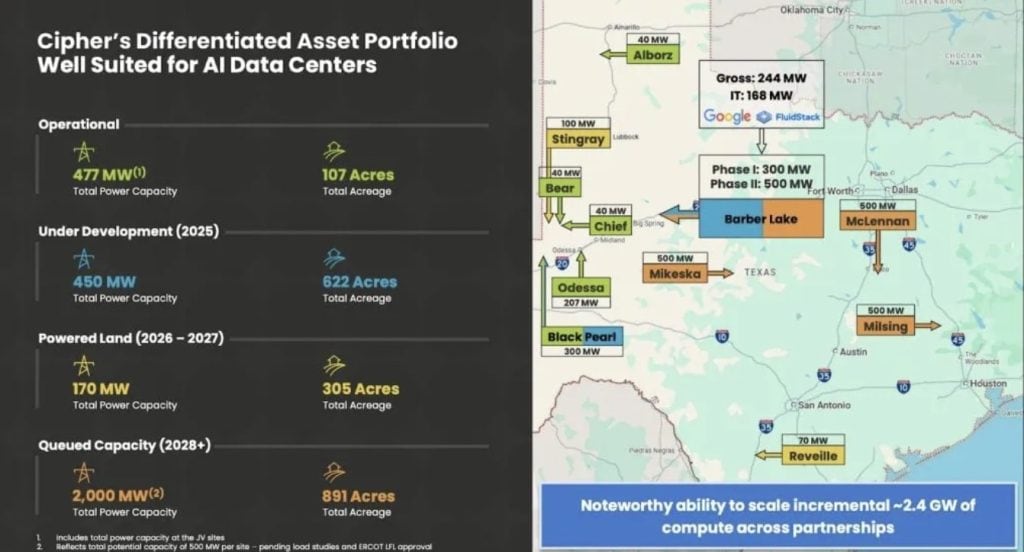

Cipher Mining (CIFR) signed a $3 billion AI hosting Agreement with Fluidstack for 10-year high-performance computing (HPC) data centers in Colorado City, Texas. Near roads to nowhere and about an hour’s drive from Abilene, Colorado City is a town of nearly 4,000 inhabitants that has seen better days. Residents may be ambivalent about bitcoin mining and AI data centers, but the lure of high-paying jobs in such towns is irresistible.

The announcement of the contract coincided with a 10% increase in Cipher’s stock price. It may be partially attributable to bitcoin’s 3% appreciation over the previous 24 hours. Bitcoin miners often see their stock prices rise and fall with bitcoin’s performance.

“Hyperscale” Computing Power

The new trend is that bitcoin miners are repurposing their sites to host HPC data centers, the backbone of big data. There are now four public BTC miners with hyperscalar deals, including Applied Digital, TeraWulf, which also signed with Fluidstack earlier this year, as well as Core Scientific.

Coming in at 168 MW, Cipher’s is actually the smallest in terms of load.

Google is “backstopping” $1.4 billion of Fluidstack’s lease obligations, sweetening the deal. If the deal is extended beyond 10 years, the total value of the deal could more than double to $7 billion.

Bitcoin mining consumes a lot of power, and its increases in demand are intermittent, which complicates the operation of local utilities, leading to congestion on the grid. Therefore, Cipher joins a short list of bitcoin miners that are “colocated” with utilities, which entails registering and following utility policies and state regulations about power usage, interconnection, and grid access. Bitcoin miners are often obligated by contract to respond in real-time to the utility operator’s needs, including curtailing power usage when ordered by the utility.

Cipher is among those miners attempting to mitigate the risk of bitcoin volatility by diversifying into AI / HPC workloads. Cipher’s Barber Lake site consists of 587 acres, sufficient to accommodate future expansion from 168 MW to 500 MW, according to Cipher.

What Goes Up

On the heels of the deal, Cipher also announced that it obtained financing, killing the momentum of its stock rally. Shares dropped 17% on “dilution concerns.”

However, it serves as a reminder of the massive upfront capital costs associated with hyperscaler hosting. To understand the financial instruments and risk-hedging tools available to miners, Disruption Banking reached out to the team at Luxor Technology, a US-based compute power company focused on Proof-of-Work Bitcoin mining and compute. Luxor operates mining pools, where miners can issue hashrate derivatives, in effect selling future compute/mining power.

In an article about a mining pool that halted withdrawals in 2022, Bloomberg described mining pools as “essentially the software that aggregates computing power from miners to increase the probability of winning the token rewards by securing the bitcoin network.” It turns out that most miners are using mining pools as a way to avoid the risk that their mining equipment fails to solve the equation involved in individual bitcoin transactions.

