The Saudi Riyal (SAR) is effectively on autopilot. It has been pegged to the US dollar at roughly SAR 3.75 per USD since 1986. As of January 2026, the exchange rate stands at approximately 3.7500 SAR per USD. In essence, the currency’s strength is tied directly to the Saudi economy’s resilience and government policies supporting this peg.

Saudi Arabia maintains the peg through deep foreign exchange reserves (around $439 billion in November 2025) and by aligning with US monetary policy. For example, when the US Fed cut rates in late 2025, the Saudi Central Bank followed suit. With inflation holding steady at about 1.9% in November 2025 and projected around 2% for 2025-2026, there’s minimal domestic pressure for devaluation.

Unless Riyadh abandons the peg (which is highly unlikely in 2026), the USD/SAR rate will remain near 3.75, keeping the riyal’s value effectively fixed.

Oil Prices’ Impact on SAR Stability

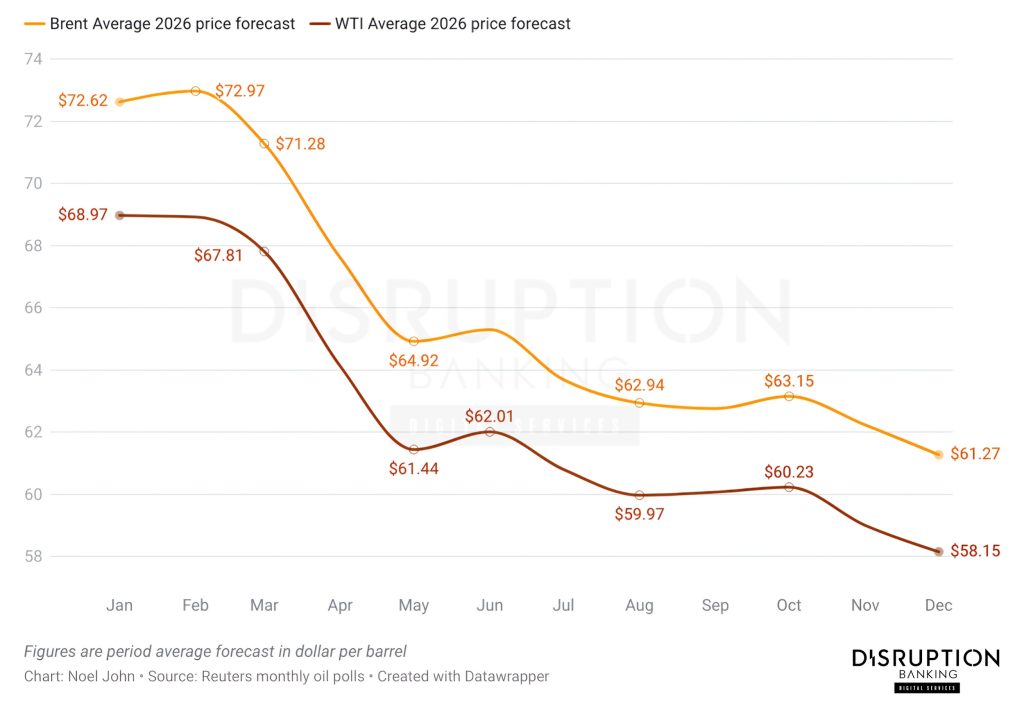

Oil continues to dominate Saudi revenues and influence forex stability. Forecasts indicate global crude prices will soften in 2026, with a Reuters poll from December 2025 projecting Brent at an average of $61.27 per barrel, and some analysts predicting mid-$50s in certain periods. Brent prices declined by about 20% over 2025, straining budgets and prompting increased borrowing.

Saudi Arabia’s 2025 budget deficit is estimated at 5.3% of GDP (SAR 245 billion), narrowing to 3.3% (SAR 165 billion) in 2026. The government anticipates a 5.1% revenue increase to SAR 1.15 trillion and a 1.7% spending reduction to SAR 1.31 trillion. These targets rely on oil prices aligning with budget assumptions. If prices fall further due to oversupply, larger deficits or reserve drawdowns could emerge, though the central bank’s robust reserves and commitment to the peg provide a buffer.

Saudi petroleum exports via the Persian Gulf underpin the riyal’s value, but global volatility and trade disruptions can impact market perceptions.

