The Travelers Companies, Inc. (ticker: TRV) has been part of the Dow Jones Industrial Average (DJIA) since June 8, 2009 when it replaced Citigroup bringing a major property-and-casualty insurer into the 30-stock index. Its addition reflected the company’s steady underwriting discipline and durable earnings power.

In today’s piece, Disruption Banking continues digging into the Dow’s 30-stock members, with eyes on the Travelers’ history in the Dow, pre-and-post inclusion era, and how it has performed so far in terms of returns and dividends.

Travelers’ Pre-Dow Resilience: Annual Returns (2005–2009)

Before joining the Dow Jones, Travelers built a reputation for long-term growth. According to Macrotrends, the firm delivered an estimated +23% return in 2006 and then a modest –2.38% in 2007. The financial crisis hit in 2008, where the return fell to roughly –14%. Yet by 2009, Travelers had rebounded with +13.49% for the year.

These data points reflect a company that weathered market turbulence and entered the Dow on a trajectory of recovery and relative stability.

Consistent Performance Post-Dow Inclusion (2009–2025)

More than 15 years later, Travelers remains one of the DJIA’s quiet performers, rarely flashy, always steady. Through the 2010s, TRV delivered steady, mostly positive single- to low-double-digit annual returns, setting the stage for its blue-chip profile, including approximately +20% in 2014 and +17% in 2019. Even during down years like 2018 (–9.64%), Travelers’ fundamentals held firm, a pattern that helped establish it as the Dow’s insurance anchor as Macrotrends’ data will further show down the years.

The stock rose about 29% in 2024, supported by stronger underwriting and higher investment yields. Through October 2025, and at the time of writing, TRV annual % returns hover around 13%.

Volatility has been muted compared with the broader market. A $1,000 investment made when Travelers entered the Dow in 2009 would now be worth over $5,000 with dividends reinvested, proof that slow-and-steady insurers can perform well over time.

Underwriting Excellence and Reduced Catastrophe Losses

A key to Travelers’ DJIA-worthiness is its disciplined underwriting and risk management. This year, the company posted very strong underwriting results, helped by lower catastrophe losses compared to prior years.

For example, in Q2 this year Travelers reported catastrophe losses of $927 million (pre-tax), down sharply from $1.509 billion a year earlier. This reduction in severe losses drove a much-improved combined ratio (90.3% in Q2 vs. over 100% prior).

CEO Alan Schnitzer noted in Q3 that “very strong underwriting results…drove the bottom line,” with underwriting income more than doubling year-on-year thanks to both fewer large disasters and higher net earned premiums. In fact, Travelers’ underlying combined ratio improved to an exceptional 83.9% in Q3.

These metrics highlight that Travelers’ insurance core is firing on all cylinders, a critical factor for a Dow component.

Travelers’ Robust 2025 Financials and Shareholder Returns

Travelers’ 2025 financial results have been robust. In quarter two, the insurer earned net income of $1.509 billion, or $6.53 per diluted share, on total revenues of $12.116 billion. For the first half, net income was $1.904 billion (up 15% from a year ago) with net written premiums of $22.058 billion (up 4%). The company returned significant capital to shareholders: in Q2 it repurchased 2.1 million shares for $557 million and declared a $1.10 quarterly dividend.

In Q3 2025 Travelers continued the momentum, reporting net income of $1.888 billion ($8.14 per diluted share) on $11.47 billion of premiums. That beat analysts’ expectations. MarketBeat notes EPS $8.14 vs $6.01 estimate, and reflected a 14% growth in net investment income.

The dividend remained at $1.10 per quarter, supporting a ~1.6% yield on today’s price.

Altogether, Travelers’ strong underwriting gains, rising book value and steady cash returns have underpinned shareholder value (the board deployed nearly $900 million in buybacks and dividends in Q3 alone), as is its Dow Jones standing.

