Equity traders with an exposure to Indian stocks are widely expecting markets to continue performing strongly should Narendra Modi secure a third term in office in elections this year.

The South Asian country has emerged as an attractive destination for foreign investment, owing to high levels of political stability and strong economic growth. The International Monetary Fund (IMF) has forecast that India will grow at 6.5% this year and again in 2025.

Indian markets have also benefited from the growing trend of foreign investors pulling assets out of China. Investors have expressed concerns that Beijing could be facing a period of “Japanification” – meaning an environment of weak growth, low inflation, rock bottom interest rates, high levels of public and private debt, and demographic decline.

With the Chinese economy perceived to be struggling in the aftermath of the pandemic, and with increasing geopolitical tension, more than $6 trillion has been wiped off stock markets in China and Hong Kong since peaking in 2021.

But with investors keen to retain their exposure to the broader Asian region despite China’s troubles, much of this capital has been reallocated to India (along with Japan). India’s BSE Sensex Index is currently trading at record highs. This trend could be reinforced with the introduction of Hong Kong’s “Article 23” law, an authoritarian security law imposed from Beijing which is likely to further deter foreign investment and prompt international banks to consider shifting assets to other Asian cities.

Investors bet an election win by Narendra Modi will extend India’s stock market boom https://t.co/8p2NbpnOBr

— Financial Times (@FT) March 28, 2024

Analysts are optimistic that more gains on equity markets could be in store should Modi win the upcoming election. He is credited by many as establishing political stability and encouraging strong levels of manufacturing investment, with global companies seeking to diversify supply chains outside of China (and take advantage of a weak Indian rupee).

Just yesterday, Tesla announced that it will be sending a team to India in order to find the best location for an electric car plant that will bring as much as $3 billion into India.

Markets have also welcomed over moves made by the Modi government, such as the improvement of India’s physical and digital infrastructure, and the continued import of cheap Russian crude oil without sanctions.

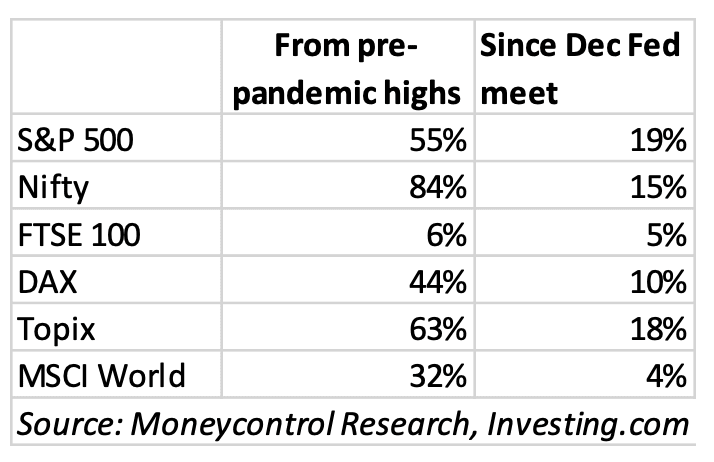

Anubhav Sahu, an equity research analyst at Moneycontrol Research in Mumbai, told Disruption Banking that the “Indian equity market has been amongst the best performing markets post-pandemic. To provide some context, the benchmark Nifty index is up 84% from its pre-pandemic high, far outperforming leading equity benchmarks like the S&P 500 by nearly 30%.”

“This outperformance has been guided by relatively stronger macroeconomic growth, reasonable control over inflation, and reforms promoting domestic manufacturing. Domestic fund flows have also been quite strong and have supported the market valuations as well as acted as a counterweight to volatile foreign institutional investor flows (FII). Since early 2021 domestic flows have been more than 4x the FII inflows,” Sahu added.

While these factors, and the prospect of another Modi victory, are leading investors to take a bullish stance towards India, some analysts suggest that it will be difficult for markets to make further gains given they are already at record highs.

Nitin Mangal, Co-Founder at India Independent Insight in Mumbai, told Disruption Banking that a Modi victory is likely to be priced in already. He fears there is a risk that markets could actually trend downwards if, for example, the size of Modi’s victory is less than expected, which could limit his ability to implement a market and business-friendly agenda.

“The outcome of the election is almost certain – I guess it is already factored into the price,” he said. “The key will be looking at the development agenda and election manifesto of Modi’s BJP party. If the BJP gets less than 250 seats, the market may see some kind of knee-jerk reaction.”

Harsh Agarwal, a Mumbai-based hedge fund manager dealing in Indian equities, has a similar assessment. He said that “a Modi win is a big factor for the markets – however a Modi win is expected. As a result, markets should be strong going into elections, and the rally post-elections may be short-lived, perhaps for a few days to a month.”

“However, the downside risk for the market is significantly higher if Modi does not win. Indian companies dependent on consumption have been struggling because of weak consumer spending. The Modi government is driving the other side of the economy – in manufacturing, power, defence, and infrastructure, for example.”

Valuations are clearly high on Indian stock markets, which seem to have already priced in a Modi victory, so it appears unlikely that traders will see any major swings around the time of the election. Volatility is likely to be at a minimum, barring an unforeseen victory for the opposition.

However, there are reasons to be bullish on the prospects for Indian markets in the medium to long-term. Rahul Aggarwal, a quantitative trader in Mumbai, noted that he is “bullish specifically on sectors such as railways, public sector undertakings, and manufacturing, where the government has shown keen interest in committing capital expenditure.”

In Sahu’s words, “an election win by the incumbent government in India can further firm up the local equity market as it would endorse policy certainty and continuity.”

Author: Harry Clynch

#India #Equities #StockMarkets #Banking #Finance #Asia