In 2025, Caterpillar’s heavy machinery business unexpectedly led the Dow Jones Industrial Average.

Caterpillar Inc. (ticker: CAT) ended 2025 as the Dow Jones Industrial Average (DJIA)’s top-performing stock, surging 59.5% for the year. This industrial equipment maker, better known for bulldozers and excavators, outpaced high-flying tech names and even the Dow itself (which gained about 13% in 2025). Its nearest rival in the index, Goldman Sachs, rose a hefty 55.8% but still couldn’t catch Caterpillar’s climb. As Disruption Banking noted in a recent report, Caterpillar became a “hybrid play” on both traditional infrastructure and the new AI-driven boom in data centers.

In a volatile year of trade-war tariffs and rate cuts, investors rewarded companies that leveraged clear growth themes. Caterpillar’s rally was a case in point, driven by concrete demand for equipment, savvy pivots into tech, and policy tailwinds.

Below, we dive into the forces behind Caterpillar’s 2025 surge, and what they mean going into 2026 and beyond.

Caterpillar’s 2025 Surge: From AI Data Centers to Infrastructure Boom

One of the biggest surprises behind Caterpillar’s rise was how artificial intelligence indirectly boosted its business. The global AI arms race in 2025 spurred massive data-center construction, lifting demand for Caterpillar’s generators and industrial engines. Its Energy & Transportation division, traditionally locomotives and turbines, became a key supplier of backup power for AI server farms.

In Q3, Cat’s power systems sales jumped 17% to $8.39 billion, “largely driven by booming demand for power generation equipment used in AI data centers.” Caterpillar posted record Q3 revenue of $17.6 billion, crushed EPS estimates, and the stock spiked 12% in a single day.

“Our team’s continued discipline in a dynamic environment, coupled with a growing backlog, positions us for sustained momentum and long-term profitable growth,” CEO Joe Creed said after the strong Q3 report.

Wall Street took notice that an old-line manufacturer was cashing in on the AI trend. “Power-generation sales are expected to continue sustainably growing as CAT maintains their market leadership in backup power for data center applications,” observed Third Bridge analyst Ryan Keeney, per a Reuters report.

Even NVIDIA‘s CEO Jensen Huang highlighted the shift. “For a century, Caterpillar has built the machines that shaped the world,” he said, adding that NVIDIA and Caterpillar are now partnering “across the full spectrum.” Those comments followed Caterpillar’s expanded partnership with NVIDIA, unveiled at the annual Consumer Electronics Show (CES) 2026 in Las Vegas. It featured Jetson Thor (NVIDIA’s edge AI platform powering real-time autonomy and machine intelligence on industrial equipment), physical AI, robotics, digital-twin simulation, and the rollout of the Cat AI Assistant (a voice-enabled AI that gives operators instant insights and safety guidance).

Investors increasingly see Caterpillar not just as a construction proxy, but as critical digital-era infrastructure, a perception shift that helped re-rate the stock in 2025.

Caterpillar has outperformed Nvidia, Gold, and Bitcoin this year pic.twitter.com/KcGntjsUrH

— Joe Weisenthal (@TheStalwart) November 6, 2025

Record $39.9B Backlog: Signal of a Supercycle Ahead

Beyond AI, traditional infrastructure spending anchored Caterpillar’s growth. Construction and mining activity rebounded in 2025 as governments accelerated public-works programs. In the U.S., funds from the 2021 infrastructure law were fully deployed, alongside a renewed “America rebuilds” agenda.

President Donald Trump’s emphasis on domestic energy and resource extraction supported Cat’s heavy equipment demand. Caterpillar’s Construction Industries segment posted about 7% revenue growth in late 2025, supported by pricing power. By early 2026, Caterpillar’s order backlog reached a record $39.9 billion, effectively locking in much of the next two years of production. This massive backlog provides a margin of safety even if the broader economy slows.

Energy-transition dynamics also boosted demand. Mining activity for copper, lithium, and iron, critical to renewables and EVs, lifted orders for Caterpillar’s trucks and shovels, while grid expansion, wind farms, and solar projects relied on its equipment. By year-end 2025, markets were pricing in a commodities and infrastructure supercycle. 2025 “rewarded precision over scale and infrastructure over applications.”

Policy developments reinforced this outlook. A late-2025 bipartisan U.S. spending deal earmarked $63.3 billion for energy and water infrastructure, up $2.4 billion year-over-year, alongside proposals to fast-track permits for bridges, factories, and chip plants. Together, these tailwinds positioned Caterpillar for what some call a “once-in-a-generation” industrial upcycle.

