The traditional idea that an investment portfolio should be 60% stocks and 40% bonds – also known as the 60/40 model – has been rejected by one of the world’s most influential institutional investors. Larry Fink, Chairman and CEO of BlackRock, noted in a CNBC interview earlier this month that, when it comes to asset allocation, long-term investors need to pursue growth opportunities more aggressively by investing as much as 80% of their portfolios in stocks or hard assets. This is in sharp contrast to the more conservative 60/40 model.

Fink noted that, thanks to advances in medical technology, individuals today are living much longer than in previous years. This creates the risk of people running out of money later in life if they don’t invest for growth today, he explained. “I’m a hopeful person. I believe that in 10 years, in 20 years, humanity will be in a better position than it is today. With that view, I want to own hard assets. I want to own equity. I want to be part of this economy,” he said.

As the head of the world’s largest asset manager with around $9.4 trillion in assets under management as of Q2 2023, Fink’s influence extends far beyond Wall Street. His recent comments on the need for investors to lean more heavily into stocks and hard assets could therefore have wider implications for the global financial system as investors who share his sentiments are likely to cut exposure to bonds and boost their holdings in stocks and hard assets.

60/40 Model Fails To Deliver

The 60/40 model was first proposed by Nobel Prize-winning economist Harry Markowitz in 1952 and has for the past seven decades been one of the primary diversification strategies that investors around the world use when building their portfolios. The strategy has, however, failed to deliver attractive returns in the past two years amid a historic slump in bond prices that was driven by interest rate hikes aimed at combating inflation.

With inflation in the US, the UK and Europe still higher than the 2% target that central bankers in these economies believe to be the ideal rate, there is a likelihood that interest rates could stay higher for longer until inflation is definitively dealt with.

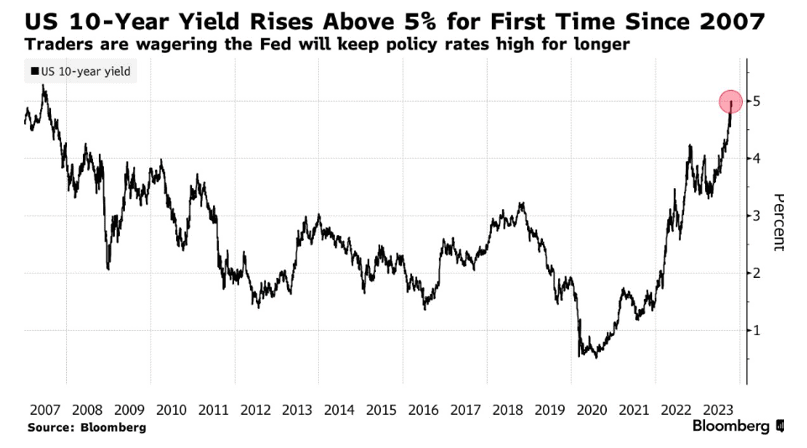

Interest rates and bond prices are inversely correlated so it is likely that bonds will continue underperforming if rates stay higher for longer as widely expected. This makes Fink’s strategy of cutting exposure to bonds an ideal way for investors to minimize losses and free more capital for investments in growth assets that could deliver better returns. Tellingly, the US 10-year yield recently rose above 5% for the first time since 2007, indicating that the ongoing sell-off in treasury bonds is yet to slow down.

Pick Growth Assets

According to Fink, investors positioning their portfolios for growth can consider stocks that are likely to benefit from three key trends. These are AI and robotics, US onshoring, and medical discoveries that can extend life.

BlackRock has also shown a growing interest in alternative investments such as cryptocurrencies, specifically Bitcoin, the largest and most valuable cryptocurrency. BlackRock applied for a Bitcoin ETF in the US earlier in the year, with Fink noting that there has been an uptick in global investors asking the asset manager about the role of crypto in their portfolios. According to Fink, since crypto is inherently global, it has a “differentiating value versus other asset classes.”

Investors who followed Fink’s preferred asset allocation strategy of leaning more heavily into growth assets like Bitcoin and stocks that offer exposure to AI and medical discoveries that can extend life have done considerably well in 2023.

As an example, Bitcoin is up more than 100% YTD, while Nvidia, whose chips are key in driving continued AI adoption, has surged more than 200% YTD. Similarly, US pharmaceutical giant Eli Lilly has seen its stock increase by 59% YTD after the overwhelmingly positive market reception to its weight loss drugs. Its close competitor Novo Nordisk, a Danish multinational pharmaceutical company that also offers highly popular weight loss drugs, is up 40% YTD on the success of these new therapies.

Crisis On The Horizon?

If investors heed Fink’s advice and cut back on their bond holdings in favor of investments that can deliver stronger growth, it is likely that the prevailing high interest rate environment will persist much longer than anticipated. This is because low demand for bonds could compel borrowing governments to issue bonds with outrageously high interest rates in order to maintain access to capital markets.

Disruption Banking recently published a deep-dive on what this new era of higher-for-longer interest rates means. One particular point worth revisiting in light of Larry Fink’s call for investors to cut exposure to bonds is the impact that this move will likely have on poor, highly indebted countries with weak currencies.

Before the interest rate hiking cycle that started in 2022, markets had grown accustomed to the era of low interest rates and loose monetary policy following the 2008 Global Financial Crisis. #bondmarketshttps://t.co/7c0mH31yAR

— #DisruptionBanking (@DisruptionBank) October 12, 2023

According to the IMF’s Director of the African Department, Abebe Selassie, about seven to eight African countries require debt restructuring. These countries are already vulnerable to high debt service costs as things stand. Persistently high interest rates are therefore the last thing they need as this could potentially lead to their debt service costs surpassing their tax revenue collection.

This is typically what leads to a sovereign debt default. Moreover, the logical solution, which is to cut budget deficits by increasing taxes or reducing spending, could backfire due to the intense political opposition that these measures often provoke. This points to a possible crisis on the horizon that could have far-reaching economic, social and political costs if not well addressed.

The pain of high interest rates will also not spare consumers in developed economies, as record high mortgage rates and soaring interest rates on credit card balances will dent consumer confidence. This could potentially trigger an economic recession, which some analysts believe will be key in getting central banks to ease monetary policy and put an end to the era of high rates.

Here To Stay

Although most economists believe that interest rates will stay higher for longer because of sticky inflation, BlackRock’s Fink also believes that there is another reason why rates are likely to stay elevated for an extended period. According to Fink, central banks will need several years to unwind the massive quantitative easing that started in the wake of the 2008 Global Financial Crisis and intensified after the Covid-19 pandemic.

Speaking with New York Times columnist Andrew Ross Sorkin at the 2022 Deal Book Summit, Fink observed that “there’s a whole reset in the marketplace.” The influential financier noted that central banks were going to take years to unwind the quantitative easing and bond purchases that they did over the past decade. “They’re (central banks) not going to be as fully equipped to re-stimulate the economy, so we believe we’re going to have rates fundamentally higher. They’re not going to go down,” he said in the interview.

Fink’s comments on interest rates at the 2022 Deal Book Summit – expressed one year ago – have proven to be prescient in view of the current interest rate environment. Perhaps investors will do well to heed his latest guidance to abandon the conservative 60/40 model in favor of a more aggressive approach of investing 80% of their portfolios in stocks and hard assets that are well positioned for strong growth over the long-term.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.