Last week we brought you a story about Light Street Capital. In the story we highlighted a group of stocks that were coined as the ‘AI5.’ These stocks were behind some of the success of the leading Californian hedge fund and are worth further investigation.

In the past we have brought you stories about the FAANG companies and later the Magnificent 7, or Mag7 for short. These terms have been with us for a long time. FAANG since 2013 and Mag7 since 2023. FAANG was a catchy term that highlighted the tech darlings of the 2010s. At the time the growth of these companies was focused on consumer-facing tech. Mag7 is also a catchy term, but the stocks that make it up are focused on market performance, innovation, and large market caps.

Today, the next terminology to gain popularity may well be the AI5.

You may not agree completely with the choice of which five companies make up the AI5. Terming a new phrase, especially in capital markets, can invite debate. However, today we are still at the onset of the AI revolution. Companies that are building the infrastructure of the AI future have large growth potential.

Today we focus on the stocks that were suggested by Glen Kacher, Founder and CIO of Light Street Capital. These stocks include Nvidia, TSMC, Microsoft, AMD, and Broadcom.

AI5: The Architects of Tomorrow

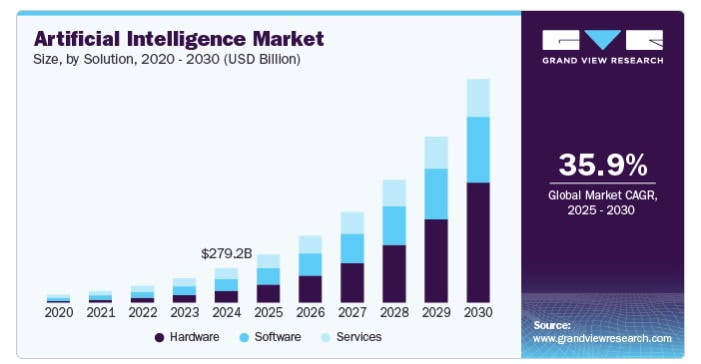

There is almost no question that AI will continue to grow in importance and value. According to a recent report from Grand View Research the global AI market was valued at $279 billion in 2024. Importantly, the market is expected to have a compound annual growth rate of 35.9 percent over the next five years. The market is projected to be worth $1.81 trillion by 2030. A significant number compared to the annual growth rate of indices like the Dow Jones or S&P 500.

Some of the companies listed in the report as significant players are not included in the AI5, but maybe they should be? We took a look at IBM, Alphabet (Google), Intel, or Baidu specifically.

When Kacher coined the term ‘AI5’, he was looking at the infrastructure needed to continue developing AI. IBM might be a leader in enterprise AI, but it is more involved in software and cloud services. Intel, on the other hand, has lost ground to Nvidia and AMD in the AI hardware race. Baidu is too limited in its geography as it predominantly serves one market. Finally, Google’s hardware is less central to the AI ecosystem.

Why is Microsoft Included in the AI5?

Microsoft has invested billions in OpenAI. The two companies have a contract until 2030 that includes revenue sharing. Microsoft has the rights to OpenAI IP in its cloud and AI products offerings. But Microsoft’s AI5 inclusion isn’t just down to its partnership with OpenAI. It’s also about Azure’s AI infrastructure strength and the popularity of Copilot in enterprise.

Microsoft was reported to be investing $80 billion on AI-enabled data centers in 2025. Half of this investment would be in the U.S, aligning with the U.S. push for reindustrialization.

Why is Broadcom Included in the AI5?

In March, Broadcom posted on X that “we’re building the future of AI infrastructure by expanding our comprehensive portfolio of optical interconnect solutions, including advancements in co-packaged optics (CPO), 200G/lane DSP and SerDes, 400G optics, and PCIe Gen6 over optics.”

Broadcom shares doubled in value in 2024 as the AI boom continued. The company is well known for creating infrastructure and connectivity solutions for data centers that support the development of LLMs and advanced AI tools.

Why is AMD Included in the AI5?

Jay Dawani, Co-Founder & CEO of Lemurian Labs recently shared on YouTube how “the impact of the openness of the ecosystem fundamentally means more companies building AI.”

Dawani believes that in the future there will be billions of AI agents. He shared how “these agents aren’t going to run on just one type of platform. They’re not going to just run on one GPU. It’s going to require dozens of GPUs for one model. To service that scale we’re going to need billions of GPUs.”

The GPUs that Dawani is referring to can’t just come from one company. He believes that hardware and software should be there to accelerate the efforts of engineers in building AI models. He believes that this is what “openness” is. Dawani uses AMD platforms to build on.

AI is moving fast—but we’re still early. @LemurianLabs CEO Jay Dawani on why AMD’s open ecosystem could future-proof how devs build #AI at scale. Watch: https://t.co/GYbrA6hyCK

— AI at AMD (@AIatAMD) April 11, 2025

“I think AMD hardware is underrated today, but I think soon people will fully realize just how good that hardware is,” Dawani highlighted.

AMD is the second-largest maker of GPUs. In some markets, like Japan, the company has reached a 45 percent market share. The recent partnership with HUMAIN, Saudi Arabia’s new AI enterprise, will lead to a new AI superstructure built by AMD and HUMAIN together. The investment is worth up to $10 billion and comes on the back of Trump’s recent visit to the Middle East.

Why is TSMC Included in the AI5?

TSMC, the leading semiconductor manufacturer, reported results for the first quarter at the end of April. Wendell Huang, Senior VP and Chief Financial Officer of TSMC shared how “our business in the first quarter was impacted by smartphone seasonality, partially offset by continued growth in AI-related demand.

“Moving into second quarter 2025, we expect our business to be supported by strong demand for our industry-leading 3nm and 5nm technologies.”

TSMC is investing $165 billion into the U.S., removing supply chain risks for customers. This is in line with Trump’s plan for ‘Reindustrialization.’

Why is Nvidia Included in the AI5?

The emergence of DeepSeek in January as a global Ai player affected the share price of Nvidia dramatically. Trump’s Liberation Day caused further volatility in the price of the leading GPU manufacturer. However, Nvidia’s constant drive to innovate has helped its share price recover.

By the end of 2024 several stories highlighted how Nvidia had up to 90 percent of the global GPU market share. AMD in the U.S., and Huawei in China, have both given the market leader something to worry about. However, Nvidia’s dominance is so big that it will take a long time for a strong competitor to emerge.

Kacher’s AI5 Fuels Blockbuster 2024, Sets Stage for 2025 Gains

In 2024, Kacher’s Light Street Capital soared 59.4 percent. His AI5 contributed to outperformance relative to broader indices. The leading investor believes that AI is a multi-decade opportunity, and his strategy is correlated by market projections of 35 percent growth per year till 2030.

Kacher has invested outside of the AI5, for instance GDS Holdings. GDS is a leading developer and operator of high-performance data centers in China and fits into his philosophy of investing into AI infrastructure.

Just like with all investments, there are risks to a strategy focusing on one group of stocks only. Readers should be reminded that hedge funds like Light Street Capital are professionals at what they do. Emulating them can be risky without the relevant know-how about how long-short equity strategies work. Returns like 59.4 percent in a market projected to grow 35 percent annually can be overly optimistic.

Investing in high-growth sectors like AI carries risks, and investors should conduct thorough due diligence. Past performance is not indicative of future results, and capital is at risk.

Author: Andy Samu

#AI5 #ArtificialIntelligence #AIInfrastructure #AISupplyChain #DataCenters

See Also:

How Light Street Capital Makes Such Good Returns | Disruption Banking

TSMC Stock Could Soar Higher Despite Taiwan Risks | Disruption Banking