Navigating Tariffs and Headwinds: How CAT Still Delivered

Caterpillar’s run came despite major headwinds, which it managed to navigate better than many expected. In April, President Trump shocked markets by slapping surprise tariffs on U.S. trading partners, triggering retaliation and a 4% one-day drop in the Dow. Caterpillar, a global trade bellwether, briefly stumbled

Management later disclosed tariffs on imported components (like sensors and steel) would cost up to $1.8 billion in 2025, pressuring margins and pushing operating results toward the low end of guidance. Still, Caterpillar raised prices and improved supply-chain efficiency. By Q4 2025, easing inflation and two Fed rate cuts totaling 50 basis points helped stabilize conditions.

In short, Caterpillar turned a potential trade-war setback into merely a bump in the road. Today Caterpillar stock is trading at $626.60; with $293 billion in market cap (TradingView).

Caterpillar shares extended a turbocharged rally fueled by bets on the industrial giant’s artificial intelligence prospects to push its market valuation above $300 billion for the first time https://t.co/NurZWpXfUl

— Bloomberg (@business) January 13, 2026

2026 Outlook: Analyst Targets Up to $740 for CAT Stock

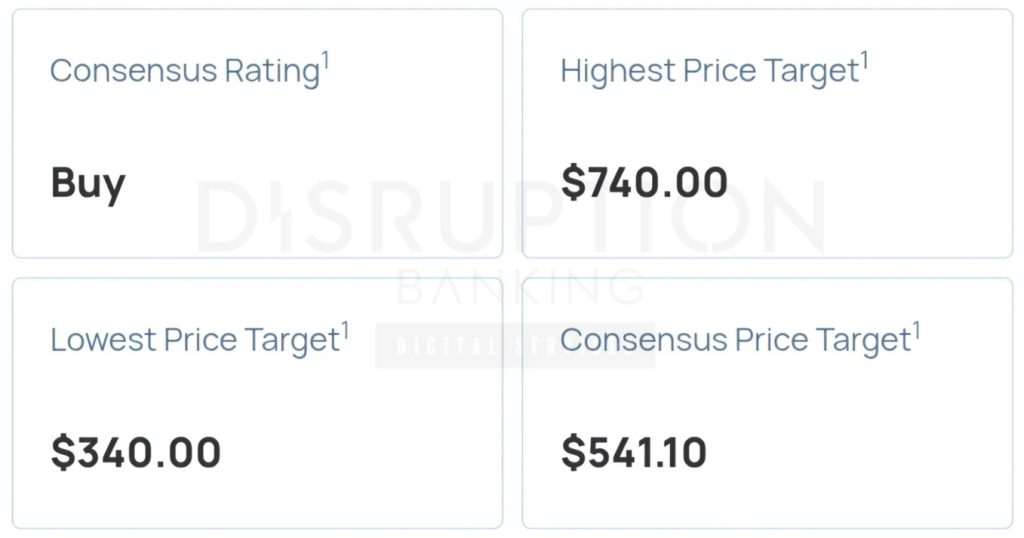

After a near-60% rally, many investors are asking if Caterpillar has more gas in the tank. Analysts at least seem to think so. In early 2026, Citigroup’s Kyle Menges raised Caterpillar’s price target to $710, citing its position at the intersection of AI and infrastructure. J.P. Morgan reportedly set a Street-high target of $740, implying further double-digit upside.

Of roughly 23 analysts, 13 rate CAT a “Strong Buy,” with only one sell recommendation. Bulls point to full order books, continued AI data-center buildouts, rising mining and energy CAPEX, and ongoing infrastructure upgrades. Caterpillar also boasts 32 consecutive years of dividend increases and active buybacks.

That said, no one is sugar-coating the risks. Effective U.S. tariff rates sit at 40-year highs, and Caterpillar cited a $686 million manufacturing cost hit in 2025. A construction labor shortfall, about 349,000 workers needed by end-2026, could slow projects. Valuation is no longer cheap, with shares trading around 21x forward earnings, a premium compared to most industrial peers.

If growth stalls, the stock could pull back. But if the AI- and infrastructure-driven supercycle holds, Caterpillar may not be done roaring.

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

2 Dow Jones Stocks That Really Dominated 2025 Performance

Caterpillar’s Dow Jones Legacy: Powering Progress Through Innovation | Disruption Banking