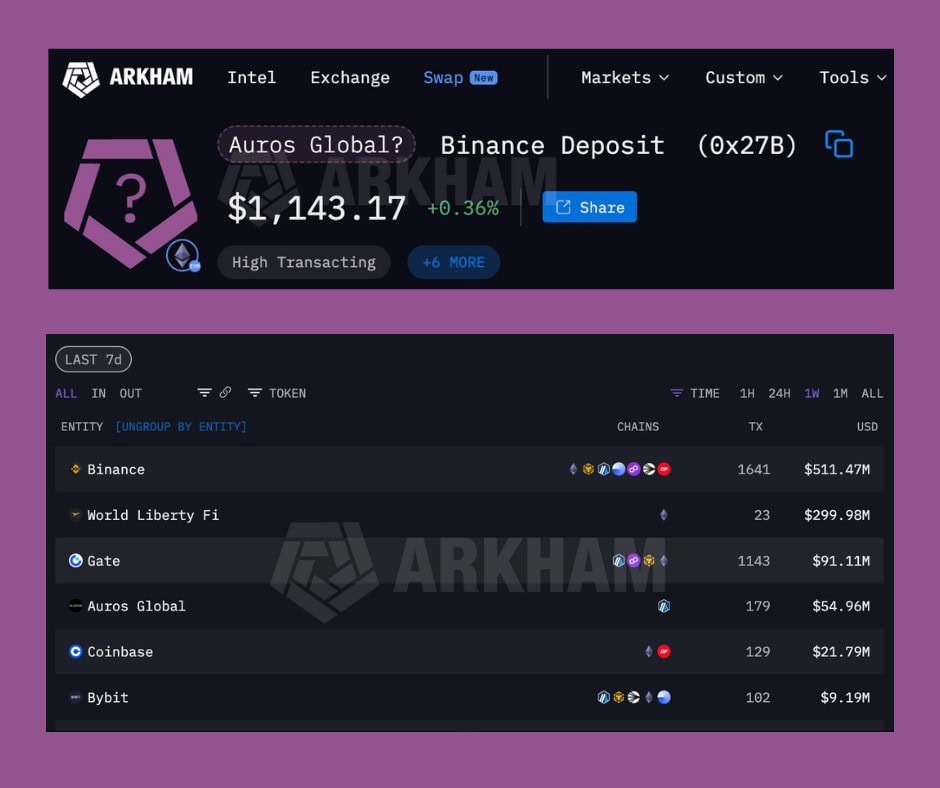

On-chain data indicates that flows linked to World Liberty Financial are increasingly intersecting with a wallet (0x27BFfB0f09C18539f9a47a39958Bb149Fe42A155) that Arkham Intelligence has provisionally labeled as Auros Global, a proprietary trading firm known for market-making and liquidity provision. Above a threshold of $200,000, there are observed on-chain transfer volumes of ~$299 million passing through this wallet cluster just in the last 7-10 days.

From DWF Labs to Auros Global: A Familiar Liquidity Pattern Re-Emerges

It’s more of exactly what Disruption Banking has been reporting here and here. Before, we exposed the involvement of DWF Labs receiving and routing ~$300 million in USD1-denominated funds cycled through the ecosystem, mostly ending up on Binance.

