Recent discussions in the financial world, like the just concluded Point Zero Forum in Zurich, have shown that both wholesale central-bank digital currencies (wCBDCs) and retail stablecoins can play key roles in shaping the future of digital finance. Wholesale CBDCs are issued by central banks for large transactions between financial institutions. Retail stablecoins, pegged to assets like the US dollar or the Euro, are used by the public for everyday payments. The big question is how these two types of digital money can work together to improve the financial system.

The Rise of Digital Currencies

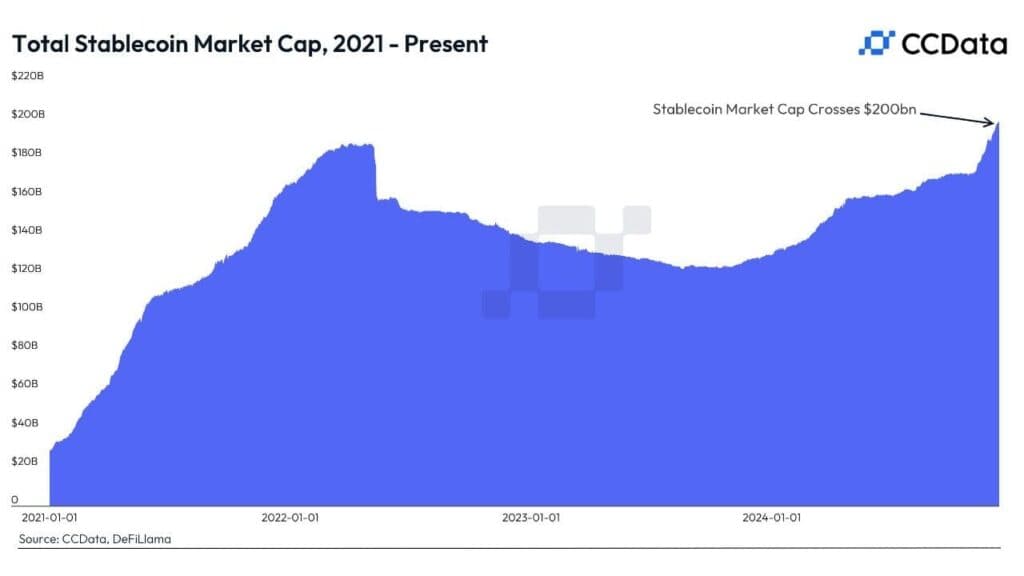

Digital currencies are growing fast. Stablecoins had a market value of approximately $243 billion in April 2025, growing from $138.4 billion in January 2023. In 2024, stablecoins handled $27.6 trillion in transactions, more than Visa or Mastercard, especially on networks like Solana, where bot activity accounted for 98% of volume the same year. This rapid growth shows how much people want stable, digital money in the retail market.

A Two-Tier Financial Ecosystem

Wholesale CBDCs or wCBDCs and retail stablecoins are likely to serve different needs but can still work together. wCBDCs give banks a secure way to settle large transactions. They act as a trusted final asset, making deals safe and smooth. Retail stablecoins, on the other hand, would be used by the public for day-to-day transactions. They would allow for fast, low-cost payments while ensuring the stability of traditional money.

Research from McKinsey and Santander CIB suggests that while wCBDCs focus on institutional transactions, stablecoins are better suited to retail use. The challenge lies in balancing innovation with financial stability, and much of the debate centers on how to regulate both effectively.

The Bank for International Settlements (BIS) suggests both systems could share the same digital ledger. wCBDCs provide the stable base, while stablecoins spark innovation for users. Experts argue that central banks may prefer to issue wCBDCs while leaving retail payments to stablecoins. This would let each type of currency serve its strengths and create a more efficient, inclusive financial system.

Bridging Systems Through Interoperability

For wCBDCs and stablecoins to function together, they need to connect smoothly. This is called interoperability. A Disruption Banking piece in 2022 emphasized that stablecoins could provide an essential bridge to CBDCs, especially in the retail space.

One example is tokenized securities settlement. In Switzerland, the Helvetia Pilot program uses wholesale CBDCs to settle digital securities on the SIX Digital Exchange, cutting out intermediaries and improving efficiency. While the platform’s current focus is on CBDCs, it could potentially integrate stablecoins for retail applications in the future.

