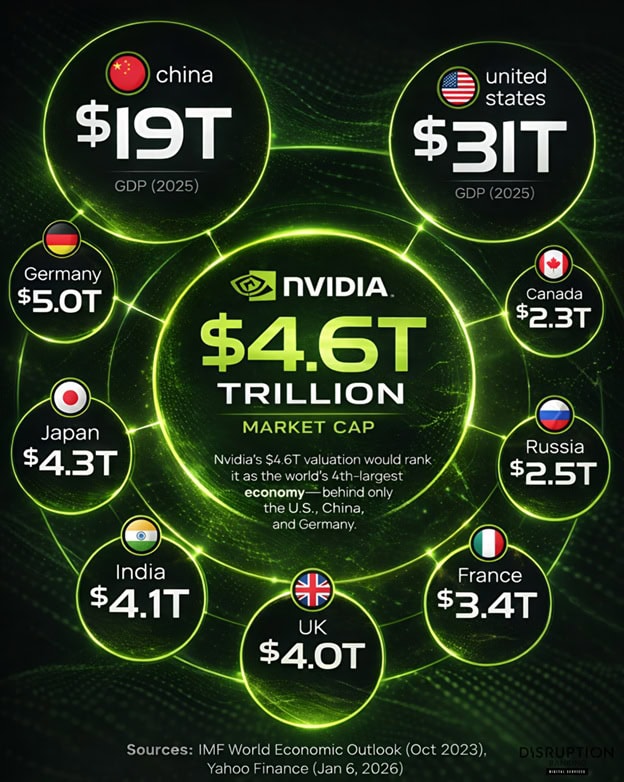

Nvidia‘s market capitalization now rivals entire nations. At the time of writing, the chipmaker’s valuation sits at approximately $4.6 trillion (TradingView), making it larger than all but three national economies. According to IMF projections for 2026, only the United States ($31.8T), China ($20.7T), and Germany ($5.3T) surpass Nvidia in economic value.

This comparison isn’t just academic. A single company now commands more market value than economic powerhouses like Japan (~$4.46T) and India (~$4.5T). The gap between Nvidia and India is razor-thin, Nvidia’s market cap has fluctuated between $4.51T and $4.59T throughout January 2026, putting it neck-and-neck with India’s gross domestic product (GDP).

Nvidia’s Explosive Rise: $3T to $5T in Record Time

Nvidia first crossed the $4 trillion threshold in July 2025, becoming only the first company ever to do so. Microsoft joined the club days later. That milestone came after an extraordinary run. Nvidia’s market cap surged 37.8% in 2025, climbing from $3.29T in January to $4.54T by December 2025.

The rally hasn’t been smooth altogether. Nvidia hit a 12-month high of $5.04T in October 2025 at $207.04 per share before pulling back, making it the first company in history to ever cross the $5T market cap. At the time of writing, the stock NVDA sits at roughly $180 (TradingView), down from those October peaks but still commanding a valuation that dwarfs most nations.

Analysts remain divided on whether Nvidia can maintain this altitude. The Motley Fool predicts Nvidia could reach $6 trillion in 2026, requiring a 33% stock increase. The bull case hinges on continued AI infrastructure spending. Goldman Sachs estimates hyperscalers will pour $527 billion into capex in 2026.

Can Nvidia Keep Dominating AI? The Sustainability Challenge

Nvidia’s ascent raises uncomfortable questions about sustainability. As we explored in January 2025, the company faces mounting pressure to maintain its innovation edge against competitors like AMD and emerging AI chipmakers.

The comparison to entire countries highlights the absurdity and reality of modern markets. Nvidia employs more than 30,000 people. India has 1.4 billion. Yet capital markets value the chipmaker’s future cash flows at roughly the same level as an entire nation’s annual economic output.

This divergence stems from growth expectations. Nvidia’s fiscal 2026 third-quarter revenue surged 62%, even as the stock pulled back from October highs. Countries struggle to achieve 3% GDP growth. Nvidia compounds at 60%+.

Is Nvidia in a Bubble? Bear Warnings and Margin Risks

Fund managers Terry Smith and Sean Peche warned that Nvidia can be a “fantastic company” but a poor investment if investors overpay, comparing it to past tech darlings like Nokia and Cisco that later devastated late-cycle buyers.

Their core concern hasn’t gone away: many of Nvidia’s biggest customers, from hyperscalers to cloud providers, are actively designing their own AI chips, often with R&D budgets larger than Nvidia’s entire cost base.

On top of that, new competition from ASIC makers and rival GPU vendors, plus trade-war tariffs and export controls, could compress those high margins that the current valuation effectively assumes will persist.

Market Cap vs GDP: Perspective on Nvidia’s True Scale

Whether Nvidia remains a good investment at these levels depends entirely on AI infrastructure spending. If data centers continue their buildout, Nvidia captures the upside. If spending moderates, the stock faces a painful repricing.

The country comparison provides perspective, not valuation guidance. Nvidia’s market cap reflects expectations of future earnings, not current economic activity. A country’s GDP measures annual output. The metrics aren’t comparable, except they are, because capital markets have made them so.

For now, Nvidia sits in rarified air. Only three countries surpass its market value. Whether that valuation holds depends on whether AI lives up to the hype.

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Nvidia’s $3.76T Triumph: Redefining Markets with AI and Robotics Disruption | Disruption Banking

Nvidia’s $3T Rise: Redefining the Dow Jones with AI Innovation | Disruption Banking