In 2025, TCI Fund Management, the hedge fund run by Sir Chris Hohn, did what even the best hedge funds seldom do: it set a new profit record for the entire industry.

Estimates from LCH Investments, part of Swiss investment firm Edmond de Rothschild, show TCI generated about $18.9 billion in net gains for clients in 2025, the largest single-year profit ever booked by a hedge fund. That decisively broke the previous record held by Ken Griffin’s Citadel, which made $16 billion in 2022. It even dwarfed legendary one-off wins such as John Paulson’sroughly$15 billion subprime trade in 2007.

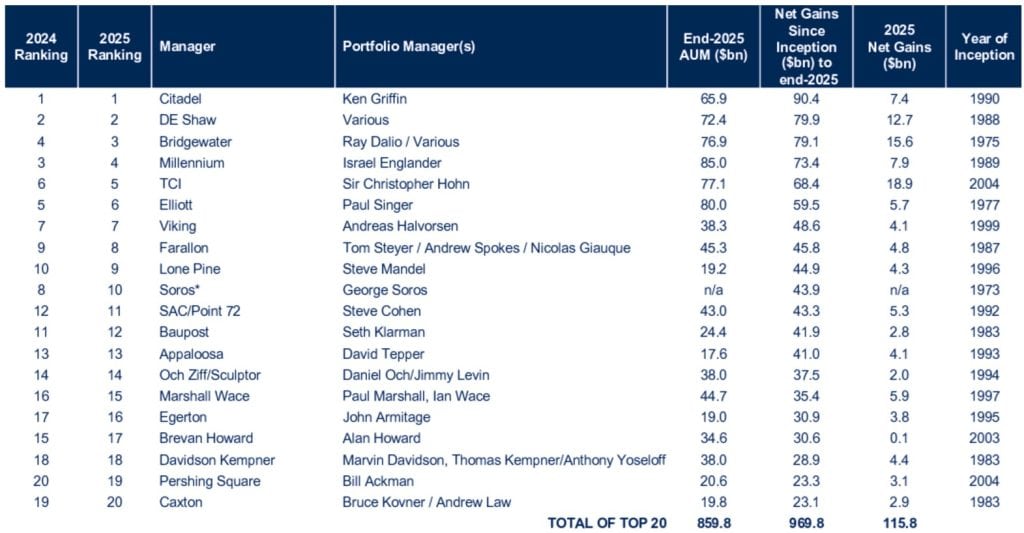

In a year when hedge funds collectively made a record $540+ billion and the top 20 managers produced $115.8 billion, TCI alone accounted for more than one-sixth of those elite gains. What follows is the 2025 result in context: the risks, the volatility, and what this record year actually tells us about TCI’s edge going into 2026.

“Quite Remarkable”: TCI’s 27.8% Return on $77B AUM

LCH Chairman Rich Sopher described TCI’s 2025 result as “quite remarkable,” noting that the firm has produced roughly$40 billion in net gains over the past three years alone. The broader context makes the feat even starker. Hedge funds globally generated a record $543 billion in profits in 2025, yet TCI’s slice of that total was extraordinary by any historical standard.

On roughly $77 billion of assets under management (AUM), TCI’s master fund returned a[proximately 27.8% for the year, per a TipRanks report. That comfortably outpaced the S&P 500’s 17.9% return, the broad hedge fund index’s roughly 12.6%, and the top-20 hedge fund group’s money-weighted return.

Since its launch in 2004, the firm has now delivered about $68.4 billion in cumulative net gains, vaulting it into the top five hedge funds of all time on LCH’s all-time ranking with Citadel topping the list, and DE Shaw trailing immediately behind.

No Quant Magic: Chris Hohn’s High-Conviction Activist Edge

TCI’s record year was not the product of a black-box quant strategy or a lucky macro trade. It was the payoff from an unusually concentrated, old-school, “own the best businesses and fight for value” strategy that simply hit a perfect macro and sector backdrop in 2025.

TCI’s edge comes from Hohn’s aggressive, long-term approach. The firm targets “high-quality companies” suffering from misunderstood governance issues, using deep research and sometimes public activism to unlock value.