Kaan Farahani, a Research Analyst at Luxor, responded, “Miners face significant revenue volatility driven by three uncontrollable variables — Bitcoin price, the network’s mining difficulty, and transaction fees — which together define ‘hashprice.’ Luxor’s derivatives directly hedge this exposure. Second, capital efficiency: miners typically finance growth plans through high-cost debt or equity. Deliverable Hashrate Forwards enable them to raise BTC or USD upfront by selling future hashrate production — effectively unlocking their balance sheet without dilution.”

Disruption Banking inquired further about the advantages of hashrate forwards, and whether such instruments can limit exposure to BTC price volatility, and Farahani wrote, “Hashrate derivatives are valuable in all market conditions, since they provide certainty. During market stress (when Bitcoin price drops or network difficulty rises), they protect against margin compression, and during bull markets, they help capture upside more quickly than building physical infrastructure.”

Luxor Technology is enlarging its footprint, recently launching a new division, Luxor Energy, a licensed Retail Electric Provider (REP), a designation enabling it to sell power directly to end users in deregulated areas of Texas, including parts that fall under the remit of ERCOT.

Bravery, a Rampart of Defense

The bitcoin mining industry is undergoing rapid transformation, and several niche providers have sprung up in recent years to diversify risks and streamline the process. Miners now collaborate with new counterparties to hedge the risks inherent in bitcoin itself and to consolidate the rewards of its creation.

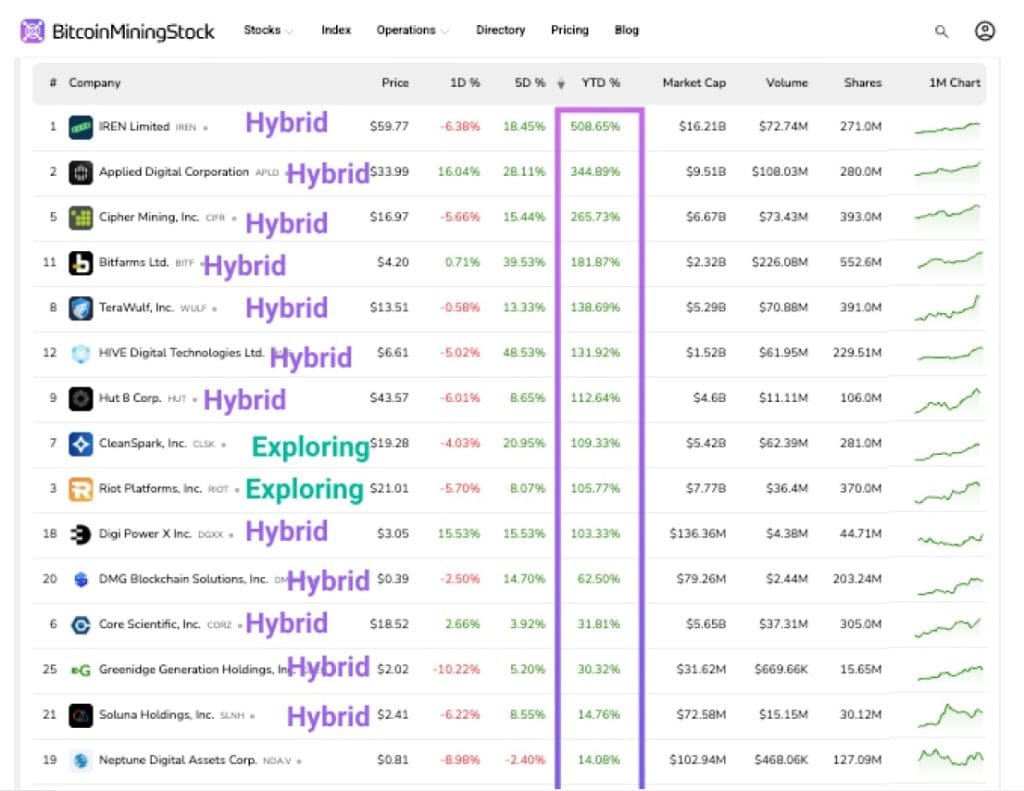

And by the way, capital markets prefer hybrid miners to “pure play” miners, reinforced by their performance in terms of ROI for investors.

Disruption Banking reached out to Cindy Feng, founder of BitcoinMiningStock.io, regarding the difference in performance. She wrote the following in an email, “Looking at year-to-date (YTD) performance, the top performers include IREN (IREN), Applied Digital (APLD), and Cipher Mining (CIFR), all of which are hybrid miners. Among them, only IREN has a large Bitcoin mining footprint; the others have relatively modest hash rates, highlighting how diversification into HPC or AI infrastructure is being rewarded by the market.”

