Procter & Gamble (ticker: PG) joined the Dow Jones Industrial Average (DJIA) on May 26, 1932, during the Great Depression, when consumer staples were added to the 30-stock index, replacing United Air Transport. The move showed how important P&G had become to everyday American life. Founded in 1837, P&G is now 188 years old and remains a cornerstone of the modern economy.

Today, Disruption Banking examines P&G’s journey — both before its Dow inclusion and over the decades since — to see how this soap-and-candle upstart evolved into a consumer goods titan among blue chips.

Building a Consumer Giant Before the Dow (Pre-1932)

Long before its DJIA debut, P&G had built a legacy of steady growth. By 1921, it was already a major international company with a $1 million annual advertising budget, promoting iconic products like Ivory soap and Crisco shortening across the U.S.

The company’s focus on innovation and marketing helped it thrive even during hard times.

While the Great Depression devastated most businesses, P&G remained comparatively resilient — launching new synthetic soaps and detergents (e.g. Dreft in 1933) and pouring resources into radio “soap opera” advertising to boost sales.

Volatility struck: by the 1933 market bottom, P&G’s stock had lost roughly 80% of its 1929 peak, as no company escaped the crash. Yet P&G’s underlying business held up, continuing to pay dividends and invest in research throughout the 1930s.

This defensive strength and adaptability set the stage for P&G’s inclusion in the Dow as a bedrock consumer staple when the index needed stability in 1932.

Navigating Market Cycles with Steady Growth (1932–Present)

