Will Aave be stronger in 2026? We analyze Aave’s DeFi dominance, TVL growth, governance battles, and roadmap to gauge its strength in 2026.

Aave is the cornerstone of DeFi lending. By mid-2025, its total value locked (TVL) had topped $50 billion, accounting for roughly 60% of all DeFi borrowing markets, which means more crypto loans run through Aave’s pools than any other protocol.

This scale has translated into nearly $94 million in annualized revenue. In an era when many DeFi projects struggle, Aave has consistently expanded across more chains, earning a reputation as a “flight-to-quality” protocol. Its AAVE token is a true governance coin, and large investors have taken notice: A report flagged a $769 million USDT transfer into Aave in January 2026, a signal of deep institutional liquidity coming into the system.

These facts underscore a bullish baseline: if demand for decentralized lending stays high, Aave’s core business is strong.

DeFi Leadership: Sustained Growth and Market Dominance

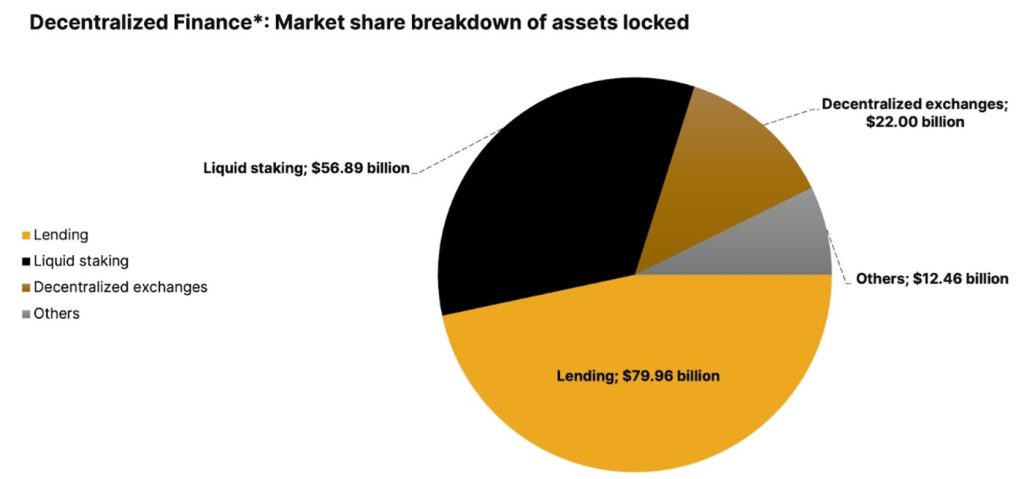

Aave’s growth metrics are eye-popping. In Q2 2025 alone, its TVL jumped 52%, nearly double the broader market’s pace. Today, it handles roughly 20% of all value locked in DeFi and most of the lending side.

To illustrate: out of $419 billion total TVL in all DeFi, Aave had nearly $80 billion, per a 21Shares report in mid-2025. Cumulatively, borrowers, at the time, had taken over $775 billion from Aave pools. These figures mean Aave’s position was strong; even as yields fluctuated, people kept depositing assets to earn interest.

Aave’s multichain deployment (including Ethereum, Polygon, Arbitrum, Base, and others) gives it an unmatched liquidity depth. At the time of writing, Aave held about $33 billion in TVL. Short of a collapse in crypto lending demand, Aave’s underlying usage remains robust.

Regulatory Resolution: Removing a Key Overhang

A decisive event in early 2026 was regulatory clarity for Aave. In December, the SEC confirmed that it does not intend to recommend an enforcement action.

As soon as this news hit, the AAVE token jumped ~7% within 24 hours. CEO Stani Kulechov noted this frees developers to focus on growth rather than legal defense. Clearing this regulatory hurdle is a major plus. It makes institutional players and wary investors more comfortable, removing a big overhang.

After four years, we are finally ready to share that the SEC has concluded its investigation into the Aave Protocol.

— Stani.eth (@StaniKulechov) December 16, 2025

This process demanded significant effort and resources from our team, and from me personally as the founder, to protect Aave, its ecosystem, and DeFi more… pic.twitter.com/aZeLrZz5ZQ

However, price charts show a different story. From highs of $385 in August 2025 today the token is trading at $159. The lowest point in 2025 was about $113, however the token started the year at $308, according to Coinbase.