Cross-border payments also stand to benefit. The mBridge project, which reached the MVP stage in mid-2024, for instance, has developed a shared ledger for real-time foreign exchange payments. It involves central banks and commercial banks from China, Thailand, UAE, Hong Kong, and Saudi Arabia since 2024.

Another project, Project Cedar Phase II, showed how wCBDCs could settle transactions between different platforms in under 30 seconds. This improves speed and security for global payments.

Retail stablecoins could also be integrated with wholesale CBDCs. Stablecoin issuers could access wCBDCs for liquidity. This ensures that stablecoins remain pegged to traditional currencies and can be easily exchanged. It would also improve the overall efficiency of the system and enhance the user’s experience.

Opportunities and Challenges for Stakeholders

For banks, the introduction of wCBDCs offers a chance to improve their operations. CBDCs could be used as collateral in financial transactions, giving banks a competitive advantage. On the other hand, stablecoins are becoming increasingly important for fast, low-cost payments, especially for cross-border transactions. Their rapid growth shows the demand for such services.

For Fintechs, stablecoins present new opportunities. By linking stablecoins with wholesale CBDCs, businesses could create real-time, programmable financial products (such as automated escrow services or smart contracts) that go beyond simple payments to help drive further innovation in the industry, as Santander CIB noted. This aligns with the findings from a Disruption Banking piece in February 2025, where we discussed how collaborations like between R3 and IDEMIA are enhancing wCBDC payment security both online and offline.

Stablecoins, such as #USDT and #USDC, are providing a reliable alternative for payments, particularly in countries like the Philippines, where international transfers are essential. #cryptohttps://t.co/RvrrvbJRst

— #DisruptionBanking (@DisruptionBank) October 1, 2024

Regulators also have a big job to do. Stablecoins, which already handle trillions in transactions, present risks related to market concentration and potential monopolies. Regulators must ensure they keep market competition alive and ensure transparency. Delays in rolling out wholesale CBDCs could make it harder to manage stablecoins, especially in regions with weaker oversight.

Navigating Regulatory Frameworks

As wCBDCs and stablecoins become commonplace, clear regulations are needed. The EU’s Markets in Crypto-Assets (MiCA) regulation, effective since June 30, 2024, requires stablecoin issuers to maintain 1:1 liquid reserves, bans algorithmic stablecoins, and mandates transparency. Similarly, the UK is advancing legislation under the Financial Services and Markets Act 2023 to regulate fiat-backed stablecoins as payment instruments, with implementation expected by 2026.

The measures above have become imperative as the Financial Stability Board (FSB) has raised concerns about the risks stablecoins pose, especially in emerging markets. Regulators need to develop clear and consistent rules to address these risks. The International Monetary Fund (IMF) has stressed that the rollout of CBDCs must be carefully planned to meet the needs of both financial institutions and consumers.

At the moment, there are ongoing debates about regulatory oversight. Some worry too many rules might slow innovation. Others fear too few could cause market chaos.

In the IMF’s discussion during the 2022 MyFinTech Week in Malaysia, the potential risks and rewards of CBDCs were thoroughly explored. The IMF pointed out that while CBDCs can enhance monetary policy efficiency, they come with concerns about privacy and financial inclusion. Finding the right balance, therefore, is key to a safe and creative digital money system.

Envisioning a Unified Digital Economy

The future of digital money will likely involve both wholesale CBDCs and retail stablecoins. Wholesale CBDCs will provide a secure, trusted foundation for the global financial system, while retail stablecoins will enable fast, low-cost transactions for everyday users. Together, these two systems can create a more efficient and resilient payment infrastructure. The technology is already in place, and regulatory frameworks are catching up to support this vision.

Albeit, careful regulation and synergy between the public and private sectors will go a long way. The goal is to ensure that the benefits of both CBDCs and stablecoins are fully realized while managing potential risks. This balanced approach can boost financial inclusion, spark innovation, and keep the market stable in the digital economy.

The path is clear for a digital money future that works for everyone.

#Stablecoins #CBDCs #wCBDCs #MiCA #Interoperability

Author: Ayanfe Fakunle

See Also:

AI Meets Blockchain: Central Banks Face a Disruption Wake-Up Call | Disruption Banking

What is the GENIUS Act? Banks and Fintechs Rush Towards Stablecoins | Disruption Banking

Tether’s Big Bet: Stablecoins as the New Global Reserve Power | Disruption Banking