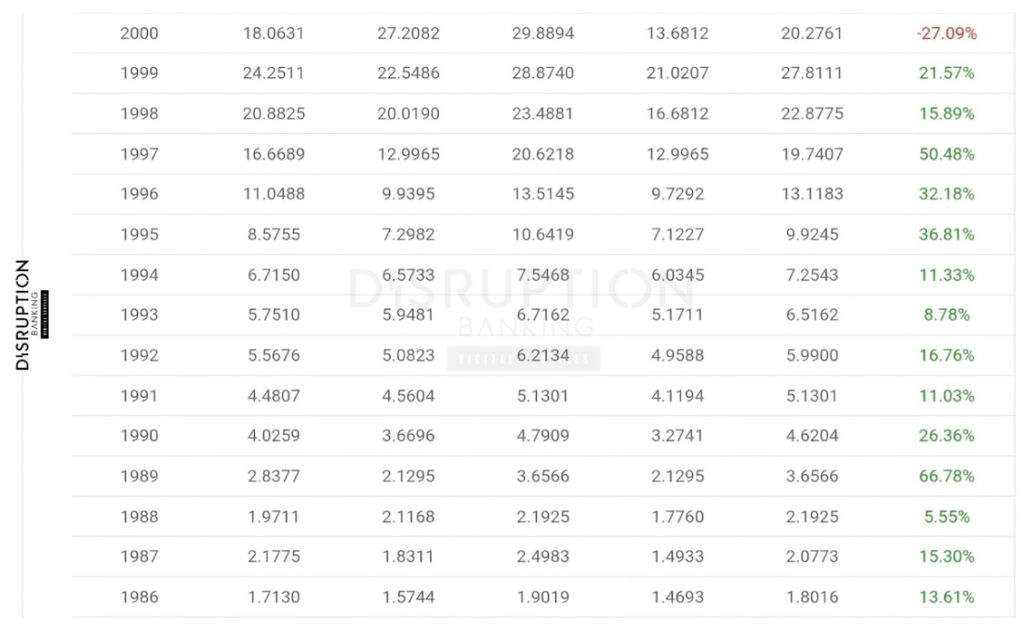

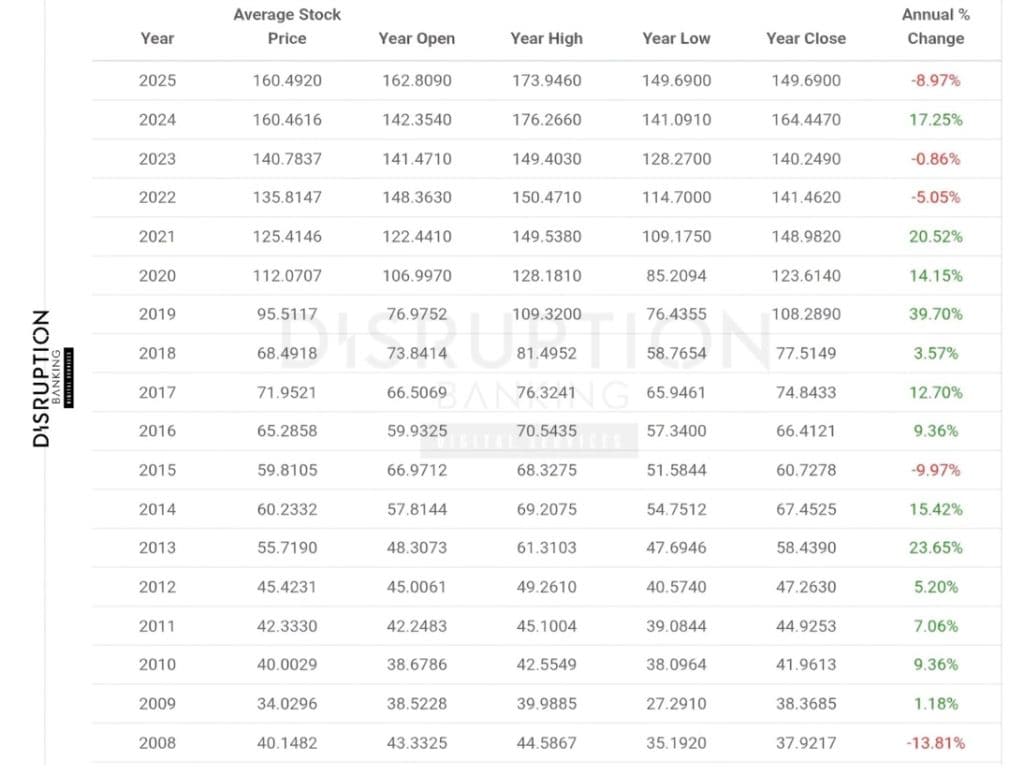

Over its 93 years in the Dow, Procter & Gamble has weathered every market cycle — from the post-WWII boom to the tech revolution — while expanding its lineup from Tide (1946) and Pampers (1961) to Olay and Gillette in the 2000s. The stock has seen dramatic swings. P&G’s stock has seen dramatic swings, surging ~67% in 1989 and ~50% in 1997 on strong earnings, but falling ~27% in 2000 during the dot-com bubble (Macrotrends).

During the 2008 financial crisis, P&G fell roughly 14 percent, far less than the market, and stayed roughly flat in 2009. In 2020, pandemic demand for cleaning products fueled a +14 percent gain, reinforcing its “recession-proof” reputation. In 2024, PG climbed ~17%, hitting a year-high of $176, before sliding ~9% YTD in 2025, underperforming the Dow’s ~7% gain (Macrotrends). It’s also worth noting that P&G acquired Gillette in January 2005, something that has led to a record up to $2.5 billion in charges over two fiscal years in the last three years.

These swings highlight P&G’s core strength: it may lag in ebullient bull markets but tends to hold up better when the economy turns south.

Delivering Financial Strength in 2025

Even with economic challenges, P&G is still performing well. In fiscal 2025 (ending June), it reported $84.3 billion in sales, approximately the same as last year, and an 8 percent rise in diluted earnings per share (EPS) year-over-year to $6.51. Organic sales grew 2 percent, marking 39 consecutive quarters of growth and nine consecutive years of higher core earnings.

The company’s cash flow stayed strong at $17.8 billion, which helped return $16 billion to shareholders — $9.9 billion in dividends and $6.5 billion in stock buybacks. In April this year, P&G raised its dividend for the 69th year in a row, continuing 135 years of uninterrupted payments. The $3.76 annual payout yields roughly 2.8 percent at current prices (MarketBeat), reinforcing P&G’s status as one of the Dow Jones’ true dividend kings.

“We grew sales and profit in fiscal 2025 and returned high levels of cash to shareowners in a dynamic, difficult, and volatile environment,” said CEO Jon Moeller, emphasizing “sustainable, balanced growth and value creation.”

Leveraging Brand Power Amid Economic Pressures

Like most global consumer giants, P&G faces inflation, tariffs, and changing shopper habits — but its scale and brand power help it adapt. In 2025, P&G acknowledged “consumer anxiety” and slowing demand as high prices squeezed budgets. CFO Andre Schulten said P&G noted that it “sees consumption trends consistently decelerating,” even for basic day-to-day items, as shoppers trade down or buy on promotion.

