Brazil, Latin America’s largest economy, has quickly become one of the world’s leading crypto markets. In Chainalysis’s 2025 Global Adoption Index, Brazil ranked 5th globally (up from 10th in 2024), reflecting a surge in grassroots crypto usage. See other information below for information about how Chainalysis’ methodology changed in September 2025, and how this has helped Brazil rise in the rankings.

Recent surveys suggest roughly 18–19 percent of Brazilians now own cryptocurrency. Brazil’s growth is fueled by its tech-savvy people. About 88 percent are online, and nearly the same share carry smartphones. Add to that a strong fintech backbone, led by Pix — the instant payment system already used by half the country by late 2021.

In short, crypto adoption is moving from niche to mainstream. Today, Brazil embraces Bitcoin, stablecoins, and altcoins at a level that matches the fastest-growing markets globally.

There’s more.

Brazil’s Crypto Scene: Youth, Tech, and a Dash of FOMO

Six countries in Latin America, which include Brazil, Argentina, Peru, Chile, Mexico, and Colombia, account for 87 percent of total crypto users across the region. Here, crypto ownership skews young and urban. Millennials (ages 18–35) are the dominant user group — about 22 percent of 18–35-year-olds report owning crypto, compared to just 14 percent of Gen X (ages 36–49).

Chainalysis notes that in Brazil demand is higher for Bitcoin and altcoins (investment vehicles) than stablecoins, unlike neighbors with weaker currencies. In fact, a recent Latin America survey found Brazil’s crypto ownership rate (18.6 percent) just trails Argentina’s (19.8 percent).

Brazilians generally do not use crypto as legal tender, but rather as a financial tool — for trading, investment, or even payments and remittances via stablecoins. For the younger, tech-driven consumers, crypto is just a way to diversify wealth and gain access to global finance.

Brazil’s Digital Obsession

Brazil today boasts a vibrant crypto infrastructure. Leading exchanges include domestic players like Mercado Bitcoin (Brazil’s largest, with over 5 million users), Foxbit, and NovaDAX — all licensed under Brazil’s regulatory regime — and global giants like Binance, Coinbase, and OKX, serving Brazilian accounts.

Mobile-first fintech firms are major crypto gatekeepers. For instance, Nubank, Brazil’s top digital bank, launched a crypto trading service in mid-2022 and has since logged 6.6 million crypto users in Brazil. Today, the bank also offers 4 percent annual yields for USDC holders — USDC makes up about 30 percent of crypto users’ portfolios, and over half of the new crypto users pick it as their first asset.

Similarly, PicPay — with around 60 million accounts and over 40 million active users by early 2025 — has added crypto features. After an 18-month break, it relaunched its crypto trading service in quarter two this year. More than 3 million Brazilians report having crypto via PicPay.

Stablecoins are increasing in popularity in Brazil. By early 2025, they made up 90 percent of crypto flows, and a July 2025 survey found 91.8 percent of crypto users in Brazil hold stablecoins (with USDT leading), though only 37 percent actually spend them in real life.

Pix Made Brazilians Crypto-Ready

On the payments front, Brazil’s nationwide Pix network has set the stage for digital finance. As of 2024, nearly 47 percent of all financial transactions in Brazil occur via Pix, while over three-quarters of all payments are conducted using the system. In 2025 so far, Banco Central do Brasil or BCB reports, these numbers have continued to grow. Consumers easily move funds from bank accounts or Pix into crypto exchanges via apps.

Pix facilitates seamless fiat-to-crypto on-ramps. As a result, crypto wallets and apps find a ready audience.

Visa has even partnered with fintechs to issue stablecoin-linked Visa cards in Latin America, hinting at future integration for Brazilians — although current Visa crypto-cards are in neighboring countries.

Bybit Taps Brazil with PIX-Integrated Payment System

— Crypto Town Hall (@Crypto_TownHall) January 28, 2025

Bybit’s launch of Bybit Pay in Brazil is a strategic push, combining crypto and fiat payments through PIX – the country’s leading instant payment network.

With multi-currency support (BRL, BTC, ETH, USDT), it simplifies… pic.twitter.com/mrhUjOwLHN

Tokens and a Central Bank That Wants Control

Brazil’s regulators have generally moved to legitimize crypto. In December 2022, Congress passed the Brazilian Virtual Assets Law (BVAL). It went into effect on June 20, 2023. This first comprehensive crypto law sets rules for crypto businesses (VASPs), requiring KYC/AML compliance and granting the BCB authority to license and supervise exchanges and wallets.

In practice, 500+ crypto firms have since registered with regulators, building confidence among users and investors.

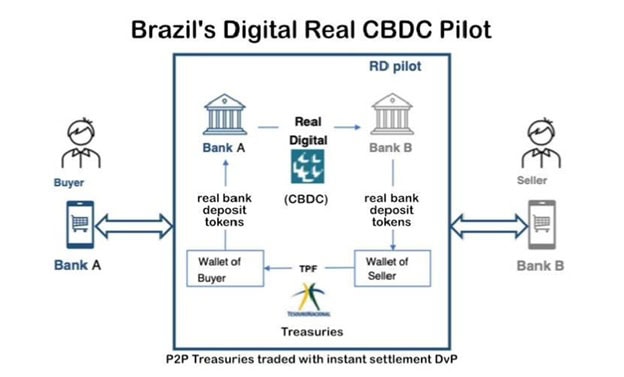

The BCB is also experimenting with its own digital currency. In March 2023, it launched a “digital real” (DREX) pilot for wholesale transactions, with a final rollout extended to 2025, with full launch now in 2026.

Notably, Brazil’s central bank has downplayed Bitcoin as official money and instead uses CBDC/blockchain to modernize payments.

Mainstream Boom and Taxation

Mainstream institutions are entering crypto. Itaú Unibanco — Brazil’s largest private bank — rolled out Bitcoin and Ether trading in its mobile app in late 2023. Likewise, Itaú’s asset management arm created a dedicated crypto fund division in September 2025, leveraging its existing Bitcoin ETF and launching a crypto retirement fund.

On the securities side, Brazil approved its first spot ETF on Ripple’s XRP in early 2025. Plans are also reported for a Real-backed stablecoin from Brazil’s Braza Bank using Ripple’s network. Even conservative pension fund managers and wealth managers now eye crypto products as demand rises.

Brazil’s Crypto Craze, Summed Up

Brazil’s crypto journey is accelerating. Its combination of high digital connectivity, a young consumer base, and a supportive regulatory regime has created fertile ground. More Brazilians use crypto yearly for trading, investment, online payments, or remittances.

The result is a dynamic crypto culture. Brazilians are bringing their passion for football and carnival to digital assets.

As one of Latin America’s fintech builders, Brazil looks prepped to embed cryptocurrency into daily life, whether investing or everyday payments, shaping the region’s financial future.

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

The Rise in Popularity of Cryptocurrency in Spain | Disruption Banking

The Rise in Popularity of Cryptocurrency in Poland | Disruption Banking

How Strong Will The Brazilian Real (BRL) Be In 2024? | Disruption Banking

Other Information:

Chainalysis introduced changes to the methodology of its Global Crypto Adoption Index in the 2025 edition, which was published on September 2, 2025. This update primarily involved two key adjustments: the removal of the retail decentralized finance (DeFi) sub-index (as internal data indicated it overemphasized niche, high-volume behaviors with limited grassroots engagement compared to centralized platforms) and the addition of a new institutional activity sub-index (to capture large-scale transfers over $1 million, reflecting growing professional and institutional participation in crypto markets). The 2025 Global Adoption Index can be found here.