Why this year’s record-breaking Black Friday (and the $10.8 billion online spend in 2024) matters more than ever for the DJIA’s retail titan.

As we wrap up our Dow Jones 30-stock series, Walmart is the last Dow constituent in our lineup of a series that has already taken us through a long list of industrial heavyweights. This is especially special as our U.S. readers prepare for Thanksgiving and find time to review their portfolio as Black Friday looms. To recap, Dow Jones companies include [3M (MMM), Boeing (BA), Caterpillar (CAT), Honeywell (HON), IBM (IBM), Home Depot (HD)], the financial powerhouses [American Express (AXP), Goldman Sachs (GS), JPMorgan Chase (JPM), Travelers (TRV), Visa (V)], the big tech engines [Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Nvidia (NVDA), Cisco Systems (CSCO), Verizon (VZ), Salesforce (CRM)], and the consumer giants [Coca-Cola (KO), McDonald’s (MCD), Nike (NKE), Procter & Gamble (PG), Walt Disney (DIS), Johnson & Johnson (JNJ), Walmart (WMT), Merck (MRK), Amgen (AMGN), Chevron (CVX), UnitedHealth Group (UNH), Sherwin-Williams (SHW)] These are the companies shaping the American economy today.

Walmart Inc. (ticker: WMT) joined the Dow Jones Industrial Average (DJIA) on March 17, 1997, replacing legacy names like Woolworth and Texaco. It wasn’t a ceremonial replacement. Its arrival signalled the moment America’s old retail order gave way to a new one. The Bentonville, Arkansas retailer stepped into the limelight as it continued to scale, grow its logistics, and continue its relentless price pressure.

Today’s piece looks at Walmart’s performance before and after its Dow debut, the strategy behind its staying power, and why it still anchors the index despite its slim weighting, as well as regulatory scrutiny and ongoing lawsuits. And why this Thanksgiving and the following Black Friday are such important days for the retailer.

Walmart Pre-Dow Era (1973–1996): Explosive Growth, Then a Cooldown

Walmart went public in the early 1970s and quickly became one of the most explosive compounders in U.S. stock market history. Beginning in 1973, the stock ripped higher, posting enormous annual gains for more than a decade: approximately +48% in 1979, +84% in 1980, +136% in 1982, +57% in 1983, +69% in 1985, +46% in 1986, and +95% in 1991, according to Macrotrends. It was the kind of long compounding streak modern investors rarely see.

By the mid-1990s, that breakneck pace cooled. The stock fell around -22% in 1993 and -14% in 1994, then flattened out through 1995–96 as retail valuations reset (Macrotrends). But even during the slowdown, Walmart’s long-term momentum was intact.

In 1997, the same year it entered the Dow Jones, WMT soared +75%, a sharp reminder that the company still had market-moving power.

Back then Black Friday was also one of the most important shopping days in the U.S. Differently to now, back then it was enough to run several promotions and hire some temporary workers, and sales went smoothly. This started to change with the onset of the internet.

Walmart Post-Dow (1997–2025): More Measured, Still Powerful

After joining the index, Walmart’s stock shifted from explosive to steady. The late 1990s were still exceptional years giving with roughly +108% growth in 1998 and +70% in 1999 (Macrotrends). It was during this period that Black Friday emerged as the busiest shopping day of the year for America, and for most Walmart stores too. The dot-com crash hit it with a roughly -23% decline in 2000, but Walmart weathered the early-2000s storms better than most retailers.

Through the 2000s, the stock moved in modest annual ranges, up in recessionary periods, flat in expansions. It proved its resilience in 2008, gaining 20% while the broader market collapsed. From 2010 to 2014, returns stabilized in the mid-teens.

The next big inflection point came in 2017, when the stock jumped ~47% as Walmart’s digital strategy finally started firing. After a roughly -27% stumble in 2015, the retailer rebounded decisively. During the pandemic, Walmart rose ~23% in 2020, then kept climbing through 2021–2023. In 2024 the stock spiked ~74%, and in 2025 it’s up another ~14%.

Over the full Dow Jones era, Walmart has delivered exactly what long-term investors expect: steady expansion, periodic upside bursts, and exceptional durability.

In 2024 Black Friday shattered records as U.S. consumers spent $10.8 billion online. Walmart.com was number two most-visited retail site on Black Friday 2024 for the sixth straight year, behind Amazon, per Similarweb. Walmart drew an estimated 25-30 million in-store shoppers on Black Friday 2024.