Below, she included an image showing the YTD stock performance of 34 Bitcoin Mining Stocks. Out of the top 18 performers, 15 of them were either hybrid or exploring, as shown below.

Blessed are the bitcoin miners who wisely invest in hashrate forwards and hyperscaler deals. After all, big data is the future, and it can be married to bitcoin.

Say, let’s check in with the Texas electric grid and assess how it is handling the new demand forecasts.

Everything Is Bigger in Texas

Texas has hosted 40% of the nationwide investment in the crypto sector, representing $4 billion and 12,000 jobs in 2024 alone, but there is comparatively less discussion about how the industry is viewed locally or impacting the community, except in the pages of the Texas Tribune, which has covered all sides of the issue.

In Texas, data center expansion and bitcoin mining have been sold as enhancing energy services and even preserving the self-reliant image of Texas, embracing new technology to keep pace with people clamoring for more power.

Riot Platforms opened a bitcoin mining facility in Milam County, northeast of Austin, creating “hundreds” of jobs and adding millions to the tax base. The county offered Riot at 45% discount on local taxes for 10 years. To its credit, Riot hired locally.

In other countries, miners have added enough to the tax base for cuts to property taxes, a welcome respite for disgruntled Texas property owners, whom Disruption covered here.

The Grid and Its Discontents

The power consumption for bitcoin mining and HPC are astronomical. The Electrical Reliability Council of Texas (ERCOT) expects that demand will double by 2030 to 150 gigawatts.

In May, the Texas Legislature passed SB-6 to alter the planning, interconnection, and cost allocation of large loads, including data centers. Accordingly, ERCOT began requiring miners to divulge more about their ownership and power needs. Miners are providing their peak load forecasts for the next 5 years, with the threat of a $25,000 per violation, per day penalty.

Residents worry that the new demand could strain the grid, but experts counter that ERCOT and state transmission providers will be closely monitoring power demand and can leverage curtailment orders during times of peak load.

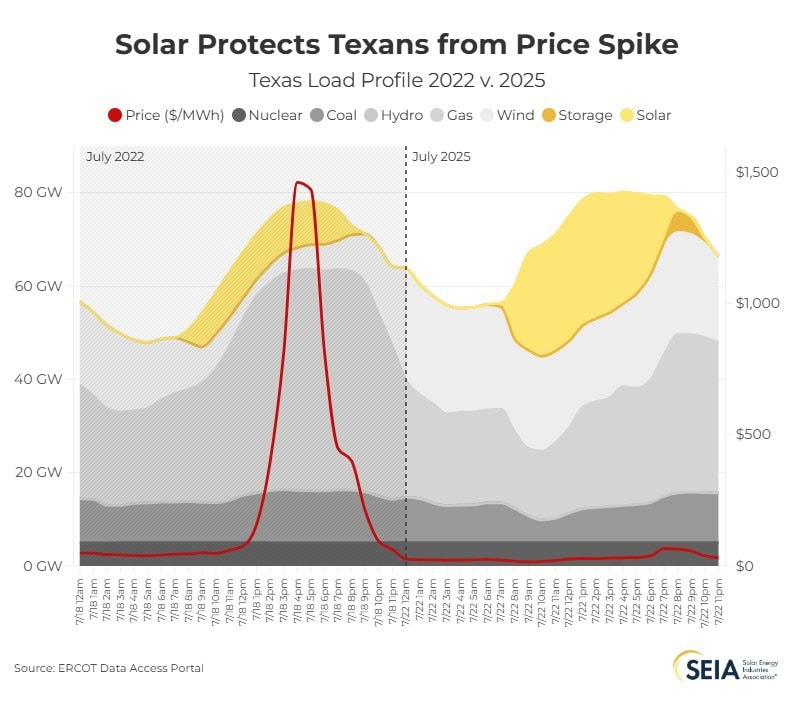

Peak load is when energy prices tend to spike, but the increased supply of solar and battery storage has added a buffer on prices, as shown in the chart below, comparing a price spike in 2022 when there was less renewable load available to the load profile of 2025.

The program is called ‘demand response,’ and ERCOT actually pays participants to shut down when the grid is under strain.