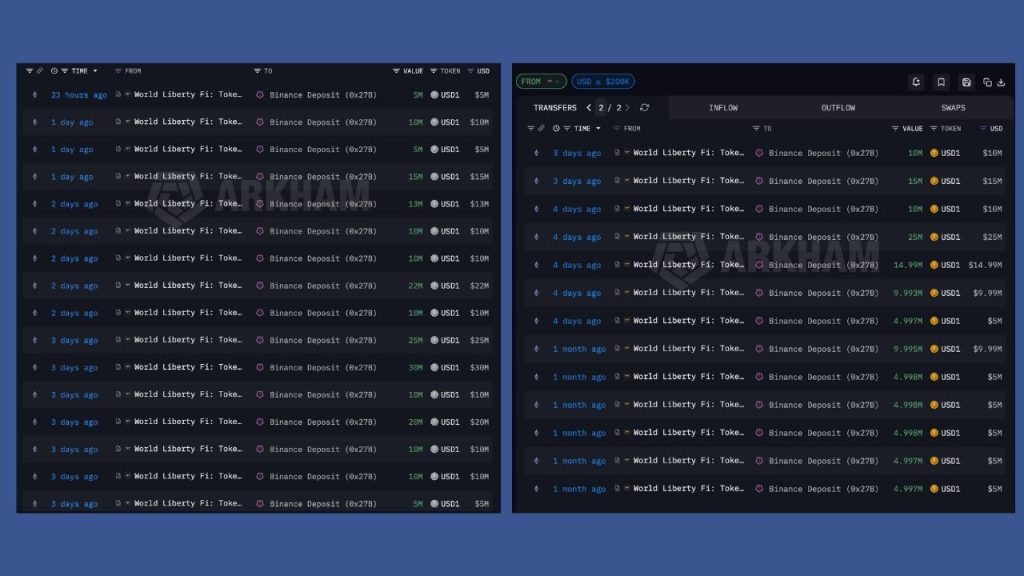

Over the past several days, repeated structured transfers from WLF-linked wallets to Binance deposit addresses appear to coincide with this analogous counterparty pattern, indicating a potential shift in WLF’s liquidity architecture and a deepening operational reliance on Binance, as shown in the image below, which contains the top counterparties over the week from January 19-26.

While Arkham’s attribution remains probabilistic, the scale, timing, and fragmentation of the transfers resemble professional execution rather than organic user activity, the same pattern Disruption Banking noted about the WLF-DWF Labs activity. On-chain data shows Auros activity consistent with a market maker systematically routing liquidity between WLF-linked flows and Binance, with spillover across major exchanges.

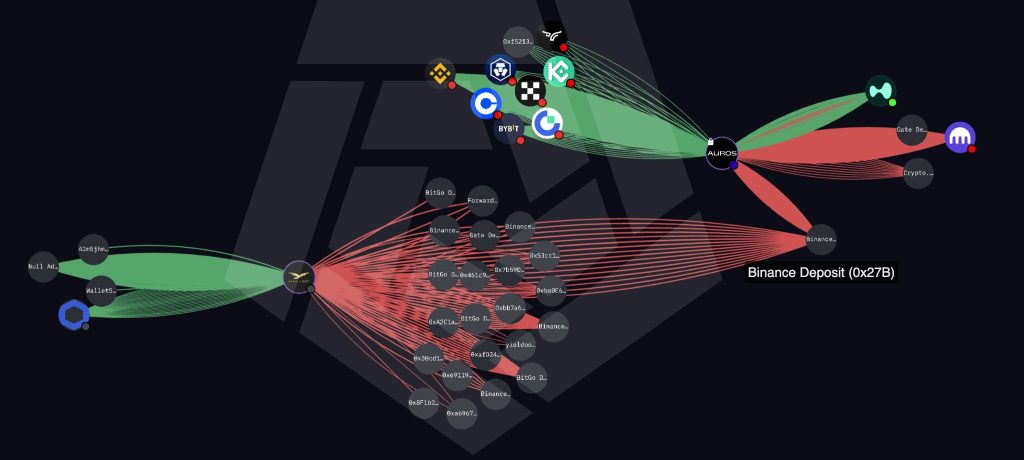

Arkham’s visualization tool shows inflows in green and outflows in red. Below, we see the wallet group Arkham confidently associates with Auros Global and that of WLF connected by the Binance Deposit wallet 0s27B (labeled “Auros Digital?”).

Why the “Auros Digital?” Cluster Behaves Like a Market Maker

First, the wallet (0x27B) labeled by Arkham as “Auros Digital?” is behaving like a routing hub, not an end user. Almost every inbound and outbound path converges through a Binance deposit address, which often then fans out to a Binance hot wallet. That pattern is classic for a trading firm that uses Binance as its primary venue for inventory management, netting, and internal transfer rather than custody.

Binance as Clearing Layer

The repeated convergence into Binance deposit addresses, followed by redistribution through Binance hot wallets, is consistent with market-maker or liquidity-provider behavior.