Travelers’ Vital Role as a Dow Stabilizer

As a Dow stock, Travelers sits in the middle of the pack. At roughly $270 per share (TradingView) with about 229 million shares outstanding, TRV’s market cap is on the order of $60+ billion, giving it ~3.5% weight (Slickcharts) in the DJIA. This means that TRV is less influential to the performance of the Dow Jones than high-priced members like Goldman Sachs (~$784), Microsoft (~$524), Caterpillar (~$523), or Home Depot (~$387).

On fundamentals, Travelers’ diversified insurance mix (commercial P&C, specialty and personal lines) means it is less cyclically sensitive than heavy industrial or energy companies. Its steady growth contrasts with peers in other corners of the Dow (e.g. tech or consumer) and provides balance to the index.

The insurer’s balance sheet is rock-solid (statutory capital remained well above targets, debt-to-capital ~22% after adjusting for investment losses, per Travelers’ Q3 2025 report release) and its return profile is stable.

Outlook for Investors: Travelers’ Future in the Dow

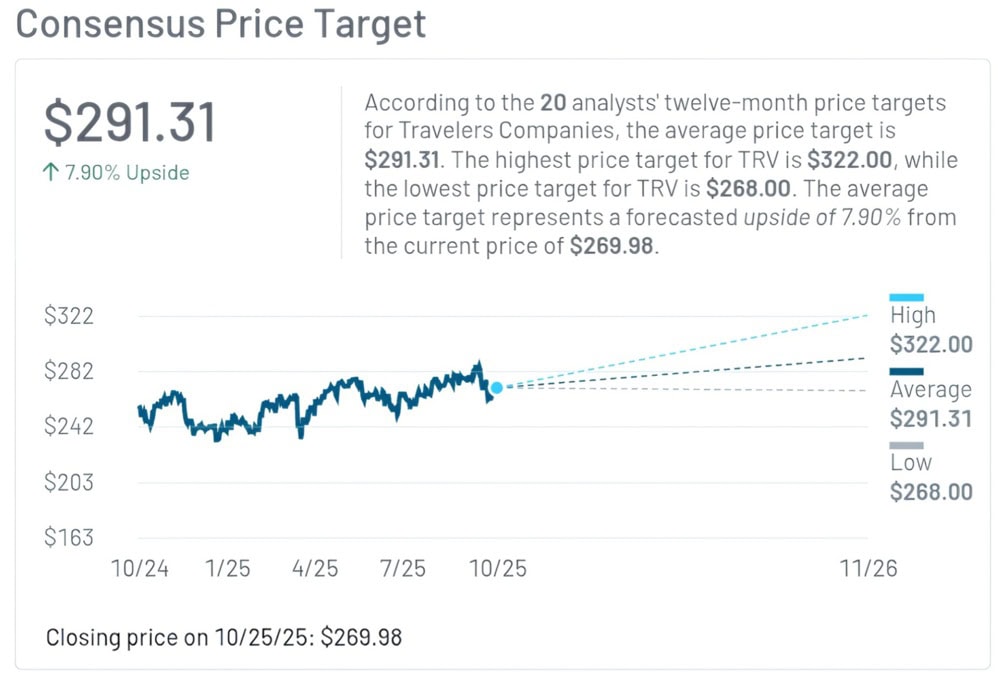

Analysts see Travelers as a reliable compounder rather than a high-growth bet. The MarketBeat consensus shows a “Hold” rating and an average price target around $291, suggesting modest upside. Research notes from Cantor Fitzgerald and other brokers highlight expected return on equity near 8% for 2025 and strong capital discipline.

CEO Alan Schnitzer emphasized that Travelers’ “high-quality investment portfolio continued to perform well.”

For long-term Dow investors, Travelers offers exactly what the index represents: resilience, dividends, and durability. It may not command headlines like the tech giants, but its discipline and consistency help insure the Dow Jones’ future, one steady quarter at a time.

#CapitalMarkets #Travelers #DowJones #DJIA #Insurance #TRV

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Salesforce: Cloud Growth & Dividends in the Dow | Disruption Banking

Apple’s Decade in the Dow: Powering Tech’s Market Influence Since 2015 | Disruption Banking

Why Hedge Funds Are Betting Big On ‘Catastrophe Bonds’ | Disruption Banking