To offset rising costs including an estimated $1 billion tariff impact, P&G raised prices by ~3-5% on a quarter of its U.S. products in July. So far, shoppers have accepted it. “…customers will still pay up for these products,” said Kim Forrest, chief investment officer at Bokeh Capital, citing P&G’s brand trust that holds even in tough times.

P&G’s Market Pulse: Analyst Views in 2025

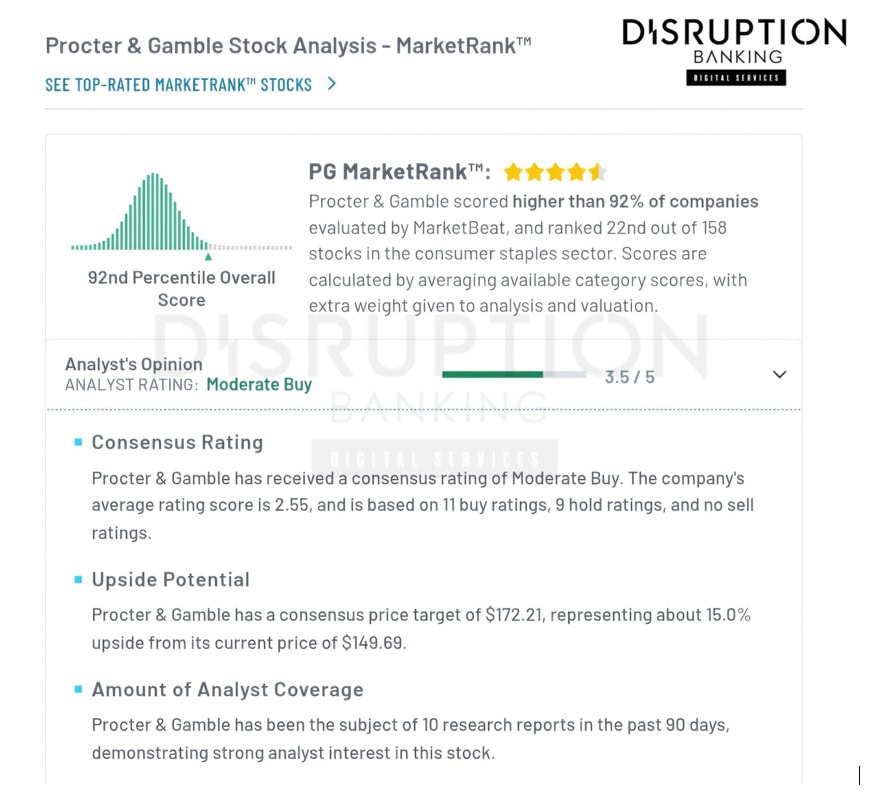

On October 9, Procter & Gamble’s stock hit a new 52-week low, after JPMorgan Chase cut its price target from $170 to $163, keeping a neutral rating. The shares fell to $149.58 during the day and are trading even lower today at $148.29 (TradingView, as of time of publishing).

Other analysts also adjusted their targets: Barclays’ Lauren Lieberman lowered its forecast from $164 to $153, UBS’ Peter Grom to $176 from $180, and Bank of America’s Peter Galbo trimmed its from $180 to $174.

Meanwhile, Berenberg Bank raised its target from $152 to $154 and rated the stock a hold, while Wells Fargo cut its target from $173 to $170 but kept an overweight rating.

Overall, MarketBeat reports that 11 analysts rate P&G a buy and 9 a hold, with a “Moderate Buy” consensus and an average price target of $172.21.

At a $350 billion market cap (TradingView) and 2 percent Dow weight (Slickcharts), P&G may not be the biggest player, but it’s one of the most stable.

A Timeless Anchor in the Dow Jones

When P&G joined the Dow in 1932, it showed that consumer goods were becoming as vital to America’s economy as steel or oil. More than 90 years later, Procter & Gamble still stands out for its steady growth, reliable earnings, and unmatched dividend record.

P&G’s resilience, innovation, and financial strength make it a trusted DJIA anchor and one of modern history’s most enduring companies. It shows why, in the Dow Jones, few names age as gracefully — or as profitably — as Procter & Gamble.

#CapitalMarkets #Procter&Gamble #DowJones #DJIA # #consumerstaples #householdproducts #Dividends #PG #P&G

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

How Merck’s Biotech Edge Powers Dow Jones Gains | Disruption Banking

Home Depot: Hammering Home Dow Jones Stability | Disruption Banking

Johnson & Johnson: A Steady Dose of Dividends in the Dow Jones | Disruption Banking