Honeywell (ticker: HON) joined the Dow Jones Industrial Average (DJIA) on August 31, 2020, replacing Raytheon Technologies in a recalibration prompted by Apple’s stock split. The addition brought a modern diversified industrial name into the 30‑stock index and underscored Honeywell’s stature in aerospace, automation, building technologies, and performance materials.

In this piece, Disruption Banking explores Honeywell’s journey before and after its Dow inclusion, its recent revenue and dividend reports, and what makes it a resilient component in the DJIA.

Honeywell’s Decade of Momentum Before the Dow Jones

Honeywell’s 2010s performance was a story of steady ascent. Macrotrends data shows that between 2014 and 2019, the stock delivered an average annual return of about 14 percent, with standout years like 2017 (approximately +32 percent) and 2019 (+37 percent). These gains came from strong demand for aerospace equipment and building automation, as Honeywell benefited from airline order cycles and commercial construction booms.

Even 2018’s –9.5 percent slide — driven by trade‑war concerns — did little to derail the long‑term trajectory. In 2014 Honeywell stock averaged at $77, this year it has already hit highs of $239 (Macrotrends), reflecting a blue‑chip path akin to its industrial peers.

After Inclusion: Riding Through Cycles

Honeywell entered the Dow during the pandemic, which brought aviation shutdowns and supply‑chain shocks. Yet the stock rose about 20 percent in 2020, helped by a pivot toward personal protective equipment and other pandemic‑era products.

According to Macrotrends, the years since entering the Dow Jones have been more muted. 2021’s loss was roughly –0.3 percent, 2022 added roughly 5 percent, 2023 was flat and 2024 delivered a modest 10 percent.

Year‑to‑date 2025 saw a slight decline in Honeywell stock (around –6 percent), as investors digested plans to break up the company. On average, returns since joining the Dow hover slightly above 5 percent, below the company’s pre‑Dow average but still demonstrating resilience through turbulent economic cycles.

Volatility aside, Honeywell trades around $208 per share (TradingView), at the time of writing — roughly 41 percent higher than its 2020 level — and has a market capitalization over $130 billion.

The Big Breakup: Unlocking Value Through Spin‑Offs

Earlier this year, Honeywell approved a plan to split into three public companies by late 2026: Automation ($18 billion in 2024 revenue, covering industrial and building systems), Aerospace ($15 billion, focused on avionics and defense), and Advanced Materials ($4 billion, specialty chemicals).

Honeywell’s management sees the breakup as a way to unlock value, tailoring each business for investors, and equally strengthening its Dow Jones position. Since late 2023 it has shed non-core assets, bought Johnson Matthey’s catalyst unit, and spent $13.5 billion on acquisitions — signalling a move from conglomerate to specialist.

Elliott's letter to Honeywell's board is a must read for anyone interested in the $HON spinoff. They discuss the same ideas I've raised – segments (mainly aero) are cheap relative to peers, success of $GE's spinoff as a precedent, estimated value of ~$380 per share.

— Divergent Capital (@Divergent7651) September 1, 2025

Record Results and Guidance for 2025

Honeywell’s second‑quarter 2025 results showcased strength across its portfolio. Sales were $10.4 billion, up 8 percent overall and 5 percent organically. Earnings per share (EPS) reached $2.45, with adjusted EPS $2.75.

CEO Vimal Kapur called it “outstanding results in the second quarter” and highlighted that three of four operating segments expanded more than 5 percent organically.

Honeywell raised its full‑year 2025 guidance to $40.8–$41.3 billion in sales and $10.45–$10.65 in adjusted EPS, implying high‑single‑digit growth despite macro headwinds.

Honeywell’s Dividend Growth and Capital Discipline

Honeywell’s shareholder returns extend beyond stock price appreciation. In September this year, the board raised the annual dividend from $4.52 to $4.76 per share, marking the 16th increase in 15 consecutive years. The payout equates to a quarterly dividend of $1.19 per share, payable in December.

CEO Kapur said the hike reflects “our confidence in the company’s future” and commitment to value creation. With a dividend yield of around 2 percent, Honeywell offers a modest but growing income stream, supported by a fortress balance sheet.

The company also repurchased $1.7 billion of shares in 2024 and maintains the flexibility to allocate capital toward growth initiatives or returns.

A Mid-Tier Player Among Blue-Chips

Honeywell’s role in the DJIA is mid‑weight. The stock contributes approximately 2.77 percent to the index’s price calculation (Slickcharts), meaning a one-dollar move in HON sways the Dow far less than high‑priced components like JPMorgan Chase, Home Depot, or Goldman Sachs.

How Does Honeywell Stack Up Against 3M and Caterpillar?

In the industrial corner of the Dow Jones, Honeywell competes with names like 3M and Caterpillar. 3M’s Q2 2025 results showed GAAP sales of $6.3 billion, 1.4 percent growth, and adjusted EPS of $2.16, prompting management to raise full‑year guidance. 3M’s CEO William Brown praised double‑digit EPS growth and the company’s operational efficiency.

Caterpillar, meanwhile, reported quarter two 2025 revenue of $16.6 billion (down 1 percent) and profit per share of $4.62, with orders buoyed by infrastructure demand.

Compared with these peers, Honeywell’s performance stands out for its diversity. To buttress that, aerospace growth offsets softness in automation, and its spin‑off strategy contrasts with 3M’s cost cuts or Caterpillar’s cyclical exposure. Yet investors should note Caterpillar’s heavier Dow weight (about 6 percent) and greater sensitivity to commodity cycles.

Resilient but Steady: What Investors Can Expect from Honeywell

Honeywell’s 2020 entry into the DJIA put in motion a shift from old-line industrials to tech-driven manufacturing. In five years, it has weathered the pandemic, inflation, and geopolitical shocks while still growing sales and dividends. Its spin-off plan shows confidence, though execution risks remain.

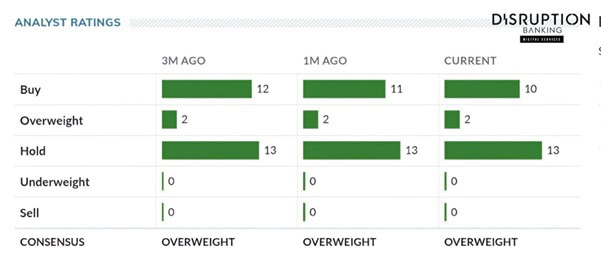

According to MarketWatch, 10 Wall Street analysts rate HON a “Moderate Buy” with an average $253.72 target price, pointing to expectations for steady upside potential rather than explosive growth.

For long-term investors, Honeywell’s mix of aerospace, automation, and materials — backed by a strong backlog and disciplined capital use — keeps it a resilient Dow Jones name adapting to a fast-changing economy.

#CapitalMarkets #Honeywell #DowJones #DJIA #Aerospace #Automation #IndustrialTech #SmartBuildings #HON

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Home Depot: Hammering Home Dow Jones Stability

3M in the Dow Jones: from Innovation to Tribulation

Caterpillar’s Dow Jones Legacy: Powering Progress Through Innovation