Walmart’s Sales Engine Keeps Firing: $681B Year, Double-Digit E-Com Growth

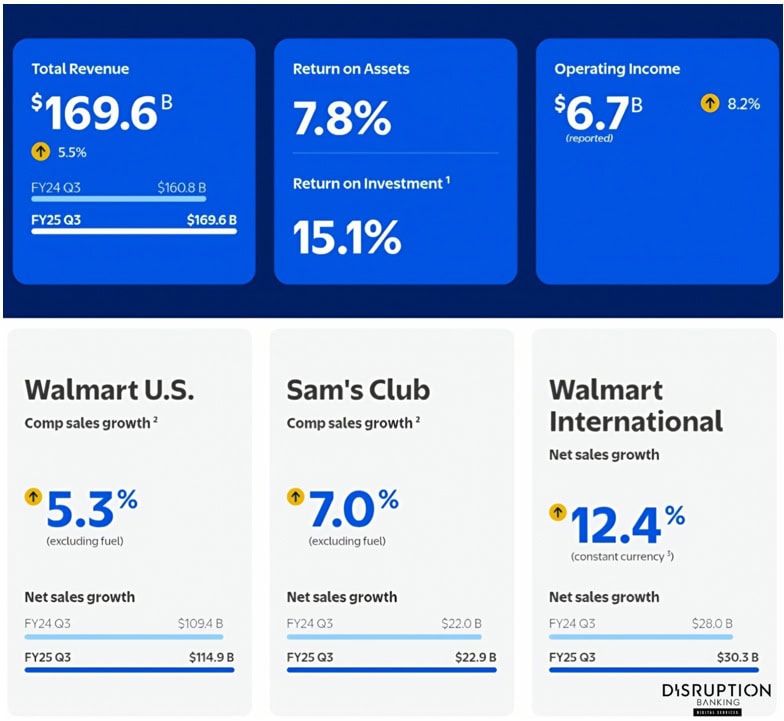

Walmart’s latest quarterly results show continued growth in sales and profitability. In Q3 FY2025 (ended Oct 31, 2024), revenue was $169.6 billion (+5.5% year-over-year) and operating income $6.7 billion (+8.2%). U.S. same-store sales (ex-fuel) grew about +5.3%, and Walmart U.S. e-commerce sales jumped +22%.

CEO Doug McMillon attributed these results to investments in prices and convenience: “Our associates are working hard to save people time and money…our newer businesses helped profits grow faster than sales while we worked to lower prices.” CFO John Rainey echoed this, noting Walmart was “broadening our assortment, improving customer experiences and earning [customers’] trust” through omnichannel investments.

In Q4 FY2025 (ended Jan 31, 2025), Walmart similarly saw broad-based gains. U.S. comp-store sales grew +4.6%, Sam’s Club comps +6.8%, and international net sales +5.7% (cc). Global e-commerce continued high growth (penetration ~18% of sales, up ~11 percentage points since 2020). Walmart highlighted strength in advertising (+28% growth) and membership services (+13%).

Overall, management reported that customer traffic and market share are rising as price investments pay off, with inventory well-managed (global inventory down ~1.0%). For fiscal 2025, Walmart’s total revenue was $681 billion (up ~5.1% from 2024), reflecting its scale as a retail titan, and a stable Dow Jones member.

52 Years of Rising Dividends

Walmart has a long, uninterrupted dividend record. In February 2025 the Board raised the annual payout 13% to $0.94 per share for FY2026, marking 52 consecutive years of increases. This implies a modest ~0.9% yield (on ~$103 stock) (Slickcharts), but it underscores Walmart’s cash-flow strength.

Executive Vice President and CFO John Rainey said the raise reflects “continued confidence in sustained business performance.” Walmart’s balanced approach means it retains ample cash for growth (e.g. e-commerce, supply chain),yet returns value to shareholders via steadily rising dividends.

Recent Challenges: Fraud and Pricing Lawsuits

Walmart has weathered multiple public challenges in labor and regulatory arenas. The company has long been accused of anti-union tactics; for instance, a January 2024 Reuters report noted the U.S. labor board accused Walmart of “illegal tactics” (interrogating and disciplining workers) to deter unionizing at a California store. Walmart faces numerous NLRB complaints on such issues, though it denies any legal violations.

Wal-Mart was sued 4,851 times during the year 2000 – Approximately one lawsuit every 2 hours.

— UberFacts (@UberFacts) September 8, 2014

In July, the Equal Employment Opportunity Commission (EEOC) sued Walmart for disability discrimination, alleging it denied a worker’s return to a former position despite approved accommodations. Bloomberg Law reported Walmart had already settled at least six EEOC cases on disability bias since 2024.