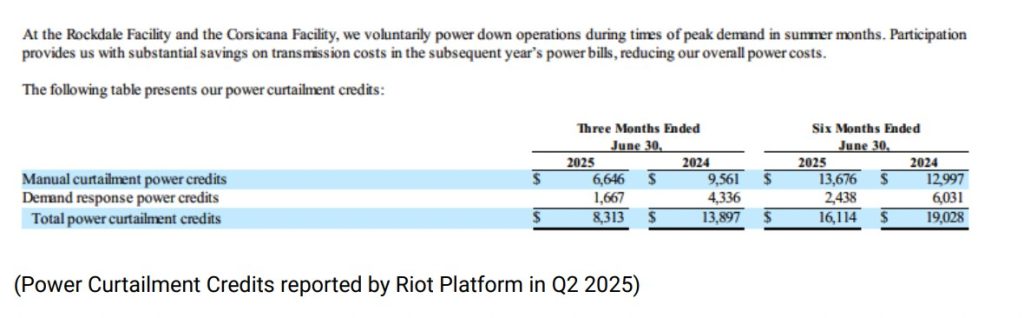

Riot Platforms reported the following income from its agreements with ERCOT for Q2 2025, in thousands of dollars.

Cindy Feng commented on the credits applied to Riot’s power invoices, “while the payments or credits may not always appear as headline revenue, they meaningfully impact the economics of mining, particularly for companies with large flexible loads and strong grid participation strategies.”

In a statement to Inside Climate News, ERCOT said, “Currently, the crypto mining industry represents the largest share of large flexible loads seeking to interconnect to the ERCOT System.”

Interestingly, when Texas media outlets requested data from the registrations of miners, the requests were denied. When the outlets appealed to the Attorney General’s Office, the AG largely supported transparency, but ERCOT sued the AG’s Office, stating that the information could be used for terrorist attacks on the grid.

Legal experts consulted by the Texas Tribune agreed that the miners definitely count as critical infrastructure for the grid.

The Cattle Are Lowing

Retail power costs have increased over the past few years. A recent study found that between January 2021 and December 2024, electricity prices went up from $0.10 USD to $0.16 per kWh. However, demand response has actually reduced the relative cost during times of peak load, when prices would normally spike.

That didn’t stop consumers from complaining when miners made millions from the grid emergencies where Texans experienced outages or skyrocketing electricity prices. There are also reports of residents reporting health maladies, including fainting, migraines, hypertension, nausea, heart palpitations, and vertigo, which they say are associated with mining activity and cattle and other animals driven insane or driven away by the constant “mechanical howl” of a mining facility. Residents of Granbury, Texas, filed a lawsuit against their local bitcoin mine last year.

Can’t Just Flip A Switch

Stress on the Texas grid, as well as pressure on ERCOT and utilities, seems likely to intensify due to transmission upgrade needs, the rollback of renewable energy incentives, and the persistent growth of demand.

Tech titans are nailing down sources of power for the future, and it’s likely that utilities will seek deeper collaboration with big tech companies. They are driving demand, and utilities are facing a budget landscape always growing bleaker.

Utilities are in a break-even business. They seek reimbursement from state and federal governments, or they propose rate increases. A recent report by Deloitte concluded that sustained capital investments of $1.4 trillion will be needed in the power sector over the next 5 years, identifying that rate increases and bond issuance “may not suffice.”

With the Department of Energy and the Federal Emergency Management Agency cancelling most of the funding for grid improvement and renewable energy adoption, utilities will go to state governments and rate-payers. Someone will have to pay the piper.

Beware, The Black Swan

Also, bitcoin miners may encounter rough waters according to the above-mentioned variables mentioned by the team at Luxor: “Bitcoin price, the network’s mining difficulty, and transaction fees.” If there were a black swan event, such as grid collapse or major market disruption, the benefits miners have accrued from their prior financial agreements would evaporate, and they could see their fortunes abruptly shift.

Asked for a forecast over the next 3-5 years, Luxor’s Farahani wrote, “Since the 2024 halving, hedged miners via hashrate forward contracts have consistently outperformed with periodic returns of +15-20%, and as of September 2025, total notional traded on Luxor’s OTC hashrate forward market has reached around $250 million USD, reflecting a broader adoption of hashrate forward contracts across the mining industry. We expect this to continue as mining margins compress, which means financial performance will hinge less on raw compute power and more on how well operators manage exposure.”

Let’s all hope that Luxor is correct in its view of the market landscape, for the sake of Luxor’s clients, who operate critical infrastructure for the Texas grid.

If this view is incorrect, if any or all of the factors do not hold, and there is a crisis or extended market disruption, Luxor and other mining pool operators might face a liquidity crunch, which has caused other mining pool operators to halt withdrawals in the past.

The team at Luxor confirmed that this has never happened before, but “there is absolutely a non-zero chance for the trend to reverse.”

For now, the honeymoon between Texas and HPC / bitcoin miners continues.

Author: Tim Tolka, Senior Reporter

#Crypto #Blockchain #DigitalAssets #BitcoinMining #HPC #ERCOT

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.