Hut 8 Corp. (NASDAQ: HUT) emerged as one of Canada’s largest Bitcoin miners, but over the past two years, the Toronto‑listed (TSX) firm has been quietly reinventing itself as a diversified energy-infrastructure company.

Chief executive Asher Genoot argues that this “power‑first” model unlocks cheaper financing and steady cash flows by leasing capacity to both crypto miners and HPC users.

The question for investors is whether this pivot is paying off.

Expanding a Digital Infrastructure Empire

Hut 8 has been busy building. In August the company advanced 1.53 gigawatts (GW) of U.S. development projects out of exclusivity and into construction. The company’s assets include a 300 megawatt (MW) “River Bend” campus in Louisiana, a 1 GW site and a 180 MW site in Texas, and a 50 MW facility in Illinois.

Genoot says commercialization of these sites would “double” the company’s scale and push its platform above 2.55 GW of capacity across 19 sites.

Hut 8 reported Q2 2025 revenue of $41.3 million and net income of $137.5 million. The company now manages more than 1,020 MW of power capacity with another 10.8 GW in early-stage development — effectively recasting itself from a crypto miner into a digital-infrastructure developer.

Wall Street’s Take on Hut 8’s Transformation

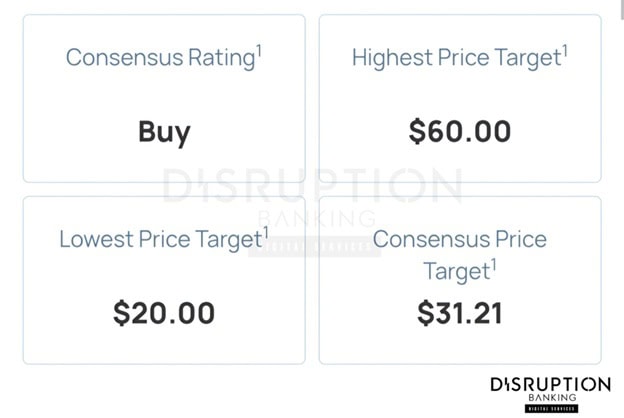

The pivot has drawn measured approval from Wall Street analysts. Benchmark analyst Mark Palmer raised his HUT price target to $36 per share (from $33) in July, citing Hut 8’s plan to double managed power capacity to 2.55 GW and its $2.4 billion liquidity. Piper Sandler and Cantor Fitzgerald initiated coverage with overweight ratings and targets around $33–$35, praising the energy asset portfolio and partnerships with chip‑maker Bitmain. These numbers are already out of date as Hut 8’s stock price closed above $43 last week.

Roth Capital went further, boosting HUT’s target to $60, arguing that leasing long‑term power contracts to hyperscale customers could re‑rate Hut 8 as a data‑center operator rather than a crypto miner. On average, analysts tracked by AInvest assign a “Buy” rating with a $27.82 target, even after a late‑September selloff knocked HUT shares down 7 percent. Again, the price has recovered dramatically since this price prediction.

Institutional ownership has climbed from roughly 12 percent to 55 percent since early 2025.

Still, there are a couple of reasons for caution.

Challenges: Capital, Execution, and Environmental Pushback

Enthusiasm is tempered by concerns about capital intensity and execution risk. Benchmark’s Palmer noted that while Hut 8’s balance-sheet liquidity stands near $2.4 billion, its ambitions require multi-year financing and regulatory coordination across several states — a test few miners-turned-infrastructure firms have passed.

To add, Hut 8’s proposed facilities in Louisiana and Illinois have already drawn scrutiny from local communities over water usage and electricity demand. Environmental groups in Louisiana warn that massive AI data centers could “damage our already bleak living situations and environment.” Analysts also caution that rising electricity prices and tight labor markets could delay commissioning schedules and erode expected margins.

Financially, Hut 8’s earnings remain volatile. The firm’s Q1 2025 net loss of $134 million underscored the difficulty of maintaining profitability during the transition away from pure mining. Its “asset-light” approach relies on joint-venture financing — a $200 million revolving credit facility with Two Prime and a $130 million line with Coinbase, boosting liquidity to roughly $2.4 billion when combined with its 10,000+ Bitcoin reserve — and a $1 billion at‑the‑market (ATM) equity offering that some investors view as dilutive.

But beyond the numbers, the pivot raises a broader question: can a company built for volatility master the predictability demanded by infrastructure investors?

Hut 8 just announced they bought the dip and purchased about $100 million of bitcoin this week.

— Anthony Pompliano 🌪 (@APompliano) December 19, 2024

Brings $HUT to over 10,000 bitcoin on their balance sheet.

An energy dealer with a big bitcoin stack.

Love to see it.

Outlook: Stability Through Strategic Execution

If successful, Hut 8’s transformation could make it one of North America’s most formidable independent data-center operators, leveraging its legacy energy expertise to supply the AI economy. Its long-term vision — to monetize power, not coins — aligns with the structural shift toward compute-intensive workloads and decentralized energy assets.

Yet the path forward depends on “flawless execution”: securing energy permits, closing customer contracts, and balancing environmental stewardship with growth — as is the case with IREN, and Riot platforms, Hut 8’s direct competitors. Wall Street’s early optimism suggests belief in that vision — but not blind faith.

As Roth Capital’s Darren Aftahi put it, Hut 8 is evolving from a Bitcoin miner into an energy-driven infrastructure play focused on AI. Whether it can do so profitably will determine if this bold pivot truly earns its Wall Street redemption.

#AIdatacentre #Hut8 #HUT #HPC

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Powering Bitcoin Accumulation: The American Bitcoin Strategy | Disruption Banking

Why IREN is Shifting Away from Bitcoin Mining to Data Centers | Disruption Banking