Remember April 2025? Trump unleashes “Liberation Day” tariffs, the 10-year yields smash past 4.6%, and the “Sell America!” wave started. PIMCO’s 14-person investment committee did the opposite.

The experienced team at PIMCO bought more 5 to 10 year Treasuries. They bought more mortgages. They held committee meetings on Sundays to work out how the markets would respond to Trump’s policies. Today the investment team at PIMCO are laughing all the way to the best active bond returns in a decade. The numbers are a hard lesson for everyone who panicked:

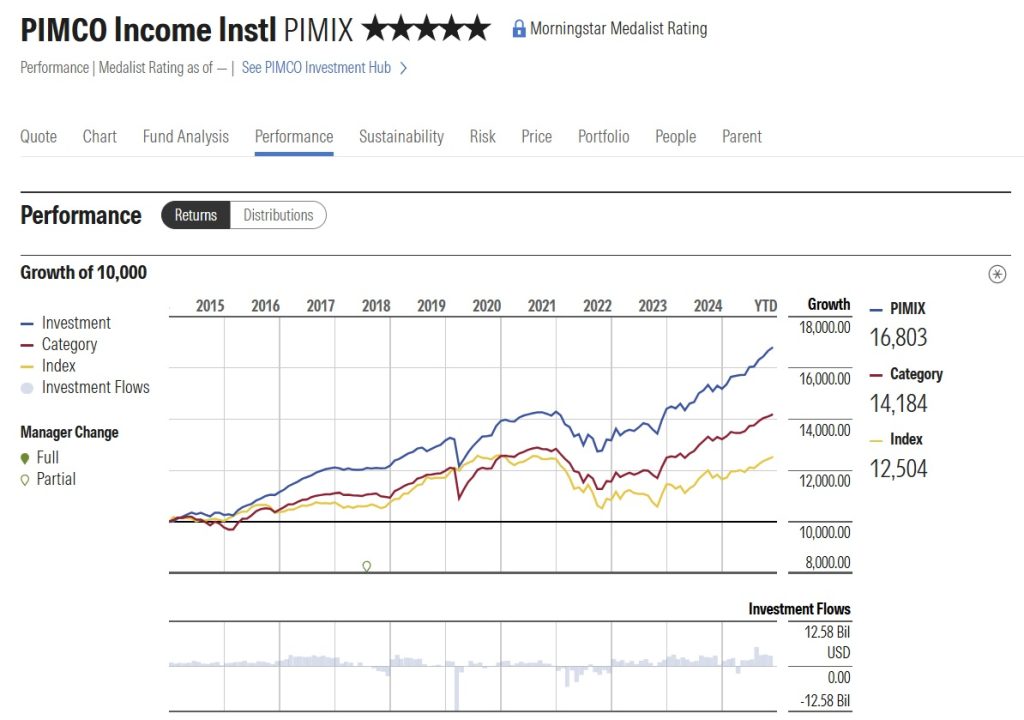

- PIMCO Income Fund (US$213bn): +10.4% YTD

- PIMCO Total Return: +9.1% YTD

- Rest of the top 10 largest active bond funds benchmarked to the Bloomberg US Agg: trailing by 300–400 bps on average

Data is taken from Morningstar

It’s not just that PIMCO has outperformed the rest. The firm did it in style, whilst continuing to hope that in the future growth of the U.S. economy, and a drop in interest rates.

How Did PIMCO Do It?

- January 2025: PIMCO was already long duration in the 5 to 10 year part of the curve, betting that Trump’s chaos would eventually slow growth and force the Fed to cut.

- April–May bloodbath: Yields ripped higher, clients pulled $2 billion from the Income Fund (first outflow since October 2023), and the bond market had its worst month of the year.

- Instead of folding, Dan Ivascyn, Mohit Mittal & Co. doubled down. They flew to London mid-crisis to take the temperature of foreign investors and concluded that nobody is selling en masse Treasuries. They’re just hedging dollar risk.

This was an ideal opportunity to load up on bonds. - They stayed underweight the long end (30-year), riding the steepener until September, then took the profits.

Result? The Income Fund now sits in the top 3% of its peer group after languishing outside the top decile since 2017. Morningstar doesn’t hand out gold stars easily.

The Bigger Message

PIMCO doesn’t do luck. The firm did the same in 2007 (short subprime while everyone else partied) and 2009–2010 (buying fire-sale mortgages while Lehman’s was still crumbling).

The bond market remains the ultimate contrarian arena. While crypto investors on X argue about laser eyes and strategic reserves, the mature investors at Newport Beach just printed 10%+ with zero leverage and zero blockchain.

What is the outcome? After cleaning up in U.S. during the year, PIMCO is now rotating out of America and into Japan, Australia and the UK where growth is slowing faster and central banks are still behind the curve.

What It Means for 2026?

- “Sell America” is officially dead.

- Active fixed-income management isn’t dead.

- If you were hiding in cash or short-dated Treasury bills waiting for the end of the world, you were just beaten by a 1990s-style bond fund.

PIMCO offers investors a lesson. The house always wins when it refuses to panic with the crowd.

Author: Andy Samu

#PIMCO #Treasuries #LiberationDay #Tariffs #SellAmerica #Bonds #Yield

See Also:

DESCO where computing and finance intersect | Disruption Banking

Why Are Hedge Funds Taking Aggressive Bets On Mortgage Bonds? | Disruption Banking