Fewer Brazilians are unemployed right now than any time since 2012. With the unemployment rate at 5.2%, President Lula da Silva’s chances for reelection in 2026 look favorable, especially since his government handily put away his predecessor Jair Bolsonaro for trying to pull a Trump-style coup, which Disruption Banking wrote about here.

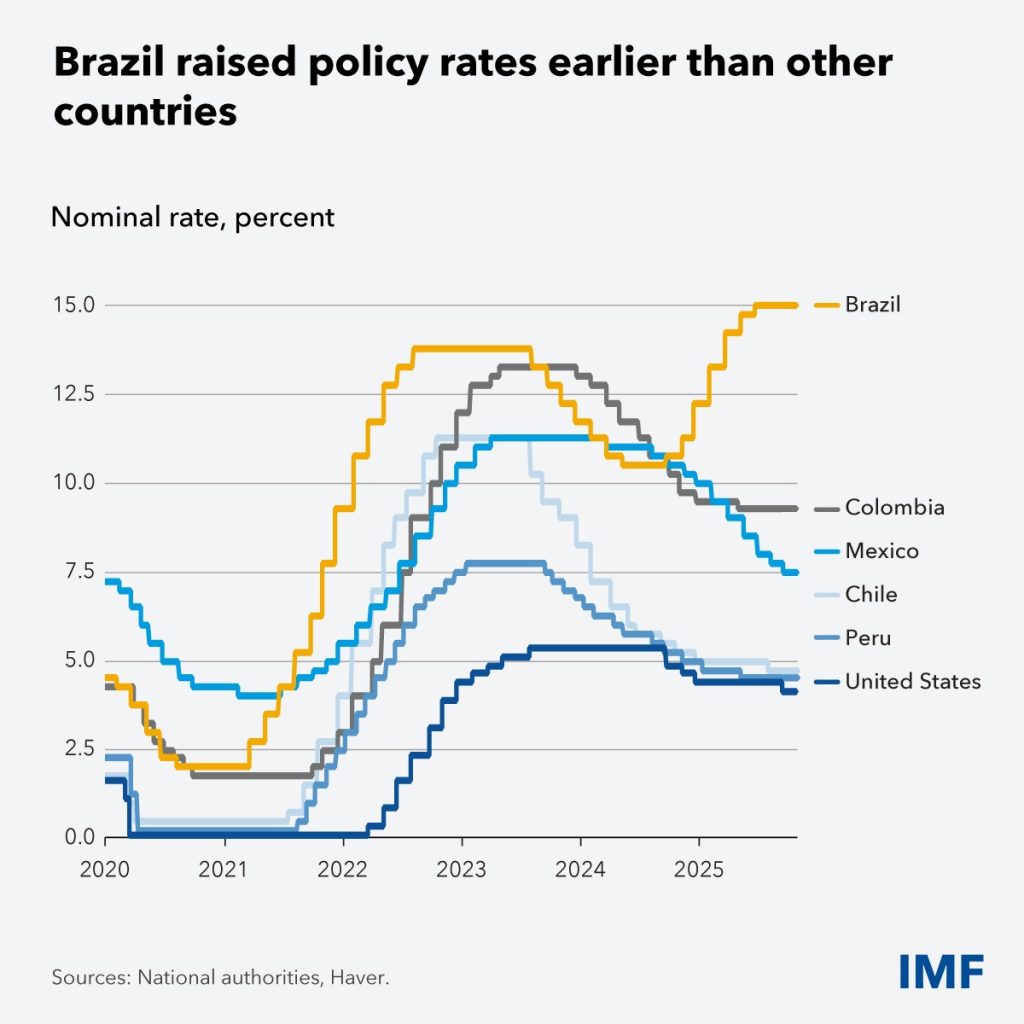

The interest rate in Brazil is 15%, the highest in nearly two decades and one of the highest among major economies, and the Brazilian Central Bank (BCB) isn’t about to change it because the annual inflation rate, at 4.46% as of November, was the lowest in more than a year.

The BCB’s rate-setting committee, called Copom, voted unanimously to leave the benchmark as is. That’s little surprise considering that in 2024, bank credit grew by 11.5% and the corporate bond issuance rose by 30%, according to the IMF.