Governance Dynamics: Lessons from Recent Tensions

Aave’s community has seen governance clashes that unsettled investors late in 2025. In mid-December 2025, a public dispute erupted between the Aave DAO (which owns the protocol) and Aave Labs (the development team) over revenue sharing. DAO members discovered that fees from a new integration were being diverted to Aave Labs rather than the DAO treasury. This triggered a heated debate and a flight of small holders. Aave’s market cap briefly dropped by about $500 million. Social media sentiment turned negative, and on-chain data showed trading activity plunging (over 18% drop in a week).

Although uncomfortable, this kind of governance skirmish is not unique to Aave.

In December, Aave Labs proposed sharing more external revenue with token holders, and AAVE’s price rebounded by almost 5% over 24 hours. This push-pull is a real factor for 2026: on one hand, community trust was dented; on the other, active whales and the founder’s “skin in the game” (Stani bought millions of dollars of AAVE in late 2025) point to a longer-term bullish case. The governance battle shows that AAVE’s token performance may lag fundamentals, and holders want assurances that the DAO captures value from the protocol.

The recent DAO vote has wrapped up, and it has raised important questions about the relationship between Aave Labs and $AAVE token holders. This is a productive discussion that’s essential for the long-term health of Aave.

— Stani.eth (@StaniKulechov) December 26, 2025

While it's been a bit hectic, debate and disagreement…

Scaling to Mainstream: Roadmap and Adoption Drivers

Looking ahead, Aave’s 2026 roadmap is ambitious. Key on-chain upgrades can boost or trip up progress. In January 2026, Aave rolled out V3.6 across multiple chains, adding new collateral modes and gas optimizations. This update, though incremental, makes borrowing more efficient: a neutral-to-bullish tweak (lower costs, better rates) without user migration.

The real prize is Aave V4, a full protocol overhaul now expected in Q1 2026. V4 uses a “hub-and-spoke” design to unite liquidity across networks, solving one of DeFi’s core issues. If successful, V4 could attract new inflows by making deep liquidity readily available (an institutionally friendly feature). However, execution is non-trivial: any delays or bugs could spook the market.

Beyond protocol code, Aave is also eyeing mainstream adoption. It launched a consumer mobile app in late 2025, aiming to onboard millions of savings-account users in 2026. A well-executed app with easy onramps could dramatically expand Aave’s user base beyond crypto natives (the roadmap even mentions onboarding the first million users).

Finally, Aave is expanding GHO’s footprint by bridging it to Aptos to make its stablecoin available in new ecosystems. Each of these moves is potentially bullish: more users, more chains, more use cases for AAVE. But it requires flawless delivery and some regulatory navigation (consumer finance apps will draw scrutiny).

Price and Technical Perspective: Near-Term Outlook

From a price perspective, AAVE enters 2026 in a consolidating stance. After hitting ~$187 post-SEC news, it briefly retraced to test the mid-$140s by late January (technical analysis noted a key support around $155). This dip partly reflects broader crypto volatility and profit-taking, rather than a collapse in fundamentals.

Many traders see AAVE’s short-term RSI and MACD signals mixed. In the absence of a fresh catalyst, expect choppiness around these levels. Long-term investors, however, weigh fundamentals: strong yields and future upgrades.

Optimistically, if V4 delivers or Aave’s app goes viral, AAVE could break out of the range. Pessimistically, if DeFi faces a renewed risk-off or execution falters, AAVE might drift lower (some charts target $125 or less on a breakdown). Weighing both sides: Aave’s underlying demand is real, but given crypto markets as they are, its price may remain somewhat subdued until big catalysts land.

Strong Fundamentals, Execution as the Deciding Factor

Aave’s strength in 2026 rests on two pillars: strong DeFi fundamentals and successful execution of upgrades. The fundamentals look solid: massive TVL, institutional interest (a $769M stablecoin inflow is not random), and regulatory clarity. On the flip side, Aave must prove its community can navigate governance and implement its roadmap.

The next wave of growth in 2026 will likely come if V4 and consumer initiatives fire on all cylinders. Any breakdown in trust or execution could cap Aave’s upside.

In summary, Aave is well-positioned to perform strongly in 2026 if it delivers on its promises. The potential is there, but the market will be looking closely. We’ll find out soon whether Aave’s 2026 will be a continuation of dominance or a test of resilience.

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.