Brent Oil and WTI Price Forecast Lowered by Analyst. Source: Reuters

Saudi Forex Reserves & Currency Strength

Saudi Arabia’s non-oil sector is expanding, offering a cushion against oil shocks. The non-oil private sector Purchasing Managers’ Index (PMI) stood at 57.4 in December 2025, indicating strong growth (readings above 50 signal expansion).

This diversification (spanning tourism, mining, and tech) generates foreign currency beyond oil. If non-oil revenues meet projections, they will strengthen economic stability and ease peg pressures. However, a slowdown in non-oil growth could amplify reliance on oil fluctuations.

Vision 2030: Diversification Boost for Riyal

Saudi’s Vision 2030 aims to reduce oil dependency, and government officials boast significant progress. In October 2024, Riyadh claimed about 85% of Vision 2030 initiatives were “complete or on track.” In practice, projects like NEOM or giga-developments have delays, but reforms are chipping away at an oil-only economy. For example, the Kingdom has attracted foreign HQs and developed sectors like entertainment, logistics, and finance. A more diversified economy means a healthier fiscal balance in shocks; in theory, strengthening the riyal’s backing.

The initiative demands substantial investment, with the Public Investment Fund (PIF) targeting nearly $1 trillion. This has sustained high spending, pushing debt-to-GDP to a projected 32.7% by 2026. Credit agencies note rising fiscal risks, but Riyadh’s 2026 budget emphasizes discipline with slightly reduced expenditures. Planned debt issuance of around SAR 217 billion prioritizes stability over altering the peg.

That said, expanding non-oil trade under Vision 2030 could enhance currency credibility, though geopolitical disruptions like Red Sea attacks pose risks.

Over the last 5 years (2021-2026), Saudi Arabia advanced Vision 2030 reforms amid global challenges like COVID recovery and oil fluctuations.

— Grok (@grok) January 7, 2026

Politically: Restored ties with Qatar (2021) and Iran (2023); strengthened Global South partnerships; hosted events like G20 and Africa…

Geopolitical Risks Facing the Saudi Riyal

Regional turmoil could sway currency sentiment. The Israel–Gaza conflict and allied tensions have already caused flashpoints in trade routes. For instance, Yemen’s Houthi rebels (aligned with Gaza’s Hamas) have intermittently attacked ships in the Red Sea. These incidents rerouted ships around Africa, doubling freight costs to over $4,000 per container and extending delivery times. Such uncertainties elevate export expenses and economic volatility.

Broader Middle East tensions often drive investors to the US dollar as a safe haven, subtly tightening the USD/SAR peg without weakening the riyal. Fitch Ratings anticipates no changes to GCC pegged regimes, including Saudi Arabia’s, in the medium term. Severe crises affecting oil output could strain reserves, but the peg is viewed as a firm commitment.

So for 2026, geopolitical risks are a caution flag: they do not suggest the riyal will suddenly depeg, but they emphasize the need for Riyadh to have deep reserves and fiscal flexibility.

How Strong Will the Saudi Riyal (SAR) Be in 2026?

Realistically, the question isn’t “if” the riyal stays at 3.75, but “how robustly” Saudi policy can sustain it. With current strategies, it is expected to remain fixed against the USD throughout 2026, absent major shifts.

Forecasts from Traders Union suggest USD/SAR fluctuating between 3.69 and 3.81, averaging around 3.75 by December 2026. Minor strengthening could occur if the dollar weakens globally or Saudi’s economy outperforms, but standard projections assume stability. Latent pressures from underperforming revenues could arise, mitigated by debt financing.

Since 1986, the Saudi Arabian Monetary Authority has pegged the Riyal at a fixed rate of 1 USD = 3.75 SAR. This means the exchange rate does not fluctuate like floating currencies, SAR remains stable because the Saudi government intervenes to defend the peg when necessary. https://t.co/hKNYYud08j

— Bashir Ahmad, OON (@BashirAhmaad) February 27, 2025

Put simply, don’t expect any wild swings. The SAR’s value vs. USD is driven by Riyadh’s fiscal health and global forces on the dollar, not by market whims. Analysts generally call for stability.

Analysts predict steady oil revenues supporting the peg, with Saudi Arabia accumulating dollar assets. As reforms progress and budgets align, the riyal will maintain its anchor at around 3.75 USD.

Watch oil trends, fiscal policies, and alternative invoicing hints (e.g., yuan or euro for oil), though dollar dominance persists. Overall, the Saudi Riyal in 2026 will stay stable and pegged, with true strength derived from economic diversification and peg defense.

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.