Regulatory scrutiny has also touched Walmart’s financial services. In June this year, Walmart agreed to pay $10 million to settle an FTC lawsuit over wire-transfer fraud. The settlement resolved claims that Walmart’s MoneyGram/Western Union kiosks were used by scammers, alleging the retailer “neither admits nor denies any of the allegations.” Under the FTC deal, Walmart must enhance anti-fraud controls for its money-transfer business.

Walmart’s Small Dow Footprint

Despite being one of the world’s largest companies, Walmart accounts for only about 1.3% of the Dow Jones’ weighting, the byproduct of a price-weighted index. Slickcharts shows Walmart sitting near the bottom of the 30 components, overshadowed by higher-priced names like Goldman Sachs and Microsoft.

But small weight doesn’t equal small importance. Walmart’s economic footprint (employment, traffic, nationwide sales data) anchors the Dow’s defensive backbone even if the stock barely moves the index.

Analyst Outlook: Modest Upside

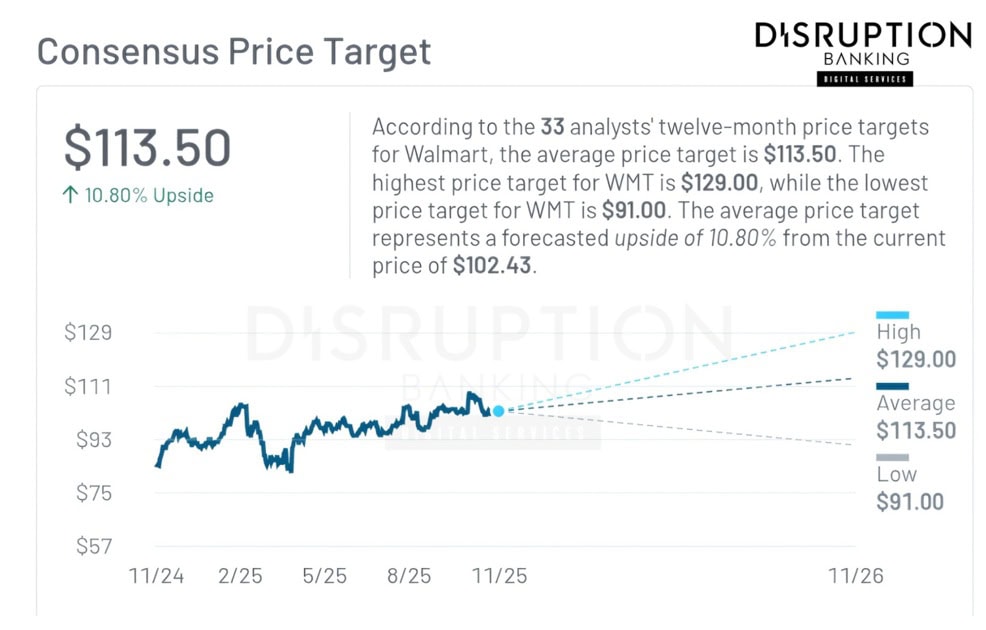

Wall Street’s analysts are cautiously optimistic about Walmart. At the time of writing, the consensus 12-month price target is about $113–114, roughly 10% above recent levels. The rating consensus is “Moderate Buy” on MarketBeat and Benzinga, with price targets ranging from the low $90s up to $129.

This reflects expectations of continued steady growth, not a breakout scenario but enough to ensure its Dow Jones’ standing. In other words, analysts see Walmart as fairly valued, with upside tied to execution of its omnichannel push and cost management.

A Retail Pillar Remade for the Digital Age

Walmart’s role in the Dow Jones isn’t symbolic. It’s structural. The company anchors U.S. consumer activity, generates deep and predictable cash flows, and maintains an omnichannel strategy few competitors can match.

As the Dow evolves, Walmart remains the steady center, less flashy than tech giants, but just as essential.

And, as we head for Thanksgiving, it’s important to note that current CEO Doug McMillon has announced that he is stepping down in the new year. As families grab Walmart’s $40 Thanksgiving meal for 10 this week and line up (or log on) for Black Friday doorbusters, the real question is what McMillon’s successor will unleash for Black Friday 2026.

#CapitalMarkets #Walmart #DowJones #DJIA #RetailGiant #OmnichannelRetail #EcommerceGrowth #USRetail #ConsumerSpending #SupplyChain #RetailLeadership #RetailStrategy #WMT

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Procter & Gamble: A Century of Steady Gains in the Dow Jones | Disruption Banking

Home Depot: Hammering Home Dow Jones Stability | Disruption Banking

Amazon’s Dow Jones Rise: Innovating Markets, Facing Scrutiny | Disruption Banking