Back in May, Sam Bankman-Fried emerged from the rubble of the Terra Luna crash as a gallant knight in shining armour. He announced he would gobble up fallen crypto lenders Celsius and Voyager, in what some saw as a selfless act for the good of the industry. Those deals never went through as FTX reneged when taking a closer look at the books — yet ironically, FTX would suffer the same fate just months later as Binance backed out of a deal to take over SBF’s sunken empire.

The situation at FTX is still shrouded in chaos. As the crypto exchange that made $1 billion of revenue in 2021 fell into administration, it was subject to a $473 million hack. FTX, which has $50 billion in assets and liabilities and 100,000 creditors, filed for Chapter 11 bankruptcy protection in the US late on Friday. Creditors range from individual traders to hedge funds and major trading houses. As the messy unwinding ensues, many from inside and outside the industry are pointing fingers. But as crypto prices continue to fall across the board, who is really to blame for the collapse?

FTX and Alameda: Closer than close

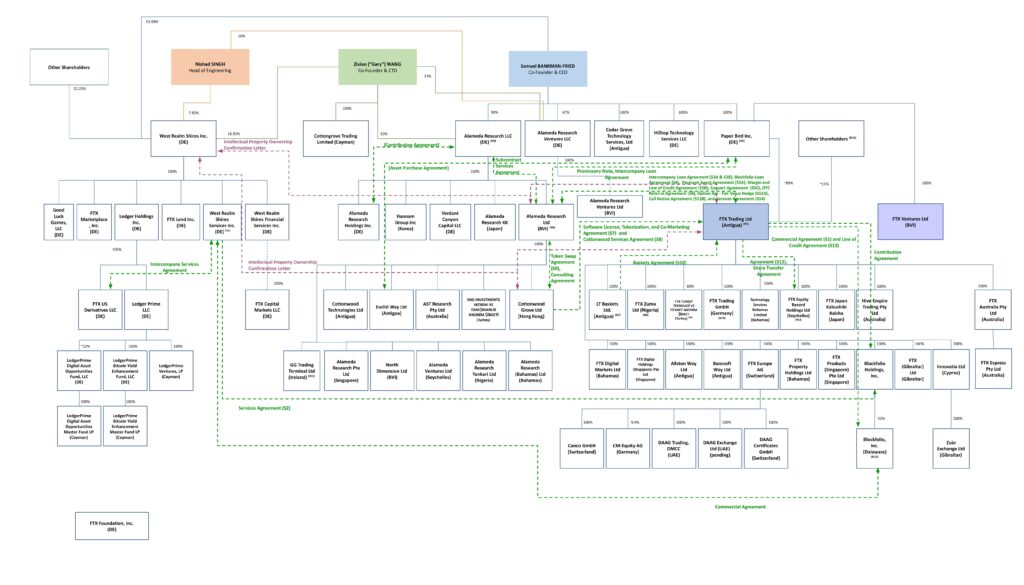

The downfall of most empires often begins with the overconfidence of a leader. When a leader ventures into territory that can only be conquered with excessive risk, existing holdings start disappearing beneath their feet. Think Napolean in Russia, or Zuckerberg’s metaverse experiment. Yet perhaps in Bankman-Fried’s case, the risks and conflicts of interest were more endemic. There is nothing too complex about what FTX was doing. SBF ran a crypto trading firm Alameda Research, that operated at an arm’s length from FTX.

Executives were aware of the clear conflicts of interest of having a market maker and a trading firm under the same roof, even in the early days. But those same executives revealed that Alameda was using FTX customer deposits to trade. So while the conglomerate was structurally labyrinthine, the mechanics were not. FTX used its own token, FTT, for collateral purposes. FTX then lends FTT to Alameda — Alameda uses the FTT as collateral to borrow funds — Alameda pumps FTT with those funds. Rinse and repeat.

Indeed, it might be easy to lay blame on SBF, a 30-year old who built a lean unicorn with just 6 developers. Alternatively, one might ask, how did investors or regulators not realise what was going on?

No Governance — Just Bahamas mansions & huge spreads

As venture capital royalty, Sequoia Capital is known for its due diligence capabilities. So when it has to write a $150 million investment in FTX down to $0, something has gone wrong. There is no doubt that more onerous governance could have prevented people from getting hurt. The warning signs were there. The exchange hired a 28-year-old COO whose only previous experience has come as an analyst at Credit Suisse in Singapore, alongside a few months at a small crypto exchange in the region. One source told Coindesk, “The company is run by a gang of kids in a luxury penthouse in the Bahamas.”

“Gary Wang (CTO), Nishad Singh (Director of Research) and Sam control the code, the exchange’s matching engine and funds,” the source added. This has led many to believe the hack was an inside job, from what sounds like an episode of a Netflix documentary.

While Sequoia is not averse to backing young, ambitious founders, it would usually use board seats as a check on the absolute power of the founder. Neither Sequoia, Blackrock, Thoma Bravo, Tiger Global or Softbank took a board seat. Seduced by the outsized spreads, there were no strings attached to the cash FTX was lavished with. The numbers were simply too good – no governance or risk issues could stop investors from pouring money into the eccentric, cerebral founder’s rocketship.

Regulators: “Not our problem”

There is no doubt that regulators will be looking at what they could’ve done – and can do to protect investors. Whilst the SEC under Gary Gensler has looked into information asymmetries in the form of payment for order flow in traditional finance, nothing was done in regard to FTX. Since regulators have largely kept crypto exchanges outside their remit, with exception of some Anti-money laundering controls, this left the Bahamas-based exchange able to go full steam ahead.

It is clear that the opacity of a business of this size should not be left untouched. SBF even appeared to agree — It was only October 19th when Bankman-Fried argued for stronger regulation around DeFi. “If you host a website aimed at facilitating and encouraging U.S. retail to connect to and trade on a DEX, this may end up falling under something like a broker-dealer/FCM/etc,” Bankman-Fried said. Some even said that SBF supported The Digital Commodities Consumer Protection act making its way through Congress. In the wake of the collapse, regulators may reflect on their insouciance during the debacle and push ahead with stronger oversight.

Blame Game

As the finger-pointing continues, FTX should give a rude awakening to the entire blockchain ecosystem. Of course, regulators should have been stronger; investors should have adopted regular governance protocols. Yet many in the crypto industry should look at whether they are operating in a digital casino or a fair marketplace. Bankman-Fried may represent a young opportunist who bamboozled investors with his rise and fall, but his kind are not an aberration in the industry.

Projects should focus on having true utility and transparency, which is supposedly the principles that undergird open, public blockchains. Developers, executives, investors and regulators should embed strong governance into the heart of the ecosystem. Only then, will the Web 3 dream become reality.

Author: Tal Feingold