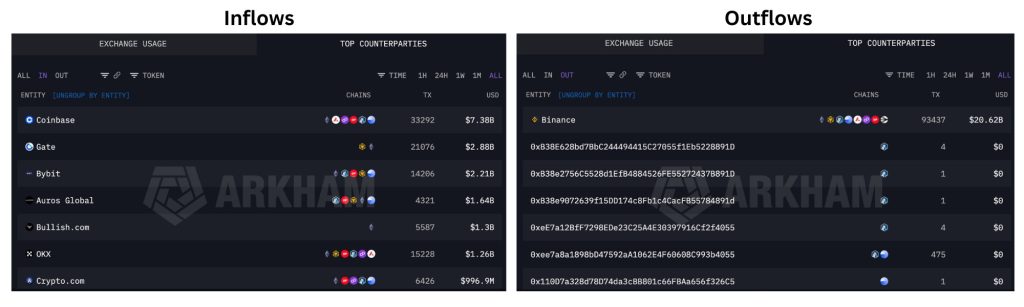

Second, look at the counterparties. On the left side, you see repeated interaction with hot wallets from KuCoin, OKX, Gate.io, Bybit, Bullish, and Crypto.com. Those are not random retail flows. That’s exchange-to-exchange plumbing. That’s exactly what you’d expect from a liquidity provider or market maker arbitrage spreads, rebalancing positions, or sourcing liquidity across venues. Retail wallets are conspicuously absent.

Among the outflows, every single (digital) penny goes to Binance. Every other wallet shows a total of 0.

Third, the amounts themselves matter. These are six- and seven-figure stablecoin transfers alongside non-trivial alt balances. That puts this wallet firmly in the professional tier. No single transaction is exotic, but the aggregate behavior, which is frequent, multi-asset, multi-exchange, centrally netted, signals institutional scale.

Finally, there is an absence that is just as important: across the observed transactions, Arkham shows zero swaps and no protocol-labeled interactions, with all outflows terminating at Binance infrastructure. This pattern is consistent with CeFi-first liquidity routing rather than DeFi-native execution.

Timing Matters: $35 Million Before the Tweets, $300 Million After

Knowing this ‘potential’ relationship puts Auros’s two tweets on January 15th, advertising promotions of WLF in a new light.

Happy USD1 Szn!

— Auros (@Auros_global) January 15, 2026

Live now on @titan_exchange – incentives for the next 2 weeks. https://t.co/t49dTeSeu8

It is not entirely clear who the partners referred to below are.

True on-chain limit orders are now live on @titan_exchange with @worldlibertyfi.

— Auros (@Auros_global) January 15, 2026

We are proud to support our partners on the launch and continue to drive efficient pricing on @Solana

USD1 pairs available now, incentives running for the next 2 weeks. https://t.co/2UimoYPfta

On-chain records show approximately $35 million in USD1 transfers from World Liberty Financial–linked wallets into a Binance deposit address before Auros Global’s January 15 promotional tweets. Afterward, almost $300 million in additional transfers took place in quick succession, based on observed transactions above $200,000.

The sequence does not establish coordination, but it does raise questions.

Silent Infrastructure, Loud Volume: Auros Global’s Scale Without a Public Profile

Auros Global is an infrastructure firm that shape markets without narrative presence. Auros has basically no news articles in the last six months, but they’re doing an incredible volume of transactions.

Auros wrote in its mid-2025 stocktake, “At Auros, the cornerstone liquidity we provide for our partner projects proved critical in navigating shifting liquidity dynamics and maintaining pricing efficiency across these volatile conditions.”

The stocktake continued, “In the first half of the year, Auros facilitated US$216 billion in spot volume, US$299 billion in perpetuals, and US$1.1 billion in options. Our infrastructure supported a peak daily volume of US$14 billion, with on-chain trading activity hitting new highs, securing top rank for all-time daily volume on strategic exchanges such as Hyperliquid.”

What This Means for World Liberty Financial’s Liquidity Architecture

Taken together, the on-chain evidence does not prove a formal partnership between World Liberty Financial and Auros Global, but it does establish a clear structural relationship: WLF-linked funds are repeatedly funneled through Binance deposit infrastructure in patterns consistent with professional market-making and liquidity routing.

The sharp acceleration in transfer volume following Auros’s January 15 promotional tweets raises legitimate questions about incentive alignment, narrative signaling, and dependency on centralized clearing venues.

As with earlier episodes involving other trading firms, the real story is less about individual actors than about how modern crypto markets quietly consolidate power through infrastructure that remains largely invisible until the flows become too large to ignore.

Author: Tim Tolka, Senior Reporter

#Crypto #Blockchain #DigitalAssets #DeFi

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.