Carlos Lopes, an economist at Banco BV, said, “Communication changed very little from the last meeting. That shows the central bank has low conviction about starting rate cuts in January. The lack of signaling now isn’t a dealbreaker, but it’s a major constraint on changing the decision in January.“

Both demand for credit and its supply have been pushed by steady income growth and expanding financial inclusion, a signature policy goal of President Luiz Inacio Lula da Silva to create a “middle-class society.”

Republic of Condo Invasions

While announcing the October launch of a new mortgage credit line, Lula stated, “There is a need for us to continue implementing social inclusion policies to see if we can help people move up a rung on the social ladder, so that we can create a kind of middle-class society.”

Lula contrasted the conception of a middle-class society he envisions against what he joked that Brazil has become, in his words, a “republic of condominium invasions.”

Brazilian Portuguese actually has a word for a special kind of flash mob composed of robbers, referred to as ‘arrastao,’ where an armed group appears and commandeers a space to rob as many people as possible.

These attacks happen on public beaches, during traffic jams, on subway trains, in shops, and in apartment buildings. In one famous case in August of 2023, a group of 17 thieves invaded a luxury condo building in Jardim Paulistano and took over $600,000 USD (450,000 GBP) worth of jewelry.

In Pursuit of the Middle Class

The Brazilian federal government has been taking a muscular approach to regulating the banking sector in pursuit of Lula’s policy goals. One plan, referred to above, concerns how home loans are funded. Instead of depending on how much money a borrower has in savings, the government’s new plan will allow banks to use an equal amount of savings-account money more freely for a period of up to five years and even longer if the bank continues to make new mortgages.

Today, banks are required to use 65% of savings-account money for mortgages. Another 20% is locked away at the BCB, and only 15% can be used freely. With the new plan, the BCB will release part of that locked-up money. At first, it will free up 5%, which could add about R$20–25 billion ($3.6-$4.5 billion USD or 2.6-3.3 billion GBP) in new mortgage loans.

Most of that released money (80%) must go to traditional home loans with capped interest rates (up to 12% per year). The remaining 20% can be used for real-estate loans that charge market interest rates.

New Central Banker

Gabriel Galipolo, head of the BCB, is the former executive-secretary of the Ministry of Finance and former chairman of the Banco do Brasil, one of five Brazilian state banks. His tenure at the Ministry of Finance and Banco do Brasil were both extremely short, 6 months and 3 months, respectively, after which he resigned due to his appointment by Lula to his first position at the BCB, as director of Copom, in 2023.

In 2025, Galipolo was elected to his position with the largest majority of support for any candidate since 1999. His mandate from Lula was to bring inflation into line with the establish target and he is known as an “inflation hawk.”

Notably, he was also Lula’s economic adviser in the 2022 election campaign, but he stated, “Every time the president met with me, it was to affirm that I would have complete freedom to decide according to my own judgment, without interference.”

Back in May, 2025, Galipolo told a group of bankers convened at Goldman Sachs’ office in Sao Paulo that cuts to the rate were not part of the discussion at Copom, the monetary policy committee, which was misinterpreted by traders as a sign that the BCB would stop raising the interest rate, referred to as the “Special System for Settlement and Custody” or SELIC, which at the time was 14.75%.

Take-aways

The BCB’s refusal to ease policy despite improving labor conditions and moderating inflation reflects a deliberate wager: that credibility, once lost, is far more costly than short-term political friction. By holding rates high while selectively unlocking credit, especially in housing, the BCB is attempting to thread a narrow path between financial discipline and Lula’s social ambitions. It is a strategy designed to cool inflationary expectations without suffocating the credit channels that underpin Brazil’s expanding middle class.

If inflation remains anchored and mortgage credit expands as planned, Lula may enter 2026 with both macroeconomic stability and a tangible social legacy. If not, the same policies could amplify inequality, asset inflation, or social unrest in a country already grappling with security anxieties and uneven urban development. For now, Brazil’s central bank is signaling something rare in emerging markets: patience, independence, and a willingness to disappoint markets today to preserve control tomorrow.

Author: Tim Tolka, Senior Reporter

#Crypto #Blockchain #DigitalAssets #DeFi

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.