2000, 2008, 2022: It is hard to avoid the parallels. From its peak in March 2000, the Nasdaq fell 60% in a single year and hundreds of dotcom startups went bankrupt. The 2008 crash led to bankruptcies for 64,318 firms, including Lehman Brothers and Merrill Lynch, because of rising sub-prime mortgage defaults. The 2022 crash could be worse because it combines the money-losing startups of the dotcom crash with the over-leveraged financial firms of 2008.

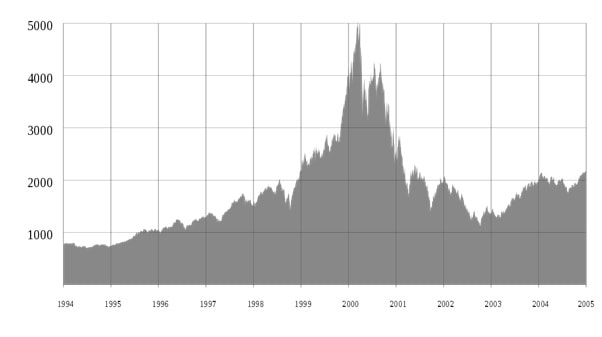

The below figure shows the decline of the Nasdaq from a peak of almost 5000 in March of 2000 to less than 2000 a year later, with many ups and downs along the way. Driven by hype about the “New Economy” and new metrics such as number of eyeballs. Growth was considered more important than profits. Startups with big losses and sometimes no revenues did IPOs and initially saw their share prices explode. Large companies also benefited from this narrative as Cisco, Qualcomm, Intel, and Nokia became defined as internet companies before seeing their share prices fall by more than half during the crash. Hundreds of small startups went bankrupt most of which involved less than $100 million in funding.

The 2008 crash also had a big drop in major indices, with the biggest this time in the Dow Jones (see below). Its decline was even bigger than was the decline for either the Dow Jones or the Nasdaq in 2000. And it was more broadly felt across a wide range of sectors. Like the 2000 bubble, the 2008 bubble was driven by a narrative, this one arguing sub-prime mortgages were bringing a housing boom and great wealth to everyone. There were a record number of bankruptcies from the packaged subprime loans and credit default swaps, and it took about four years for the Dow to regain its 2008 peak. Many large companies including American International Group never recovered.

The current bubble is driven by a broader and more sophisticated narrative, one that involves technology disrupting almost every sector of the modern economy. The technologies range from AI to augmented reality, blockchain and even science-based technologies such as synthetic biology and nuclear fusion and they were expected but have yet to remake sectors ranging from healthcare to property (proptech) and even regulated sectors (regtech). There is even a modern form of the sub-prime mortgage, the buy-now-pay later startups whose share prices have already dropped much further and faster than have other startups.

Another common aspect of the 2000, 2008, and 2022 bubbles are big startup losses and over leveraged companies, in this case ones investing in startups (e.g., Softbank, pension funds). At the end of 3Q 2021, ten startups had more than $3 billion in cumulative losses, a figure first achieved by Amazon almost 20 years ago including Uber ($24.5 billion), WeWork ($12.2 billion), and Snap ($8.4 billion), The number of publicly traded Unicorns with greater than $1 billion and $500 million in cumulative losses has reached 23 and 59 respectively. These numbers together suggest the 2022 crash will be bigger than the 2000 one because today’s losses are much bigger than during the dotcom period whose funding were typically less than $100 million.

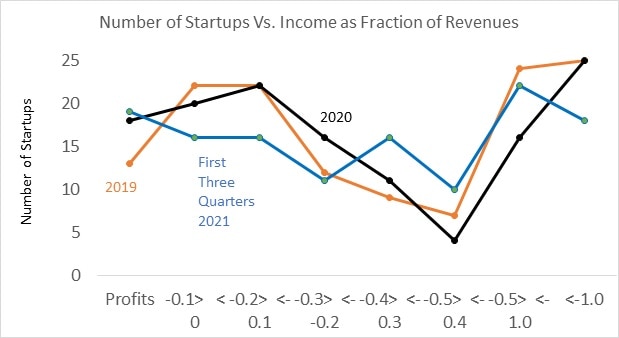

A more revealing figure might be the number of ex-Unicorns with cumulative losses greater than annual revenues, a feat briefly achieved by Amazon when its cumulative losses peaked at $3 billion. There are now 89 of those ex-Unicorns among the total of 133, or about 67%, up from 60% before the IPOs of 2021 are added. This rising percentage partly comes from the many SPACs that had little or no revenues. Rising interest rates will increase the cost of servicing the loans for those losses.

Is profitability improving for some startups? As shown in the below figure, 19 publicly traded Unicorns were profitable in the first three quarters of 2021, up from 18 in 2020 and 13 in 2019. Nevertheless, there were fewer Unicorn startups with losses less than either 10% or 20% of revenues in 2021 than in 2019 or 2020. Clearly, the trend towards profitability is weak.

Similar losses exist for startups outside the U.S. with at least $100 billion for startups in China, India, and Singapore. Video-streaming Kuaishou has the largest cumulative losses of any ex-Unicorn as of mid-2021 with $34.7 billion, about 50% higher than those for Uber. Many others have cumulative losses higher than their 2020 revenues.

Consider for a moment the plight of those startups with cumulative losses greater than 2020 revenues. Even if they were to magically achieve profits equal to 10 percent of revenue, a truly difficult feat, it would still take 10 years to erase the cumulative losses. Although Amazon managed to achieve this and later become one of America’s most valuable companies, few startups will likely repeat Amazon’s success. Particularly when many of these 89 ex-Unicorns cited above have cumulative losses much greater than their annual revenues.

How far could share prices drop for these publicly traded Unicorns? Share prices are traditionally based on the discounted cash flow of a company’s expected income. When a company has had zero profits for many years, the probability of achieving profitability is low and thus any company with appreciable cumulative losses, for instance ones exceeding annual revenues, probably has a low chance of ever erasing those losses. With 67% of today’s Unicorn startups in exactly that situation, many of them will go bankrupt or be acquired for fire-sale prices.

Furthermore, when you add up the cumulative income for all these Unicorns, both ones with losses and profits, there is a $131 billion hole just for American startups that is growing bigger every quarter. The total market capitalization for just the unprofitable American startups is close to $1 trillion. This means the entire venture capital and startup sector represents a gaping financial hole, one that will likely have a big impact on multiple sectors.

An even bigger concern is the privately held Unicorns of which there are 1000 globally with a total valuation of $3.2 trillion. Because the percentage of startups with cumulative losses greater than annual revenues is higher for those going public in 2021 than previously going public, it is likely that privately held Unicorns are in worse financial shape than are the publicly traded Unicorns. Big companies that invested in these startups through corporate venture capital funds may be forced to write off their investments in both privately and publicly held startups. When the losses are added up, the $3.2 purported value may be negative to the tune of hundreds of billions of dollars.

How will the stock market decline proceed? The past two crashes occurred over about a year with many ups and downs. The current decline will also have ups and downs along with likely government interventions. Just as governments bailed out stock markets in March 2020 with lower interest rates and asset repurchases, they may again intervene by not raising interest rates much or by not tapering as much as they have said they will do. There are many variables that will affect the speed and extent of the decline, but the big losses suggest the decline will happen.

Author: Dr. Jeffrey Funk

Jeffrey Funk is a retired Associate Professor, winner of the NTT DoCoMo mobile science award, and author of recent articles on startups and technology in American Affairs, Issues in Science & Technology, Scientific American, IEEE Spectrum, Slate, and Mind Matters News.