9 Core Holdings, $53B Concentrated: TCI’s 2025 Winners (GE Aerospace Leads)

Regulatory filings and reporting show that by Q3 2025 TCI was running an extremely focused portfolio: roughly nine core US positions worth about$52–53 billion, alongside sizeable European stakes.

Its single largest holding was GE Aerospace, valued at around $14.2 billion by late 2025 after the stock surged roughly 84%. The pure-play aviation business benefited from the recovery in global travel, rising defense spending, and expanding margins following its separation. TCI also leaned heavily into aerospace and industrial champions such as Airbus and Safran, both of which rose more than 40% in 2025, alongside durable franchise businesses including Microsoft, Visa, Moody’s, Alphabet, Canadian Pacific, and S&P Global.

Chris Hohn's TCI Fund brought in a net $18.9 billion in 2025, the largest annual hedge fund profit ever and beating Citadel's 2022 record of $16 billion.

— Hedge Vision (@HedgeVision) January 19, 2026

TCI operates an extremely concentrated fund with $52.7 billlion spread across just nine 13F holdings.

TCI's top position,… pic.twitter.com/CAgGzlBeGU

This is classic high-conviction hedge fund investing: very few names, very long holding periods, often eight years or more, and an aggressive willingness to engage publicly with management teams when governance or capital allocation threatens returns. The concentration magnified winners in 2025, just as it has historically amplified drawdowns when markets move the wrong way.

That context shouldn’t be ignored. TCI lost about18% in 2022, roughly an $8 billion hit, before rebounding with about $12.9 billion of gains in 2023 and then the record $18.9 billion in 2025. Over a full cycle, that volatility is not a flaw but the price of its edge.

The lesson is not that TCI can produce 27% every year from now on. Anyone expecting that is kidding themselves. But that concentrated activism in world-class companies can still dramatically outperform diversified, lower-risk hedge fund portfolios over time.

Hohn’s story is wild.

— Aakash Gupta (@aakashgupta) January 19, 2026

In 2008, he lost 43% and watched his fund collapse from $19 billion to under $5 billion. Investors fled. He publicly swore off activism after getting humiliated in a railroad proxy fight.

17 years later, he just posted the largest single-year hedge fund… https://t.co/wMnf055ke9

Citadel’s Solid $7.4B vs TCI’s $18.9B Record: Contrasting Hedge Titans

Citadel remains the most profitable hedge fund firm in history in cumulative terms. While many people confuse the two, Citadel LLC (the hedge fund) is not the same as CEO Peng Zhao’s Citadel Securities, one of the world’s dominant electronic market makers. Both sit under Ken Griffin’s empire, but they are legally and economically distinct.

Since 1990, Ken Griffin’s multi-strategy giant has generated about $90.4 billion in net investor gains, keeping it firmly in first place on LCH’s all-time list. But in 2025, Citadel’s performance was solid rather than spectacular.

Citadel’s flagship Wellington fund returned around 10 – 10.2% in 2025, while the firm generated an estimated $7.4 billion in net gains for investors. That trailed both the S&P 500’s high-teens return and the top-20 hedge fund group’s roughly 15.7% money-weighted return.

2025 Owned by Chris Hohn: TCI’s $18.9B Triumph Over Citadel

For 2026, it would be naïve to expect TCI to repeat a nearly 30% gain on almost $80 billion. Markets are volatile, and Hohn’s approach, leveraged into big equity positions, can swing the other way. Notwithstanding, TCI’s methods and positioning, targeting cheap, high-quality firms with activist engagement, give it a fighting chance to deliver well above-average returns again. Citadel, by contrast, will likely churn returns at single-digit rates while shuffling capital back to investors. Both, however, are built on high conviction and talent.

In the brutally competitive hedge fund world, one thing was clear in 2025: Chris Hohn won. His $18.9 billion record haul has rewritten the history books. Citadel’s firms earned their keep, but TCI’s result will stand out for years. As one source put it, only a tiny handful of top funds generated the lion’s share of 2025’s profits, and Hohn’s TCI was squarely on top.

Author: Richardson Chinonyerem

See Also:

D.E. Shaw Oculus Soars 28.2% in 2025

How Citadel’s Peng Zhao is Disrupting Capital Markets | Disruption Banking