Ukrainians in the EU also rely on crypto for savings, payments, and remittances. As analyst, Anna Voievodina observed, “Ukrainians now use crypto for everyday purposes like savings, donations, and sending remittances back home.”

Crypto as a Lifeline: Donations, Remittances, and Survival

The 2022 invasion by Russia thrust Ukraine’s crypto ecosystem into the global spotlight. Just before the war, the parliament had passed the “On Virtual Assets” bill to legalize digital assets, though implementation halted after Russia’s invasion days later. In the conflict’s early months, millions in crypto donations poured into Ukraine to support its army, helping fund military and humanitarian needs when traditional systems faltered.

In March 2022, the National Bank of Ukraine (NBU) temporarily banned hryvnia-to-crypto trading “to prevent unproductive capital outflow,” later easing restrictions as officials recognized crypto’s role in payments and remittances.

Public interest has surged since. With towns destroyed and the economy strained, many Ukrainians, including refugees in the EU, have embraced crypto platforms for daily use.

Though total volumes fell amid hardship, on-chain data show small retail transfers held steady or even grew, underscoring crypto’s continued practical value.

Donations, including those made with cryptocurrencies, have been pouring into Ukraine since the start of the Russian invasion, launched on Thursday. https://t.co/udrpfIrkOj pic.twitter.com/obOTCrpvvk

— Forbes (@Forbes) February 25, 2022

From Legalisation Chaos to MiCA Alignment

Ukraine’s government has largely embraced crypto as innovation rather than restrict it. In February 2022, the Rada gave final approval to the amended ‘On Virtual Assets’ law, legalizing cryptocurrencies. Crypto was recognized as a legal asset and the National Commission on Securities and Stock Market was named as the regulator. However, tax and civil code updates stalled implementation.

By mid-2025, Ukraine moved to align with the EU’s MiCA framework. In September, the Ukrainian parliament passed the first reading of the crypto legalization bill, introducing a 23% tax on crypto gains, split between personal income tax (18%) and a military levy (5%). Officials estimated Ukraine had missed an estimated $200 million in crypto taxes since 2019. The new framework aims to formalize the sector and capture revenue for reconstruction and defense.

The NBU is also testing a digital hryvnia. Its “e-hryvnia” CBDC pilot, launched in 2021, explores retail payments, programmable transfers, integration with virtual assets, and cross-border use. The Ministry of Digital Transformation’s 2025 – 2026 roadmap prioritizes virtual asset adoption, signaling a shift from wartime caution to active crypto engagement.

Ukraine’s $5.6 Billion Bitcoin War Chest

Ukraine’s financial sector is increasingly recognizing crypto’s role. The government now holds about 46,351 BTC, worth roughly $5.6 billion as of mid-2025, ranking among the largest state crypto reserves worldwide. Lawmakers have even proposed creating a formal digital assets reserve as a strategic asset, following the U.S. and other countries that are exploring it.

Banks, Exchanges, and the P2P Underground

NBU Governor Andriy Pyshnyy backs regulated crypto activity but insists virtual assets shouldn’t become legal tender as they may threaten monetary policy. The central bank is integrating crypto under strict oversight. It is licensing exchanges, enforcing AML/KYC rules, and monitoring large transactions, to balance innovation with stability.

Private institutions are cautiously testing the waters. Banks offer few crypto services, though startups are filling the gap. Kuna, Ukraine’s largest exchange, relocated to Lithuania to serve EU users and is building crypto-payment and custody tools for future domestic use. Peer-to-peer (P2P) trading on Binance and OKX also remain popular. Once regulation is complete, Ukrainian banks and payment providers are expected to expand crypto-friendly services.

2026 Outlook: Crypto Goes Mainstream in Ukraine

Despite the war, Ukraine’s tech sector continues to foster a growing crypto ecosystem. The Ministry of Digital Transformation has promoted blockchain startups and digital projects, while the “Diia City” IT zone attracts fintech and Web3 firms with tax breaks and flexible rules. Several local companies now provide crypto wallets, payment tools, and blockchain services for Ukrainian users.

Global exchanges remain vital for retail access, with exchanges such as Binance and Bybit remaining important gateways for retail users in Ukraine. Especially where domestic platforms are still in the process of licensing and full local regulatory frameworks are evolving. Peer-to-peer and UAH-based markets are widely used, though detailed data on volume growth is limited.

Mining, once modest, has nearly vanished amid power shortages and wartime damage. Russian occupation authorities even banned mining in seized areas due to grid strain. Most Ukrainian miners have gone offline or moved abroad, as focus shifts from energy-heavy mining to portable crypto uses like payments and savings.

Innovation Despite Blackouts: Diia City and Web3 Startups

By late 2025, Ukraine’s crypto market should be shifting towards the mainstream. Millions now hold or trade digital assets, driven by economic pressures and a tech-savvy population. The war sped up trends like crypto donations and remittance use, even as it slowed banking adoption and mining. The government, once cautious, is now building a full legal and tax framework.

Regulators and institutions, from the NBU to parliament, acknowledge crypto’s expanding role. Backed by the Ministry of Digital Transformation and global partners, Ukraine is aligning with MiCA and FATF standards while integrating digital assets into reconstruction plans. If successful, 2025 – 2026 could be a time when crypto becomes a normal part of Ukraine’s financial system, used by everyday citizens and businesses alike.

#Crypto #Ukraine #Adoption

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

How Concerned Is The US About Corruption In Ukraine? | Disruption Banking

Airbnb’s Hryvnia support makes up for Ukraine’s War Bonds | Disruption Banking