Why PLN’s 2026 Value Matters

The Polish zloty (PLN) is one of Eastern Europe’s most actively traded emerging-market currencies, making its 2026 outlook critical for investors and corporates alike. The direction of the zloty directly influences FX hedging strategies, cross-border investment decisions, and valuations of PLN-denominated assets. With global monetary policy shifting, geopolitical uncertainty rising, and domestic economic conditions in flux, the next 12–24 months will be pivotal for the PLN forecast.

As of 29 November 2025, USD/PLN trades near 3.65, compared with roughly 4.07 a year earlier, indicating a meaningful appreciation of the zloty. Part of this move reflects stronger PLN fundamentals, and part reflects a broad softening of the US dollar as global rate-cut expectations increased throughout 2025. However, the graph below clearly demonstrates a strengthening of PLN against the euro as well, with EUR/PLN gradually declining from levels around 4.40 at the start of the year to the mid-4.20s by late November.

2025 Economic Backdrop

- Interest rates: Over the course of 2025, Narodowy Bank Polski (NBP) cut rates gradually. The current reference rate is 4.25%, a significant decrease (150 bps) from the beginning of the year, the lowest rates seen in 3.5 years.

- Inflation: PKO Bank Polski economists reported that food and non-alcoholic beverage prices rose 2.7% YoY and 0.1% MoM in November, weaker than typical seasonal patterns.

- Market sentiment: The zloty has shown periodic volatility, as soft economic data, such as weaker industrial production and retail sales, have triggered expectations of further NBP rate cuts. These episodes temporarily pressured PLN, although they did not reverse its broader appreciation trend.

- Fundamentals: Despite mixed short-term data, medium-term fundamentals remain supportive. Growth forecasts are stable, EU funds continue to underpin investment activity, and investor appetite for Central Europe has held up, providing a solid base for PLN heading into 2026.

- Russia-Ukraine war: Compared with last year, the Russia–Ukraine war has played a smaller role in driving PLN volatility. While the conflict initially weakened the zloty in 2022 and kept geopolitical risk elevated through 2023–2024, by 2025 its influence had largely faded into the background.

Overall, PLN enters 2026 amid a tug-of-war between supportive factors such as growth potential and relative yields, and downside risks including global risk aversion, rate-cut expectations, and inflation uncertainty. This tension will shape the zloty’s trajectory throughout 2026.

6 Key Factors That Will Shape the Polish Zloty in 2026

Several macro forces will influence the Polish zloty’s trajectory in 2026. Together, they form the foundation of any credible PLN forecast.

1. Monetary Policy and Interest Rates (NBP vs. ECB/Fed)

NBP is expected to continue its slow rate-cutting cycle into 2026. However, because ECB and Fed cuts are also expected, the interest-rate differential should remain positive, helping PLN avoid sharp depreciation. PLN is therefore likely to stay broadly stable, not collapse.

2. Inflation Trends and Domestic Stability

With inflation trending back toward target, Poland enters 2026 with improved macro stability. A return to low, predictable inflation makes PLN more attractive to foreign investors and lowers the risk premium attached to Polish assets.

