Speculation is growing on foreign exchange markets that the authorities in Beijing may seek to devalue the Chinese yuan (CNY).

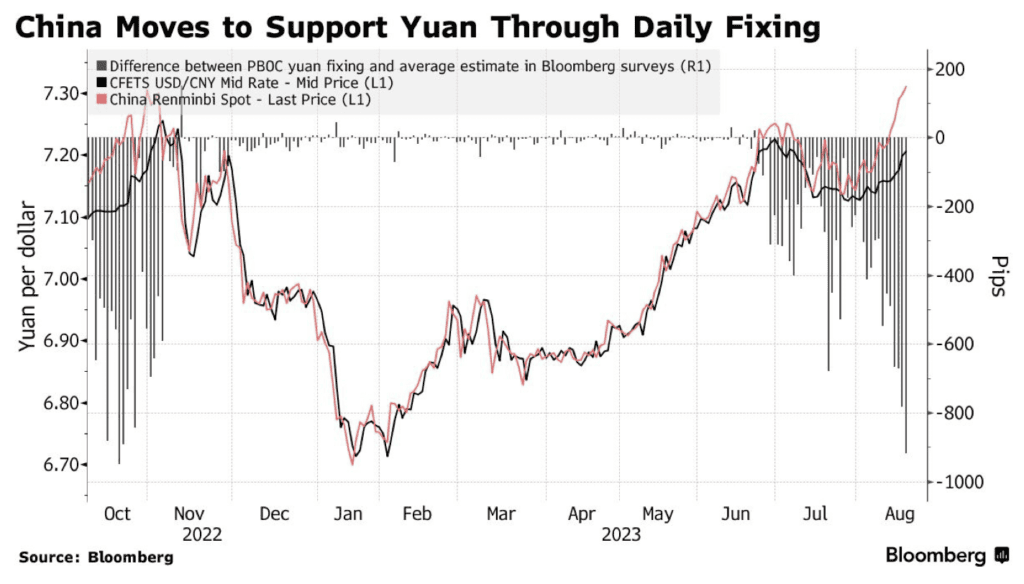

Pressure on the yuan has been building for several months now. Since the start of the year, the dollar has gained almost 150 basis points on CNY. This decline comes even despite China’s central bank and state-owned institutions moving to prop up the currency on several occasions in the last twelve months, with Beijing keen to limit volatility.

Despite the fact that China’s previous interventions suggest that it wants to maintain a relatively strong yuan, the West has started to make noises that a pending devaluation represents a form of currency manipulation. This is particularly because China has recently announced plans to commit substantial amounts of public money into manufacturing and pursue an aggressive export strategy.

Some in the West suspect that China is deliberately weakening the yuan in order to make Chinese manufacturing goods cheaper and more competitive on global markets. While China still runs a huge trade surplus, that surplus did fall by 11% in 2023 to just under $600 billion. A weaker yuan, in theory, could be the key to getting that surplus back up.

Reuters reported in April that Chinese businesses are “hoarding” dollars because they expect the yuan to weaken. A shortage of dollars is in turn driving up the value of the greenback even higher in Chinese markets, reinforcing the decline of value in the yuan.

Chinese businesses are hoarding dollars because they expect their own currency to weaken, and that in turn is exacerbating a slide in the yuan that has been driven by wobbly stock markets and feeble growth in the world's second largest economy. More here: https://t.co/4OpUBkfpOM

— Reuters Business (@ReutersBiz) April 16, 2024

China could indeed benefit in several ways from a cheaper yuan. The Head of Global Foreign Exchange at the Jefferies investment bank said that China “probably should” seek a weaker yuan “to boost exports, help deflation, and help domestic growth.”

However, the idea that Beijing is deliberately devaluing the yuan and engaging in currency manipulation is not quite accurate. The yuan is significantly overvalued against the dollar as things stand. A weaker yuan is to be expected.

That is because of the interest rate differentials. The benchmark rate in the US still stands at between 5.25-5.5% – and the Chairman of the Federal Reserve, Jay Powell, recently indicated that rates will remain “higher for longer.” These higher rates reflect the fact that the US has had a problem with persistent inflation that it is still trying to get under control.

China does not have a problem with inflation. In fact, it has the opposite situation – an environment of deflation, with prices not rising by very much at all. Despite this, the PBOC has put rates up to a relatively high 3.45%, in large part to try and track the Federal Reserve as much as possible and minimise forex volatility. It cannot put rates up any further without causing potentially serious economic stress.

This means that there is a more than 2% spread between the yields available on the US dollar compared to the Chinese yuan. Traders earn more by holding the dollar rather than the yuan. As a result, it is inevitable that we have seen capital outflows from China and into the States. A weaker yuan and stronger dollar is exactly what is to be expected in this situation.

1/8

— Michael Pettis (@michaelxpettis) April 30, 2024

"High Fed rates, a response to stubborn inflation, mean that American assets offer better returns than much of the world, and investors need dollars to buy them."

This creates a double whammy for US producers.https://t.co/KGf4ZXv2Ok

It is hard to escape the conclusion that the US simply want it all ways. They need to maintain higher rates in order to bring inflation under control. But they do not want the strong dollar, that higher rates cause, as that is increasingly making American manufacturing uncompetitive. The only answer is to get a grip on inflation and lower interest rates, which would encourage traders to move out of the dollar and into higher-yielding currencies.

Until that happens, the dollar will continue to be much stronger than the yuan and therefore US manufacturing exports will continue to be expensive. Blaming China won’t fix the problem.

Author: Harry Clynch

#China #Yuan #CNY #ForeignExchange #CapitalMarkets