The Dow Jones Industrial Average (DJIA) closed 2025 at all-time highs, but the rally was narrow, dominated by a few giants. NVIDIA (ticker: NVDA) stood out. Its stock jumped 40.2% in 2025. That eye-popping gain made Nvidia one of the top five performers in the 30-stock index.

Critically, this surge wasn’t just Wall Street’s AI fever. It stemmed from real demand for Nvidia’s GPUs and record revenues, backed by bullish guidance.

We unpack how Nvidia’s 40% leap helped power the Dow Jones, and why analysts see room for more growth in 2026.

Dow 2025: Record Rally Fueled by Tech and Finance

In 2025 the Dow Jones climbed roughly 13% (closing near 48,060 on December 31), extending a three-year winning streak. But the advance was highly uneven. A handful of stocks, especially those tied to AI and financials, drove most of the gains.

For example, Caterpillar rallied ~60% and Goldman Sachs ~56%, while staples and utilities barely budged. NVIDIA (a Dow member since November 2024) replaced Intel in the index and stood out with its +40.2% return.

In sum, the Dow’s record year was powered by data-center demand and bank dealmakers. NVIDIA’s performance alone “helped push the Dow Jones to all-time highs,” even as many other Dow stocks had flat or modest returns.

$57B Quarter, +62% Growth: The Earnings Engine Behind the AI Trade

NVIDIA’s surge was built on product and earnings momentum, not just hype. After joining the DJIA, the AI-chip maker continued to smash records. In Q3 FY2026 (ended October 2025), Nvidia reported $57 billion in revenue, up 62% year-over-year (YoY), powered by a sell-out of its AI GPUs (the new “Blackwell” series).

CEO Jensen Huang proclaimed that Nvidia was in the “virtuous cycle of AI” as demand exploded. The company also repurchased shares aggressively (returning $37B to shareholders YTD) and maintained rock-solid margins. Over the full year, Nvidia delivered roughly 40% gains for investors, mirroring its stock jump.

Key factors behind Nvidia’s 2025 performance include:

- Dominant AI GPUs: Nvidia’s GPUs are the industry standard for AI data centers. Its latest H100/Blackwell chips offer 10–50x more performance than prior generations, and customers are snapping them up. NVIDIA’s record Q3 data-center revenue (approximately $51.2B) beat estimates, underscoring vast unmet demand.

- Blowout Financials: Q3 GAAP EPS was $1.30, up 67% from a year ago. Management guided Q4 revenue around $65B, well above Wall Street’s ~$62B estimate. This implies fiscal-2026 revenue of ~$212B (roughly +60% YoY), a company record.

- New Products and Scale: Nvidia already dominates AI training chips. In 2024–2025 it unveiled the next-gen “Blackwell Ultra” GPUs. Now it’s developing a new “Rubin” architecture (2026) said to be 3.3x more powerful than Blackwell Ultra. Rubin will come when demand is already far outstripping supply, giving Nvidia pricing power and future growth.

Vera Rubin is in full production.

— NVIDIA (@nvidia) January 6, 2026

We just kicked off the next generation of AI infrastructure with the NVIDIA Rubin platform, bringing together six new chips to deliver one AI supercomputer built for AI at scale.

Here are the top 5 things to know 🧵 pic.twitter.com/TiQKUK4eY3

- Huge Addressable Market: CEO Huang projects that by 2030, hyperscalers will spend up to $4 trillion annually on AI infrastructure, a market where Nvidia is “everywhere” (cloud, on-prem, AI labs). Only a sliver of enterprises have fully adopted AI so far, so the runway remains enormous.

- Index Inclusion and Flows: Joining the Dow Jones in 2024 brought more institutional buyers (index funds and ETFs). With Nvidia’s share price split 10-for-1 in 2024, it became accessible to more investors. The combination of index flows and fear-of-missing-out (FOMO) on AI stocks amplified buying during 2025.

Despite these strengths, some investors caution that the AI frenzy could fade. As Reuters notes, “the concern that AI infrastructure spending growth is not sustainable is not likely to ebb,” warned Ruben Roy, Stifel analyst.

NVIDIA also faces political headwinds (new chip export curbs) and rising competition (AMD, Google, and even self-made chips by hyperscalers). But on balance, 2025’s earnings and guidance show Nvidia riding real economic momentum, not a mere bubble.

Beyond the Hype: Record Profits and Even Bullisher Forecasts

NVIDIA’s 2025 metrics back up the hype with hard numbers. In the first nine months of FY2026, net income rose 65% year-over-year to $31.9B. Gross margins stayed above 73%, even as the product mix shifted fully to AI chips. Share buybacks and a modest cash dividend kept capital disciplined.

At the same time, Nvidia remains in a race to build more capacity: it’s investing in new fabs and considering U.S. chip plants to hedge geopolitical risks.