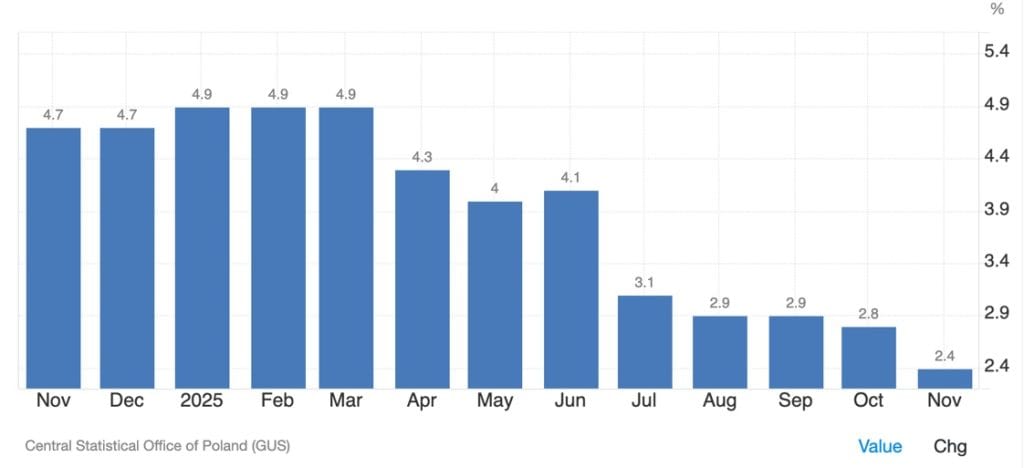

“The annual inflation rate in Poland slowed to 2.4% in November 2025 from 2.8% in the previous month, marking the lowest level since April 2024, according to a flash estimate.” – from Trading Economics

3. Economic Growth and Structural Fundamentals

Poland’s GDP is forecast to grow steadily in 2026 (but moderately in 2027), supported by EU funds, resilient consumption, and recovering exports.If global risk appetite improves and central banks pivot toward easing, emerging-market currencies like PLN tend to benefit.A calm, risk-on environment in 2026 could push EUR/PLN lower, strengthening the zloty.

4. Global Market Conditions and Capital Flows

As an emerging-market currency, PLN is highly sensitive to global risk appetite and cross-border capital flows. Poland remains attractive due to its relatively high yields and improving political environment, but sustained foreign portfolio inflows depend heavily on external factors: global interest-rate cycles, investor appetite for equity market risk, and the broader macro outlook. If global markets remain supportive, these inflows could strengthen or stabilise PLN; if risk aversion rises, PLN would be among the first regional currencies to feel the pressure.

Polish economy continues to surprise with low CPI, despite high GDP growth: EM asset management community underweighted POLGBs, despite slowing inflation and the prospect of further NBP cuts in 2026 https://t.co/mhqwyrNFe0 pic.twitter.com/pK4wsN1LjZ

— FOMC Alerts (@FOMCAlerts) November 29, 2025

5. Fiscal Policy and Government Strategy

Concerns around Poland’s fiscal deficit and rising public-sector commitments remain the main domestic risk to PLN. International institutions, including the IMF, have recently highlighted the need for credible fiscal consolidation. A clear plan would reinforce PLN stability, while additional slippage could undermine investor confidence and place pressure on EUR/PLN.

“Poland must prioritise curbing the rapid increase in its public debt, the International Monetary Fund said on Monday, adding that it sees rising fiscal vulnerabilities over the medium term.” – from Reuters

6. Unpredictable Shocks and Scenario Risks

Energy disruptions, global financial stress, or renewed escalation in Ukraine could hit regional currencies quickly. These events are not the base case, but if they occur, PLN could weaken sharply in a short time, even if fundamentals are otherwise supportive.

Implications for Investors and Corporations

Taking all six factors together, the evidence points clearly toward a base-case outlook of a stable or modestly appreciating Polish zloty in 2026. While upside and downside risks exist, particularly from global shocks or shifts in investor appetite, they currently appear less likely than a steady trajectory driven by improving domestic stability and moderate growth.

- Corporates with FX exposure: 2026 is unlikely to deliver a straight-line PLN trend, making active hedging essential. Forward contracts or options can help protect margins if rate-cut cycles or global risk aversion trigger short-term zloty weakness.

- Investors in PLN-denominated assets: A base-case scenario of PLN stability or modest appreciation enhances the attractiveness of Polish bonds and money-market instruments, particularly relative to other emerging markets. Still, global-risk swings and NBP policy surprises mean disciplined risk management remains important.

- Fintech & cross-border firms: Expected currency stability supports predictable revenue and transaction-cost planning. However, firms serving Polish consumers or merchants should continue building scenario-based pricing models to account for volatility around key policy decisions or external shocks.

- International borrowers/creditors: Anyone holding PLN liabilities or receivables should monitor potential depreciation phases, especially if rate cuts outpace the ECB or risk sentiment turns. Proactive FX management can prevent unexpected cash-flow stress.

Author: Caroline Adams

#PLN #PLNUSD #Zloty #NBP #Poland

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Poland: Staff Concluding Statement of the 2025 Article IV Mission | Disruption Banking

The Rise in Popularity of Cryptocurrency in Poland | Disruption Banking

Is it Worth Investing in Poland in 2025? | Disruption Banking