At the time of writing, silver (XAG) had broken the $100/oz barrier, notching a fresh all-time high of $117.17 on Monday, according to a Bloomberg report, before retracting to around $117 (TradingView). Bear in mind the precious metal was around $30/oz almost exactly a year ago, and the significance of the story becomes clear.

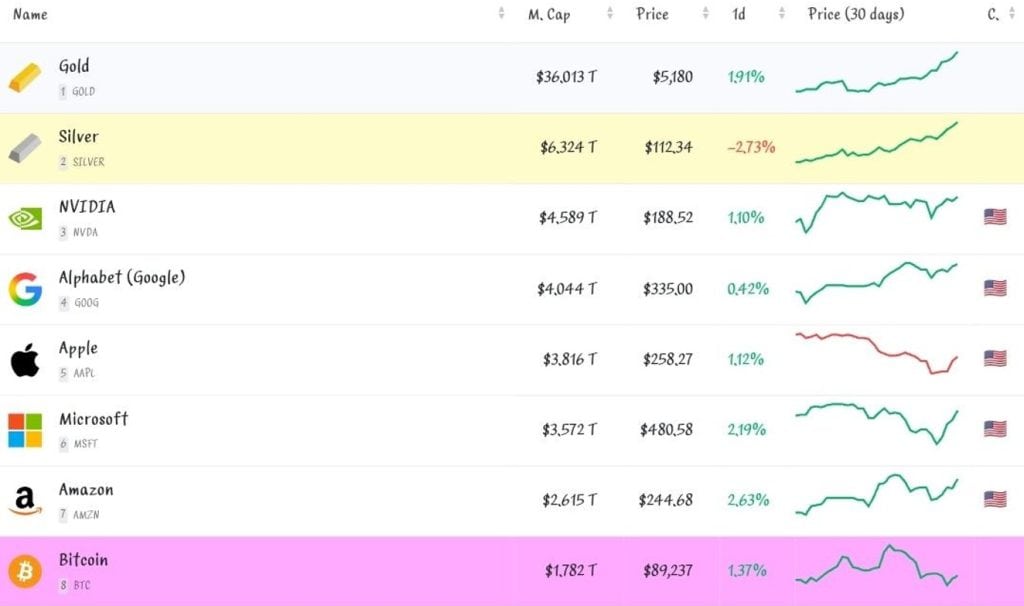

On the asset-leaderboard sites traders obsess over, silver briefly sits behind only gold as the world’s second-largest asset by market value. The “how” is simple: CompaniesMarketCap’s estimate puts silver around $6 trillion, based on spot price multiplied by an estimate of total historical mined supply.

The “why” is the story: a toxic cocktail of geopolitics, fiscal anxiety, and an industrial supply squeeze that doesn’t care about your narratives. Coin Bureau, a well-known crypto education and research brand, dubbed it “metals mayhem” on their Live News stream.

Silver Surpasses Nvidia: The $6 Trillion Market Cap Shock in 2026

The headline rests on how dashboards define “asset”. Sites like CompaniesMarketCap rank companies, commodities, and crypto together. In that framing, silver can “flip” a mega-cap stock when its price spikes hard enough. Bitbo noted silver briefly overtook Nvidia for second place as the year opened, before swapping ranks again.

This is not investable float. CompaniesMarketCap stresses the calculation is approximate, cites CPM Group for cumulative mined tonnes, and notes that significant volumes have been lost to industrial use. In plain terms, the ranking is a macro signal, not a claim that six trillion dollars of liquid silver bars exist to be bought with a click.

But as signals go, it’s loud. When a “boring” metal throws off tech-stock gravity, something big is happening underneath the tape.

Why Silver Surged to $116

The trigger was fear, then momentum. On January 27, gold (XAU) pushed above $5,500/oz (TradingView) and silver topped new highs as markets fixated on tariff threats and U.S. shutdown risk. The Wall Street Journal reported silver’s surge to around $115 as its biggest single-day gain since 1985.

Reuters described the move as a self-propelling frenzy: retail buying of coins and small bars, inflows into physically backed silver ETFs, and tightness in London bullion availability after years of structural deficits. When that kind of bid hits a market with thin “ready” inventory, the price quits climbing and starts gapping.

It also explains why Hong Kong and Shanghai mattered. Reports over the last year have repeatedly pointed to regional dislocations and shortages, including bouts of London-market stress that rippled into Asia.

Metals Mayhem: Coin Bureau Predicts $200 Silver

Coin Bureau’s angle was basically: stop thinking of silver as “cheap gold”. Think of it as a monetary metal sitting inside the wiring of the modern economy. On their Live News stream, Guy and Nic argued silver can outrun crypto in a debasement-and-uncertainty cycle, even calling “$200 before Solana,” and noting ETH priced in silver at a five-year low.

The fundamentals back the posture. The Silver Institute reported industrial demand hit a record 680.5 Moz in 2024, and global demand exceeded supply again, creating a 148.9 Moz structural deficit. That is the boring, compounding engine behind the fireworks: year after year, the market has been drawing down stockpiles.

And when prices explode, the industry feels it immediately. Pv magazine reported silver at $108.17/oz on January 26 and estimated silver paste at “more than 30%” of PV module costs at those levels, pushing manufacturers toward copper-based metallisation.

🚨JUST IN: Silver hits a new all-time high above $110 per ounce.

— Coin Bureau (@coinbureau) January 26, 2026

It's now up +257% YoY, while Bitcoin is down -14%.

Silver’s market cap has surged to $6.14T, now the 2nd largest asset in the world.

That’s 3.5× BIGGER than Bitcoin. pic.twitter.com/u6s991s4B8

Silver’s Chronic Supply Deficit: 5 Years of Shortages Driving 2026 Prices Higher

Silver’s superpower, and its curse, is that supply is slow to respond. Even the U.S. Geological Survey notes U.S. output comes from a handful of primary silver mines, but also as byproduct/coproduct output across dozens of other mining operations. When demand spikes, you can’t wave a wand and mine more silver unless other metals’ economics also justify expansions.

Reuters adds a more market-specific wrinkle: recycling is meaningful, but refining bottlenecks slow how fast scrap returns to the market. Meanwhile, London’s “mobilisable” vault stocks were drawn down sharply during the deficit years.

Robert Kiyosaki, author of “Rich Dad, Poor Dad” alongside Citigroup analysts, are bullishly optimistic about silver’s price. Both believe silver’s price in 2026 could reach $150-200/oz.

WHY SILVER is SUPERIOR

— Robert Kiyosaki (@theRealKiyosaki) January 22, 2026

Gold and silver have been money for thousands of years.

But…in today’s Technology Age….silver is elevated into an economic structural metal…. much like iron was the structural metal of

the Industrial Age.

In 1990…silver was approximately

$ 5.00 an…

Silver Bubble or Structural Shift? Reality Check on 2026’s Massive Rally

So, is this a bubble? Maybe. Reuters warned the move was flashing “wealth warnings” even as it documented the underlying tightness. But if this is a regime shift, it will look exactly like this: monetary fear plus an industrial metal that can’t be printed, can’t be forked, and can’t be replenished on a quarterly earnings schedule.

In the interim, whether silver keeps a leaderboard badge is as important as whether policy volatility and the green-tech buildout keep draining inventory faster than miners and recyclers can refill it. If they do, silver’s breakout won’t be remembered as a spike. It’ll be remembered as a reset.

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

The Banks and the Silver Surge: More Rumors vs. Reality | Disruption Banking

The Banks and the Silver Surge: Rumors vs. Reality | Disruption Banking