2025 was a turning point in foreign exchange markets. According to JPMorgan, in the first half, the U.S. dollar (as measured by the DXY index) fell sharply, down 10.7%, its worst H1 decline in over 50 years. By year-end, the U.S. dollar fell by more than 9%, its worst annual performance since 2017.

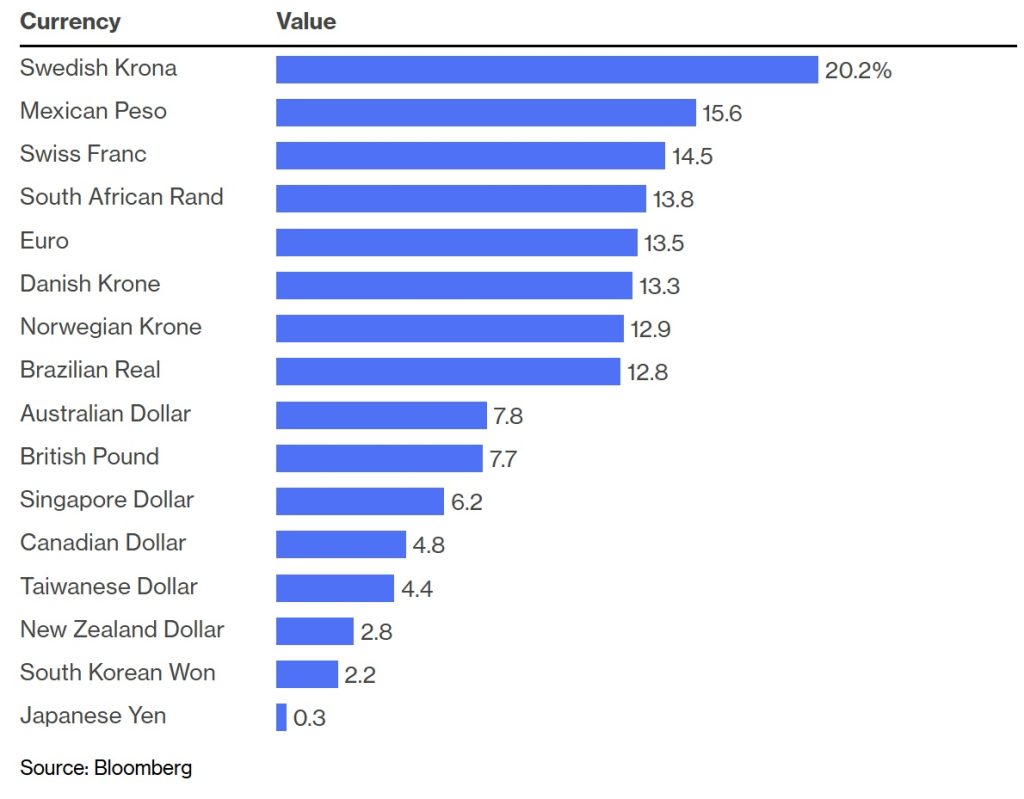

As the dollar weakened, a regular range of currencies, from the Swedish krona to the Japanese yen, strengthened against the U.S. dollar. That outcome caught many off guard.

Capital Flows Shift Away from the Dollar

As confidence in U.S. assets weakened last year, capital moved toward alternative markets. According to Robert Burgess, executive editor of Bloomberg Opinion, the following sixteen major currencies appreciated against the dollar over the course of 2025:

1. Swedish Krona: Decades-High Surge

The Swedish Krona (SEK, +20.2%) led the pack, gaining roughly 20% against the dollar, its strongest annual rally in more than two decades. This Scandinavian currency entered 2025 deeply undervalued. As Sweden’s inflation cooled and the Riksbank’s earlier rate hikes fed through to the economy, capital returned quickly. Dollar weakness finished the job.

2. Mexican Peso Up ~16%: Nearshoring Trumps Tariffs

The Mexican Peso (MXN, +15.6%) rose about 16% in 2025, its best year since Mexico adopted a free-floating currency in 1994. We warned of MXN tariff risks here but noted short-term strength from USMCA exemptions. It panned out: compliant goods stayed tariff-free, aiding recovery after a 1.5% dip. Banxico’s 9% rates and nearshoring surges, U.S. firms relocating, drove gains.

3. Swiss Franc and South African Rand: Safe Havens and Metals

Traditional safe-haven currencies benefited from 2025’s uncertainty. The Swiss Franc (CHF, +14.5%) gained almost 15%, supported by global risk aversion and the Swiss National Bank’s tighter stance following years of negative rates.

Meanwhile, the South African Rand (ZAR, +13.8%) climbed nearly 14%, its strongest year in 16 years. As explored in Disruption Banking’s ZAR outlooks for 2025 and 2026, the rand benefited from gold prices surging above $5,000/oz, easing inflation pressures, a credit-rating upgrade, and South Africa’s removal from the FATF “grey list.”

4. Euro and Peers: Europe’s Strategic Shift

Major European currencies rode the dollar’s slide as well. The Euro (EUR, +13.5%), which carries the largest weight in the dollar index, gained roughly 14%, reaching an all-time high in trade-weighted terms by late 2025.

The Danish krone (DKK, +13.3%), pegged to the euro, naturally mirrored the euro’s ~13% appreciation. Scandinavia’s other currency, the Norwegian krone (NOK, +12.9%), appreciated about 13%. Norway’s oil-and-gas-powered economy, combined with one of the highest interest rates in the developed world, drew investors back after a weak 2024.

TheBritish pound (GBP, +7.7%) rose ~8% as the Bank of England kept policy tight amid stubborn inflation, pushing sterling to its strongest levels since 2021.

5. Commodity & Carry Trade Winners: Real, Aussie, Loonie, Kiwi

Several commodity-linked and high-yield currencies saw substantial gains. Brazil’s real (BRL, +12.8%) gained ~13%, driven by mid-teens interest rates and strong exports under President Luiz Inácio Lula da Silva.

In the South Pacific, the Australian dollar (AUD, +7.8%) rose about 8%, echoing themes discussed in Disruption Banking’s AUD 2025 and 2026 outlooks: firm commodity demand, China’s recovery, and a hawkish Reserve Bank of Australia. Its cousin, the New Zealand dollar (NZD, +2.8%), also strengthened (mid-single-digit percent) thanks to high dairy and agricultural export revenues and the Reserve Bank of New Zealand keeping rates elevated.

North of the border, the Canadian dollar (CAD, +4.8%), covered earlier in Disruption Banking’s 2025 outlook, rose a more modest 5%. After early tariff jitters, solid oil prices and Bank of Canada policy stability helped the loonie recover toward C$1.33 per USD by year-end.

6. Asian Currencies: Stability and Policy Shifts

The Singapore dollar (SGD, +6.2%) gained 6%, reflecting disciplined monetary management. The Taiwanese dollar (TWD, +4.4%) and South Korean won (KRW, 2.2%) advanced modestly as the semiconductor cycle recovered.

The Japanese yen (JPY, +0.3%) ended 2025 roughly flat. As explored in Disruption Banking’s JPY 2026 outlooks, the Bank of Japan exited negative rates, but fiscal stimulus capped gains. Holding ground was itself a win after years of decline.

DXY Near 98 Raises Questions Over the Durability of the Decline

At the time of writing, the DXY, the ticker symbol for the U.S. dollar, is hovering near 98 underscoring how much purchasing power the dollar had ceded. This raises the questions about whether policy and trade risks could extend the weakness into 2026.

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no people or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.