Analysts are overwhelmingly optimistic for 2026. Street forecasts imply huge jumps in revenue and earnings: consensus sees fiscal-2027 revenue about $313 billion (fiscal years to January ’27), with EPS near $7.46. That would be ~48% revenue growth and ~59% EPS growth.

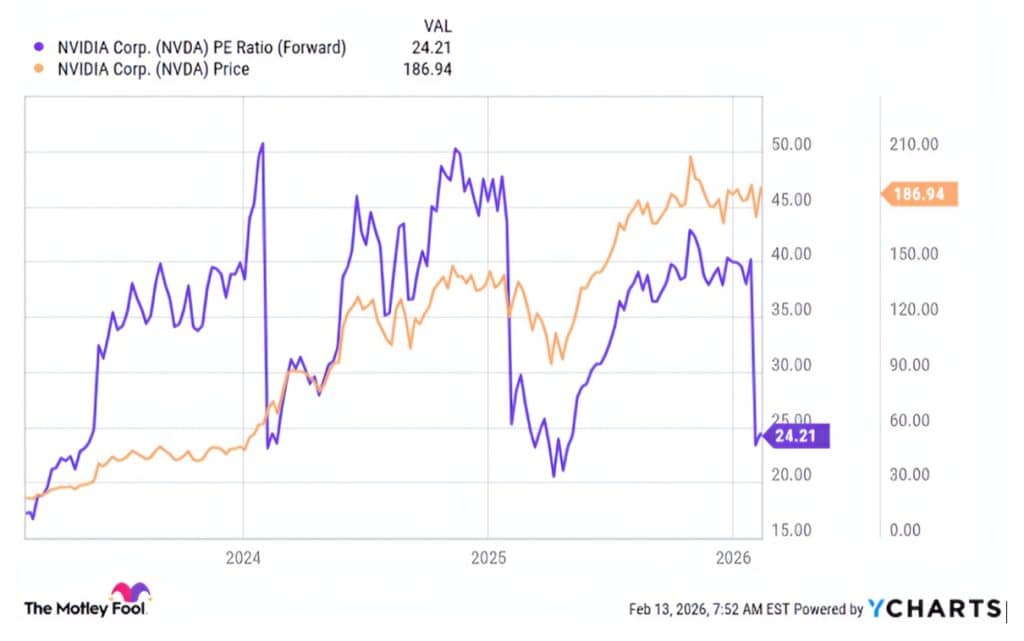

If achieved, Nvidia’s forward P/E (~25x) would still be well below its decade average (~61x), suggesting room to run. In fact, Nvidia trades at a discount to its own trailing multiples once future growth is factored in.

As a Motley Fool analysis notes, at the expected $7.46 EPS for 2027, Nvidia’s forward P/E (~24) implies the stock would need to rise 84% to hit its long-term norm.

Dan Ives’ $250 Call: Can Nvidia Add 84% From Here?

Importantly, Nvidia seems on track to hit these lofty numbers. Its stock has already risen more than 10-fold since early 2023, but many experts insist the build-out is only beginning.

Wedbush’s Dan Ives, often cited on Nvidia, still “pounds the table,” recently reiterating a $250 price target by end-2026. His argument: every single AI model relies on Nvidia’s chips, so consensus forecasts are still too low.

Broadly, Wall Street believes corporate AI spending will continue accelerating. Even after record 2025 results, Nvidia has raised capital expenditure plans, stock buybacks, and R&D to ensure it stays ahead of demand.

NVIDIA in 2026: Still Worth the Ride?

Looking forward, the key question is whether Nvidia can keep translating AI hype into revenue. Based on current guidance and analyst models, its story remains compelling. The launch of Rubin GPUs and continued data-center expansion are likely to keep growth rates well above industry norms.

At the same time, investors should watch for any slowdown in capex by hyperscalers or rough macro turns (Fed policy changes, China tensions, others) that could impact Nvidia’s top line.

In plain terms: 2025 showed that Nvidia’s rise was grounded in substance. Its GPUs are fueling a genuine AI infrastructure boom. The company’s 60–70%+ sales growth in 2025 wasn’t a fluke. If Nvidia continues delivering on earnings and guidance, and if data-center operators keep their foot on the gas, the market could easily retest analysts’ bullish targets. Even large increases in 2026 (to $250 or beyond) would not break the core trend.

In summary, Nvidia’s +40% run in 2025 was far more than hype. It was profit and innovation playing out in real time, setting the stage for another strong year.

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Nvidia Surpasses Japan: $4.4T Market Cap Dwarfs Most National GDPs | Disruption Banking

Nvidia’s $3.76T Triumph: Redefining Markets with AI and Robotics Disruption | Disruption Banking